The Central Bank of Kenya (CBK) has cut its benchmark interest rate for the first time in over four years.

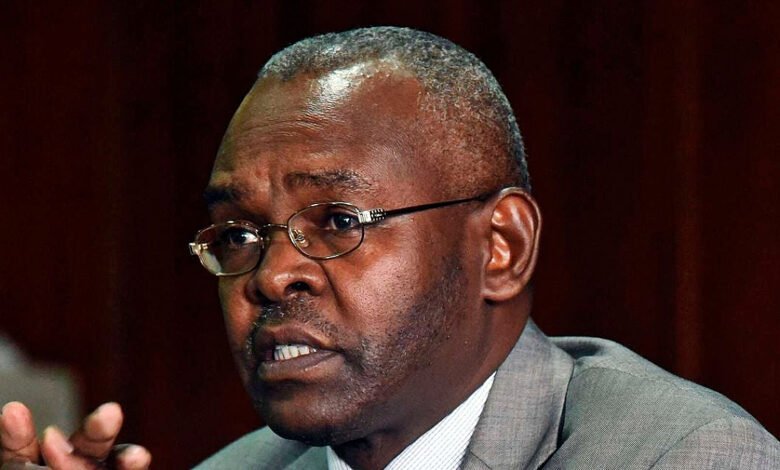

CBK Governor Governor Kamau Thugge announced the move Tuesday, signaling the bank’s confidence that inflation will remain below the midpoint of its target range in the near term.

The Monetary Policy Committee (MPC) reduced the key rate to 12.75% from 13% following a significant slowdown in headline inflation, which has reached a four-year low.

The decision came after two consecutive monetary policy meetings where the Central Bank Rate was left unchanged.

“The MPC noted that its previous measures have lowered overall inflation to below the mid-point of the target range, stabilized the exchange rate, and anchored inflationary expectations,” said Thugge.

Global Monetary Trends and Local Implications

Kenya’s rate cut aligns with a global trend of easing monetary policies aimed at fostering economic stability.

Also Read: Bank of England Cuts Interest Rates to 5% for First Time Since 2020

The global growth prospects in major economies such as the US, China, and India could further enhance Kenya’s trade and investment opportunities, contributing to a more favorable economic outlook.

Economic Outlook and Investment Climate

According to the CBK, Kenya’s economic indicators point towards a stable investment climate. The country’s real GDP growth in Q1 2024, coupled with a projected annual growth rate of 5.4%, suggests a resilient economy.

The reduction in the current account deficit and an increase in goods exports, particularly from the agricultural sector, signal promising economic conditions.

However, analysts worry that the recent protests and high business costs present potential risks that investors should be aware of.

I’m extremely impressed with your writing skills as well as with the structure on your weblog. Is that this a paid topic or did you customize it your self? Anyway stay up the excellent high quality writing, it’s rare to look a great weblog like this one today!