Kenya’s bond market has recently seen a resurgence of confidence, as evidenced by the Central Bank of Kenya’s (CBK) latest tap sale.

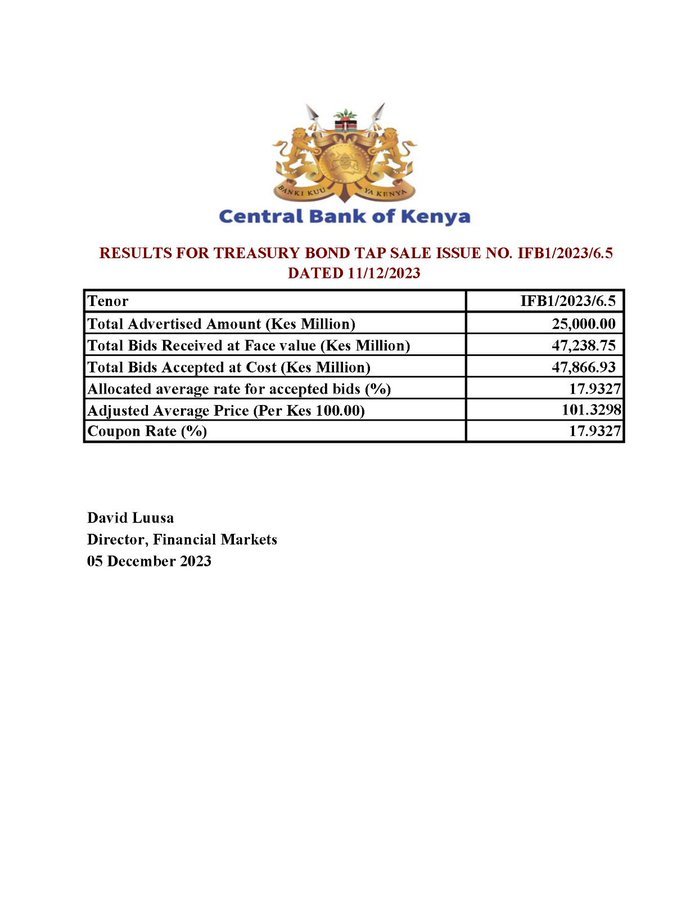

The CBK offered Ksh.25 billion from a November bond with a maturity of 6.5 years, signaling a positive shift in the market dynamics.

The auction garnered substantial interest, with bids totaling a face value of Ksh.42.2 billion. The CBK accepted Ksh.42.8 billion of this amount, reflecting the robust participation in the market.

Investors were drawn to the attractive terms of the bond.

What was perhaps unique in this tap sale was that bidders did not have to specify the price or yield they were willing to accept for the bond. Instead, they bid at the average rate of the accepted bids for the original bond auction, which was 17.9%.

This rate is then adjusted for accrued interest, ensuring that investors receive a fair return on their investment.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/id/join?ref=V3MG69RO