Merali family has witnessed an uptick in its investments in under four days, thanks to the gains in the shilling.

The family is among the main shareholders in Sasini Tea and has witnessed a surge in investment at $1.5 million (Ksh.209.08 billion).

This is anchored on the return of investors at the Nairobi Securities Exchange ( NSE).

NSE, over the past few days, has experienced increased activity as the shilling reclaims its glory.

Investors have been engaging in share acquisitions that have boosted Sasini Tea’s market presence.

The return of investors in the market is premised on the Kenya Shilling – which has gained strength over the green back for the past week.

It exchanged at 138.8 units against the dollar on Wednesday, compared to March 11 when it opened at 139 units.

Sasini Tea is a distinguished name in Kenya’s agribusiness sector, involved in the cultivation and processing of tea, coffee, avocados, and macadamia nuts.

Commanding Shares in Sasini

The Merali family hold a significant influence in Sasini Tea, commanding 65.46% of shares – equivalent to 168,856,800 shares.

Also Read: Sasini bounces back to profitability in its half year results

The period since March 8 has seen Sasini’s shares skyrocket by 7.2%, marking a rise from Ksh.19.45 ($0.140) to Ksh.20.85 ($0.150).

Sasini’s market cap has soared to $34.24 million.

This bullish trend cements Merali as a strategic investor in Kenya, with Ksh.209.08 billion worth of investment in Kenya.

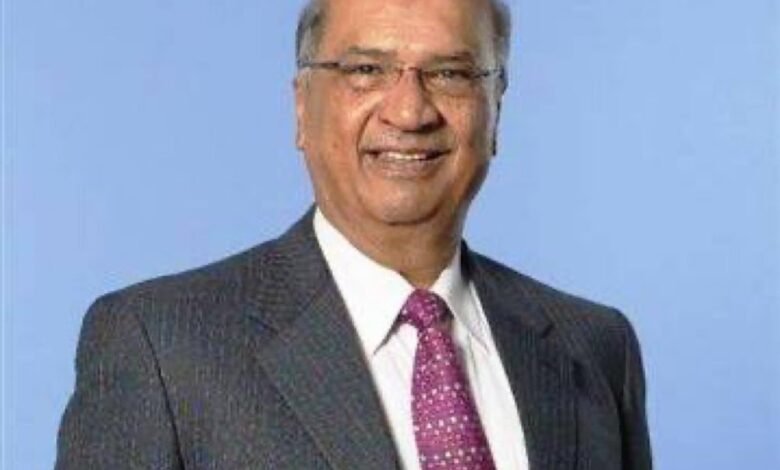

Businessman Naushad Merali – the founder of Kencell (now Airtel) and Sameer Group died in Nairobi in July 2021.