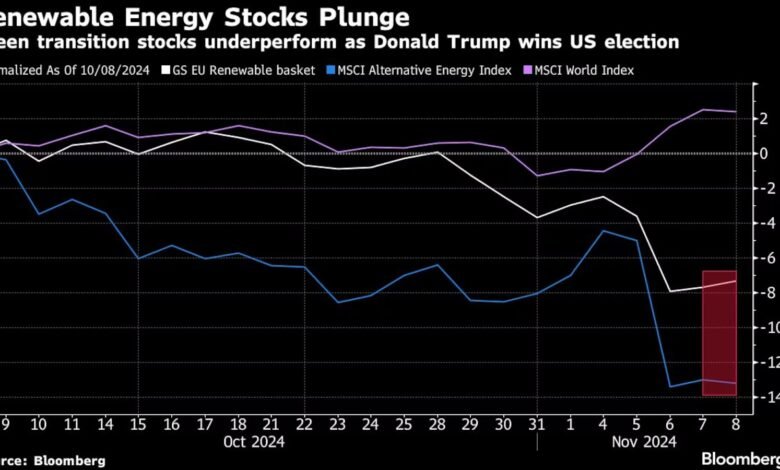

This week’s selloff in renewable energy stocks following Donald Trump’s election victory has been a boon for short sellers betting against clean energy.

The biggest renewables stocks fell sharply following the Republican Party’s resounding election win. The plunge represents a paper gain of $1.3 billion for short sellers, according to Bloomberg calculations based on shares out on loan for a global basket of clean energy companies.

Plug Power Inc., SolarEdge Technologies Inc., Bloom Energy Corp., First Solar Inc. and Enphase Energy Inc. are among the most shorted renewables stocks, according to the latest data from S&P Global Market Intelligence, with more than 5% of their market capitalization out on loan. US solar is one of the sectors with the biggest short positions across the market.

In Europe, Solaria Energia y Medio Ambiente SA, Nordex SE and Orsted A/S are among the most shorted renewable energy stocks, the data show.

The drop since Monday’s close on a European basket of renewable stocks represents a paper gain of $440 million for short sellers, according to Bloomberg calculations.

Wow! Thank you! I always wanted to write on my blog something like that. Can I include a part of your post to my website?

I’d incessantly want to be update on new content on this web site, bookmarked! .

I appreciate, cause I found exactly what I was looking for. You have ended my 4 day long hunt! God Bless you man. Have a nice day. Bye

After I originally commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Is there any manner you’ll be able to remove me from that service? Thanks!

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.

Hello, i read your blog occasionally and i own a similar one and i was just wondering if you get a lot of spam remarks? If so how do you stop it, any plugin or anything you can suggest? I get so much lately it’s driving me insane so any help is very much appreciated.

certainly like your website but you have to take a look at the spelling on quite a few of your posts. Many of them are rife with spelling problems and I find it very troublesome to tell the truth on the other hand I will certainly come again again.

I’ve learn several good stuff here. Certainly worth bookmarking for revisiting. I surprise how much effort you place to create this kind of great informative site.

Utterly composed content material, Really enjoyed looking at.

Hello my family member! I want to say that this article is awesome, great written and come with approximately all significant infos. I¦d like to look more posts like this .

My husband and i got quite fulfilled when Chris managed to conclude his survey from the precious recommendations he gained using your site. It is now and again perplexing just to find yourself freely giving information and facts which usually men and women may have been trying to sell. And we grasp we need the writer to be grateful to because of that. Those explanations you made, the straightforward website navigation, the relationships your site assist to engender – it’s got most terrific, and it’s letting our son in addition to us consider that this matter is enjoyable, which is certainly wonderfully pressing. Many thanks for the whole lot!

hi!,I really like your writing very so much! share we communicate more approximately your post on AOL? I require a specialist in this house to unravel my problem. May be that’s you! Having a look ahead to look you.

Definitely believe that which you stated. Your favorite justification appeared to be on the internet the easiest thing to be aware of. I say to you, I certainly get annoyed while people consider worries that they plainly don’t know about. You managed to hit the nail upon the top and also defined out the whole thing without having side-effects , people can take a signal. Will likely be back to get more. Thanks

Keepp this going please, geat job! https://careers.mycareconcierge.com/companies/22bit-22bit-casino21/

You actually make it seem really easy along with your presentation but I find this matter to be actually something that I believe I might never understand. It kind of feels too complicated and extremely large for me. I’m looking forward on your next publish, I’ll try to get the hold of it!

Very interesting details you have remarked, thankyou for posting. “The judge is condemned when the criminal is absolved.” by Publilius Syrus.

Hey there just wanted to give you a quick heads up. The text in your post seem to be running off the screen in Internet explorer. I’m not sure if this is a format issue or something to do with browser compatibility but I thought I’d post to let you know. The design look great though! Hope you get the problem fixed soon. Thanks

Hi, I think your website might be having browser compatibility issues. When I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, amazing blog!

Merely a smiling visitant here to share the love (:, btw great pattern. “Justice is always violent to the party offending, for every man is innocent in his own eyes.” by Daniel Defoe.

WONDERFUL Post.thanks for share..more wait .. …

Keep functioning ,terrific job!

There is evidently a lot to know about this. I consider you made certain nice points in features also.

I got what you mean ,saved to bookmarks, very nice internet site.