Kenya is returning to the international markets with a plan to borrow Ksh.193.5 billion ($1.5 billion) through a new bond while simultaneously repurchasing up to Ksh.116.1 billion ($900 million) of existing debt, the National Treasury announced.

It is a strategy by the National Treasury designed to ease short-term repayment pressures and stretch the country’s debt obligations further into the future.

The new bond, maturing in 2036, carries a 9.5% interest rate as Kenya targets older bonds due in 2027 with a 7% interest rate for its buyback program.

Investors holding the 2027 bonds can sell them back to the government at Ksh.129,322.50 ($1,002.50) per Ksh129,000 ($1,000) face value—a small profit incentive.

The buyback offer remains flexible, allowing the government to adjust the amount redeemed based on financial needs.

What it Means

This dual approach reduces Kenya’s repayment burden in 2027 while extending it to 2036 with the new bond.

Also Read: What It Means After Kenya Failed to Honour Promised $300 Million Buyback

However, the higher interest rate on the 2036 bond means taxpayers will shoulder increased costs over time. Investors now face a choice: cash out now with the buyback or hold their 2027 bonds for full repayment with continued 7% interest.

Treasury Slashes Revenue Forecasts After Overly Optimistic Projections

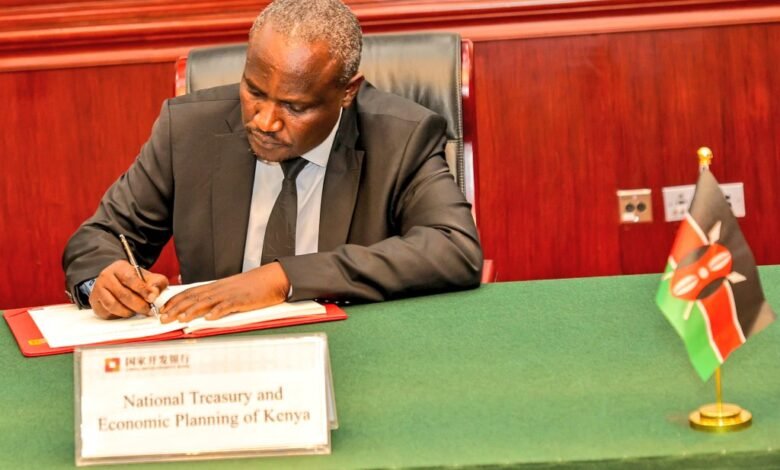

In a candid address on Thursday, Treasury Cabinet Secretary John Mbadi admitted the government has been “living a lie” by overestimating revenue.

Initially projecting Ksh2.6 trillion in ordinary revenue for the 2024-2025 financial year, the figure has been cut to Ksh2.5 trillion due to underperforming collections. Looking ahead, the 2025-2026 budget has also been revised downward by Ksh183 billion.

“We are now more realistic,” Mbadi said, signaling a shift toward conservative financial planning.

The adjustments come as Kenya grapples with balancing ambitious budgets against economic realities, even as it takes on fresh debt to manage existing liabilities.

I’m impressed, I have to say. Actually rarely do I encounter a blog that’s each educative and entertaining, and let me let you know, you might have hit the nail on the head. Your idea is outstanding; the issue is one thing that not enough individuals are talking intelligently about. I am very pleased that I stumbled across this in my seek for something regarding this.

you’ve got a terrific blog right here! would you like to make some invite posts on my blog?

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

This design is wicked! You obviously know how to keep a reader entertained. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Fantastic job. I really loved what you had to say, and more than that, how you presented it. Too cool!

What’s up, its good article on the topic of media print, we all

be aware of media is a fantastic source of data.

My page … nordvpn coupons inspiresensation; http://cfg.me,

350fairfax Nordvpn Promotion

We are a group of volunteers and starting

a new scheme in our community. Your website provided us

with valuable info to work on. You have done an impressive

job and our entire community will be thankful to you.

Outstanding post, I think blog owners should larn a lot from this web blog its real user genial.

You made some really good points there. I checked on the

web to learn more about the issue and found most people

will go along with your views on this site.

Look at my website … eharmony special coupon code 2025

I am often to blogging and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your site and keep checking for new information.

I would like to thnkx for the efforts you have put in writing this site. I am hoping the same high-grade blog post from you in the upcoming as well. Actually your creative writing abilities has inspired me to get my own site now. Actually the blogging is spreading its wings rapidly. Your write up is a great example of it.

My family members every time say that I am killing my time here

at net, but I know I am getting experience every day by reading such fastidious posts.

gamefly free trial https://tinyurl.com/28wjzmw4

For newest news you have to go to see world-wide-web and on the web I found this site as a most excellent site for latest

updates. https://tinyurl.com/2bm4xgrn what does a vpn do

I am usually to running a blog and i actually recognize your content. The article has actually peaks my interest. I’m going to bookmark your web site and keep checking for brand new information.

You are so interesting! I do not believe

I have read something like that before. So wonderful

to find someone with a few original thoughts on this subject.

Seriously.. many thanks for starting this up. This

web site is something that is needed on the internet,

someone with some originality!

Hiya, I am really glad I have found this information. Today bloggers publish only about gossips and internet and this is actually annoying. A good site with exciting content, this is what I need. Thanks for keeping this web site, I’ll be visiting it. Do you do newsletters? Can’t find it.

Thanks on your marvelous posting! I actually enjoyed reading

it, you will be a great author.I will be sure to bookmark

your blog and will often come back later in life. I want to encourage that you

continue your great job, have a nice evening!

Super-Duper blog! I am loving it!! Will come back again. I am taking your feeds also

Hi! Quick question that’s completely off topic. Do you know how to make your site mobile friendly? My weblog looks weird when viewing from my iphone. I’m trying to find a template or plugin that might be able to fix this issue. If you have any recommendations, please share. Appreciate it!

You have noted very interesting details ! ps decent internet site.

I have recently started a site, the info you provide on this site has helped me tremendously. Thank you for all of your time & work. “A physicist is an atom’s way of knowing about atoms.” by George Wald.

Really good info can be found on web blog.

I enjoy studying and I conceive this website got some really useful stuff on it! .

Great work! This is the type of information that should be shared around the internet. Shame on Google for not positioning this post higher! Come on over and visit my web site . Thanks =)

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You obviously know what youre talking about, why throw away your intelligence on just posting videos to your blog when you could be giving us something enlightening to read?

Hello, i think that i saw you visited my site so i came to “return the favor”.I

am attempting to find things to improve my website!I suppose its ok to

use some of your ideas!! https://tinyurl.com/ypubsnjg eharmony special coupon code 2025

I¦ve been exploring for a bit for any high quality articles or blog posts in this sort of area . Exploring in Yahoo I eventually stumbled upon this website. Reading this info So i am glad to show that I’ve a very just right uncanny feeling I found out exactly what I needed. I such a lot indubitably will make certain to do not put out of your mind this site and provides it a look on a relentless basis.

Hello! This is my first comment here so I just wanted to give a quick shout out and tell you I truly enjoy reading your posts. Can you suggest any other blogs/websites/forums that cover the same subjects? Thanks!

Wonderful, what a blog it is! This website presents helpful information to us, keep it up.

Feel free to visit my web blog – https://tinyurl.com/3zcr8enu

Precisely what I was looking for, appreciate it for posting.

I got what you intend,saved to my bookmarks, very nice website .

You made some clear points there. I did a search on the topic and found most persons will consent with your site.

What’s Taking place i am new to this, I stumbled upon this I have discovered It absolutely helpful and it has helped me out loads. I hope to contribute & aid different users like its aided me. Good job.

What’s Happening i’m new to this, I stumbled upon this I have found It absolutely helpful and it has aided me out loads. I hope to contribute & aid other users like its aided me. Great job.