Kenya has been added onto the “gray list” by the Financial Action Task Force (FAFT) once again.

This means Kenya has dropped the ball in its efforts to combating illicit financial flows.

The FATF, an international watchdog focused on money laundering and terrorist financing, has outlined specific areas for Kenya to address.

These include the supervision of cryptoassets, enhancement of financial intelligence quality, and an increase in the prosecution of money laundering cases.

The inclusion of Kenya is a major concern as it seeks to attract foreign investment.

Also Read: Court freezes over Ksh.115 million belonging to Kenyan woman in money laundering fight

Other countries on the new gray list are South Africa and Nigeria, Africa’s largest economies.

Namibia is also on the list but Uganda has been dropped.

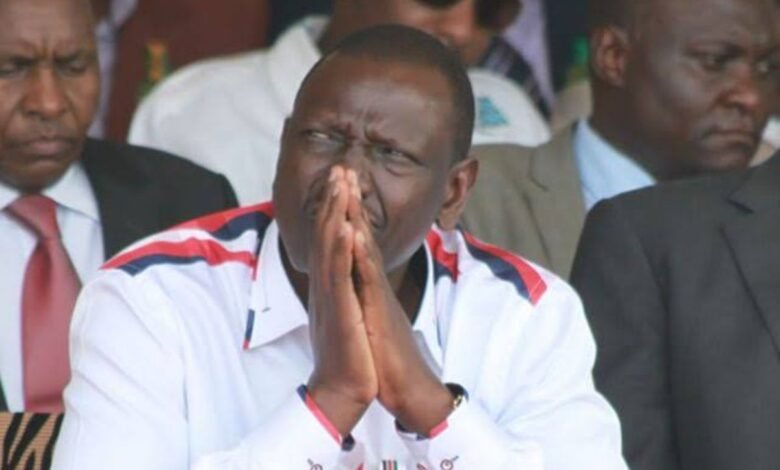

What President Ruto Said

In an interview Thursday, President William Ruto cognizant of the implications, said his administration is committed to addressing these concerns.

He revealed plans to increase Kenya’s deposits with multilateral lenders such as the African Export-Import Bank, the African Development Bank, and the Trade and Development Bank.

It is part of Kenya’s strategy to source affordable borrowing and to enhance the nation’s appeal to investors.

The National Treasury’s statement, in response to the FATF’s listing, underscored the urgency of improving regulatory frameworks, especially concerning emerging financial technologies like cryptoassets.

Kenya’s position on the regulation of cryptoassets has been one of cautious advancement, with existing laws providing a foundation for oversight while acknowledging the need for further refinement.

Kenya was last on the list in 2014, with push from IMF for the state to tighten laws around money laundering activities as means to get access to more funding.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.