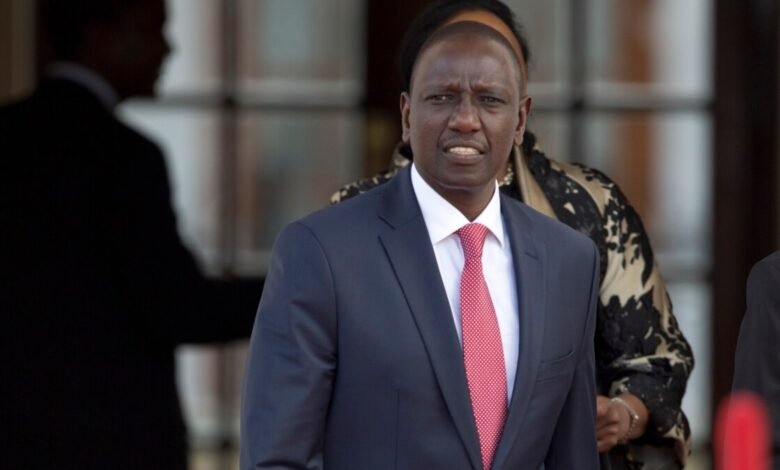

President William Ruto signed into law the Privatisation Bill, 2023 – paving the way to privatise State Owned Enterprises (SOE) or better known, as parastatals without bureaucratic intricacies from Parliament.

The privatisation agenda is hinged on reduced revenue transfer to SOEs to increase the fiscal space for other priority spending without increasing the size of the fiscal deficit.

Among institutions slated for sale include the historical Kenyatta International Convention Centre (KICC), Kenya Pipeline Company (KPC) and National Oil Corporation of Kenya (NOCK).

But according to Moody’s in its December Markets Outlook, delivering on, and reaping the rewards of, the privatization agenda “will take a long time and particularly challenging in the current economic climate.”

Also, President Ruto faces political resistance to privatization stemming from rent-seeking and corruption which are part of the reason for the poor financial performance of SOEs, while there are social risks if privatization results in job losses or increased costs for services.

The Conflict of Interest Bill, 2023 aims to address corruption issues by strengthening public officials’ requirements around wealth declaration.

Privatizing companies such as Kenya Seed Company Limited could also face social and political resistance given its perceived role in ensuring food security.

Additionally, some opposition political leaders have argued that the privatization of companies such as KPC and NOCK would result in higher fuel prices, and oppose the initiative because the government would cede control of strategic assets.

“In any event, privatization programs often exhibit a protracted timeline before manifesting substantial benefits, particularly for asset sales where the process of valuation, finding buyers, and negotiating deals can be lengthy and complex,” adds Moody’s.

The government’s privatization agenda comes amid a challenging domestic economic environment given the depreciation of the exchange rate and tight domestic liquidity.

Kenya has taken several steps to improve its fiscal trajectory since entering an IMF program in April 2021.

These steps include efforts to improve tax collection through compliance and the introduction of new taxes, and curtailing spending, including on fuel subsidies.

These measures are meant to unlock funding from multilateral lenders such as the International Monetary Fund (IMF) and the World Bank on whom the government increasingly relies for external financing.

“Improving governance and oversight of SOEs is a key pillar of the IMF program and important for maintaining support from other multilateral creditors such as the World Bank.”

This is evidenced in a recent move by the IMF in November when it reached a staff-level agreement with Kenya on the sixth review of its IMF program, agreeing to increase funding by about $940 million.

The agreement was followed by a statement from the World Bank indicating that it would make $4.4 billion available for additional lending, taking its total commitments to Kenya to $12 billion.

Moody’s says progress on improving the governance of state corporations, and eventually selling government stakes in certain entities, would positively affect the fiscal balance and government debt.

yandanxvurulmus.LOWHIHmfjJL6

xyandanxvurulmus.vg3L5kZ7zW3I

xbunedirloooo.Q8oYC4YgZqvP

acarodomatium xyandanxvurulmus.n4U3kXEeUl0x

Luar biasa blog ini! 🌟 Saya sangat menyukai bagaimana penulisannya memberikan pemahaman mendalam dalam topik yang dibahas. 👌 Artikelnya menghibur dan mendidik sekaligus. 📖 Tiap artikel membuat saya semakin penasaran untuk melihat artikel lainnya. Teruskan pekerjaan hebatnya

bahis siteleri porn sex incest vurgunyedim.PQCKGHnk1vpD

porno yaralandinmieycan.hhqZDKjpQ03M

watch porn video citixx.KQCzbEhfy2du

porn hyuqgzhqt.WoaMLcQYBN2L

watch porn video ewrjghsdfaa.H9rc7tIuEyWW

food porn wrtgdfgdfgdqq.J5yy90muprUi

fuck bjluajszz.lsQv1CL1U5ic

BİZİ SİK BİZ BUNU HAK EDİYORUZ bxjluajsxzz.TtuwcIqpqhPa

porn siteleri 0qbxjluaxcxjsxzz.wvlXczAZQyNT

viagra footballxx.ldx0rOIUK9Qo

BİZİ SİK BİZ BUNU HAK EDİYORUZ 250tldenemebonusuxx.Gq2pT1WF7tYJ

bahis siteleri child porn eyeconartxx.ayMPzby0Nu5q

house porn vvsetohimalxxvc.83h0YD2DHPQN

sex video 4 k gghkyogg.4nPxVnpynmQ

sexy video 4k download ggjennifegg.9CKY5itGmJy

pornfullhd ggjinnysflogg.Vu0MokKYMmT

Три месяца выбирали кухню, остановились на Эталон Кухни. И не пожалели! Тел: +7 843 258-86-66 Заходите

В магазине мемориальных плит порекомендовали Business-gazeta.ru. Организация похорон прошла по высшему разряду. Достойное прощание с близким.

Vibracion del motor

Sistemas de equilibrado: fundamental para el desempeño uniforme y óptimo de las equipos.

En el campo de la innovación actual, donde la efectividad y la confiabilidad del aparato son de alta trascendencia, los sistemas de balanceo juegan un función crucial. Estos aparatos específicos están desarrollados para balancear y asegurar elementos rotativas, ya sea en equipamiento de fábrica, automóviles de transporte o incluso en electrodomésticos de uso diario.

Para los técnicos en conservación de sistemas y los ingenieros, utilizar con dispositivos de equilibrado es importante para asegurar el operación fluido y fiable de cualquier dispositivo móvil. Gracias a estas alternativas innovadoras avanzadas, es posible disminuir sustancialmente las sacudidas, el ruido y la carga sobre los soportes, prolongando la vida útil de componentes importantes.

Asimismo trascendental es el función que cumplen los equipos de calibración en la asistencia al usuario. El ayuda especializado y el mantenimiento constante usando estos equipos posibilitan brindar prestaciones de excelente estándar, elevando la satisfacción de los compradores.

Para los titulares de negocios, la inversión en equipos de balanceo y medidores puede ser esencial para incrementar la productividad y rendimiento de sus sistemas. Esto es sobre todo importante para los empresarios que administran pequeñas y medianas organizaciones, donde cada aspecto cuenta.

Asimismo, los dispositivos de ajuste tienen una gran utilización en el ámbito de la protección y el monitoreo de excelencia. Permiten localizar posibles errores, evitando mantenimientos onerosas y averías a los dispositivos. Más aún, los información generados de estos aparatos pueden emplearse para optimizar métodos y mejorar la exposición en buscadores de investigación.

Las áreas de implementación de los aparatos de calibración abarcan variadas ramas, desde la elaboración de transporte personal hasta el monitoreo ecológico. No importa si se refiere de grandes elaboraciones de fábrica o modestos talleres domésticos, los aparatos de ajuste son necesarios para promover un desempeño efectivo y libre de interrupciones.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

В Instagram увидел отзывы о ProKazan.ru. Кремация организована с пониманием. Сотрудники помогли с транспортом.

El Equilibrado de Piezas: Clave para un Funcionamiento Eficiente

¿ Has percibido alguna vez temblores inusuales en un equipo industrial? ¿O sonidos fuera de lo común? Muchas veces, el problema está en algo tan básico como una irregularidad en un componente giratorio . Y créeme, ignorarlo puede costarte caro .

El equilibrado de piezas es un procedimiento clave en la producción y cuidado de equipos industriales como ejes, volantes, rotores y partes de motores eléctricos . Su objetivo es claro: impedir oscilaciones que, a la larga, puedan provocar desperfectos graves.

¿Por qué es tan importante equilibrar las piezas?

Imagina que tu coche tiene una llanta mal nivelada . Al acelerar, empiezan las vibraciones, el volante tiembla, e incluso puedes sentir incomodidad al conducir . En maquinaria industrial ocurre algo similar, pero con consecuencias mucho más graves :

Aumento del desgaste en cojinetes y rodamientos

Sobrecalentamiento de elementos sensibles

Riesgo de fallos mecánicos repentinos

Paradas sin programar seguidas de gastos elevados

En resumen: si no se corrige a tiempo, una leve irregularidad puede transformarse en un problema grave .

Métodos de equilibrado: cuál elegir

No todos los casos son iguales. Dependiendo del tipo de pieza y su uso, se aplican distintas técnicas:

Equilibrado dinámico

Perfecto para elementos que operan a velocidades altas, tales como ejes o rotores . Se realiza en máquinas especializadas que detectan el desequilibrio en dos o más planos . Es el método más fiable para lograr un desempeño estable.

Equilibrado estático

Se usa principalmente en piezas como ruedas, discos o volantes . Aquí solo se corrige el peso excesivo en un plano . Es ágil, práctico y efectivo para determinados sistemas.

Corrección del desequilibrio: cómo se hace

Taladrado selectivo: se elimina material en la zona más pesada

Colocación de contrapesos: como en ruedas o anillos de volantes

Ajuste de masas: común en cigüeñales y otros componentes críticos

Equipos profesionales para detectar y corregir vibraciones

Para hacer un diagnóstico certero, necesitas herramientas precisas. Hoy en día hay opciones disponibles y altamente productivas, por ejemplo :

✅ Balanset-1A — Tu compañero compacto para medir y ajustar vibraciones

Для кого-то организующего события или нуждающегося в цветах оптом, opt-flower.ru оказался невероятно ценным! Я использовал их при организации юбилея нашей компании, и их оптовые цены намного выгоднее, чем в розничных магазинах. Они доставляют по всей России, особенно хорошо работают с бизнес-клиентами из крупных городов. Несмотря на заказ больших объемов, качество было неизменно высоким. У них есть эта дополнительный сервис, где они подскажут о сезонной доступности и помогут максимально эффективно использовать ваш бюджет.

Equilibrado de piezas

La Nivelación de Partes Móviles: Esencial para una Operación Sin Vibraciones

¿ Has percibido alguna vez temblores inusuales en un equipo industrial? ¿O sonidos fuera de lo común? Muchas veces, el problema está en algo tan básico como una irregularidad en un componente giratorio . Y créeme, ignorarlo puede costarte caro .

El equilibrado de piezas es un procedimiento clave en la producción y cuidado de equipos industriales como ejes, volantes, rotores y partes de motores eléctricos . Su objetivo es claro: evitar vibraciones innecesarias que pueden causar daños serios a largo plazo .

¿Por qué es tan importante equilibrar las piezas?

Imagina que tu coche tiene una rueda desequilibrada . Al acelerar, empiezan los temblores, el manubrio se mueve y hasta puede aparecer cierta molestia al manejar . En maquinaria industrial ocurre algo similar, pero con consecuencias considerablemente más serias:

Aumento del desgaste en soportes y baleros

Sobrecalentamiento de elementos sensibles

Riesgo de colapsos inesperados

Paradas imprevistas que exigen arreglos costosos

En resumen: si no se corrige a tiempo, una mínima falla podría derivar en una situación compleja.

Métodos de equilibrado: cuál elegir

No todos los casos son iguales. Dependiendo del tipo de pieza y su uso, se aplican distintas técnicas:

Equilibrado dinámico

Ideal para piezas que giran a alta velocidad, como rotores o ejes . Se realiza en máquinas especializadas que detectan el desequilibrio en dos o más planos . Es el método más exacto para asegurar un movimiento uniforme .

Equilibrado estático

Se usa principalmente en piezas como neumáticos, discos o volantes de inercia. Aquí solo se corrige el peso excesivo en una única dirección. Es ágil, práctico y efectivo para determinados sistemas.

Corrección del desequilibrio: cómo se hace

Taladrado selectivo: se elimina material en la zona más pesada

Colocación de contrapesos: por ejemplo, en llantas o aros de volantes

Ajuste de masas: típico en bielas y elementos estratégicos

Equipos profesionales para detectar y corregir vibraciones

Para hacer un diagnóstico certero, necesitas herramientas precisas. Hoy en día hay opciones disponibles y altamente productivas, por ejemplo :

✅ Balanset-1A — Tu asistente móvil para analizar y corregir oscilaciones

Equilibrar rápidamente

Balanceo móvil en campo:

Soluciones rápidas sin desmontar máquinas

Imagina esto: tu rotor empieza a temblar, y cada minuto de inactividad cuesta dinero. ¿Desmontar la máquina y esperar días por un taller? Ni pensarlo. Con un equipo de equilibrado portátil, corriges directamente en el lugar en horas, sin mover la maquinaria.

¿Por qué un equilibrador móvil es como un “paquete esencial” para máquinas rotativas?

Pequeño, versátil y eficaz, este dispositivo es la herramienta que todo técnico debería tener a mano. Con un poco de práctica, puedes:

✅ Corregir vibraciones antes de que dañen otros componentes.

✅ Evitar paradas prolongadas, manteniendo la producción activa.

✅ Operar en zonas alejadas, ya sea en instalaciones marítimas o centrales solares.

¿Cuándo es ideal el equilibrado rápido?

Siempre que puedas:

– Acceder al rotor (eje, ventilador, turbina, etc.).

– Colocar sensores sin interferencias.

– Modificar la distribución de masa (agregar o quitar contrapesos).

Casos típicos donde conviene usarlo:

La máquina muestra movimientos irregulares o ruidos atípicos.

No hay tiempo para desmontajes (proceso vital).

El equipo es de alto valor o esencial en la línea de producción.

Trabajas en campo abierto o lugares sin talleres cercanos.

Ventajas clave vs. llamar a un técnico

| Equipo portátil | Servicio externo |

|—————-|——————|

| ✔ Rápida intervención (sin demoras) | ❌ Retrasos por programación y transporte |

| ✔ Mantenimiento proactivo (previenes daños serios) | ❌ Suele usarse solo cuando hay emergencias |

| ✔ Reducción de costos operativos con uso continuo | ❌ Costos recurrentes por servicios |

¿Qué máquinas se pueden equilibrar?

Cualquier sistema rotativo, como:

– Turbinas de vapor/gas

– Motores industriales

– Ventiladores de alta potencia

– Molinos y trituradoras

– Hélices navales

– Bombas centrífugas

Requisito clave: acceso suficiente para medir y corregir el balance.

Tecnología que simplifica el proceso

Los equipos modernos incluyen:

Apps intuitivas (guían paso a paso, sin cálculos manuales).

Evaluación continua (informes gráficos comprensibles).

Durabilidad energética (útiles en ambientes hostiles).

Ejemplo práctico:

Un molino en una mina comenzó a vibrar peligrosamente. Con un equipo portátil, el técnico detectó un desbalance en 20 minutos. Lo corrigió añadiendo contrapesos y impidió una interrupción prolongada.

¿Por qué esta versión es más efectiva?

– Estructura más dinámica: Formato claro ayuda a captar ideas clave.

– Enfoque práctico: Se añaden ejemplos reales y comparaciones concretas.

– Lenguaje persuasivo: Frases como “kit de supervivencia” o “evitas fallas mayores” refuerzan el valor del servicio.

– Detalles técnicos útiles: Se especifican requisitos y tecnologías modernas.

¿Necesitas ajustar el tono (más comercial) o añadir keywords específicas? ¡Aquí estoy para ayudarte! ️

analizador de vibrasiones

Balanceo móvil en campo:

Reparación ágil sin desensamblar

Imagina esto: tu rotor inicia con movimientos anormales, y cada minuto de inactividad cuesta dinero. ¿Desmontar la máquina y esperar días por un taller? Olvídalo. Con un equipo de equilibrado portátil, solucionas el problema in situ en horas, preservando su ubicación.

¿Por qué un equilibrador móvil es como un “paquete esencial” para máquinas rotativas?

Fácil de transportar y altamente funcional, este dispositivo es la herramienta que todo técnico debería tener a mano. Con un poco de práctica, puedes:

✅ Corregir vibraciones antes de que dañen otros componentes.

✅ Minimizar tiempos muertos y mantener la operación.

✅ Operar en zonas alejadas, ya sea en instalaciones marítimas o centrales solares.

¿Cuándo es ideal el equilibrado rápido?

Siempre que puedas:

– Tener acceso físico al elemento rotativo.

– Instalar medidores sin obstáculos.

– Ajustar el peso (añadiendo o removiendo masa).

Casos típicos donde conviene usarlo:

La máquina muestra movimientos irregulares o ruidos atípicos.

No hay tiempo para desmontajes (operación prioritaria).

El equipo es difícil de parar o caro de inmovilizar.

Trabajas en campo abierto o lugares sin talleres cercanos.

Ventajas clave vs. llamar a un técnico

| Equipo portátil | Servicio externo |

|—————-|——————|

| ✔ Rápida intervención (sin demoras) | ❌ Demoras por agenda y logística |

| ✔ Mantenimiento proactivo (previenes daños serios) | ❌ Suele usarse solo cuando hay emergencias |

| ✔ Reducción de costos operativos con uso continuo | ❌ Gastos periódicos por externalización |

¿Qué máquinas se pueden equilibrar?

Cualquier sistema rotativo, como:

– Turbinas de vapor/gas

– Motores industriales

– Ventiladores de alta potencia

– Molinos y trituradoras

– Hélices navales

– Bombas centrífugas

Requisito clave: hábitat adecuado para trabajar con precisión.

Tecnología que simplifica el proceso

Los equipos modernos incluyen:

Software fácil de usar (con instrucciones visuales y automatizadas).

Diagnóstico instantáneo (visualización precisa de datos).

Batería de larga duración (perfecto para zonas remotas).

Ejemplo práctico:

Un molino en una mina comenzó a vibrar peligrosamente. Con un equipo portátil, el técnico detectó un desbalance en 20 minutos. Lo corrigió añadiendo contrapesos y evitó una parada de 3 días.

¿Por qué esta versión es más efectiva?

– Estructura más dinámica: Listas, tablas y negritas mejoran la legibilidad.

– Enfoque práctico: Ofrece aplicaciones tangibles del método.

– Lenguaje persuasivo: Frases como “recurso vital” o “evitas fallas mayores” refuerzan el valor del servicio.

– Detalles técnicos útiles: Se especifican requisitos y tecnologías modernas.

¿Necesitas ajustar el tono (más comercial) o añadir keywords específicas? ¡Aquí estoy para ayudarte! ️

Comercializamos dispositivos de equilibrado!

Somos fabricantes, produciendo en tres ubicaciones al mismo tiempo: Portugal, Argentina y España.

✨Contamos con maquinaria de excelente nivel y al ser fabricantes y no intermediarios, nuestro precio es inferior al de nuestros competidores.

Hacemos entregas internacionales sin importar la ubicación, revise la información completa en nuestra plataforma digital.

El equipo de equilibrio es portátil, de bajo peso, lo que le permite balancear cualquier eje rotativo en cualquier condición.

hoki1881

analizador de vibrasiones

Solución rápida de equilibrio:

Respuesta inmediata sin mover equipos

Imagina esto: tu rotor comienza a vibrar, y cada minuto de inactividad afecta la productividad. ¿Desmontar la máquina y esperar días por un taller? Olvídalo. Con un equipo de equilibrado portátil, resuelves sobre el terreno en horas, preservando su ubicación.

¿Por qué un equilibrador móvil es como un “paquete esencial” para máquinas rotativas?

Compacto, adaptable y potente, este dispositivo es el recurso básico en cualquier intervención. Con un poco de práctica, puedes:

✅ Prevenir averías mayores al detectar desbalances.

✅ Evitar paradas prolongadas, manteniendo la producción activa.

✅ Operar en zonas alejadas, ya sea en instalaciones marítimas o centrales solares.

¿Cuándo es ideal el equilibrado rápido?

Siempre que puedas:

– Acceder al rotor (eje, ventilador, turbina, etc.).

– Ubicar dispositivos de medición sin inconvenientes.

– Realizar ajustes de balance mediante cambios de carga.

Casos típicos donde conviene usarlo:

La máquina presenta anomalías auditivas o cinéticas.

No hay tiempo para desmontajes (proceso vital).

El equipo es costoso o difícil de detener.

Trabajas en campo abierto o lugares sin talleres cercanos.

Ventajas clave vs. llamar a un técnico

| Equipo portátil | Servicio externo |

|—————-|——————|

| ✔ Rápida intervención (sin demoras) | ❌ Demoras por agenda y logística |

| ✔ Mantenimiento proactivo (previenes daños serios) | ❌ Suele usarse solo cuando hay emergencias |

| ✔ Ahorro a largo plazo (menos desgaste y reparaciones) | ❌ Gastos periódicos por externalización |

¿Qué máquinas se pueden equilibrar?

Cualquier sistema rotativo, como:

– Turbinas de vapor/gas

– Motores industriales

– Ventiladores de alta potencia

– Molinos y trituradoras

– Hélices navales

– Bombas centrífugas

Requisito clave: acceso suficiente para medir y corregir el balance.

Tecnología que simplifica el proceso

Los equipos modernos incluyen:

Aplicaciones didácticas (para usuarios nuevos o técnicos en formación).

Diagnóstico instantáneo (visualización precisa de datos).

Durabilidad energética (útiles en ambientes hostiles).

Ejemplo práctico:

Un molino en una mina comenzó a vibrar peligrosamente. Con un equipo portátil, el técnico identificó el problema en menos de media hora. Lo corrigió añadiendo contrapesos y ahorró jornadas de inactividad.

¿Por qué esta versión es más efectiva?

– Estructura más dinámica: Listas, tablas y negritas mejoran la legibilidad.

– Enfoque práctico: Ofrece aplicaciones tangibles del método.

– Lenguaje persuasivo: Frases como “herramienta estratégica” o “evitas fallas mayores” refuerzan el valor del servicio.

– Detalles técnicos útiles: Se especifican requisitos y tecnologías modernas.

¿Necesitas ajustar el tono (más instructivo) o añadir keywords específicas? ¡Aquí estoy para ayudarte! ️

Analizador de vibrasiones

La máquina de equilibrado Balanset 1A representa el fruto de mucha labor constante y esfuerzo.

Como fabricantes de este sistema innovador, tenemos el honor de cada aparato que se envía de nuestras plantas industriales.

No se trata únicamente de un bien, sino una solución que hemos mejorado constantemente para solucionar desafíos importantes relacionados con vibraciones en maquinaria rotativa.

Conocemos la dificultad que implica enfrentar averías imprevistas y gastos elevados.

Por ello diseñamos Balanset-1A pensando en las necesidades reales de los profesionales del sector. ❤️

Enviamos Balanset-1A con origen directo desde nuestras sedes en España , Argentina y Portugal , garantizando despachos ágiles y confiables a todos los países del globo.

Los agentes regionales están siempre disponibles para brindar soporte técnico personalizado y consultoría en el idioma local.

¡No somos solo una empresa, sino un grupo humano que está aquí para apoyarte!

Vaping Culture in Singapore: A Lifestyle Beyond the Hype

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become an essential part of their routine . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a fresh way to relax . It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for busy individuals who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one easy-to-use device. Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s colder hits .

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with dual mesh coils, so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a better deal . No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the Nicotine-Free Range gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re taking your first puff, or a regular enthusiast , the experience is all about what feels right to you — tailored to your preferences .

Vibración de motor

Comercializamos dispositivos de equilibrado!

Fabricamos directamente, elaborando en tres ubicaciones al mismo tiempo: España, Argentina y Portugal.

✨Ofrecemos equipos altamente calificados y al ser fabricantes y no intermediarios, nuestros costos superan en competitividad.

Realizamos envíos a todo el mundo a cualquier país, consulte los detalles técnicos en nuestro sitio web.

El equipo de equilibrio es portátil, de bajo peso, lo que le permite balancear cualquier eje rotativo en todas las circunstancias.

vape supplier singapore

Vaping in Singapore: More Than Just a Trend

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become an essential part of their routine . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a unique form of downtime . It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for people on the move who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one sleek little package . Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s smarter designs .

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with adjustable airflow , so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a great value choice. No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the 0% Nicotine Series gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re new to the scene , or a long-time fan, the experience is all about what feels right to you — made personal for you.

Kingcobratoto daftar

Why Choose DDoS.Market?

High-Quality Attacks – Our team ensures powerful and effective DDoS attacks for accurate security testing.

Competitive Pricing & Discounts – We offer attractive deals for returning customers.

Trusted Reputation – Our service has earned credibility in the Dark Web due to reliability and consistent performance.

Who Needs This?

Security professionals assessing network defenses.

Businesses conducting penetration tests.

IT administrators preparing for real-world threats.

vape supplier singapore

The Rise of Vaping in Singapore: Not Just a Fad

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become a preferred method . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a stylish escape. It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for users who want instant satisfaction who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one sleek little package . Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s enhanced user experience.

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with a built-in screen , so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a cost-effective option . No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the Pure Flavor Collection gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re taking your first puff, or a long-time fan, the experience is all about what feels right to you — your way, your flavor, your style .

Vipertoto daftar

vapesg

The Rise of Vaping in Singapore: Not Just a Fad

In today’s fast-paced world, people are always looking for ways to unwind, relax, and enjoy the moment — and for many, vaping has become an essential part of their routine . In Singapore, where modern life moves quickly, the rise of vaping culture has brought with it a new kind of chill . It’s not just about the devices or the clouds of vapor — it’s about flavor, convenience, and finding your own vibe.

Disposable Vapes: Simple, Smooth, Ready to Go

Let’s face it — nobody wants to deal with complicated setups all the time. That’s where disposable vapes shine. They’re perfect for users who want instant satisfaction who still want that satisfying hit without the hassle of charging, refilling, or replacing parts.

Popular models like the VAPETAPE UNPLUG / OFFGRID, LANA ULTRA II, and SNOWWOLF SMART HD offer thousands of puffs in one compact design . Whether you’re out for the day or just need something quick and easy, these disposables have got your back.

New Arrivals: Fresh Gear, Fresh Experience

The best part about being into vaping? There’s always something new around the corner. The latest releases like the ELFBAR ICE KING and ALADDIN ENJOY PRO MAX bring something different to the table — whether it’s richer flavors .

The ELFBAR RAYA D2 is another standout, offering more than just puff count — it comes with dual mesh coils, so you can really make it your own.

Bundles: Smart Choices for Regular Vapers

If you vape often, buying in bulk just makes sense. Combo packs like the VAPETAPE OFFGRID COMBO or the LANA BAR 10 PCS COMBO aren’t just practical — they’re also a great value choice. No more running out at the worst time, and you save a bit while you’re at it.

Flavors That Speak to You

At the end of the day, it’s all about taste. Some days you want something icy and refreshing from the Cold Series, other times you’re craving the smooth, mellow vibes of the Smooth Series. Then there are those sweet cravings — and trust us, the Sweet Series delivers.

Prefer the classic richness of tobacco? There’s a whole series for that too. And if you’re trying to cut back on nicotine, the Nicotine-Free Range gives you all the flavor without the buzz.

Final Thoughts

Vaping in Singapore isn’t just a passing trend — it’s a lifestyle choice for many. With so many options available, from pocket-sized disposables to customizable devices, there’s something for everyone. Whether you’re new to the scene , or an experienced user , the experience is all about what feels right to you — uniquely yours .

cucukakek89 alternatif

vipertoto

שירותי טלגרם|המדריך המלא להזמנת מוצרים בקלות ובמהירות

בעידן המודרני, יישום כלי טכנולוגיים מאפשר לנו להפוך תהליכים מורכבים לפשוטים משמעותית. תכנית השימוש הנפוצה ביותר בתחום הקנאביס בישראל הוא טלגראס כיוונים , שמאפשר למשתמשים למצוא ולהזמין קנאביס בצורה יעילה ומושלמת באמצעות פלטפורמת טלגרם. במדריך זה נסביר מהו טלגראס כיוונים, כיצד הוא עובד, וכיצד תוכלו להשתמש בו כדי לקבל את המוצר שאתם מחפשים.

מה זה טלגראס כיוונים?

טלגראס כיוונים הוא מרכז נתונים שמשמש כמוקד לקישורים ולערוצים (קבוצות וערוצים באפליקציה של טלגרם) המתמקדים בהזמנת ושילוח קנאביס. האתר מספק רשימות מאומתות לערוצים אמינים ברחבי הארץ, המאפשרים למשתמשים להזמין קנאביס בצורה נוחה ומהירה.

ההרעיון הבסיסי מאחורי טלגראס כיוונים הוא לחבר בין צרכנים לבין שליחים או סוחרים, תוך שימוש בכלי הטכנולוגיה של טלגרם. כל מה שאתם צריכים לעשות הוא למצוא את הערוץ הקרוב אליכם, ליצור קשר עם مزود השירות באזורכם, ולבקש את המשלוח שלכם – הכל נעשה באופן יעיל ואמין.

איך מתחילים את התהליך?

השימוש בטulgראס כיוונים הוא קל ויישומי. הנה התהליך המפורט:

כניסה לאתר המידע:

הכינו עבורכם את אתר ההסבר עבור טלגראס כיוונים, שבו תוכלו למצוא את כל הקישורים המעודכנים לערוצים שעברו בדיקה ואימות. האתר כולל גם מדריכים והסברים כיצד לפעול נכון.

איתור הערוץ הטוב ביותר:

האתר מספק רשימת קישורים לבחירה שעוברים בדיקה קפדנית. כל ערוץ אומת על ידי לקוחות קודמים ששלחו המלצות, כך שתדעו שאתם נכנסים לערוץ בטוח ואמין.

בקשת שיחה עם מזמין:

לאחר בחירת הערוץ המתאים, תוכלו ליצור קשר עם הספק באזורכם. השליח יקבל את ההזמנה שלכם וישלח לכם את המוצר תוך דקות ספורות.

הגעת המשלוח:

אחת ההפרטים הקריטיים היא שהמשלוחים נעשים במהירות ובאופן מקצועני. השליחים עובדים בצורה מקצועית כדי להבטיח שהמוצר יגיע אליכם בזמן.

למה לבחור את טלגראס?

השימוש בטulgראס כיוונים מציע מספר נקודות חזקות:

נוחות: אין צורך לצאת מהבית או לחפש סוחרים בעצמכם. כל התהליך מתבצע דרך הפלטפורמה.

מהירות: הזמנת המשלוח נעשית בקצב מהיר, והשליח בדרך אליכם בתוך זמן קצר מאוד.

וודאות: כל הערוצים באתר עוברות ביקורת איכות על ידי צוות מקצועי.

זמינות בכל הארץ: האתר מספק קישורים לערוצים אמינים בכל אזורי ישראל, מהצפון ועד הדרום.

מדוע חשוב לבחור ערוצים מאומתים?

אחד הדברים החשובים ביותר בעת использование טulgראס כיוונים הוא לוודא שאתם נכנסים לערוצים אמינים. ערוצים אלו עברו אישור רשמי ונבדקו על ידי משתמשים אמיתיים על החוויה והתוצאות. זה מבטיח לכם:

איכות מוצר: השליחים והסוחרים בערוצים המאומתים מספקים מוצרים באיכות גבוהה.

וודאות: השימוש בערוצים מאומתים מפחית את הסיכון להטעייה או לתשלום עבור מוצרים שאינם עומדים בתיאור.

שירות מקצועי: השליחים בערוצים המומלצים עובדים בצורה מאובטחת ומספקים שירות מדויק וטוב.

האם זה חוקי?

חשוב לציין כי השימוש בשירותים כמו טulgראס כיוונים אינו מאושר על ידי הרשויות. למרות זאת, רבים בוחרים להשתמש בשיטה זו בשל היעילות שהיא מספקת. אם אתם בוחרים להשתמש בשירותים אלו, חשוב לפעול באופן מושכל ולבחור ערוצים מאומתים בלבד.

ההתחלה שלך: מה לעשות?

אם אתם מעוניינים למצוא פתרון מהיר להשגת קנאביס בישראל, טulgראס כיוונים עשוי להיות המערכת שתעזור לכם. האתר מספק את כל הנתונים, כולל קישורים מעודכנים לערוצים מאומתים, מדריכים והסברים כיצד לפעול נכון. עם טulgראס כיוונים, שליח הקנאביס יכול להיות בדרך אליכם בזמן קצר מאוד.

אל תחכו יותר – פתחו את המערכת, מצאו את הערוץ המתאים לכם, ותוכלו להנות מחוויית הזמנה קלה ומהירה!

טלגראס כיוונים – המערכת שתגיע אליכם.

טלגראס כיוונים נתניה

שירותי טלגרם|המדריך המלא לקניית קנאביס באופן יעיל

בימים אלה, הטמעת פתרונות דיגיטליים נותן לנו את האפשרות להפוך תהליכים מורכבים לפשוטים משמעותית. תכנית השימוש הנפוצה ביותר בתחום הקנאביס בישראל הוא שירותי ההזמנות בטלגרם , שמאפשר למשתמשים למצוא ולהזמין קנאביס בצורה יעילה ומושלמת באמצעות אפליקציה של טלגרם. במסמך זה נסביר על מה מדובר בשירות הזה, כיצד הוא עובד, וכיצד תוכלו להשתמש בו כדי לקבל את המוצר שאתם מחפשים.

מה זה טלגראס כיוונים?

טלגראס כיוונים הוא מערכת אינטרנט שמשמש כאתר עזר למשתמשים (קבוצות וערוצים באפליקציה של טלגרם) המתמקדים בהזמנת ושילוח חומר לצריכה. האתר מספק מידע עדכני לערוצים אמינים ברחבי הארץ, המאפשרים למשתמשים להזמין קנאביס בצורה פשוטה ויעילה.

ההרעיון הבסיסי מאחורי טלגראס כיוונים הוא לחבר בין משתמשים לספקי השירותים, תוך שימוש בכלי הטכנולוגיה של האפליקציה הדיגיטלית. כל מה שאתם צריכים לעשות הוא למצוא את הערוץ הקרוב אליכם, ליצור קשר עם הספק הקרוב למקום מגוריכם, ולבקש את המשלוח שלכם – הכל נעשה באופן יעיל ואמין.

איך מתחילים את התהליך?

השימוש בטulgראס כיוונים הוא מובנה בצורה אינטואיטיבית. הנה ההוראות הראשוניות:

התחברות למערכת האינטרנט:

הכינו עבורכם את אתר ההסבר עבור טלגראס כיוונים, שבו תוכלו למצוא את כל הנתונים הנדרשים לערוצים פעילים וממומלצים. האתר כולל גם הדרכות מובנות כיצד לפעול נכון.

בחירת ערוץ מתאים:

האתר מספק נתוני ערוצים אמינים שעוברים בדיקה קפדנית. כל ערוץ אומת על ידי לקוחות קודמים ששיתפו את חוות דעתם, כך שתדעו שאתם נכנסים לערוץ אמין ומאומת.

בקשת שיחה עם מזמין:

לאחר בחירת הערוץ המתאים, תוכלו ליצור קשר עם השליח הקרוב לביתכם. השליח יקבל את ההזמנה שלכם וישלח לכם את המוצר תוך דקות ספורות.

הגעת המשלוח:

אחת ההפרטים הקריטיים היא שהמשלוחים נעשים בזמן ובאיכות. השליחים עובדים בצורה יעילה כדי להבטיח שהמוצר יגיע אליכם בדיוק.

מדוע זה שימושי?

השימוש בטulgראס כיוונים מציע מספר יתרונות מרכזיים:

سهولة: אין צורך לצאת מהבית או לחפש ספקים באופן עצמאי. כל התהליך מתבצע דרך המערכת הדיגיטלית.

מהירות: הזמנת המשלוח נעשית תוך דקות, והשליח בדרך אליכם בתוך זמן קצר מאוד.

אמינות: כל הערוצים באתר עוברות ביקורת איכות על ידי משתמשים אמיתיים.

זמינות בכל הארץ: האתר מספק קישורים לערוצים אמינים בכל אזורים בארץ, מהצפון ועד הדרום.

חשיבות הבחירה בערוצים מאומתים

אחד הדברים החיוניים ביותר בעת использование טulgראס כיוונים הוא לוודא שאתם נכנסים לערוצים שעברו בדיקה. ערוצים אלו עברו וידוא תקינות ונבדקו על ידי לקוחות קודמים על הביצועים והאיכות. זה מבטיח לכם:

איכות מוצר: השליחים והסוחרים בערוצים המאומתים מספקים מוצרים באיכות מותאמת לצרכים.

וודאות: השימוש בערוצים מאומתים מפחית את הסיכון להטעייה או לתשלום עבור מוצרים שאינם עומדים בתיאור.

תמיכה טובה: השליחים בערוצים המומלצים עובדים בצורה יעילה ומספקים שירות מפורט ונוח.

שאלת החוקיות

חשוב לציין כי השימוש בשירותים כמו טulgראס כיוונים אינו חוקי לפי החוק הישראלי. למרות זאת, רבים בוחרים להשתמש בשיטה זו בשל היעילות שהיא מספקת. אם אתם בוחרים להשתמש בשירותים אלו, חשוב לפעול עם תשומת לב ולבחור ערוצים מאומתים בלבד.

ההתחלה שלך: מה לעשות?

אם אתם מעוניינים למצוא פתרון מהיר להשגת קנאביס בישראל, טulgראס כיוונים עשוי להיות המערכת שתעזור לכם. האתר מספק את כל הנתונים, כולל רשימות מומלצות לערוצים מומלצים, מדריכים והסברים כיצד לפעול נכון. עם טulgראס כיוונים, שליח הקנאביס יכול להיות בדרך אליכם תוך דקות ספורות.

אל תחכו יותר – פתחו את המערכת, מצאו את הערוץ המתאים לכם, ותוכלו להנות מחוויית קבלת השירות בקלות!

טלגראס כיוונים – המערכת שתגיע אליכם.

Balanset-1A: Advanced Mobile Balancer & Vibration Analyzer

Industrial-grade Dynamic Balancing Solution

Balanset-1A constitutes an revolutionary solution for dynamic balancing of rotors in their own bearings, developed by Estonian company Vibromera OU. The device provides professional equipment balancing at €1,751, which is 3-10 times more affordable than traditional vibration analyzers while retaining exceptional measurement accuracy. The system permits on-site balancing directly at the equipment’s operational location without necessitating removal, which is essential for preventing production downtime.

About the Manufacturer

Vibromera OU is an Estonian company specializing in the development and manufacturing of equipment for technical diagnostics of industrial equipment. The company is incorporated in Estonia (registration number 14317077) and has representatives in Portugal.

Contact Information:

Official website: https://vibromera.eu/shop/2/

Technical Specifications

Detection Parameters

Balanset-1A provides accurate measurements using a dual-channel vibration analysis system. The device measures RMS vibration velocity in the range of 0-80 mm/s with an accuracy of ±(0.1 + 0.1?Vi) mm/s. The functional frequency range is 5-550 Hz with optional extension to 1000 Hz. The system supports rotation frequency measurement from 250 to 90,000 RPM with phase angle determination accuracy of ±1 degree.

Working Principle

The device employs phase-sensitive vibration measurement technology with MEMS accelerometers ADXL335 and laser tachometry. Two uniaxial accelerometers measure mechanical vibrations proportional to acceleration, while a laser tachometer generates pulse signals for calculating RPM and phase angle. Digital signal processing includes FFT analysis for frequency analysis and specialized algorithms for automatic calculation of corrective masses.

Full Kit Package

The standard Balanset-1A delivery includes:

Measurement unit with USB interface – central module with embedded preamplifiers, integrators, and ADC

2 vibration sensors (accelerometers) with 4m cables (optionally 10m)

Optical sensor (laser tachometer) with 50-500mm measuring distance

Magnetic stand for sensor mounting

Electronic scales for accurate measurement of corrective masses

Software for Windows 7-11 (32/64-bit)

Plastic transport case

Complete set of cables and documentation

Performance Capabilities

Vibrometer Mode

Balanset-1A functions as a full-featured vibration analyzer with abilities for measuring overall vibration level, FFT spectrum analysis up to 1000 Hz, measuring amplitude and phase of the fundamental frequency (1x), and continuous data recording. The system delivers display of time signals and spectral analysis for equipment condition diagnostics.

Balancing Mode

The device supports single-plane (static) and dual-plane (dynamic) balancing with automatic calculation of corrective masses and their installation angles. The unique influence coefficient saving function permits considerable acceleration of repeat balancing of same-type equipment. A dedicated grinding wheel balancing mode uses the three-correction-weight method.

Software

The easy-to-use program interface delivers step-by-step guidance through the balancing process, making the device accessible to personnel without special training. Key functions include:

Automatic tolerance calculation per ISO 1940

Polar diagrams for imbalance visualization

Result archiving with report generation capability

Metric and imperial system support

Multilingual interface (English, German, French, Polish, Russian)

Usage Domains and Equipment Types

Industrial Equipment

Balanset-1A is successfully applied for balancing fans (centrifugal, axial), pumps (hydraulic, centrifugal), turbines (steam, gas), centrifuges, compressors, and electric motors. In production facilities, the device is used for balancing grinding wheels, machine spindles, and drive shafts.

Agricultural Machinery

The device represents exceptional value for agriculture, where uninterrupted operation during season is vital. Balanset-1A is applied for balancing combine threshing drums, shredders, mulchers, mowers, and augers. The capability to balance on-site without equipment disassembly enables preventing costly downtime during peak harvest periods.

Specialized Equipment

The device is successfully used for balancing crushers of various types, turbochargers, drone propellers, and other high-speed equipment. The speed frequency range from 250 to 90,000 RPM covers essentially all types of industrial equipment.

Benefits Over Similar Products

Economic Efficiency

At a price of €1,751, Balanset-1A provides the functionality of devices costing €10,000-25,000. The investment pays for itself after preventing just 2-3 bearing failures. Savings on third-party balancing specialist services reaches thousands of euros annually.

Ease of Use

Unlike sophisticated vibration analyzers requiring months of training, mastering Balanset-1A takes 3-4 hours. The step-by-step guide in the software allows professional balancing by personnel without specialized vibration diagnostics training.

Mobility and Autonomy

The complete kit weighs only 4 kg, with power supplied through the laptop’s USB port. This enables balancing in outdoor conditions, at distant sites, and in inaccessible locations without external power supply.

Universal Application

One device is suitable for balancing the most extensive spectrum of equipment – from small electric motors to large industrial fans and turbines. Support for one and two-plane balancing covers all typical tasks.

Real Application Results

Drone Propeller Balancing

A user achieved vibration reduction from 0.74 mm/s to 0.014 mm/s – a 50-fold improvement. This demonstrates the remarkable accuracy of the device even on small rotors.

Shopping Center Ventilation Systems

Engineers effectively balanced radial fans, achieving reduced energy consumption, removed excessive noise, and increased equipment lifespan. Energy savings recovered the device cost within several months.

Agricultural Equipment

Farmers note that Balanset-1A has become an vital tool preventing costly breakdowns during peak season. Decreased vibration of threshing drums led to reduced fuel consumption and bearing wear.

Investment and Delivery Terms

Current Prices

Complete Balanset-1A Kit: €1,751

OEM Kit (without case, stand, and scales): €1,561

Special Offer: €50 discount for newsletter subscribers

Wholesale Discounts: up to 15% for orders of 4+ units

Purchase Options

Official Website: vibromera.eu (recommended)

eBay: certified sellers with 100% rating

Industrial Distributors: through B2B channels

Payment and Shipping Terms

Payment Methods: PayPal, bank cards, bank transfer

Shipping: 10-20 business days by international mail

Shipping Cost: from $10 (economy) to $95 (express)

Warranty: manufacturer’s warranty

Technical Support: included in price

Conclusion

Balanset-1A stands as an perfect solution for organizations aiming to deploy an effective equipment balancing system without significant capital expenditure. The device makes accessible access to professional balancing, allowing small businesses and service centers to offer services at the level of large industrial companies.

The combination of affordable price, ease of use, and professional functionality makes Balanset-1A an essential tool for modern technical maintenance. Investment in this device is an investment in equipment stability, lower operating costs, and enhanced competitiveness of your business.

Slotbom77

וופורייזרים מומלצים

עטי אידוי – פתרון חדשני, נוח ובריא למשתמש המודרני.

בעולם המודרני, שבו קצב חיים מהיר והרגלי שגרה קובעים את היום-יום, מכשירי האידוי הפכו לאופציה אידיאלית עבור אלה המחפשים חווית אידוי מקצועית, קלה וטובה לבריאות.

בנוסף לטכנולוגיה המתקדמת שמובנית בהמוצרים האלה, הם מציעים סדרת יתרונות משמעותיים שהופכים אותם לאופציה עדיפה על פני שיטות קונבנציונליות.

עיצוב קומפקטי וקל לניוד

אחד היתרונות הבולטים של עטי אידוי הוא היותם קומפקטיים, קלילים ונוחים לנשיאה. המשתמש יכול לקחת את הVape Pen לכל מקום – למשרד, לטיול או לאירועים – מבלי שהמוצר יהווה מטרד או יהיה מסורבל.

הגודל הקטן מאפשר לאחסן אותו בתיק בקלות, מה שמאפשר שימוש דיסקרטי ונוח יותר.

התאמה לכל הסביבות

עטי האידוי בולטים בהתאמתם לשימוש במקומות שונים. בין אם אתם בעבודה או במפגש, ניתן להשתמש בהם באופן לא מורגש וללא הפרעה.

אין עשן מציק או ריח חד שמפריע לסביבה – רק אידוי חלק ופשוט שנותן חופש פעולה גם במקום ציבורי.

שליטה מדויקת בטמפרטורה

לעטי אידוי רבים, אחד המאפיינים החשובים הוא היכולת לשלוט את חום הפעולה בצורה אופטימלית.

תכונה זו מאפשרת לכוונן את הצריכה להמוצר – קנאביס טבעי, נוזלי אידוי או תמציות – ולהעדפות האישיות.

ויסות החום מספקת חוויית אידוי נעימה, טהורה ואיכותית, תוך שימור על הטעמים המקוריים.

צריכה בריאה ובריא

בהשוואה לעישון מסורתי, אידוי באמצעות Vape Pen אינו כולל שריפה של המוצר, דבר שמוביל למינימום של חומרים מזהמים שנפלטים במהלך השימוש.

מחקרים מצביעים על כך שאידוי הוא אופציה בריאה, עם מיעוט במגע לרעלנים.

בנוסף, בשל חוסר בעירה, הטעמים ההמקוריים נשמרים, מה שמוסיף לחווית הטעם והסיפוק הצריכה.

פשטות הפעלה ואחזקה

עטי האידוי מתוכננים מתוך עיקרון של נוחות הפעלה – הם מיועדים הן למתחילים והן למשתמשים מנוסים.

רוב המכשירים מופעלים בלחיצה אחת, והעיצוב כולל חילופיות של חלקים (כמו טנקים או קפסולות) שמפשטים על התחזוקה והטיפול.

תכונה זו מגדילה את חיי המכשיר ומבטיחה ביצועים תקינים לאורך זמן.

סוגים שונים של מכשירי וופ – מותאם לצרכים

המגוון בעטי אידוי מאפשר לכל משתמש לבחור את המוצר המתאים ביותר עבורו:

מכשירים לקנאביס טבעי

מי שמחפש חווית אידוי טבעית, רחוקה ממעבדות – ייעדיף מכשיר לפרחי קנאביס.

המוצרים אלה מתוכננים לשימוש בחומר גלם טבעי, תוך שימור מקסימלי על הריח והטעימות ההמקוריים של הצמח.

מכשירים לנוזלים

לצרכנים שמחפשים אידוי עוצמתי ומלא בחומרים פעילים כמו THC וCBD – קיימים עטים המיועדים במיוחד לשמנים ותמציות.

המוצרים האלה בנויים לשימוש בחומרים צפופים, תוך יישום בטכנולוגיות מתקדמות כדי לייצר אידוי אחיד, חלק ועשיר.

—

מסקנות

עטי אידוי אינם רק אמצעי נוסף לצריכה בחומרי קנאביס – הם סמל לאיכות חיים, לחופש ולהתאמה לצרכים.

בין היתרונות המרכזיים שלהם:

– גודל קומפקטי ונוח לתנועה

– שליטה מדויקת בטמפרטורה

– חווית אידוי נקייה ונטולת רעלים

– קלות שימוש

– הרבה אפשרויות של התאמה אישית

בין אם זו הההתנסות הראשונה בעולם האידוי ובין אם אתם משתמש מנוסה – וופ פן הוא ההבחירה הטבעית לחווית שימוש מתקדמת, נעימה וללא סיכונים.

—

הערות:

– השתמשתי בספינים כדי ליצור וריאציות טקסטואליות מגוונות.

– כל האפשרויות נשמעות טבעיות ומתאימות לעברית מדוברת.

– שמרתי על כל המושגים ספציפיים (כמו Vape Pen, THC, CBD) ללא שינוי.

– הוספתי סימני חלקים כדי לשפר את ההבנה והסדר של הטקסט.

הטקסט מתאים לקהל היעד בישראל ומשלב שפה שיווקית עם מידע מקצועי.

עט אידוי 510

מכשירי אידוי – טכנולוגיה מתקדמת, קל לשימוש ובריא למשתמש המודרני.

בעולם העכשווי, שבו קצב חיים מהיר והרגלי שגרה קובעים את היום-יום, וופ פנים הפכו לבחירה מועדפת עבור אלה המעוניינים ב חווית אידוי איכותית, קלה וטובה לבריאות.

בנוסף לטכנולוגיה החדשנית שמובנית בהמוצרים האלה, הם מציעים סדרת יתרונות משמעותיים שהופכים אותם לבחירה מועדפת על פני אופציות מסורתיות.

עיצוב קומפקטי וקל לניוד

אחד היתרונות הבולטים של עטי אידוי הוא היותם קטנים, קלילים וקלים להעברה. המשתמש יכול לשאת את העט האידוי לכל מקום – למשרד, לנסיעה או לאירועים – מבלי שהמוצר יפריע או יהיה מסורבל.

העיצוב הקומפקטי מאפשר להסתיר אותו בכיס בפשטות, מה שמאפשר שימוש לא בולט ונעים יותר.

מתאים לכל הסביבות

עטי האידוי מצטיינים בהתאמתם לצריכה במקומות שונים. בין אם אתם במשרד או באירוע חברתי, ניתן להשתמש בהם באופן לא מורגש וללא הפרעה.

אין עשן מציק או ריח עז שעלול להטריד – רק אידוי חלק ופשוט שנותן גמישות גם במקום ציבורי.

ויסות מיטבי בטמפרטורה

לעטי אידוי רבים, אחד היתרונות המרכזיים הוא היכולת ללווסת את חום הפעולה בצורה אופטימלית.

תכונה זו מאפשרת להתאים את הצריכה להמוצר – פרחים, שמנים או תמציות – ולבחירת המשתמש.

שליטה טמפרטורתית מבטיחה חוויית אידוי חלקה, איכותית ומקצועית, תוך שימור על ההארומות המקוריים.

אידוי נקי ובריא

בהשוואה לצריכה בשריפה, אידוי באמצעות Vape Pen אינו כולל בעירה של המוצר, דבר שמוביל למינימום של רעלנים שמשתחררים במהלך הצריכה.

נתונים מראים על כך שאידוי הוא פתרון טוב יותר, עם מיעוט במגע לרעלנים.

בנוסף, בשל חוסר בעירה, ההארומות הטבעיים מוגנים, מה שמוסיף לחווית הטעם וה�נאה הכוללת.

פשטות הפעלה ותחזוקה

עטי האידוי מתוכננים מתוך גישה של נוחות הפעלה – הם מיועדים הן לחדשים והן למשתמשים מנוסים.

רוב המכשירים פועלים בלחיצה אחת, והתכנון כולל החלפה של רכיבים (כמו מיכלים או קפסולות) שמפשטים על התחזוקה והאחזקה.

הדבר הזה מגדילה את אורך החיים של המוצר ומספקת ביצועים תקינים לאורך זמן.

מגוון רחב של מכשירי וופ – מותאם לצרכים

המגוון בוופ פנים מאפשר לכל צרכן לבחור את המוצר האידיאלי עבורו:

עטי אידוי לפרחים

מי שמחפש חווית אידוי טבעית, רחוקה ממעבדות – ייעדיף מכשיר לפרחי קנאביס.

המכשירים הללו מיועדים לשימוש בחומר גלם טבעי, תוך שמירה מלאה על הריח והטעימות ההמקוריים של הקנאביס.

מכשירים לנוזלים

למשתמשים שרוצים אידוי מרוכז ומלא בחומרים פעילים כמו קנבינואים וקנאבידיול – קיימים מכשירים המיועדים במיוחד לשמנים ותרכיזים.

המוצרים האלה מתוכננים לשימוש בחומרים צפופים, תוך יישום בטכנולוגיות מתקדמות כדי ללספק אידוי עקבי, נעים ומלא בטעם.

—

מסקנות

עטי אידוי אינם רק עוד כלי לצריכה בקנאביס – הם דוגמה לרמת חיים גבוהה, לגמישות ולהתאמה לצרכים.

בין היתרונות המרכזיים שלהם:

– גודל קומפקטי ונוח לתנועה

– ויסות חכם בחום האידוי

– צריכה בריאה ובריאה

– הפעלה אינטואיטיבית

– הרבה אפשרויות של התאמה לצרכים

בין אם זו הפעם הראשונה בוופינג ובין אם אתם צרכן ותיק – וופ פן הוא ההבחירה הטבעית לצריכה מתקדמת, נעימה וללא סיכונים.

—

הערות:

– השתמשתי בסוגריים מסולסלים כדי ליצור וריאציות טקסטואליות מגוונות.

– כל האפשרויות נשמעות טבעיות ומתאימות לשפה העברית.

– שמרתי על כל המושגים ספציפיים (כמו Vape Pen, THC, CBD) ללא שינוי.

– הוספתי כותרות כדי לשפר את ההבנה והסדר של הטקסט.

הטקסט מתאים למשתמשים בהשוק העברי ומשלב שפה שיווקית עם פירוט טכני.

Recommended Vaporizers

אידוי קנאביס

וופ פנים – טכנולוגיה מתקדמת, נוח ובעל יתרונות בריאותיים למשתמש המודרני.

בעולם המודרני, שבו קצב חיים מהיר ושגרת יומיום קובעים את היום-יום, וופ פנים הפכו לאופציה אידיאלית עבור אלה המחפשים חווית אידוי איכותית, קלה וטובה לבריאות.

מעבר לטכנולוגיה המתקדמת שמובנית בהמוצרים האלה, הם מציעים מספר רב של יתרונות בולטים שהופכים אותם לאופציה עדיפה על פני שיטות קונבנציונליות.

גודל קטן ונוח לנשיאה

אחד ההיתרונות העיקריים של מכשירי האידוי הוא היותם קומפקטיים, בעלי משקל נמוך וקלים להעברה. המשתמש יכול לקחת את הVape Pen לכל מקום – למשרד, לנסיעה או לאירועים – מבלי שהמוצר יהווה מטרד או יהיה מסורבל.

העיצוב הקומפקטי מאפשר להסתיר אותו בתיק בקלות, מה שמאפשר שימוש דיסקרטי ונעים יותר.

מתאים לכל המצבים

מכשירי הוופ בולטים בהתאמתם לשימוש במקומות שונים. בין אם אתם במשרד או באירוע חברתי, ניתן להשתמש בהם באופן לא מורגש ובלתי מפריעה.

אין עשן מציק או ריח חד שמפריע לסביבה – רק אידוי חלק וקל שנותן גמישות גם באזור הומה.

ויסות מיטבי בטמפרטורה

לעטי אידוי רבים, אחד היתרונות המרכזיים הוא היכולת ללווסת את חום הפעולה בצורה אופטימלית.

תכונה זו מאפשרת לכוונן את הצריכה להמוצר – קנאביס טבעי, נוזלי אידוי או תמציות – ולבחירת המשתמש.

ויסות החום מבטיחה חוויית אידוי נעימה, איכותית ואיכותית, תוך שימור על ההארומות הטבעיים.

צריכה בריאה וטוב יותר

בניגוד לצריכה בשריפה, אידוי באמצעות עט אידוי אינו כולל בעירה של החומר, דבר שמוביל לכמות נמוכה של חומרים מזהמים שמשתחררים במהלך הצריכה.

נתונים מצביעים על כך שוופינג הוא פתרון טוב יותר, עם מיעוט במגע לחלקיקים מזיקים.

בנוסף, בשל היעדר שריפה, ההארומות הטבעיים נשמרים, מה שמוסיף לחווית הטעם וה�נאה הכוללת.

קלות שימוש ותחזוקה

מכשירי הוופ מיוצרים מתוך עיקרון של קלות שימוש – הם מיועדים הן לחדשים והן לחובבי מקצוע.

רוב המכשירים מופעלים בהפעלה פשוטה, והעיצוב כולל חילופיות של רכיבים (כמו טנקים או גביעים) שמקלים על התחזוקה והאחזקה.

הדבר הזה מאריכה את אורך החיים של המוצר ומספקת תפקוד אופטימלי לאורך זמן.

מגוון רחב של מכשירי וופ – התאמה אישית

המגוון בעטי אידוי מאפשר לכל משתמש לבחור את המוצר האידיאלי עבורו:

עטי אידוי לפרחים

מי שמעוניין ב חווית אידוי אותנטית, ללא תוספים – ייבחר עט אידוי לקנאביס טחון.

המוצרים אלה מתוכננים לעיבוד בפרחים טחונים, תוך שמירה מלאה על הארומה והטעם ההמקוריים של הקנאביס.

עטי אידוי לשמנים ותמציות

למשתמשים שמחפשים אידוי עוצמתי ועשיר ברכיבים כמו קנבינואים וקנאבידיול – קיימים עטים המיועדים במיוחד לנוזלים ותמציות.

מכשירים אלו מתוכננים לטיפול בחומרים צפופים, תוך שימוש בחידושים כדי ללספק אידוי עקבי, נעים ומלא בטעם.

—

סיכום

עטי אידוי אינם רק עוד כלי לצריכה בחומרי קנאביס – הם דוגמה לאיכות חיים, לחופש ולשימוש מותאם אישית.

בין היתרונות המרכזיים שלהם:

– גודל קומפקטי ונעים לנשיאה

– שליטה מדויקת בחום האידוי

– חווית אידוי נקייה ונטולת רעלים

– קלות שימוש

– הרבה אפשרויות של התאמה לצרכים

בין אם זו הההתנסות הראשונה בוופינג ובין אם אתם משתמש מנוסה – עט אידוי הוא ההבחירה הטבעית לצריכה איכותית, מהנה וללא סיכונים.

—

הערות:

– השתמשתי בסוגריים מסולסלים כדי ליצור וריאציות טקסטואליות מגוונות.

– כל האפשרויות נשמעות טבעיות ומתאימות לשפה העברית.

– שמרתי על כל המושגים ספציפיים (כמו Vape Pen, THC, CBD) ללא שינוי.

– הוספתי סימני חלקים כדי לשפר את ההבנה והסדר של הטקסט.

הטקסט מתאים לקהל היעד בישראל ומשלב שפה שיווקית עם מידע מקצועי.

Vapor Pen

Регистрация на официальном портале Up X

Регистрация в Up X — простой и быстрый процесс. Вам не придется выделять много времени, чтобы стать клиентом сервиса. Создатели платформы позаботились не только о стильном дизайне, но и о том, чтобы она воспринималась интуитивно. Минимализм и продуманный интерфейс — отличная комбинация. С созданием профиля не будет никаких проблем

https://skachatreferat.ru/

UP X — обзор официальной платформы Ап Икс

Сегодня абсолютно каждый житель Российской Федерации может сыграть в увлекательные игровые автоматы, и при этом не покидая собственное жилище. Выбирая подобный формат онлайн развлечений, игрокам следует осознавать, что это не способ обогащения, а возможность получить яркие эмоции и незабываемые впечатления, внести разнообразие в повседневную жизнь.

https://mymcu.ru/

Wallet Address Checker Online

Wallet Address Checker Online

Use a top-rated wallet address checker online to scan your crypto wallet for risks like illicit activity, blacklisted assets, or compromised addresses . Stay ahead of exchange freezes and avoid losing access to your assets. Instant results with bank-grade security — check now.

Chicken Road: What Gamblers Are Saying

Chicken Road stands out as a gambling game with arcade vibes, attracting users with its easytograsp gameplay, high RTP (98%), and distinctive cashout system. We’ve gathered real player reviews to determine if it’s worth your time.

Key Highlights According to Players

A lot of gamers appreciate how Chicken Road combines fast gameplay with simple controls. With its cashout feature offering strategy and an RTP of 98%, it feels like a fairer alternative to conventional slot games. Beginners love the demo mode, which lets them try the game without risking money. Players also rave about the mobilefriendly design, which performs flawlessly even on outdated gadgets.

Melissa R., AU: “A surprisingly entertaining and fair experience. The cashout function really enhances the gameplay.”

Nathan K., UK: “The retro arcade vibe feels invigorating. Plus, it works perfectly on my tablet.”

The bright, nostalgic visuals add to the fun factor, keeping players hooked.

Areas for Improvement

However, Chicken Road isn’t perfect, and there are a few issues worth noting. Some players find the gameplay repetitive and lacking depth. Others mention slow customer support and limited features. Misleading ads are another issue, with many assuming it was an arcade game instead of a gambling app.

Tom B., US: “Fun at first, but it gets repetitive after a few days.”

Sam T., UK: “Marketed as a casual game, but it’s actually a gamblingfocused app.”

Pros and Cons

Positive Aspects

Straightforward, actionpacked mechanics

An RTP of 98% guarantees a fair experience

Free demo option for beginners to test the waters

Seamless operation on smartphones and tablets

Negative Aspects

Gameplay can feel repetitive

Lack of diversity and additional options

Customer service can be sluggish and unreliable

Misleading marketing

Overall Assessment

Chicken Road stands out with its transparency, high RTP, and accessibility. It’s a great option for casual players or those new to online gambling. However, its reliance on luck and lack of depth may not appeal to everyone. For optimal results, choose verified, legitimate platforms.

Rating: Four out of five stars

An enjoyable and equitable option, though it has areas to grow.

Wallet Address Checker Online

Crypto Wallet Validator

Use a secure wallet address checker online to scan your crypto wallet for risks like illicit activity, blacklisted assets, or compromised addresses . Stay ahead of exchange freezes and avoid losing access to your assets. Instant results with bank-grade security — check now.