With domestic interest rates soaring to 17% and external loans shrinking, Kenya faces a tough challenge in securing affordable funding for its upcoming budget as investors demand higher returns and borrowing costs rise.

Kenya faces increasing challenges in securing domestic loans in the upcoming financial year, as a prolonged standoff with local investors over interest rates persists and external borrowing options remain limited.

The National Treasury plans to raise its domestic borrowing target by 27% to Ksh.522.7 billion ($4.05bn) and slash external borrowing by over 50% to Ksh.166.7 billion ($1.29bn) for the 2025/26 financial year (FY), aiming to shift from short- to long-term debt securities.

In the current financial year 2024/25, domestic and external borrowing stand at Ksh.413.1 billion ($3.2bn) and Ksh.355.5 billion ($2.76bn), respectively.

However, local investors — primarily commercial banks, pension funds, and insurers — are already demanding higher returns, with average interest rates at 17%. This could complicate the government’s efforts to secure cheaper loans and slow the rapid accumulation of debt.

“The Central Bank of Kenya (CBK) faces a huge test,” says analysts at AIB AXYS Africa.

“We expect heightened yield tensions between the CBK on the one hand, and investors on the other keen to maximise real yields.”

Also Read: Kenya seeks Ksh.25 billion to fill up borrowing gap by June 23

With inflation at 4.4% as of August, well within the government’s preferred range, Cytonn Kenya estimates the real return on 10- and 20-year debt papers to be 12.9%.

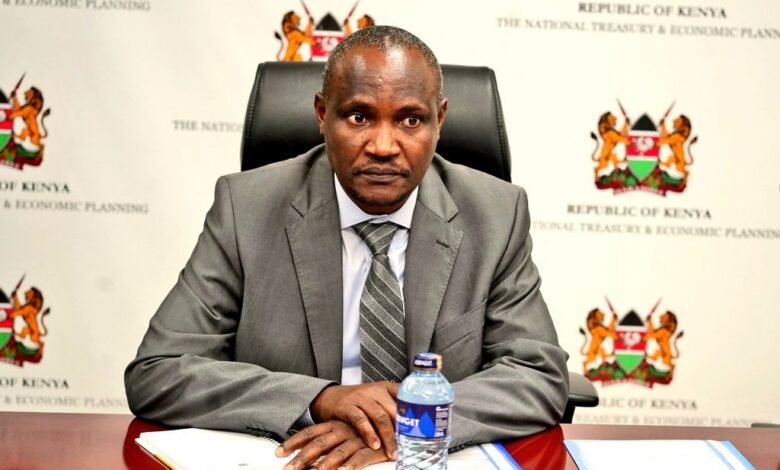

“The government will continue to optimise concessional funding, extend the maturity profile of public debt, and deepen the domestic debt market to reduce the cost of borrowing,” said Trreasury CS John Mbadi in the 2024 budget review and outlook paper (BROP).

Recent long-term government bond sales, a key part of the fiscal consolidation strategy, have remained undersubscribed, reflecting investor caution.

Last week, bond buyers offered Ksh.22.64 billion against the Ksh.30 billion target for reopened 10- and 20-year papers. The (CBK) accepted Ksh.19.28 billion worth of bids, rejecting those deemed too costly.

These same bonds fell short by 50% during July sales. Analysts suggest that investors are hesitant to commit long-term, anticipating that central banks worldwide will cut rates in the coming months.

Failed tax targets

Public discontent over tax hikes, which aim to boost government revenue and reduce reliance on borrowing, further complicates Kenya’s fiscal challenges, especially given the country’s heavy debt repayment obligations and funding gaps.

The country’s fiscal deficit, which determines borrowing needs, is expected to drop to Ksh.689.4 billion ($5.3bn) in the next budget cycle. In the medium term, the government plans to borrow only for development purposes, rather than for recurrent spending.

However, the government’s increased demand for domestic credit could undermine CBK’s efforts to lower interest rates.

Government bonds, seen as risk-free, are more attractive than private-sector lending; a flood of local government bonds in the market will crowd out the private sector, pushing up interest rates for them.

In its last monetary policy committee (MPC) meeting, CBK trimmed the base lending rate by 25 basis points to 12.75% in response to “easing inflationary pressures”, with indications that other central banks will soon embark on a similar trajectory.

The cut, the first in four years, could help the private sector to access cheaper credit and spur economic growth. A lower interest rate will also help the central bank to tame inflation and foreign currency exchange rates, which had peaked at historic levels and made debt repayment costly.

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.

As I site possessor I believe the content material here is rattling great , appreciate it for your hard work. You should keep it up forever! Best of luck.

Hi there! Do you know if they make any plugins to safeguard against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

Regards for this rattling post, I am glad I found this site on yahoo.

I?¦ve read several good stuff here. Definitely worth bookmarking for revisiting. I surprise how much attempt you place to create such a excellent informative web site.

Pretty nice post. I just stumbled upon your weblog and wished to say that I’ve really loved surfing around your blog posts. In any case I will be subscribing on your rss feed and I am hoping you write again very soon!

You made some good points there. I did a search on the topic and found a good number of folks will go along with with your blog.

There is noticeably a bundle to know about this. I assume you made certain nice points in features also.

Thanks for sharing excellent informations. Your web-site is very cool. I am impressed by the details that you have on this blog. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for more articles. You, my friend, ROCK! I found just the info I already searched all over the place and just could not come across. What an ideal web site.

Thank you for the good writeup. It in fact was a amusement account it.

Look advanced to more added ahreeable from you! However, how ccan we communicate? https://glassiindia.wordpress.com/

Thank youu for the good writeup. It in fact was a amusement account

it. Look advanced to more added agreeable from you! However, how

can we communicate? https://glassiindia.wordpress.com/

Thanks for another informative website. The place else could I get that kind of info written in such an ideal way? I’ve a undertaking that I am simply now operating on, and I have been at the glance out for such information.

Oh my goodness! a tremendous article dude. Thank you Nevertheless I’m experiencing concern with ur rss . Don’t know why Unable to subscribe to it. Is there anyone getting identical rss problem? Anyone who knows kindly respond. Thnkx

Just wanna remark on few general things, The website style is perfect, the content is rattling fantastic : D.

Nice post. I learn something more challenging on different blogs everyday. It will always be stimulating to read content from other writers and practice a little something from their store. I’d prefer to use some with the content on my blog whether you don’t mind. Natually I’ll give you a link on your web blog. Thanks for sharing.

I love your writing style really enjoying this site.

I discovered your blog site on google and check a few of your early posts. Continue to keep up the very good operate. I just additional up your RSS feed to my MSN News Reader. Seeking forward to reading more from you later on!…

Very interesting info!Perfect just what I was searching for!

Right now it appears like Movable Type is the preferred blogging platform available right now. (from what I’ve read) Is that what you’re using on your blog?

We stumbled over here different website and thought I should check things out. I like what I see so now i am following you. Look forward to looking over your web page for a second time.

I’m extremely inspired along with your writing talents and also with the format for your weblog. Is this a paid subject matter or did you customize it yourself? Either way stay up the nice quality writing, it is rare to peer a great blog like this one today..

There is noticeably a bundle to learn about this. I assume you made certain good factors in features also.

Perfect work you have done, this website is really cool with good information.