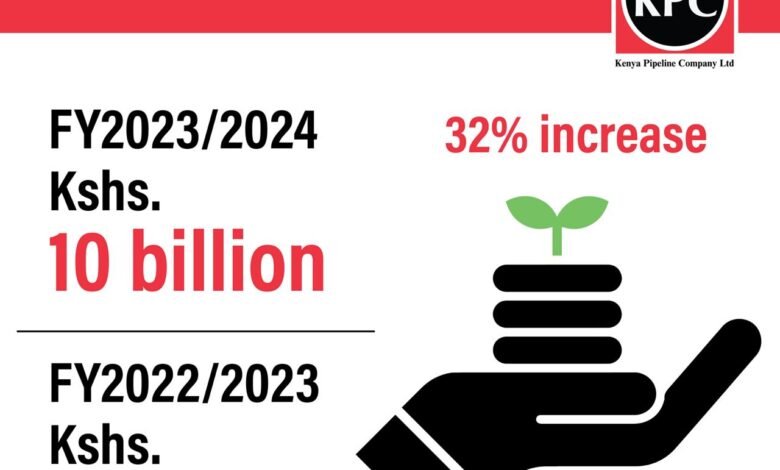

The Kenya Pipeline Company (KPC) has reported a robust profit before tax of Ksh. 10 billion for the financial year 2023/2024, a 32% increase from the Ksh.7.6 billion recorded in the previous fiscal year.

The company’s revenue rose by 15%, climbing from Ksh. 30.9 billion in the prior year to Ksh. 35.4 billion for the year ended June 2024. This uptick was fueled by higher sales volumes and favorable foreign exchange rates.

Total throughput volumes increased by 6%, reaching 9.1 million cubic meters (M3) compared to 8.6 million M3 in the previous year.

While domestic throughput saw a marginal 0.1% rise to 4.5 million M3, export volumes surged by 12% to 4.7 million M3, underscoring KPC’s enhanced capacity to meet growing regional demand.

Also Read: KPC Foundation Enhances Healthcare Access for Nkuene Ward Residents With Ksh.6.5 Million Facility

“Our strategic outlook has evolved with the revision of our Corporate Strategic Plan to Vision 2025. This forward-thinking approach ensures KPC remains aligned with the evolving market environment and continues to fulfill its strategic imperatives,” said KPC Board Chairman Faith Bett-Boinett.

Managing Director Joe Sang said the company is focused on sustainability and innovation.

“Looking ahead, we remain dedicated to driving sustainable growth and innovation. We will continue to invest in our people, infrastructure, and technology to not only meet but exceed the expectations of our customers and stakeholders,” Sang said.

A key milestone in the year was KPC’s completion of the acquisition of Kenya Petroleum Refineries Limited (KPRL), which it had operated under a lease agreement since 2017.

This move strengthens KPC’s strategic use of KPRL’s fuel storage assets, positioning Kenya as a regional hub for oil and gas.

To bolster operational efficiency, KPC is investing in major capital projects, including leak and intrusion detection systems, the Supervisory Control and Data Acquisition (SCADA) system, capacity enhancements for Line IV (Nairobi-Eldoret), and the bottom loading facility at Nairobi Terminal (PS10).

Beyond its core business of transporting and storing petroleum products, KPC is diversifying into alternative revenue streams such as Fiber Optic Cable (FOC), the Morendat Institute of Oil and Gas (MIOG), and investments in Liquefied Petroleum Products (LPG).

PrimeBiome I like the efforts you have put in this, regards for all the great content.

Puraburn I like the efforts you have put in this, regards for all the great content.

I am extremely inspired together with your writing skills as well as with the layout to your weblog. Is that this a paid subject matter or did you modify it yourself? Either way keep up the excellent quality writing, it is rare to look a nice blog like this one today!