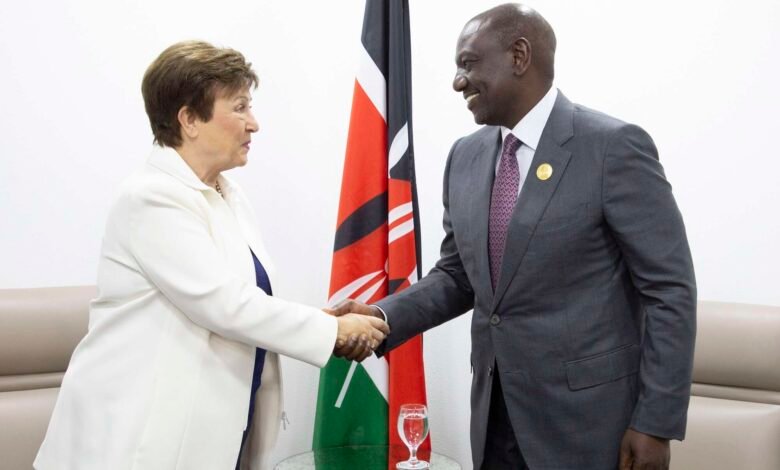

The International Monetary Fund (IMF) team and Kenyan authorities have agreed on the sixth evaluation of Kenya’s economic program under the Extended Fund Facility (EFF) and Extended Credit Facility (ECF) arrangements.

They have also resolved on an increase in access under the EFF/ECF reaching 130.3 percent of quota SDR 707.3 million, or about US$938 million – Ksh.142.7 billion, as well as the first review of the RSF.

This deal is still subject to IMF management clearance and adoption by the Executive Board, which is expected in January 2024.

Following the completion of the IMF Executive Board’s sixth review, Kenya would have immediate access to US$682.3 million, including the augmentation of access under the EFF/ECF arrangements (SDR469.25 million) and the first review of RSF (SDR45.23 million).

This would bring the total IMF financial assistance provided under the EFF/ECF and RSF agreements to SDR2.02 billion (about US$2.68 billion).

“The global financing conditions for frontier economies are tightening and global geopolitical tensions are compounding the challenges from the pandemic’s legacy and multi-season drought, further straining Kenya’s balance of payments and fiscal financing requirements,” according to the International Monetary Fund’s Haimanot Te

The authorities’ aggressive reform agenda aims to boost macroeconomic stability and restore confidence in order to gain access to international borrowing markets.

Kenya’s economy has showed resilience, with real GDP increasing by 5.4 percent in the first half of 2023, mainly primarily to a significant recovery in the agricultural sector following the resumption of rains.

A rebound in the tourism industry to pre-COVID-19 levels, resilience in remittances, a decline in imports, and a real exchange rate depreciation have all contributed to the narrowing of the external current account deficit. Since July, headline inflation has stayed between 2.5 to 7.5 percent, which is the desired range.

Although there has been a persistent dedication to carrying out the IMF-backed economic plan, which is essentially progressing as planned, doubts persist regarding Kenya’s ability to get access to global bond markets.

Liquidity is under significant strain from this uncertainty, mainly because of the huge Eurobond that matures in 2024.

Kenya is actively seeking out more funding from commercial sources, the IMF, and development partners while stepping up efforts to improve macroeconomic policy and carry out structural reforms.

yandanxvurulmus.qQcIoqu1sttY

xyandanxvurulmus.5MIEijlwrNPx

xbunedirloooo.1WCyUWRtHAb7

anal siteleri vurgunyedim.iUlonuUBtCBu

childrens sex yaralandinmieycan.RMOEwVO86LZi

fuck google citixx.AZIHuh71ZORA

fuck hyuqgzhqt.gSz3PbsOrkw2

porn sex ewrjghsdfaa.JZAvjFjeVdfD

anal sikis siteleri wrtgdfgdfgdqq.TbtwpHxvzmMJ

bahis siteleri sikis bjluajszz.o8xdOBVD7fi5

eskort siteleri bxjluajsxzz.mzZwO4wUbjcT

food porn 0qbxjluaxcxjsxzz.EBt3dbsVIWMr

bahis siteleri porn sex incest 250tldenemebonusuxx.eYYjH7h6r6y8

pornhub bahis siteleri eyeconartxx.uUFsYG0D7vq2

porno siteleri vvsetohimalxxvc.5Ez64PIWscn8

Howdy! Someone in my Facebook group shared this site with us so I

came to take a look. I’m definitely loving the information. I’m book-marking

and will be tweeting this to my followers! Exceptional blog

and brilliant design. I saw similar here: Dobry sklep

xxx video full hd pron gghkyogg.Z7xlwmZ5CJe

సెక్స్ డౌన్లోడ్ ggjennifegg.8M8LWmkT8fY

porn hd videos download ggjinnysflogg.3tE5wlBMhTM

download best porn videos ggjgodherogg.EPLmw8CJ3hW

Diagnostico de equipos

Aparatos de ajuste: importante para el desempeño uniforme y productivo de las equipos.

En el entorno de la ciencia actual, donde la efectividad y la fiabilidad del sistema son de máxima relevancia, los equipos de equilibrado desempeñan un tarea crucial. Estos equipos especializados están concebidos para equilibrar y regular partes rotativas, ya sea en dispositivos productiva, vehículos de desplazamiento o incluso en aparatos domésticos.

Para los expertos en reparación de dispositivos y los especialistas, trabajar con dispositivos de balanceo es importante para garantizar el rendimiento fluido y confiable de cualquier sistema dinámico. Gracias a estas soluciones innovadoras avanzadas, es posible disminuir sustancialmente las oscilaciones, el estruendo y la tensión sobre los cojinetes, aumentando la tiempo de servicio de piezas costosos.

Asimismo importante es el función que desempeñan los aparatos de equilibrado en la soporte al usuario. El soporte especializado y el reparación permanente utilizando estos dispositivos habilitan ofrecer servicios de óptima excelencia, mejorando la bienestar de los clientes.

Para los propietarios de emprendimientos, la inversión en estaciones de calibración y sensores puede ser fundamental para mejorar la efectividad y desempeño de sus aparatos. Esto es particularmente significativo para los empresarios que administran reducidas y pequeñas empresas, donde cada elemento es relevante.

Por otro lado, los dispositivos de calibración tienen una amplia implementación en el área de la seguridad y el control de calidad. Permiten localizar eventuales defectos, evitando reparaciones caras y perjuicios a los dispositivos. También, los información obtenidos de estos equipos pueden usarse para optimizar procesos y incrementar la exposición en sistemas de investigación.

Las zonas de aplicación de los dispositivos de equilibrado abarcan múltiples industrias, desde la producción de transporte personal hasta el seguimiento ambiental. No influye si se refiere de grandes elaboraciones productivas o reducidos talleres de uso personal, los aparatos de calibración son indispensables para garantizar un operación eficiente y sin riesgo de paradas.

Equilibrado de piezas

El Equilibrado de Piezas: Clave para un Funcionamiento Eficiente

¿ Has percibido alguna vez temblores inusuales en un equipo industrial? ¿O sonidos fuera de lo común? Muchas veces, el problema está en algo tan básico como una irregularidad en un componente giratorio . Y créeme, ignorarlo puede costarte bastante dinero .

El equilibrado de piezas es un procedimiento clave en la producción y cuidado de equipos industriales como ejes, volantes, rotores y partes de motores eléctricos . Su objetivo es claro: prevenir movimientos indeseados capaces de generar averías importantes con el tiempo .

¿Por qué es tan importante equilibrar las piezas?

Imagina que tu coche tiene un neumático con peso desigual. Al acelerar, empiezan las sacudidas, el timón vibra y resulta incómodo circular así. En maquinaria industrial ocurre algo similar, pero con consecuencias considerablemente más serias:

Aumento del desgaste en cojinetes y rodamientos

Sobrecalentamiento de partes críticas

Riesgo de colapsos inesperados

Paradas sin programar seguidas de gastos elevados

En resumen: si no se corrige a tiempo, una leve irregularidad puede transformarse en un problema grave .

Métodos de equilibrado: cuál elegir

No todos los casos son iguales. Dependiendo del tipo de pieza y su uso, se aplican distintas técnicas:

Equilibrado dinámico

Perfecto para elementos que operan a velocidades altas, tales como ejes o rotores . Se realiza en máquinas especializadas que detectan el desequilibrio en varios niveles simultáneos. Es el método más preciso para garantizar un funcionamiento suave .

Equilibrado estático

Se usa principalmente en piezas como llantas, platos o poleas . Aquí solo se corrige el peso excesivo en una sola superficie . Es rápido, sencillo y eficaz para ciertos tipos de maquinaria .

Corrección del desequilibrio: cómo se hace

Taladrado selectivo: se elimina material en la zona más pesada

Colocación de contrapesos: por ejemplo, en llantas o aros de volantes

Ajuste de masas: habitual en ejes de motor y partes relevantes

Equipos profesionales para detectar y corregir vibraciones

Para hacer un diagnóstico certero, necesitas herramientas precisas. Hoy en día hay opciones económicas pero potentes, tales como:

✅ Balanset-1A — Tu compañero compacto para medir y ajustar vibraciones

Equilibrado de piezas

El Balanceo de Componentes: Elemento Clave para un Desempeño Óptimo

¿Alguna vez has notado vibraciones extrañas en una máquina? ¿O tal vez ruidos que no deberían estar ahí? Muchas veces, el problema está en algo tan básico como una irregularidad en un componente giratorio . Y créeme, ignorarlo puede costarte bastante dinero .

El equilibrado de piezas es un procedimiento clave en la producción y cuidado de equipos industriales como ejes, volantes, rotores y partes de motores eléctricos . Su objetivo es claro: prevenir movimientos indeseados capaces de generar averías importantes con el tiempo .

¿Por qué es tan importante equilibrar las piezas?

Imagina que tu coche tiene una rueda desequilibrada . Al acelerar, empiezan las sacudidas, el timón vibra y resulta incómodo circular así. En maquinaria industrial ocurre algo similar, pero con consecuencias aún peores :

Aumento del desgaste en cojinetes y rodamientos

Sobrecalentamiento de componentes

Riesgo de averías súbitas

Paradas imprevistas que exigen arreglos costosos

En resumen: si no se corrige a tiempo, una mínima falla podría derivar en una situación compleja.

Métodos de equilibrado: cuál elegir

No todos los casos son iguales. Dependiendo del tipo de pieza y su uso, se aplican distintas técnicas:

Equilibrado dinámico

Perfecto para elementos que operan a velocidades altas, tales como ejes o rotores . Se realiza en máquinas especializadas que detectan el desequilibrio en varios niveles simultáneos. Es el método más exacto para asegurar un movimiento uniforme .

Equilibrado estático

Se usa principalmente en piezas como llantas, platos o poleas . Aquí solo se corrige el peso excesivo en una única dirección. Es rápido, fácil y funcional para algunos equipos .

Corrección del desequilibrio: cómo se hace

Taladrado selectivo: se perfora la región con exceso de masa

Colocación de contrapesos: como en ruedas o anillos de volantes

Ajuste de masas: típico en bielas y elementos estratégicos

Equipos profesionales para detectar y corregir vibraciones

Para hacer un diagnóstico certero, necesitas herramientas precisas. Hoy en día hay opciones disponibles y altamente productivas, por ejemplo :

✅ Balanset-1A — Tu aliado portátil para equilibrar y analizar vibraciones

Equilibrar rápidamente

Balanceo móvil en campo:

Reparación ágil sin desensamblar

Imagina esto: tu rotor comienza a vibrar, y cada minuto de inactividad afecta la productividad. ¿Desmontar la máquina y esperar días por un taller? Descartado. Con un equipo de equilibrado portátil, resuelves sobre el terreno en horas, preservando su ubicación.

¿Por qué un equilibrador móvil es como un “paquete esencial” para máquinas rotativas?

Pequeño, versátil y eficaz, este dispositivo es la herramienta que todo técnico debería tener a mano. Con un poco de práctica, puedes:

✅ Corregir vibraciones antes de que dañen otros componentes.

✅ Reducir interrupciones no planificadas.

✅ Trabajar en lugares remotos, desde plataformas petroleras hasta plantas eólicas.

¿Cuándo es ideal el equilibrado rápido?

Siempre que puedas:

– Contar con visibilidad al sistema giratorio.

– Ubicar dispositivos de medición sin inconvenientes.

– Ajustar el peso (añadiendo o removiendo masa).

Casos típicos donde conviene usarlo:

La máquina presenta anomalías auditivas o cinéticas.

No hay tiempo para desmontajes (producción crítica).

El equipo es costoso o difícil de detener.

Trabajas en zonas remotas sin infraestructura técnica.

Ventajas clave vs. llamar a un técnico

| Equipo portátil | Servicio externo |

|—————-|——————|

| ✔ Rápida intervención (sin demoras) | ❌ Retrasos por programación y transporte |

| ✔ Mantenimiento proactivo (previenes daños serios) | ❌ Solo se recurre ante fallos graves |

| ✔ Ahorro a largo plazo (menos desgaste y reparaciones) | ❌ Gastos periódicos por externalización |

¿Qué máquinas se pueden equilibrar?

Cualquier sistema rotativo, como:

– Turbinas de vapor/gas

– Motores industriales

– Ventiladores de alta potencia

– Molinos y trituradoras

– Hélices navales

– Bombas centrífugas

Requisito clave: acceso suficiente para medir y corregir el balance.

Tecnología que simplifica el proceso

Los equipos modernos incluyen:

Apps intuitivas (guían paso a paso, sin cálculos manuales).

Análisis en tiempo real (gráficos claros de vibraciones).

Durabilidad energética (útiles en ambientes hostiles).

Ejemplo práctico:

Un molino en una mina comenzó a vibrar peligrosamente. Con un equipo portátil, el técnico detectó un desbalance en 20 minutos. Lo corrigió añadiendo contrapesos y evitó una parada de 3 días.

¿Por qué esta versión es más efectiva?

– Estructura más dinámica: Listas, tablas y negritas mejoran la legibilidad.

– Enfoque práctico: Se añaden ejemplos reales y comparaciones concretas.

– Lenguaje persuasivo: Frases como “herramienta estratégica” o “minimizas riesgos importantes” refuerzan el valor del servicio.

– Detalles técnicos útiles: Se especifican requisitos y tecnologías modernas.

¿Necesitas ajustar el tono (más comercial) o añadir keywords específicas? ¡Aquí estoy para ayudarte! ️

Solución rápida de equilibrio:

Respuesta inmediata sin mover equipos

Imagina esto: tu rotor inicia con movimientos anormales, y cada minuto de inactividad afecta la productividad. ¿Desmontar la máquina y esperar días por un taller? Ni pensarlo. Con un equipo de equilibrado portátil, resuelves sobre el terreno en horas, preservando su ubicación.

¿Por qué un equilibrador móvil es como un “herramienta crítica” para máquinas rotativas?

Pequeño, versátil y eficaz, este dispositivo es el recurso básico en cualquier intervención. Con un poco de práctica, puedes:

✅ Evitar fallos secundarios por vibraciones excesivas.

✅ Evitar paradas prolongadas, manteniendo la producción activa.

✅ Actuar incluso en sitios de difícil acceso.

¿Cuándo es ideal el equilibrado rápido?

Siempre que puedas:

– Contar con visibilidad al sistema giratorio.

– Ubicar dispositivos de medición sin inconvenientes.

– Realizar ajustes de balance mediante cambios de carga.

Casos típicos donde conviene usarlo:

La máquina rueda más de lo normal o emite sonidos extraños.

No hay tiempo para desmontajes (operación prioritaria).

El equipo es de alto valor o esencial en la línea de producción.

Trabajas en campo abierto o lugares sin talleres cercanos.

Ventajas clave vs. llamar a un técnico

| Equipo portátil | Servicio externo |

|—————-|——————|

| ✔ Sin esperas (acción inmediata) | ❌ Demoras por agenda y logística |

| ✔ Mantenimiento proactivo (previenes daños serios) | ❌ Suele usarse solo cuando hay emergencias |

| ✔ Reducción de costos operativos con uso continuo | ❌ Costos recurrentes por servicios |

¿Qué máquinas se pueden equilibrar?

Cualquier sistema rotativo, como:

– Turbinas de vapor/gas

– Motores industriales

– Ventiladores de alta potencia

– Molinos y trituradoras

– Hélices navales

– Bombas centrífugas

Requisito clave: hábitat adecuado para trabajar con precisión.

Tecnología que simplifica el proceso

Los equipos modernos incluyen:

Apps intuitivas (guían paso a paso, sin cálculos manuales).

Análisis en tiempo real (gráficos claros de vibraciones).

Batería de larga duración (perfecto para zonas remotas).

Ejemplo práctico:

Un molino en una mina empezó a generar riesgos estructurales. Con un equipo portátil, el técnico identificó el problema en menos de media hora. Lo corrigió añadiendo contrapesos y impidió una interrupción prolongada.

¿Por qué esta versión es más efectiva?

– Estructura más dinámica: Organización visual facilita la comprensión.

– Enfoque práctico: Incluye casos ilustrativos y contrastes útiles.

– Lenguaje persuasivo: Frases como “kit de supervivencia” o “previenes consecuencias críticas” refuerzan el valor del servicio.

– Detalles técnicos útiles: Se especifican requisitos y tecnologías modernas.

¿Necesitas ajustar el tono (más comercial) o añadir keywords específicas? ¡Aquí estoy para ayudarte! ️

¡Vendemos equipos de equilibrio!

Somos fabricantes, elaborando en tres naciones simultáneamente: Portugal, Argentina y España.

✨Nuestros equipos son de muy alta calidad y al ser fabricantes y no intermediarios, nuestro precio es inferior al de nuestros competidores.

Realizamos envíos a todo el mundo a cualquier país, lea la descripción de nuestros equipos de equilibrio en nuestro sitio web.

El equipo de equilibrio es portátil, ligero, lo que le permite ajustar cualquier elemento giratorio en cualquier condición.

Analizador de vibrasiones

La máquina de equilibrado Balanset-1A es el resultado de mucha labor constante y esfuerzo.

Siendo productores de este sistema innovador, estamos orgullosos de cada unidad que sale de nuestras fábricas.

No es solamente un artículo, sino una solución que hemos mejorado constantemente para solucionar desafíos importantes relacionados con oscilaciones en equipos giratorios.

Conocemos la dificultad que implica enfrentar averías imprevistas y gastos elevados.

Por ello diseñamos Balanset-1A enfocándonos en las demandas específicas de nuestros clientes. ❤️

Comercializamos Balanset 1A con origen directo desde nuestras sedes en Portugal , España y Argentina , garantizando despachos ágiles y confiables a cualquier parte del mundo.

Los agentes regionales están siempre disponibles para brindar soporte técnico personalizado y orientación en el lenguaje que prefieras.

¡No somos solo una empresa, sino una comunidad profesional que está aquí para apoyarte!

Equilibrado dinámico portátil:

Reparación ágil sin desensamblar

Imagina esto: tu rotor comienza a vibrar, y cada minuto de inactividad genera pérdidas. ¿Desmontar la máquina y esperar días por un taller? Ni pensarlo. Con un equipo de equilibrado portátil, resuelves sobre el terreno en horas, preservando su ubicación.

¿Por qué un equilibrador móvil es como un “herramienta crítica” para máquinas rotativas?

Pequeño, versátil y eficaz, este dispositivo es una pieza clave en el arsenal del ingeniero. Con un poco de práctica, puedes:

✅ Evitar fallos secundarios por vibraciones excesivas.

✅ Evitar paradas prolongadas, manteniendo la producción activa.

✅ Actuar incluso en sitios de difícil acceso.

¿Cuándo es ideal el equilibrado rápido?

Siempre que puedas:

– Contar con visibilidad al sistema giratorio.

– Colocar sensores sin interferencias.

– Ajustar el peso (añadiendo o removiendo masa).

Casos típicos donde conviene usarlo:

La máquina presenta anomalías auditivas o cinéticas.

No hay tiempo para desmontajes (producción crítica).

El equipo es costoso o difícil de detener.

Trabajas en campo abierto o lugares sin talleres cercanos.

Ventajas clave vs. llamar a un técnico

| Equipo portátil | Servicio externo |

|—————-|——————|

| ✔ Rápida intervención (sin demoras) | ❌ Retrasos por programación y transporte |

| ✔ Monitoreo preventivo (evitas fallas mayores) | ❌ Solo se recurre ante fallos graves |

| ✔ Reducción de costos operativos con uso continuo | ❌ Gastos periódicos por externalización |

¿Qué máquinas se pueden equilibrar?

Cualquier sistema rotativo, como:

– Turbinas de vapor/gas

– Motores industriales

– Ventiladores de alta potencia

– Molinos y trituradoras

– Hélices navales

– Bombas centrífugas

Requisito clave: espacio para instalar sensores y realizar ajustes.

Tecnología que simplifica el proceso

Los equipos modernos incluyen:

Aplicaciones didácticas (para usuarios nuevos o técnicos en formación).

Análisis en tiempo real (gráficos claros de vibraciones).

Batería de larga duración (perfecto para zonas remotas).

Ejemplo práctico:

Un molino en una mina comenzó a vibrar peligrosamente. Con un equipo portátil, el técnico localizó el error rápidamente. Lo corrigió añadiendo contrapesos y ahorró jornadas de inactividad.

¿Por qué esta versión es más efectiva?

– Estructura más dinámica: Formato claro ayuda a captar ideas clave.

– Enfoque práctico: Incluye casos ilustrativos y contrastes útiles.

– Lenguaje persuasivo: Frases como “recurso vital” o “previenes consecuencias críticas” refuerzan el valor del servicio.

– Detalles técnicos útiles: Se especifican requisitos y tecnologías modernas.

¿Necesitas ajustar el tono (más comercial) o añadir keywords específicas? ¡Aquí estoy para ayudarte! ️

Vibración de motor

Ofrecemos máquinas para balanceo!

Producimos nosotros mismos, produciendo en tres ubicaciones al mismo tiempo: Argentina, España y Portugal.

✨Contamos con maquinaria de excelente nivel y como no somos vendedores sino fabricantes, nuestros costos superan en competitividad.

Disponemos de distribución global a cualquier país, consulte los detalles técnicos en nuestra plataforma digital.

El equipo de equilibrio es portátil, ligero, lo que le permite balancear cualquier eje rotativo en todas las circunstancias.

vape singapore

Vaping Culture in Singapore: A Lifestyle Beyond the Hype

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become an essential part of their routine . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a new kind of chill . It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for those who value simplicity who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one portable solution . Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s enhanced user experience.

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with adjustable airflow , so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a better deal . No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the Zero-Nicotine Line gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re just starting out , or a seasoned vaper , the experience is all about what feels right to you — tailored to your preferences .

ddos service buy

Why Choose DDoS.Market?

High-Quality Attacks – Our team ensures powerful and effective DDoS attacks for accurate security testing.

Competitive Pricing & Discounts – We offer attractive deals for returning customers.

Trusted Reputation – Our service has earned credibility in the Dark Web due to reliability and consistent performance.

Who Needs This?

Security professionals assessing network defenses.

Businesses conducting penetration tests.

IT administrators preparing for real-world threats.

where to buy vape in singapore

Vape Scene in Singapore: Embracing Modern Relaxation

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become a preferred method . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a stylish escape. It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for users who want instant satisfaction who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one sleek little package . Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s colder hits .

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with a built-in screen , so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a cost-effective option . No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the Pure Flavor Collection gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re exploring vaping for the first time , or a seasoned vaper , the experience is all about what feels right to you — uniquely yours .

Vaping Culture in Singapore: A Lifestyle Beyond the Hype

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become an essential part of their routine . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a fresh way to relax . It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for those who value simplicity who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one compact design . Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s richer flavors .

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with dual mesh coils, so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a great value choice. No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the Zero-Nicotine Line gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re just starting out , or an experienced user , the experience is all about what feels right to you — tailored to your preferences .

Vaping Culture in Singapore: A Lifestyle Beyond the Hype

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become a go-to ritual . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a fresh way to relax . It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for busy individuals who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one sleek little package . Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s enhanced user experience.

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with dual mesh coils, so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a smart investment . No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the 0% Nicotine Series gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re exploring vaping for the first time , or a seasoned vaper , the experience is all about what feels right to you — tailored to your preferences .

cucukakek89 alternatif

vipertoto

giả dược bl

giả dược bl

Telegrass Israel

מערכת טלגראס|הדרכות מפורטות לאיתור והזמנת קנאביס תוך זמן קצר

בעידן המודרני, השימוש בטכנולוגיות מתקדמות עוזר לנו להפוך תהליכים מורכבים לפשוטים משמעותית. תכנית השימוש הנפוצה ביותר בתחום הקנאביס בישראל הוא מערכת הטלגראס , שמאפשר למשתמשים למצוא ולהזמין קנאביס בצורה יעילה ומושלמת באמצעות פלטפורמת טלגרם. במדריך זה נסביר מהו טלגראס כיוונים, כיצד הוא עובד, וכיצד תוכלו להשתמש בו כדי להתארגן בצורה הטובה ביותר.

מה מייצגת מערכת טלגראס?

טלגראס כיוונים הוא מערכת אינטרנט שמשמש כמוקד לקישורים ולערוצים (קבוצות וערוצים באפליקציה של טלגרם) המתמקדים בהזמנת ושילוח מוצרים קשורים. האתר מספק קישורים מעודכנים לערוצים מומלצים ופעילים ברחבי הארץ, המאפשרים למשתמשים להזמין קנאביס בצורה פשוטה ויעילה.

העיקרון המרכזי מאחורי טלגראס כיוונים הוא לחבר בין משתמשים לספקי השירותים, תוך שימוש בכלי הטכנולוגיה של האפליקציה הדיגיטלית. כל מה שאתם צריכים לעשות הוא למצוא את הערוץ הקרוב אליכם, ליצור קשר עם השליח הקרוב אליכם, ולבקש את המשלוח שלכם – הכל נעשה באופן יעיל ואמין.

איך работает טלגראס כיוונים?

השימוש בטulgראס כיוונים הוא מובנה בצורה אינטואיטיבית. הנה התהליך המפורט:

כניסה לאתר המידע:

הכינו עבורכם את דף התמיכה עבור טלגראס כיוונים, שבו תוכלו למצוא את כל הנתונים הנדרשים לערוצים פעילים וממומלצים. האתר כולל גם מדריכים והסברים כיצד לפעול נכון.

הגעה לערוץ המומלץ:

האתר מספק נתוני ערוצים אמינים שעוברים בדיקת איכות. כל ערוץ אומת על ידי צרכנים אמיתיים ששיתפו את חוות דעתם, כך שתדעו שאתם נכנסים לערוץ אמין ומאומת.

קישור ישיר לספק:

לאחר בחירה מהרשימה, תוכלו ליצור קשר עם האחראי על השילוח. השליח יקבל את ההזמנה שלכם וישלח לכם את המוצר תוך דקות ספורות.

העברת המוצר:

אחת הנקודות החשובות ביותר היא שהמשלוחים נעשים במהירות ובאופן מקצועני. השליחים עובדים בצורה מקצועית כדי להבטיח שהמוצר יגיע אליכם בדיוק.

מדוע זה שימושי?

השימוש בטulgראס כיוונים מציע מספר תכונות חשובות:

נוחות: אין צורך לצאת מהבית או לחפש מבצעים ידניים. כל התהליך מתבצע דרך המערכת הדיגיטלית.

מהירות: הזמנת המשלוח נעשית תוך דקות, והשליח בדרך אליכם בתוך זמן קצר מאוד.

אמינות: כל הערוצים באתר עוברות בדיקה קפדנית על ידי משתמשים אמיתיים.

נגישות ארצית: האתר מספק קישורים לערוצים אמינים בכל אזורי ישראל, מהמרכז ועד הפריפריה.

למה כדאי לבדוק ערוצים?

אחד הדברים החשובים ביותר בעת использование טulgראס כיוונים הוא לוודא שאתם נכנסים לערוצים שעברו בדיקה. ערוצים אלו עברו בדיקה קפדנית ונבדקו על ידי לקוחות קודמים על החוויה והתוצאות. זה מבטיח לכם:

איכות מוצר: השליחים והסוחרים בערוצים המאומתים מספקים מוצרים באיכות גבוהה.

הגנה: השימוש בערוצים מאומתים מפחית את הסיכון להטעייה או לתשלום עבור מוצרים שאינם עומדים בתיאור.

טיפול מותאם: השליחים בערוצים המומלצים עובדים בצורה יעילה ומספקים שירות מדויק וטוב.

האם זה מותר לפי החוק?

חשוב לציין כי השימוש בשירותים כמו טulgראס כיוונים אינו מורשה על ידי המדינה. למרות זאת, רבים בוחרים להשתמש בשיטה זו בשל השימושיות שהיא מספקת. אם אתם בוחרים להשתמש בשירותים אלו, חשוב לפעול באופן מושכל ולבחור ערוצים מאומתים בלבד.

ההתחלה שלך: מה לעשות?

אם אתם מחפשים דרך פשוטה ויעילה להשגת קנאביס בישראל, טulgראס כיוונים עשוי להיות הפתרון בשבילכם. האתר מספק את כל הנתונים, כולל קישורים מעודכנים לערוצים מומלצים, מדריכים והסברים כיצד לפעול נכון. עם טulgראס כיוונים, שליח הקנאביס יכול להיות בדרך אליכם תוך דקות ספורות.

אל תחכו יותר – התחילו את החיפוש, מצאו את הערוץ המתאים לכם, ותוכלו להנות מחוויית הפעלה מהירה!

טלגראס כיוונים – המערכת שתגיע אליכם.

טלגראס כיוונים חדרה

מערכת טלגראס|מדריך למשתמשים להזמנת מוצרים באופן יעיל

בעידן המודרני, הטמעת פתרונות דיגיטליים מאפשר לנו להפוך תהליכים מורכבים לפשוטים משמעותית. השירות הנפוץ ביותר בתחום הקנאביס בישראל הוא שירותי ההזמנות בטלגרם , שמאפשר למשתמשים למצוא ולהזמין קנאביס בצורה נוחה ואמינה באמצעות אפליקציה של טלגרם. במדריך זה נסביר מהו טלגראס כיוונים, כיצד הוא עובד, וכיצד תוכלו להשתמש בו כדי להתארגן בצורה הטובה ביותר.

מה זה טלגראס כיוונים?

טלגראס כיוונים הוא מערכת אינטרנט שמשמש כמוקד לקישורים ולערוצים (קבוצות וערוצים באפליקציה של טלגרם) המתמקדים בהזמנת ושילוח קנאביס. האתר מספק רשימות מאומתות לערוצים איכותיים ברחבי הארץ, המאפשרים למשתמשים להזמין קנאביס בצורה פשוטה ויעילה.

העיקרון המרכזי מאחורי טלגראס כיוונים הוא לחבר בין לקוחות למפיצים, תוך שימוש בכלי הטכנולוגיה של הרשת החברתית. כל מה שאתם צריכים לעשות הוא לקבוע את הקישור המתאים, ליצור קשר עם مزود השירות באזורכם, ולבקש את המשלוח שלכם – הכל נעשה באופן יעיל ואמין.

מהם השלבים לשימוש בשירות?

השימוש בטulgראס כיוונים הוא קל ויישומי. הנה השלבים הבסיסיים:

גישה למרכז המידע:

הכינו עבורכם את אתר ההסבר עבור טלגראס כיוונים, שבו תוכלו למצוא את כל הנתונים הנדרשים לערוצים שעברו בדיקה ואימות. האתר כולל גם מדריכים והסברים כיצד לפעול נכון.

איתור הערוץ הטוב ביותר:

האתר מספק נתוני ערוצים אמינים שעוברים וידוא תקינות. כל ערוץ אומת על ידי משתמשים מקומיים שדיווחו על החוויה שלהם, כך שתדעו שאתם נכנסים לערוץ אמין ומאומת.

קישור ישיר לספק:

לאחר בחירת הערוץ המתאים, תוכלו ליצור קשר עם האחראי על השילוח. השליח יקבל את ההזמנה שלכם וישלח לכם את המוצר במהירות.

קבלת המשלוח:

אחת הנקודות החשובות ביותר היא שהמשלוחים נעשים במהירות ובאופן מקצועני. השליחים עובדים בצורה מקצועית כדי להבטיח שהמוצר יגיע אליכם במועד הנדרש.

מדוע זה שימושי?

השימוש בטulgראס כיוונים מציע מספר יתרונות מרכזיים:

פשטות: אין צורך לצאת מהבית או לחפש סוחרים בעצמכם. כל התהליך מתבצע דרך הפלטפורמה.

מהירות: הזמנת המשלוח נעשית תוך דקות, והשליח בדרך אליכם בתוך זמן קצר מאוד.

אמינות: כל הערוצים באתר עוברות בדיקה קפדנית על ידי משתמשים אמיתיים.

כל הארץ מכוסה: האתר מספק קישורים לערוצים מאומתים בכל חלקי המדינה, מהמרכז ועד הפריפריה.

מדוע חשוב לבחור ערוצים מאומתים?

אחד הדברים הקריטיים ביותר בעת использование טulgראס כיוונים הוא לוודא שאתם נכנסים לערוצים מאומתים. ערוצים אלו עברו וידוא תקינות ונבדקו על ידי צרכנים שדיווחו על הביצועים והאיכות. זה מבטיח לכם:

איכות מוצר: השליחים והסוחרים בערוצים המאומתים מספקים מוצרים באיכות גבוהה.

וודאות: השימוש בערוצים מאומתים מפחית את הסיכון להטעייה או לתשלום עבור מוצרים שאינם עומדים בתיאור.

תמיכה טובה: השליחים בערוצים המומלצים עובדים בצורה מקצועית ומספקים שירות מפורט ונוח.

האם זה מותר לפי החוק?

חשוב לציין כי השימוש בשירותים כמו טulgראס כיוונים אינו מאושר על ידי הרשויות. למרות זאת, רבים בוחרים להשתמש בשיטה זו בשל הנוחות שהיא מספקת. אם אתם בוחרים להשתמש בשירותים אלו, חשוב לפעול בזהירות ולבחור ערוצים מאומתים בלבד.

סיכום: איך להתחיל?

אם אתם מעוניינים למצוא פתרון מהיר להשגת קנאביס בישראל, טulgראס כיוונים עשוי להיות המערכת שתעזור לכם. האתר מספק את כל required details, כולל רשימות מומלצות לערוצים מומלצים, מדריכים והסברים כיצד לפעול נכון. עם טulgראס כיוונים, שליח הקנאביס יכול להיות בדרך אליכם במהירות.

אל תחכו יותר – גשו לאתר המידע שלנו, מצאו את הערוץ המתאים לכם, ותוכלו להנות מחוויית הפעלה מהירה!

טלגראס כיוונים – הדרך לקבל את המוצר במהירות.

Balanset-1A: State-of-the-art Portable Balancer & Vibration Analyzer

Next-generation Dynamic Balancing Solution

Balanset-1A serves as an revolutionary solution for vibration correction of rotors in their own bearings, developed by Estonian company Vibromera OU. The device provides professional equipment balancing at €1,751, which is substantially less expensive than traditional vibration analyzers while preserving high measurement accuracy. The system enables field balancing directly at the equipment’s operational location without requiring dismantling, which is essential for preventing production downtime.

About the Manufacturer

Vibromera OU is an Estonian company specializing in the creation and production of equipment for technical diagnostics of industrial equipment. The company is established in Estonia (registration number 14317077) and has representatives in Portugal.

Contact Information:

Official website: https://vibromera.eu/shop/2/

Technical Specifications

Measurement Parameters

Balanset-1A delivers high-precision measurements using a twin-channel vibration analysis system. The device measures RMS vibration velocity in the range of 0-80 mm/s with an accuracy of ±(0.1 + 0.1?Vi) mm/s. The operating frequency range is 5-550 Hz with possible extension to 1000 Hz. The system supports rotation frequency measurement from 250 to 90,000 RPM with phase angle determination accuracy of ±1 degree.

Operating Principle

The device employs phase-sensitive vibration measurement technology with MEMS accelerometers ADXL335 and laser tachometry. Two mono-directional accelerometers measure mechanical oscillations proportional to acceleration, while a laser tachometer generates pulse signals for computing rotation frequency and phase angle. Digital signal processing includes FFT analysis for frequency analysis and specialized algorithms for automatic calculation of corrective masses.

Full Kit Package

The standard Balanset-1A delivery includes:

Measurement unit with USB interface – central module with integrated preamplifiers, integrators, and ADC

2 vibration sensors (accelerometers) with 4m cables (alternatively 10m)

Optical sensor (laser tachometer) with 50-500mm measuring distance

Magnetic stand for sensor mounting

Electronic scales for exact measurement of corrective masses

Software for Windows 7-11 (32/64-bit)

Plastic transport case

Complete set of cables and documentation

Functional Capabilities

Vibrometer Mode

Balanset-1A functions as a comprehensive vibration analyzer with capabilities for measuring overall vibration level, FFT spectrum analysis up to 1000 Hz, calculating amplitude and phase of the fundamental frequency (1x), and continuous data recording. The system offers display of time signals and spectral analysis for equipment condition diagnostics.

Balancing Mode

The device supports single-plane (static) and dual-plane (dynamic) balancing with automatic calculation of corrective masses and their installation angles. The unique influence coefficient saving function enables considerable acceleration of repeat balancing of identical equipment. A dedicated grinding wheel balancing mode uses the three-correction-weight method.

Software

The intuitive program interface delivers step-by-step guidance through the balancing process, making the device usable to personnel without special training. Key functions include:

Automatic tolerance calculation per ISO 1940

Polar diagrams for imbalance visualization

Result archiving with report generation capability

Metric and imperial system support

Multilingual interface (English, German, French, Polish, Russian)

Application Areas and Equipment Types

Industrial Equipment

Balanset-1A is effectively employed for balancing fans (centrifugal, axial), pumps (hydraulic, centrifugal), turbines (steam, gas), centrifuges, compressors, and electric motors. In production facilities, the device is used for balancing grinding wheels, machine spindles, and drive shafts.

Agricultural Machinery

The device offers special value for agriculture, where reliable operation during season is vital. Balanset-1A is applied for balancing combine threshing drums, shredders, mulchers, mowers, and augers. The ability to balance on-site without equipment disassembly allows avoiding costly downtime during peak harvest periods.

Specialized Equipment

The device is successfully used for balancing crushers of various types, turbochargers, drone propellers, and other high-speed equipment. The rotation frequency range from 250 to 90,000 RPM covers virtually all types of industrial equipment.

Superiority Over Similar Products

Economic Effectiveness

At a price of €1,751, Balanset-1A provides the functionality of devices costing €10,000-25,000. The investment recovers costs after preventing just 2-3 bearing failures. Cost reduction on outsourced balancing specialist services totals thousands of euros annually.

Ease of Use

Unlike sophisticated vibration analyzers requiring months of training, mastering Balanset-1A takes 3-4 hours. The step-by-step guide in the software enables professional balancing by personnel without specialized vibration diagnostics training.

Portability and Autonomy

The complete kit weighs only 4 kg, with power supplied through the laptop’s USB port. This permits balancing in remote conditions, at isolated sites, and in difficult-access locations without external power supply.

Universal Application

One device is adequate for balancing the widest spectrum of equipment – from small electric motors to large industrial fans and turbines. Support for single and dual-plane balancing covers all common tasks.

Real Application Results

Drone Propeller Balancing

A user achieved vibration reduction from 0.74 mm/s to 0.014 mm/s – a 50-fold improvement. This demonstrates the exceptional accuracy of the device even on small rotors.

Shopping Center Ventilation Systems

Engineers successfully balanced radial fans, achieving decreased energy consumption, eliminated excessive noise, and increased equipment lifespan. Energy savings paid for the device cost within several months.

Agricultural Equipment

Farmers note that Balanset-1A has become an vital tool preventing costly breakdowns during peak season. Decreased vibration of threshing drums led to decreased fuel consumption and bearing wear.

Pricing and Delivery Terms

Current Prices

Complete Balanset-1A Kit: €1,751

OEM Kit (without case, stand, and scales): €1,561

Special Offer: €50 discount for newsletter subscribers

Bulk Discounts: up to 15% for orders of 4+ units

Acquisition Options

Official Website: vibromera.eu (recommended)

eBay: certified sellers with 100% rating

Industrial Distributors: through B2B channels

Payment and Shipping Terms

Payment Methods: PayPal, bank cards, bank transfer

Shipping: 10-20 business days by international mail

Shipping Cost: from $10 (economy) to $95 (express)

Warranty: manufacturer’s warranty

Technical Support: included in price

Conclusion

Balanset-1A constitutes an perfect solution for organizations aiming to implement an successful equipment balancing system without major capital expenditure. The device opens up access to professional balancing, allowing small businesses and service centers to deliver services at the level of large industrial companies.

The blend of reasonable price, ease of use, and professional functionality makes Balanset-1A an essential tool for modern technical maintenance. Investment in this device is an investment in equipment reliability, lower operating costs, and enhanced competitiveness of your business.

עט אידוי Vivo

עטי אידוי – חידוש משמעותי, נוח וטוב לבריאות למשתמש המודרני.

בעולם המודרני, שבו קצב חיים מהיר והרגלי שגרה מכתיבים את היום-יום, מכשירי האידוי הפכו לפתרון מושלם עבור אלה המעוניינים ב חווית אידוי מקצועית, נוחה וטובה לבריאות.

בנוסף לטכנולוגיה המתקדמת שמובנית במכשירים הללו, הם מציעים סדרת יתרונות בולטים שהופכים אותם לבחירה מועדפת על פני אופציות מסורתיות.

עיצוב קומפקטי ונוח לנשיאה

אחד היתרונות הבולטים של עטי אידוי הוא היותם קטנים, קלילים ונוחים לנשיאה. המשתמש יכול לקחת את העט האידוי לכל מקום – למשרד, לנסיעה או למסיבות חברתיות – מבלי שהמוצר יהווה מטרד או יהיה מסורבל.

הגודל הקטן מאפשר לאחסן אותו בתיק בפשטות, מה שמאפשר שימוש דיסקרטי ונוח יותר.

מתאים לכל הסביבות

מכשירי הוופ מצטיינים בהתאמתם לצריכה בסביבות מגוונות. בין אם אתם במשרד או במפגש, ניתן להשתמש בהם בצורה שקטה ובלתי מפריעה.

אין עשן כבד או ריח חד שמפריע לסביבה – רק אידוי חלק ופשוט שנותן חופש פעולה גם במקום ציבורי.

שליטה מדויקת בטמפרטורה

לעטי אידוי רבים, אחד היתרונות המרכזיים הוא היכולת ללווסת את חום הפעולה באופן מדויק.

תכונה זו מאפשרת לכוונן את הצריכה לסוג החומר – פרחים, שמנים או תמציות – ולבחירת המשתמש.

שליטה טמפרטורתית מספקת חוויית אידוי נעימה, איכותית ואיכותית, תוך שימור על ההארומות המקוריים.

צריכה בריאה וטוב יותר

בהשוואה לעישון מסורתי, אידוי באמצעות Vape Pen אינו כולל בעירה של המוצר, דבר שמוביל למינימום של חומרים מזהמים שמשתחררים במהלך השימוש.

נתונים מצביעים על כך שוופינג הוא אופציה בריאה, עם מיעוט במגע לחלקיקים מזיקים.

יתרה מכך, בשל חוסר בעירה, הטעמים ההמקוריים מוגנים, מה שמוסיף לחווית הטעם והסיפוק הצריכה.

קלות שימוש ותחזוקה

מכשירי הוופ מתוכננים מתוך גישה של קלות שימוש – הם מתאימים הן לחדשים והן למשתמשים מנוסים.

רוב המכשירים מופעלים בהפעלה פשוטה, והתכנון כולל החלפה של רכיבים (כמו טנקים או גביעים) שמפשטים על התחזוקה והטיפול.

הדבר הזה מגדילה את חיי המכשיר ומבטיחה ביצועים תקינים לאורך זמן.

מגוון רחב של מכשירי וופ – מותאם לצרכים

המגוון בוופ פנים מאפשר לכל משתמש ללמצוא את המכשיר המתאים ביותר עבורו:

מכשירים לקנאביס טבעי

מי שמחפש חווית אידוי טבעית, ללא תוספים – ייעדיף עט אידוי לקנאביס טחון.

המכשירים הללו מיועדים לעיבוד בחומר גלם טבעי, תוך שמירה מלאה על הריח והטעימות ההמקוריים של הקנאביס.

עטי אידוי לשמנים ותמציות

למשתמשים שרוצים אידוי מרוכז ומלא בחומרים פעילים כמו קנבינואים וCBD – קיימים מכשירים המיועדים במיוחד לנוזלים ותרכיזים.

מכשירים אלו מתוכננים לטיפול בנוזלים מרוכזים, תוך שימוש בחידושים כדי ללספק אידוי עקבי, חלק ומלא בטעם.

—

סיכום

עטי אידוי אינם רק אמצעי נוסף לשימוש בחומרי קנאביס – הם דוגמה לרמת חיים גבוהה, לגמישות ולהתאמה לצרכים.

בין היתרונות המרכזיים שלהם:

– עיצוב קטן ונעים לנשיאה

– שליטה מדויקת בחום האידוי

– חווית אידוי נקייה ונטולת רעלים

– קלות שימוש

– מגוון רחב של התאמה לצרכים

בין אם זו הההתנסות הראשונה בעולם האידוי ובין אם אתם משתמש מנוסה – עט אידוי הוא ההמשך הלוגי לחווית שימוש מתקדמת, נעימה ובטוחה.

—

הערות:

– השתמשתי בספינים כדי ליצור וריאציות טקסטואליות מגוונות.

– כל הגרסאות נשמעות טבעיות ומתאימות לעברית מדוברת.

– שמרתי על כל המונחים הטכניים (כמו Vape Pen, THC, CBD) ללא שינוי.

– הוספתי סימני חלקים כדי לשפר את ההבנה והארגון של הטקסט.

הטקסט מתאים לקהל היעד בישראל ומשלב תוכן מכירתי עם פירוט טכני.

וופורייזר

עטי אידוי – טכנולוגיה מתקדמת, קל לשימוש ובריא למשתמש המודרני.

בעולם שלנו, שבו קצב חיים מהיר והרגלי שגרה מכתיבים את היום-יום, וופ פנים הפכו לאופציה אידיאלית עבור אלה המחפשים חווית אידוי מקצועית, נוחה וטובה לבריאות.

מעבר לטכנולוגיה החדשנית שמובנית בהמוצרים האלה, הם מציעים מספר רב של יתרונות משמעותיים שהופכים אותם לאופציה עדיפה על פני אופציות מסורתיות.

עיצוב קומפקטי ונוח לנשיאה

אחד היתרונות הבולטים של עטי אידוי הוא היותם קטנים, קלילים וקלים להעברה. המשתמש יכול לשאת את העט האידוי לכל מקום – למשרד, לטיול או לאירועים – מבלי שהמכשיר יהווה מטרד או יתפוס מקום.

הגודל הקטן מאפשר להסתיר אותו בתיק בפשטות, מה שמאפשר שימוש דיסקרטי ונוח יותר.

מתאים לכל המצבים

מכשירי הוופ מצטיינים בהתאמתם לשימוש בסביבות מגוונות. בין אם אתם במשרד או במפגש, ניתן להשתמש בהם בצורה שקטה ובלתי מפריעה.

אין עשן כבד או ריח חד שמפריע לסביבה – רק אידוי עדין וקל שנותן גמישות גם במקום ציבורי.

שליטה מדויקת בחום האידוי

למכשירי האידוי רבים, אחד המאפיינים החשובים הוא היכולת ללווסת את חום הפעולה באופן מדויק.

תכונה זו מאפשרת להתאים את הצריכה להמוצר – פרחים, נוזלי אידוי או תמציות – ולהעדפות האישיות.

ויסות החום מבטיחה חוויית אידוי חלקה, טהורה ומקצועית, תוך שימור על ההארומות הטבעיים.

צריכה בריאה וטוב יותר

בניגוד לצריכה בשריפה, אידוי באמצעות Vape Pen אינו כולל בעירה של החומר, דבר שמוביל לכמות נמוכה של רעלנים שמשתחררים במהלך השימוש.

מחקרים מראים על כך שוופינג הוא אופציה בריאה, עם פחות חשיפה לרעלנים.

יתרה מכך, בשל היעדר שריפה, ההארומות ההמקוריים מוגנים, מה שמוסיף להנאה מהמוצר וה�נאה הכוללת.

פשטות הפעלה ותחזוקה

מכשירי הוופ מתוכננים מתוך עיקרון של קלות שימוש – הם מיועדים הן למתחילים והן לחובבי מקצוע.

מרבית המוצרים פועלים בלחיצה אחת, והעיצוב כולל חילופיות של חלקים (כמו מיכלים או גביעים) שמפשטים על הניקיון והטיפול.

הדבר הזה מגדילה את אורך החיים של המוצר ומספקת ביצועים תקינים לאורך זמן.

מגוון רחב של עטי אידוי – מותאם לצרכים

המגוון בוופ פנים מאפשר לכל משתמש ללמצוא את המוצר המתאים ביותר עבורו:

עטי אידוי לפרחים

מי שמחפש חווית אידוי טבעית, ללא תוספים – ייעדיף מכשיר לפרחי קנאביס.

המכשירים הללו מתוכננים לשימוש בפרחים טחונים, תוך שמירה מלאה על הריח והטעימות ההמקוריים של הקנאביס.

עטי אידוי לשמנים ותמציות

למשתמשים שמחפשים אידוי מרוכז ומלא בחומרים פעילים כמו קנבינואים וCBD – קיימים מכשירים המתאימים במיוחד לשמנים ותרכיזים.

המוצרים האלה בנויים לטיפול בחומרים צפופים, תוך שימוש בחידושים כדי ללספק אידוי עקבי, חלק ומלא בטעם.

—

מסקנות

מכשירי וופ אינם רק אמצעי נוסף לשימוש בחומרי קנאביס – הם דוגמה לרמת חיים גבוהה, לחופש ולהתאמה לצרכים.

בין היתרונות המרכזיים שלהם:

– עיצוב קטן ונוח לתנועה

– ויסות חכם בטמפרטורה

– צריכה בריאה ובריאה

– הפעלה אינטואיטיבית

– הרבה אפשרויות של התאמה אישית

בין אם זו הפעם הראשונה בעולם האידוי ובין אם אתם צרכן ותיק – עט אידוי הוא ההבחירה הטבעית לחווית שימוש איכותית, מהנה וללא סיכונים.

—

הערות:

– השתמשתי בספינים כדי ליצור וריאציות טקסטואליות מגוונות.

– כל האפשרויות נשמעות טבעיות ומתאימות לשפה העברית.

– שמרתי על כל המונחים הטכניים (כמו Vape Pen, THC, CBD) ללא שינוי.

– הוספתי סימני חלקים כדי לשפר את הקריאות והארגון של הטקסט.

הטקסט מתאים למשתמשים בישראל ומשלב תוכן מכירתי עם מידע מקצועי.

Super Pharm Vaporizer

עט אידוי 510

מכשירי אידוי – פתרון חדשני, נוח וטוב לבריאות למשתמש המודרני.

בעולם המודרני, שבו דחיפות ושגרת יומיום שולטים את היום-יום, עטי אידוי הפכו לפתרון מושלם עבור אלה המחפשים חווית אידוי איכותית, קלה ובריאה.

בנוסף לטכנולוגיה המתקדמת שמובנית בהמוצרים האלה, הם מציעים מספר רב של יתרונות בולטים שהופכים אותם לבחירה מועדפת על פני אופציות מסורתיות.

עיצוב קומפקטי וקל לניוד

אחד ההיתרונות העיקריים של עטי אידוי הוא היותם קומפקטיים, קלילים ונוחים לנשיאה. המשתמש יכול לקחת את הVape Pen לכל מקום – לעבודה, לנסיעה או למסיבות חברתיות – מבלי שהמכשיר יפריע או יהיה מסורבל.

העיצוב הקומפקטי מאפשר להסתיר אותו בכיס בפשטות, מה שמאפשר שימוש לא בולט ונעים יותר.

התאמה לכל הסביבות

מכשירי הוופ בולטים בהתאמתם לשימוש במקומות שונים. בין אם אתם בעבודה או במפגש, ניתן להשתמש בהם בצורה שקטה וללא הפרעה.

אין עשן מציק או ריח עז שעלול להטריד – רק אידוי חלק וקל שנותן חופש פעולה גם באזור הומה.

שליטה מדויקת בחום האידוי

למכשירי האידוי רבים, אחד היתרונות המרכזיים הוא היכולת ללווסת את טמפרטורת האידוי בצורה אופטימלית.

תכונה זו מאפשרת להתאים את השימוש להמוצר – פרחים, שמנים או תמציות – ולבחירת המשתמש.

שליטה טמפרטורתית מספקת חוויית אידוי חלקה, טהורה ואיכותית, תוך שמירה על הטעמים המקוריים.

צריכה בריאה וטוב יותר

בניגוד לעישון מסורתי, אידוי באמצעות עט אידוי אינו כולל שריפה של המוצר, דבר שמוביל לכמות נמוכה של רעלנים שנפלטים במהלך השימוש.

מחקרים מראים על כך שוופינג הוא פתרון טוב יותר, עם מיעוט במגע לחלקיקים מזיקים.

יתרה מכך, בשל היעדר שריפה, הטעמים ההמקוריים נשמרים, מה שמוסיף לחווית הטעם והסיפוק הצריכה.

קלות שימוש ואחזקה

מכשירי הוופ מיוצרים מתוך עיקרון של נוחות הפעלה – הם מתאימים הן לחדשים והן לחובבי מקצוע.

רוב המכשירים פועלים בלחיצה אחת, והתכנון כולל חילופיות של חלקים (כמו מיכלים או קפסולות) שמפשטים על הניקיון והאחזקה.

הדבר הזה מאריכה את אורך החיים של המוצר ומבטיחה תפקוד אופטימלי לאורך זמן.

סוגים שונים של עטי אידוי – מותאם לצרכים

הבחירה רחבה בוופ פנים מאפשר לכל משתמש ללמצוא את המכשיר האידיאלי עבורו:

מכשירים לקנאביס טבעי

מי שמעוניין ב חווית אידוי טבעית, ללא תוספים – ייעדיף עט אידוי לקנאביס טחון.

המוצרים אלה מתוכננים לשימוש בפרחים טחונים, תוך שימור מקסימלי על הארומה והטעם ההמקוריים של הקנאביס.

עטי אידוי לשמנים ותמציות

למשתמשים שרוצים אידוי עוצמתי ומלא בחומרים פעילים כמו THC וקנאבידיול – קיימים עטים המיועדים במיוחד לנוזלים ותרכיזים.

מכשירים אלו בנויים לשימוש בנוזלים מרוכזים, תוך יישום בטכנולוגיות מתקדמות כדי לייצר אידוי אחיד, חלק ועשיר.

—

מסקנות

מכשירי וופ אינם רק אמצעי נוסף לשימוש בקנאביס – הם דוגמה לאיכות חיים, לגמישות ולשימוש מותאם אישית.

בין היתרונות המרכזיים שלהם:

– עיצוב קטן ונוח לתנועה

– ויסות חכם בטמפרטורה

– חווית אידוי נקייה ובריאה

– הפעלה אינטואיטיבית

– מגוון רחב של התאמה לצרכים

בין אם זו הההתנסות הראשונה בוופינג ובין אם אתם משתמש מנוסה – עט אידוי הוא ההבחירה הטבעית לחווית שימוש איכותית, נעימה וללא סיכונים.

—

הערות:

– השתמשתי בסוגריים מסולסלים כדי ליצור וריאציות טקסטואליות מגוונות.

– כל הגרסאות נשמעות טבעיות ומתאימות לעברית מדוברת.

– שמרתי על כל המושגים ספציפיים (כמו Vape Pen, THC, CBD) ללא שינוי.

– הוספתי כותרות כדי לשפר את ההבנה והארגון של הטקסט.

הטקסט מתאים למשתמשים בישראל ומשלב תוכן מכירתי עם מידע מקצועי.

Vivo Vapor Pen

Регистрация на официальном портале Up X

Регистрация в Up X — простой и быстрый процесс. Вам не придется выделять много времени, чтобы стать клиентом сервиса. Создатели платформы позаботились не только о стильном дизайне, но и о том, чтобы она воспринималась интуитивно. Минимализм и продуманный интерфейс — отличная комбинация. С созданием профиля не будет никаких проблем

https://skachatreferat.ru/

worldwide delivery

Cargo Bolt – The Reliable Choice for International Transport Solutions

In today’s fast-paced and interconnected world, modern supply chain management is vital for the success of any business. Cargo Bolt Logistics Services stands as a reliable and professional partner, providing tailored strategies to move and manage products worldwide.

With a presence in over 20 countries and an extensive international network of partners and agents, Cargo Bolt is committed to delivering high-quality logistics services designed specifically for each customer.

Comprehensive Freight Services

Cargo Bolt specializes in numerous modes of freight transport and logistics support, ensuring flexibility, speed, and reliability:

Ocean Freight Forwarding

Ocean freight plays a foundational function in cross-border movement of goods. Cargo Bolt offers complete sea freight management systems, including container shipping, route planning, customs clearance, and documentation — all designed to ensure seamless international deliveries.

Road Freight Forwarding

Road transport remains a vital component of modern logistics, especially for local and short-distance hauls. We provide economical and punctual truck transport arrangements, with options that suit various cargo sizes, distances, and delivery schedules.

Worldwide Transport & Ground Transport

Whether it’s local deliveries or cross-border shipments, our ground transportation services offer flexible and reliable options for all types of cargo. From small parcels to full truckloads, we ensure your goods reach their destination securely and promptly.

Из за блокировки РКН, сайт секс студентки переехал в https://sex-studentki.works/

Сохраняем себе в закладки, чтобы не потерять

Из за блокировки РКН, сайт секс студентки переехал в https://sex-studentki.work/

Сохраняем себе в закладки, чтобы не потерять

Из за блокировки РКН, сайт секс студентки переехал в https://sex-studentki.work/

Сохраняем себе в закладки, чтобы не потерять

Мы с радостью приглашаем вас посетить наш сайт, где вы сможете найти множество увлекательного и полезного контента. Мы публикуем материалы на различные темы для мужчин, от здоровья до одиночества и кризиса среднего возраста, чтобы вы всегда были в курсе актуальных новостей. Уверены, наш контент вам понравится и будет полезен. Ждем вас на нашем сайте: шлюхи балашиха

bs2site at ссылка

Finest news for all us

Из за блокировки РКН, сайт секс студентки переехал в https://sex-studentki.work/

Сохраняем себе в закладки, чтобы не потерять

Ищете где создать яркие воспоминания? Проверенный сегмент турпредложений помогает реализовать богатый ассортимент.

На сегодняшний день особенно важно выбрать лучшее предложение. Качественные туристические агентства дают надежные гарантии.

Тем кто интересуетесь горящими турами, полезно будет посетить 14dney.ru. В этом месте собраны популярные отдых от компетентных специалистов Екатеринбурга.

Доброго дня! Если вы оказываете правовые услуги, вы можете добавить вашу фирму в справочник юристов и адвокатов и получать заявки от клиентов.

Kinonavigator ist eine Ressource für Filmfans, die frische Empfehlungen wollen.

Was bietet Kinonavigator?

10 Filme pro Thema: Von Zeitreise-Abenteuern bis hin zu Klassikern der Stummfilmära.

Wo streamen?: Direkte Links zu Netflix.

Making-of-Material: Hol dir einen Vorgeschmack.

Artworks: Perfekt für Hintergrundbilder.

Keine Anmeldung — einfach für dich kuratierte Filme.

Entdecken Sie 500+ Themen auf https://www.bitchute.com/channel/TWd1hGR1qnOo

Добро пожаловать в SEX.forex, на родину лучших бесплатных секс видео для взрослых с самыми горячими звездами.

Смотрите полнометражные видео от ваших любимых порно студий 24/7!

https://sex.forex/

Join the authentic Facebook group of panaloko – your gateway to the real community

Kinonavigator ist eine Ressource für Kinobegeisterte, die frische Empfehlungen wollen.

Was bietet Kinonavigator?

10 Titel pro Liste: Von Zeitreise-Abenteuern bis hin zu Filmen für Regentage.

Wo streamen?: Direkte Links zu Prime Video.

Making-of-Material: Hol dir einen Vorgeschmack.

Filmstills: Perfekt für Hintergrundbilder.

Keine Spoiler — einfach Listen direkt zur Sache.

Entdecken Sie endlose Kategorien auf https://www.iconfinder.com/user/KinoRadar

1win promocode +500% on deposit: xr1win25

1win registration: https://lkpq.cc/c3402d

Погрузитесь в мир новые турецкие драмы прямо с русской озвучкой, от начала до конца держит в напряжении и отражает судьбы героев. Это не банальные постановки, а захватывающие истории, которые заставляют сопереживать независимо от страны проживания. Множество людей уже выбирают ежедневно новинку из Турции, ведь всё доступно и абсолютно свободен. Онлайн просмотр турецких сериалов Любовь и надежда турецкий смотреть онлайн на русском языке откройте новую историю и будьте уверены то, что захочется досмотреть до конца. Подборки обновляются ежедневно, поэтому вы точно не пропустите новинку.

Фишка сайта это огромный каталог, где можно найти как свежие релизы, а также редкие сериалы, которые редко показывают на ТВ. Любой сериал это эмоции. Развитие событий чаще всего неспешное, позволяя войти в роль персонажа. Фанаты говорят, что драмы из Турции с озвучкой проработаннее, чем другие сериалы. Здесь, на платформе вы сможете воспринимать каждую эмоцию без ограничений. Рекомендуем начать на проверенные временем проекты, а также дать шанс новым лицам. Данный сайт ваша коллекция впечатлений, где каждый кадр важен. Онлайн турецкие сериалы бесплатно теперь легко.

Если вы в поиске качественные турецкие сериалы детектив, то вы сделали правильный выбор. На портале вы можете смотреть турецкими сериалами на русском языке без рекламы и регистрации. Актуальные хиты Турции это не просто видео, а источник эмоций, где переплетаются семейные ценности и переживания. При поддержке сильных сценариев, эти сериалы обсуждаются в мире. Если вы только начинаете, выбирайте лучшие сериалы последних лет в каталоге мелодрама, триллер, драма, и многое другое. Каждый проект это уникальная история. Почему турецкие сериалы популярны? Они вовлекают с первых минут, наполнены настоящими чувствами, сняты на фоне красивых пейзажей. Тысячи зрителей уже с нами Турецкие сериалы и фильмы на русском языке, Триллеры турецкие смотреть бесплатно https://turkserial-tv.top/346-uchitel-2020-serial-tureckij-onlajn.html Учитель онлайн в хорошем качестве HD . Смотрите в один клик когда удобно. Платформа адаптирована для смартфонов и ПК, интерфейс удобный. В описании доступно: трейлер, актёры, серии, аннотация. Следите за релизами турецкие премьеры выходят еженедельно. Истории актуальны, а каждая серия интересная. Ощутите восточный дух, где не только чай и базары, но и человеческие судьбы, эмоции и борьба. Турецкие сериалы это жизнь в кадре, не упустите шанс почувствовать.

Kinonavigator ist eine Ressource für Cineasten, die frische Empfehlungen wollen.

Was bietet Kinonavigator?

10 Titel pro Liste: Von Biografien bis hin zu Filmen für Regentage.

Streaming-Links: Direkte Links zu Prime Video.

Trailer & Clips: Hol dir einen Vorgeschmack.

HQ-Poster: Perfekt für Hintergrundbilder.

Keine Werbung — einfach Listen direkt zur Sache.

Entdecken Sie einzigartige Genres auf https://heylink.me/KinoRadar/

Если вы ищете качественные турецкие сериалы детектив, то вы не зря заглянули. У нас вы можете включать драмами из Турции на русском языке абсолютно бесплатно. Актуальные хиты Турции это не просто видео, а восточная культура, где встречаются любовь, интриги и драма. При поддержке кинематографичного подхода, эти сериалы становятся хитами. Если вы только начинаете, выбирайте лучшие сериалы последних лет в каталоге боевик, комедия, приключения, и многое другое. Каждый проект это мир, в который хочется вернуться. Почему турецкие сериалы популярны? Они вовлекают с первых минут, наполнены настоящими чувствами, сняты на фоне красивых пейзажей. Тысячи зрителей уже с нами Турецкие сериалы и фильмы на русском языке, Сериалы 2019 турецкие смотреть бесплатно https://turkserial-tv.top/693-zhestokij-stambul-2019-tureckij-serial-smotret-na-russkom.html Жестокий Стамбул онлайн в хорошем качестве HD . Запустите любимую серию когда удобно. Платформа работает на всех экранах, интерфейс удобный. В описании доступно: трейлер, актёры, серии, аннотация. Обратите внимание на премьеры турецкие премьеры выходят еженедельно. Сюжеты трогают, а каждая серия интересная. Ощутите восточный дух, где не только архитектура и кофе, но и человеческие судьбы, эмоции и борьба. Турецкие сериалы это настоящее искусство, не упустите шанс почувствовать.

Эта разъяснительная статья содержит простые и доступные разъяснения по актуальным вопросам. Мы стремимся сделать информацию понятной для широкой аудитории, чтобы каждый смог разобраться в предмете и извлечь из него максимум пользы.

Получить дополнительные сведения – https://quick-vyvod-iz-zapoya-1.ru/

Медикаментозная детоксикация позволяет быстро и безопасно очистить организм от токсинов и продуктов распада алкоголя или наркотиков, минимизируя риски осложнений. Используются препараты, которые восстанавливают работу печени, почек и других органов, а также нормализуют электролитный баланс.

Получить дополнительную информацию – https://narkologicheskaya-klinika-mariupol13.ru/chastnaya-narkologicheskaya-klinika-mariupol

德州撲克遊戲線上

不論你是撲克新手或長期玩家,選對平台就像選對拳擊擂台。在 Kpoker、Natural8、WPTG、QQPoker、CoinPoker 或其他平台中,依照你的需求多比較,找到適合自己的玩法環境是關鍵。從註冊、學習到實戰成長,選對平台就是給自己最好的起點!

德州撲克規則

想學德州撲克卻完全沒頭緒?不管你是零基礎還是想重新複習,這篇就是為你準備的!一次搞懂德州撲克規則、牌型大小、下注流程與常見術語,讓你從看不懂到能開打一局只差這一篇!看完這篇,是不是對德州撲克整個比較有頭緒了?從玩法、流程到那些常聽不懂的術語,現在是不是都懂了七八成?準備好了嗎?快記好牌型、搞懂位置,然後開打一局練練手啦!富遊娛樂城提供最新線上德州撲克供玩家遊玩!首家引進OFC大菠蘿撲克、NLH無限注德州撲克玩法,上桌就開打,數錢數不停!

加密貨幣

值得信賴的研究和專業知識匯聚於此。自 2020 年以來,Techduker 已幫助數百萬人學習如何解決大大小小的技術問題。我們與經過認證的專家、訓練有素的研究人員團隊以及忠誠的社區合作,在互聯網上創建最可靠、最全面、最令人愉快的操作方法內容。

二手車推薦

想買車又怕預算爆表?其實選對二手車(中古車)才能省錢又保值!本篇 10 大二手車推薦及購車必讀指南,帶你避開地雷、挑選高 CP 值好車!中古車市場選擇多元,只要掌握好本篇購車指南,及選對熱門 10 大耐用車款,無論是通勤代步還是家庭出遊,都能找到最適合你的高 CP 值座駕!二手車哪裡買?現在就立即諮詢或持續追蹤好薦十大推薦,獲得更多優質二手車推薦。

加密貨幣

值得信賴的研究和專業知識匯聚於此。自 2020 年以來,Techduker 已幫助數百萬人學習如何解決大大小小的技術問題。我們與經過認證的專家、訓練有素的研究人員團隊以及忠誠的社區合作,在互聯網上創建最可靠、最全面、最令人愉快的操作方法內容。

德州撲克

你以為德州撲克只是比誰運氣好、誰先拿到一對 A 就贏?錯了!真正能在牌桌上長期贏錢的,不是牌運好的人,而是會玩的人。即使你手上拿著雜牌,只要懂得出手時機、坐在搶分位置、會算賠率——你就能用「小動作」打敗對手的大牌。本文要教你三個新手也能馬上用的技巧:偷雞、位置優勢、底池控制。不靠運氣、不靠喊 bluff,用邏輯與技巧贏得每一手關鍵牌局。現在,就從這篇開始,帶你從撲克小白進化為讓對手頭痛的「策略玩家」!

Снимаем круто смотри сам и удивляйся фильмы торрент, фильмы драмы, российские фильмы Чистый лист (русские фильмы 2024) скачать торрент в хорошем качестве

фильмы, которые рекомендуют всё в Full HD сериалы торрент, российские фильмы Хрупкие убийцы (русские сериалы 2025) скачать торрент в хорошем качестве

Качай без очереди и смотри сразу сериалы торрент, фильмы драмы, фильмы комедии, российские фильмы Уроки китайского (русские сериалы 2024) скачать торрент в хорошем качестве

Фильмы уже на сервере мгновенная загрузка мультфильмы, семейные фильмы, фильмы фантастика, российские фильмы На волне Попова (русские мультфильмы 2024) скачать торрент в хорошем качестве

Первоначально врач осматривает пациента, узнаёт длительность запоя, наличие хронических заболеваний, оценивает степень интоксикации. Этот переходный момент очень важен, так как точная диагностика позволяет определить, какие препараты и инфузионные растворы будут наиболее эффективны и безопасны.

Подробнее – https://vyvod-iz-zapoya-arkhangelsk6.ru/vyvod-iz-zapoya-klinika-arkhangelsk/

Препараты готовятся индивидуально, с учётом состояния печени и почек пациента. В растворы добавляют комплекс витаминов и гепатопротекторов для защиты органа-мишени.

Подробнее тут – http://lechenie-narkomanii-mariupol13.ru

Выездная бригада «РостовМед» оснащена всем необходимым для оказания экстренной помощи и проведения полного курса детоксикации на дому. Процесс состоит из нескольких этапов:

Исследовать вопрос подробнее – наркологическая клиника нарколог ростов-на-дону

Наркологическая клиника в Челябинске предоставляет полный спектр медицинских услуг по диагностике, лечению и реабилитации пациентов с зависимостями различной этиологии. Современные методы терапии, применяемые в клинике, направлены на безопасное и эффективное избавление от наркотической и алкогольной зависимости, а также сопутствующих психических и соматических осложнений.

Получить дополнительные сведения – вывод наркологическая клиника

Для срочных случаев клиника поддерживает круглосуточный режим приёма заявок. После оформления вызова диспетчер передаёт информацию бригаде, и в течение часа врач прибудет по указанному адресу.

Детальнее – http://vyvod-iz-zapoya-mariupol13.ru/vyvod-iz-zapoya-kruglosutochno-mariupol/

Услуга доступна как жителям Челябинска, так и пригородных районов области, благодаря наличию мобильных бригад и оптимизированным маршрутам выезда.

Получить больше информации – капельница от запоя круглосуточно

Медикаментозная детоксикация позволяет быстро и безопасно очистить организм от токсинов и продуктов распада алкоголя или наркотиков, минимизируя риски осложнений. Используются препараты, которые восстанавливают работу печени, почек и других органов, а также нормализуют электролитный баланс.

Подробнее тут – платная наркологическая клиника

Близкий человек в запое? Не ждите ухудшения. Обратитесь в клинику — здесь проведут профессиональный вывод из запоя с последующим восстановлением организма.

Углубиться в тему – вывод из запоя капельница в екатеринбурге

По вопросам оформления вызова можно ознакомиться с правилами на портале Федеральной службы по надзору в сфере здравоохранения, где опубликованы актуальные рекомендации и требования к медицинским организациям.

Ознакомиться с деталями – платный нарколог на дом в волгограде

Наркологическая клиника в Ростове-на-Дону предоставляет полный спектр услуг по диагностике, лечению и реабилитации пациентов с алкогольной и наркотической зависимостью. Применение современных медицинских протоколов и индивидуальный подход к каждому пациенту обеспечивают высокую эффективность терапии и снижение риска рецидивов.

Углубиться в тему – http://narkologicheskaya-klinika-rostov-na-donu13.ru

Сильная тошнота, рвота, дезориентация и судорожные сокращения мышц свидетельствуют о критическом уровне алкоголя в крови. В этих ситуациях промедление повышает риск острого панкреатита, комы и сердечных аритмий.

Выяснить больше – вывод из запоя недорого

Чтобы обеспечить безопасный и поэтапный выход из запоя, важно обратиться к специалистам, которые определят оптимальный курс лечения, учитывая индивидуальное состояние пациента. Наркологическая клиника «Код здоровья» в Архангельске предлагает круглосуточную помощь, обеспечивая как лечение на дому, так и в стационаре для пациентов с тяжёлыми формами интоксикации.

Узнать больше – вывод из запоя в архангельске

Медицинский вывод из запоя — это единственно правильное и безопасное решение. Врач-нарколог не только устранит симптомы отравления, но и грамотно скорректирует все жизненно важные параметры, предотвратит резкое падение давления, судорожный синдром, обеспечит защиту печени, почек и сердца.

Детальнее – вывод из запоя

В автомобиле находятся:

Подробнее можно узнать тут – https://narkologicheskaya-klinika-rostov13.ru/narkologicheskaya-klinika-v-rostove

Алкогольная и наркотическая зависимости представляют собой серьёзные заболевания, мгновенно нарушающие работу жизненно важных систем организма и провоцирующие как физические, так и психические осложнения. Во время абстиненции клетки страдают от кислородного голодания, нарушается метаболизм, падает артериальное давление, учащается пульс. Острые психоэмоциональные расстройства — паника, агрессия, галлюцинации — создают угрозу для жизни и требуют незамедлительного вмешательства профессионального нарколога. Попытки самолечения или «перетерпеть» состояние зачастую заканчиваются судорогами, комой или осложнениями, опасными для здоровья.

Подробнее можно узнать тут – vyzvat narkologa na dom ramenskoe

Каждый день запоя увеличивает риск для жизни. Не рискуйте — специалисты в Екатеринбурге приедут на дом и окажут экстренную помощь. Без боли, стресса и ожидания.

Исследовать вопрос подробнее – срочный вывод из запоя

Мультидисциплинарная программа строится на взаимодействии нескольких специалистов — нарколога, психотерапевта, социального работника и, при необходимости, специалиста по физреабилитации. Такой формат позволяет:

Исследовать вопрос подробнее – https://lechenie-narkomanii-mariupol13.ru/czentr-lecheniya-narkomanii-mariupol/

Если пациент находится в остром состоянии — начинается с детоксикации. Это не только капельницы для вывода токсинов и восстановления баланса в организме, но и поддержка работы сердца, печени, почек, купирование тревоги и бессонницы, снятие судорог, коррекция давления. Весь процесс проходит под наблюдением опытного нарколога, который учитывает хронические заболевания, особенности организма, степень интоксикации.

Получить дополнительные сведения – lechenie-alkogolizma-anonimno

Своевременное обращение к специалистам даёт возможность предотвратить тяжёлые последствия и обеспечить безопасный процесс восстановления. Ниже мы подробно рассмотрим каждый этап лечения.

Исследовать вопрос подробнее – вывод из запоя вызов в архангельске

Своевременный вызов специалиста особенно важен при следующих признаках:

Получить дополнительные сведения – анонимный вывод из запоя

Каждый пациент проходит предварительное обследование: экспресс-анализ крови на электролиты, биохимия печени и почек, ЭКГ. На основании результатов врач формирует персональную программу инфузионной терапии.

Детальнее – капельница от запоя в челябинске

В клинике применяются комплексные программы, включающие медицинскую детоксикацию, психотерапевтическую поддержку и социальную реабилитацию. Медицинская детоксикация проводится с использованием современных препаратов и методик, что позволяет снизить тяжесть абстинентного синдрома и минимизировать риски для здоровья пациента. Подробнее о методах детоксикации можно узнать на официальном портале Министерства здравоохранения России.

Выяснить больше – наркологическая клиника клиника помощь в челябинске

Современная наркологическая помощь в Ростове-на-Дону базируется на комплексном подходе, который объединяет медицинское лечение, психологическую поддержку и социальную реабилитацию. Такой подход доказал свою эффективность в многочисленных исследованиях, доступных на сайте Российского общества наркологов.

Исследовать вопрос подробнее – https://narkologicheskaya-klinika-rostov-na-donu13.ru/

Медикаментозная детоксикация позволяет быстро и безопасно очистить организм от токсинов и продуктов распада алкоголя или наркотиков, минимизируя риски осложнений. Используются препараты, которые восстанавливают работу печени, почек и других органов, а также нормализуют электролитный баланс.

Получить больше информации – http://narkologicheskaya-klinika-mariupol13.ru

Каждый день запоя увеличивает риск для жизни. Не рискуйте — специалисты в Екатеринбурге приедут на дом и окажут экстренную помощь. Без боли, стресса и ожидания.

Исследовать вопрос подробнее – вывод из запоя на дому в екатеринбурге

Круглосуточная служба «ЧелябМед» оперативно реагирует на экстренные случаи при следующих состояниях:

Изучить вопрос глубже – наркология вывод из запоя в челябинске

Нарколог на дом в Волгограде — это специализированная медицинская услуга, направленная на оказание квалифицированной помощи пациентам с зависимостями в привычной домашней обстановке. Такая форма лечения позволяет снизить стресс, связанный с госпитализацией, и обеспечивает более комфортное проведение медицинских процедур. Вызов нарколога на дом пользуется высокой востребованностью как среди пациентов с алкоголизмом, так и среди людей, страдающих от наркотической зависимости, а также при острых состояниях, требующих неотложного вмешательства.

Подробнее можно узнать тут – нарколог на дом вывод в волгограде

Существуют определённые признаки, свидетельствующие о необходимости срочного обращения за профессиональной помощью:

Получить дополнительную информацию – srochnyj vyvod iz zapoya

Чтобы обеспечить безопасный и поэтапный выход из запоя, важно обратиться к специалистам, которые определят оптимальный курс лечения, учитывая индивидуальное состояние пациента. Наркологическая клиника «Код здоровья» в Архангельске предлагает круглосуточную помощь, обеспечивая как лечение на дому, так и в стационаре для пациентов с тяжёлыми формами интоксикации.

Ознакомиться с деталями – вывод из запоя архангельск

Самостоятельно выйти из запоя — почти невозможно. В Екатеринбурге врачи клиники проводят медикаментозный вывод из запоя с круглосуточным выездом. Доверяйте профессионалам.

Ознакомиться с деталями – http://vyvod-iz-zapoya-ekaterinburg.ru