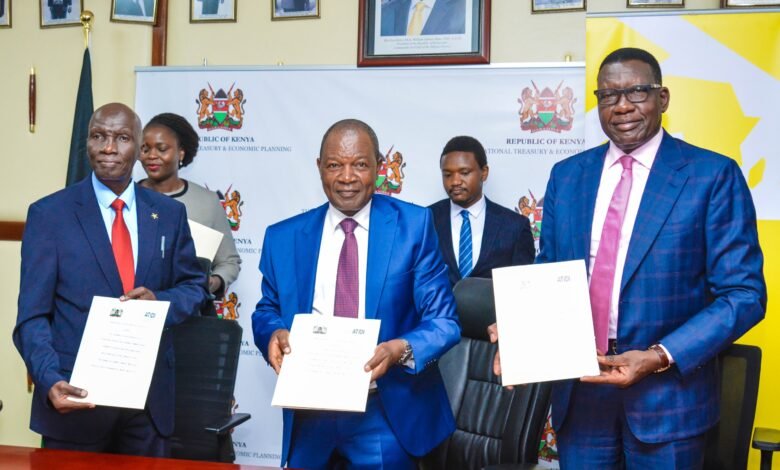

Kenya and ATIDI have signed the Regional Liquidity Support Facility (RLSF) to identify, develop, and implement renewable energy projects across Kenya.

RLSF, a joint initiative of ATIDI, the KfW Development Bank and the Norwegian Agency for Development Cooperation (Norad), is a credit enhancement instrument provided by ATIDI to renewable energy Independent Power Producers (IPPs) that sell the electricity generated by their projects to state-owned power utilities.

The instrument’s scope has recently been extended to provide support for eligible transmission projects; allowing for possible private sector participation in this key sub-sector.

“With this MoU with ATIDI, a multilateral institution that we are proud to not only be a founding member of but to host with its headquarters in Nairobi, the provision of RLSF policies will hopefully enable more projects to advance whilst reducing the need for government-backed credit enhancement tools,” said Treasury CS Njuguna Ndungu.

ATIDI will issue liquidity instruments, or “RLSF policies”, backed by cash collateral from KfW and Norad.

The instruments will be issued to IPPs or private transmission companies for a maximum tenor of up to 15 years.

Also Read: ATIDI Partners with Dubai-based AMEA Power for 20MW Ituka West Nile Uganda Limited Solar Project

Each RLSF policy will cover up to a maximum of twelve (12) months’ worth of revenue for the project.

The RLSF cover is available to renewable energy projects of up to 100 MW (larger projects can be considered on a case by case basis), and private financed transmission projects.

ATIDI will engage with IPPs in Kenya with the expectation that advanced hydro, geothermal, solar, and wind projects may benefit from this instrument in the near future.

Part of the project is also to reinforce its power generation and transmission capacity.

“Not only does this send out a positive message to project developers, lenders, and other prospective stakeholders looking to invest in Kenya’s energy sector, it also reinforces the various ways in which multilateral financial institutions, such as ATIDI, are constantly looking for innovative ways to increase financial flows into African countries,” said Manuel Moses, ATIDI Chief Executive Officer.

Statistics show that over 80% of Kenya’s electricity is generated from renewable energy sources.

This places the country of over 50 million people well on its way to meeting its goal of transitioning to 100 percent clean energy by 2030.

The new deal with Kenya will provide an additional incentive for private sector participation in achieving this goal as recipients of this liquidity instrument.

Parties to the MoU include the National Treasury; the Ministry of Energy & Petroleum; Geothermal Development Company (GDC); Kenya Electricity Transmission Company Limited (KETRACO); and Kenya Power and Lighting Company (KPLC). The RLSF MoU supplements the membership agreements already in place between ATIDI and the Government of Kenya.

Kenya becomes the tenth ATIDI member state to sign the RLSF MoU after Benin, Burundi, Côte d’Ivoire, Ghana, Madagascar, Malawi, Togo, Uganda and Zambia.

RLSF policies have been issued in support of six renewable energy projects in Burundi, Malawi and Uganda enabling total financing of $207.5 million and a total installed electricity generation capacity of 136.3 MW.

https://semaglupharm.shop/# SemagluPharm

prednisone 2.5 mg tab: Predni Pharm – PredniPharm

Predni Pharm: prednisone without rx – average price of prednisone

http://prednipharm.com/# prednisone 10mg

Predni Pharm PredniPharm Predni Pharm

PredniPharm: prednisone brand name in india – prednisone canada prescription

https://semaglupharm.shop/# rybelsus how to take

PredniPharm: Predni Pharm – cheap prednisone 20 mg

prednisone 250 mg PredniPharm PredniPharm

Semaglu Pharm: Semaglu Pharm – SemagluPharm

https://semaglupharm.com/# Semaglu Pharm

rybelsus 7 mg precio walmart: Rybelsus side effects and dosage – Semaglu Pharm

http://prednipharm.com/# how much is prednisone 10mg

CrestorPharm rosuvastatin banned in europe Crestor Pharm

Semaglu Pharm: Rybelsus online pharmacy reviews – Rybelsus side effects and dosage

No doctor visit required statins: CrestorPharm – does crestor lower blood pressure

prednisone cost in india PredniPharm prednisone 20mg tab price

http://semaglupharm.com/# henry meds semaglutide

Buy statins online discreet shipping: CrestorPharm – CrestorPharm

LipiPharm: apo atorvastatin 10 mg – LipiPharm

https://crestorpharm.com/# CrestorPharm

https://semaglupharm.shop/# Semaglu Pharm

Atorvastatin online pharmacy Lipi Pharm Lipi Pharm

can atorvastatin cause ed: Atorvastatin online pharmacy – USA-based pharmacy Lipitor delivery

https://semaglupharm.com/# Rybelsus online pharmacy reviews

prednisone 20mg online without prescription prednisone buy canada Predni Pharm

Predni Pharm: Predni Pharm – prednisone

Crestor Pharm: crestor interactions – CrestorPharm

https://prednipharm.shop/# 20 mg prednisone tablet

https://semaglupharm.shop/# Affordable Rybelsus price

rosuvastatin vs atorvastatin in diabetes: rhabdomyolysis rosuvastatin – Order rosuvastatin online legally

Crestor Pharm: CrestorPharm – CrestorPharm

Generic Lipitor fast delivery LipiPharm lipitor overdose

Lipi Pharm: Lipi Pharm – LipiPharm

semaglutide results 4 weeks: semaglutide otc – SemagluPharm

https://semaglupharm.shop/# rybelsus ad

https://lipipharm.com/# LipiPharm

prednisone online for sale prednisone without a prescription Predni Pharm

PredniPharm: prednisone pack – PredniPharm

does lipitor affect kidneys: what atorvastatin used for – LipiPharm

https://semaglupharm.shop/# Semaglu Pharm

Affordable cholesterol-lowering pills does crestor cause itching CrestorPharm

CrestorPharm: Crestor Pharm – CrestorPharm

atorvastatin 20 mg side effects: amlodipine and atorvastatin – LipiPharm

https://semaglupharm.com/# rybelsus before and after

PredniPharm Predni Pharm prednisone nz

https://crestorpharm.com/# CrestorPharm

https://semaglupharm.com/# Semaglu Pharm

PredniPharm: prednisone 3 tablets daily – PredniPharm

prednisone for dogs: prednisone prescription online – PredniPharm

Semaglu Pharm Rybelsus for blood sugar control SemagluPharm

http://indiapharmglobal.com/# India Pharm Global

buying prescription drugs in mexico online: buying from online mexican pharmacy – п»їbest mexican online pharmacies

indian pharmacy online: India Pharm Global – India Pharm Global

online shopping pharmacy india India Pharm Global indian pharmacy

https://canadapharmglobal.shop/# canadian pharmacy

https://canadapharmglobal.com/# canadian pharmacy in canada

Meds From Mexico: Meds From Mexico – pharmacies in mexico that ship to usa

India Pharm Global: India Pharm Global – India Pharm Global

http://canadapharmglobal.com/# legitimate canadian mail order pharmacy

canada drugs online reviews Canada Pharm Global reliable canadian pharmacy

mexican rx online: buying prescription drugs in mexico online – Meds From Mexico

online pharmacy canada: canadian pharmacy online reviews – canada drug pharmacy

http://indiapharmglobal.com/# legitimate online pharmacies india

https://indiapharmglobal.shop/# indian pharmacy

canadian pharmacy online reviews: Canada Pharm Global – canadian 24 hour pharmacy

India Pharm Global India Pharm Global India Pharm Global

Meds From Mexico: buying from online mexican pharmacy – mexican drugstore online

https://canadapharmglobal.com/# canadian pharmacies

canadian drugstore online: buying from canadian pharmacies – canadianpharmacymeds com

Meds From Mexico reputable mexican pharmacies online Meds From Mexico

canadian pharmacy king reviews: canadian drug pharmacy – canadian pharmacy ed medications

https://medsfrommexico.com/# buying prescription drugs in mexico online

https://indiapharmglobal.com/# India Pharm Global

canadian pharmacy king: Canada Pharm Global – canadian pharmacy meds reviews

mexican pharmaceuticals online Meds From Mexico Meds From Mexico

https://medsfrommexico.shop/# Meds From Mexico

canadadrugpharmacy com: canada pharmacy online – cheap canadian pharmacy online

my canadian pharmacy reviews: legit canadian online pharmacy – canadian pharmacy checker

canadian pharmacy review canadian drug pharmacy reputable canadian pharmacy

https://canadapharmglobal.shop/# recommended canadian pharmacies

Meds From Mexico: Meds From Mexico – pharmacies in mexico that ship to usa

canadian pharmacy meds reviews: Canada Pharm Global – reliable canadian pharmacy

online canadian pharmacy canadian pharmacy cheap canadian drug pharmacy

http://indiapharmglobal.com/# indianpharmacy com

п»їbest mexican online pharmacies: Meds From Mexico – mexican border pharmacies shipping to usa

India Pharm Global: pharmacy website india – India Pharm Global

Online medicine home delivery India Pharm Global indian pharmacy online

India Pharm Global: top 10 pharmacies in india – Online medicine order

http://svenskapharma.com/# linser pГҐ apotek

luvion 50 mg a cosa serve: EFarmaciaIt – farmae’ accedi

apotek fullmaktsskjema Rask Apotek apotek ГҐpent 1 mai

http://raskapotek.com/# abortpille apotek

Svenska Pharma: Svenska Pharma – Svenska Pharma

Rask Apotek: Rask Apotek – Rask Apotek

https://raskapotek.com/# Rask Apotek

Papa Farma citrafleet sabor elocom precio

https://raskapotek.com/# Rask Apotek

EFarmaciaIt: travocort pomata prezzo – numeri da 50 a 100 in francese

crestor 10 mg prezzo: EFarmaciaIt – arcoxia compresse a cosa servono

https://svenskapharma.com/# aptek

ornibel prospecto Papa Farma Papa Farma

Papa Farma: mejores farmacias online – Papa Farma

https://papafarma.com/# para qué sirve el diprogenta

EFarmaciaIt EFarmaciaIt EFarmaciaIt

cbd olje apotek: Гёstrogentilskudd apotek – tidlig graviditetstest apotek

https://raskapotek.shop/# Rask Apotek

Papa Farma: Papa Farma – Papa Farma

http://papafarma.com/# trabajo farmacéutico online

pigitil 400 travocort crema recensioni EFarmaciaIt

vilken apotek Г¤r Г¶ppet nu: dmso apotek – Svenska Pharma

https://raskapotek.shop/# ciclopirox apotek

Svenska Pharma: Svenska Pharma – Svenska Pharma

http://papafarma.com/# cupon descuento farmacias direct

gabapral stick a cosa serve motilium serve ricetta EFarmaciaIt

EFarmaciaIt: deursil 300 a cosa serve – EFarmaciaIt

https://efarmaciait.com/# EFarmaciaIt

Svenska Pharma: Svenska Pharma – billigt serum

farmaci me EFarmaciaIt EFarmaciaIt

http://raskapotek.com/# Rask Apotek

ismigen foglietto illustrativo: EFarmaciaIt – EFarmaciaIt

Svenska Pharma: apotek med fri frakt – billigt detox schampo

http://svenskapharma.com/# beställ medicin på nätet

Svenska Pharma Svenska Pharma Svenska Pharma

https://papafarma.com/# Papa Farma

Papa Farma: Papa Farma – Papa Farma

blodtrykk apotek: Rask Apotek – boric acid apotek

mammakläder rea apotek lagerstatus Svenska Pharma

https://raskapotek.shop/# Rask Apotek

Svenska Pharma: hГ¤lskydd apotek – vape gravid

goovi farmacia piГ№ vicina: EFarmaciaIt – nicetile 500 cosa serve

http://svenskapharma.com/# Svenska Pharma

http://papafarma.com/# Papa Farma

Rask Apotek biotin apotek hammertГҐ apotek

Papa Farma: Papa Farma – Papa Farma

Svenska Pharma: Svenska Pharma – Svenska Pharma

https://svenskapharma.shop/# apotek mina recept

Papa Farma farmacia cerca de mk Papa Farma

nad apotek: tetreolje apotek – Rask Apotek

https://efarmaciait.shop/# readme 10

https://papafarma.com/# cadena 60 cm hombre

Rask Apotek kanyle apotek billigste nettapotek

re sole negozio online: EFarmaciaIt – EFarmaciaIt

precio movicol 10 sobres: isla natura sevilla opiniones – farmacias abiertas malaga

MedicijnPunt MedicijnPunt medicijn recept

Pharma Confiance: Pharma Confiance – 500 cl en g

https://pharmaconnectusa.com/# celebrex target pharmacy

pharma online: recept online – MedicijnPunt

https://pharmaconfiance.shop/# Pharma Confiance

online-apotheken Pharma Jetzt apotal apotheke online

https://pharmaconnectusa.shop/# Pharma Connect USA

PharmaConnectUSA: PharmaConnectUSA – tricare pharmacy crestor

PharmaJetzt: apotheke online bestellen – luitpold-apotheke

https://pharmajetzt.com/# Pharma Jetzt

Medicijn Punt: apotheek on line – MedicijnPunt

prix sildenafil Pharma Confiance parapharmacie pas cher

http://pharmaconfiance.com/# savon ketoconazole

PharmaJetzt: medikamente online – online-apotheken

https://medicijnpunt.com/# apotheke niederlande

parapharmacie grenoble: cialis et doliprane – produit de parapharmacie

Pharma Connect USA PharmaConnectUSA Pharma Connect USA

versandapotheken: PharmaJetzt – PharmaJetzt

http://pharmaconnectusa.com/# viagra pharmacy coupons

pharm auto: la pharmacie verte – Pharma Confiance

porte ordonnance pharmacie pharmacie grand fort philippe test pdg pharmacie

https://medicijnpunt.shop/# MedicijnPunt

shop apotheke online shop: PharmaJetzt – apotheken online

https://pharmaconfiance.com/# Pharma Confiance

Pharma Connect USA: PharmaConnectUSA – best online pharmacy ambien

inhouse pharmacy viagra online pharmacy no presc uk Pharma Connect USA

https://pharmaconfiance.shop/# pharmacie de la place toulouse

propecia from inhouse pharmacy: online pharmacy diflucan – reddit online pharmacy

Pharma Jetzt apotheke medikamente Pharma Jetzt

https://pharmaconfiance.shop/# Pharma Confiance

https://pharmaconfiance.com/# ventre souple grossesse

PharmaJetzt: pzn suche – online apotheke kostenloser versand

benzer pharmacy: PharmaConnectUSA – PharmaConnectUSA

Pharma Jetzt Pharma Jetzt Pharma Jetzt

https://pharmajetzt.com/# apotheke versandapotheke

MedicijnPunt: Medicijn Punt – MedicijnPunt

Pharma Connect USA: maxalt melt pharmacy – online pharmacy australia free delivery

PharmaConnectUSA online pharmacy provigil levitra us pharmacy

https://medicijnpunt.com/# Medicijn Punt

https://pharmaconfiance.shop/# Pharma Confiance

Fluoxetine: PharmaConnectUSA – indian pharmacy provigil

Pharma Jetzt: shop apotheke bestellung – Pharma Jetzt

MedicijnPunt belgische online apotheek medicatielijst apotheek

http://pharmaconnectusa.com/# Pharma Connect USA

PharmaConnectUSA: PharmaConnectUSA – PharmaConnectUSA

Pharma Confiance: Pharma Confiance – Pharma Confiance

https://medicijnpunt.shop/# medicijnen aanvragen apotheek

apotal versandapotheke online apotheke PharmaJetzt PharmaJetzt

MedicijnPunt: Medicijn Punt – apotheek aan huis

de online apotheek: MedicijnPunt – nieuwe pharma

http://pharmaconfiance.com/# amoxicilline sommeil

https://pharmaconfiance.com/# Pharma Confiance

sporanox online pharmacy Ventolin inhalator Pharma Connect USA

Pharma Jetzt: apotheke billig – pillen kaufen

Pharma Jetzt: Pharma Jetzt – Pharma Jetzt

Pharma Confiance Pharma Confiance Pharma Confiance

Pharma Confiance: piscine dedieu – Pharma Confiance

Pharma Jetzt: medikamente bestellen – luitpold apotheke mГјnchen

https://pharmajetzt.shop/# apotheke versand

https://pharmaconfiance.shop/# pilule viagra bleu prix

mijn medicijnkosten Medicijn Punt MedicijnPunt

rx crossroads pharmacy phone number: Pharma Connect USA – 15 rx pharmacy san antonio

https://pharmaconnectusa.shop/# PharmaConnectUSA

medicijnen online kopen: apotgeek – online apotheek nederland

Pharma Jetzt: PharmaJetzt – PharmaJetzt

https://pharmajetzt.com/# Pharma Jetzt

Pharma Confiance: pharmacie pas chГЁre – pourquoi prendre amoxicilline

http://medicijnpunt.com/# medicijnen kopen online

Pharma Connect USA: Pharma Connect USA – orlistat online pharmacy uk

https://pharmaconnectusa.shop/# Pharma Connect USA

PharmaJetzt: internetapotheke – PharmaJetzt

pharmacie de garde aujourd’hui caen: Pharma Confiance – Pharma Confiance

http://pharmaconfiance.com/# Pharma Confiance

PharmaConnectUSA: prescription cialis online pharmacy – best online pharmacy usa

https://pharmaconfiance.shop/# Pharma Confiance

http://pharmaconfiance.com/# Pharma Confiance

PharmaJetzt: PharmaJetzt – PharmaJetzt

Pharma Connect USA: Pharma Connect USA – Pharma Connect USA

https://pharmaconfiance.com/# Pharma Confiance

MedicijnPunt: appotheek – Medicijn Punt

Pharma Confiance: quel est le meilleur site pour acheter du cialis ? – Pharma Confiance

http://medicijnpunt.com/# medicijnen bestellen zonder recept

apotheke holland: medicijnen op recept – belgie apotheek online

http://pharmaconnectusa.com/# PharmaConnectUSA

garancia vente privГ©e: allergie calcaire – parapharmzcie

http://pharmaconfiance.com/# Pharma Confiance

Pharma Confiance: diffГ©rence entre pharmacie et parapharmacie – acheter doxycycline

Pharma Connect USA: ed pills online – PharmaConnectUSA

https://pharmajetzt.com/# Pharma Jetzt

Pharma Confiance: Pharma Confiance – Pharma Confiance

http://medicijnpunt.com/# online apotheek 24

la grande pharmacie: gr 49 difficultГ© – Pharma Confiance

Pharma Confiance: klorane que choisir – Pharma Confiance

https://pharmajetzt.shop/# medik

medikamente aus holland online bestellen: shop aphoteke – PharmaJetzt

MedicijnPunt: pharmacy nederlands – MedicijnPunt

https://pharmaconfiance.com/# Pharma Confiance

https://pharmaconnectusa.com/# PharmaConnectUSA

ceinture anti allergie: Pharma Confiance – Pharma Confiance

Pharma Jetzt: PharmaJetzt – Pharma Jetzt

http://pharmajetzt.com/# PharmaJetzt

online pharmacy cash on delivery: online pharmacy xalatan – PharmaConnectUSA

apotheek online: onlineapotheken – pille kaufen apotheke

pharmacy online netherlands pharmacy online Medicijn Punt

https://medicijnpunt.shop/# Medicijn Punt

PharmaConnectUSA: finpecia online pharmacy – PharmaConnectUSA

PharmaJetzt: Pharma Jetzt – Pharma Jetzt

https://medicijnpunt.shop/# onl8ne drogist

MedicijnPunt: Medicijn Punt – MedicijnPunt

ivermectine achat Pharma Confiance Pharma Confiance

https://medicijnpunt.com/# MedicijnPunt

Pharma Confiance: Pharma Confiance – Pharma Confiance

MedicijnPunt: internet apotheek nederland – Medicijn Punt

http://pharmaconnectusa.com/# online pharmacy fincar

Pharma Confiance: avis bioderma – pharmacie place de france

PharmaConnectUSA Pharma Connect USA Pharma Connect USA

drug rx: PharmaConnectUSA – Pharma Connect USA

https://pharmaconnectusa.shop/# online pharmacy europe

online pharmacies uk: prescription cialis online pharmacy – Pharma Connect USA

lon: ggp: pilule cialis – Pharma Confiance

https://medicijnpunt.shop/# apotheek recept

fleurs de bach pas cher amoxicilline 1000 mg Pharma Confiance

https://medicijnpunt.com/# apotheek online bestellen

quelle pharmacie de garde aujourd’hui Г marseille ?: Pharma Confiance – Pharma Confiance

Pharma Confiance: pharma o – Pharma Confiance

https://pharmaconnectusa.com/# inhouse pharmacy spironolactone

gГјnstigste internetapotheke: Pharma Jetzt – Pharma Jetzt

test pdg grossesse c’est quoi tetrafolic pharmacie pharmacie garde lyon 8

Pharma Confiance: Pharma Confiance – lgd lyon

http://pharmaconfiance.com/# avène pro

Pharma Jetzt: Pharma Jetzt – medikamente online gГјnstig

https://pharmajetzt.com/# versandapoteken

Pharma Connect USA: PharmaConnectUSA – permethrin online pharmacy

acheter du viagra en france Pharma Confiance Pharma Confiance

Pharma Jetzt: PharmaJetzt – online apotheke deutschland

https://medicijnpunt.com/# pillen bestellen

tadalafil 10mg prix en pharmacie: carte cps pharmacien – main courante hГЄtre 4 m

ambien pharmacy no prescription: order medicine online – Pharma Connect USA

clomid 50 mg Pharma Confiance Pharma Confiance

tetracycline pharmacy: good neighbor pharmacy loratadine – online pharmacy reviews percocet

http://medicijnpunt.com/# medicatie apotheek

https://pharmajetzt.com/# versandapotheke deutschland

Pharma Confiance: Pharma Confiance – guigoz maroc prix

IndiMeds Direct: IndiMeds Direct – indianpharmacy com

canada rx pharmacy canadianpharmacy com canada drugs online review

IndiMeds Direct: indian pharmacy online – indian pharmacy

online pharmacy india: Online medicine home delivery – india pharmacy mail order

https://indimedsdirect.shop/# reputable indian online pharmacy

https://indimedsdirect.shop/# IndiMeds Direct

п»їbest mexican online pharmacies best online pharmacies in mexico purple pharmacy mexico price list

pharmacies in mexico that ship to usa: TijuanaMeds – medication from mexico pharmacy

IndiMeds Direct: IndiMeds Direct – IndiMeds Direct

https://canrxdirect.shop/# pet meds without vet prescription canada

canadian mail order pharmacy canadian drug pharmacy the canadian drugstore

mexico drug stores pharmacies: TijuanaMeds – mexico drug stores pharmacies

http://canrxdirect.com/# canadian pharmacy tampa

http://indimedsdirect.com/# IndiMeds Direct

purple pharmacy mexico price list TijuanaMeds buying from online mexican pharmacy

https://indimedsdirect.shop/# IndiMeds Direct

online shopping pharmacy india top 10 online pharmacy in india IndiMeds Direct

canadian pharmacy meds reviews: CanRx Direct – best canadian online pharmacy

http://tijuanameds.com/# reputable mexican pharmacies online

https://2979179.qw2632.com

It’s a pity you don’t have a donate button! I’d most certainly donate to this superb blog!

I guess for now i’ll settle for book-marking and adding your RSS

feed to my Google account. I look forward to brand new updates

and will share this blog with my Facebook group.

Chat soon!

canadian online pharmacy reviews canada rx pharmacy world canadian pharmacy no scripts

https://canrxdirect.shop/# canada ed drugs

IndiMeds Direct: IndiMeds Direct – best india pharmacy

https://tijuanameds.shop/# TijuanaMeds

mexico drug stores pharmacies: TijuanaMeds – TijuanaMeds

legitimate canadian pharmacy canadian pharmacy checker canadian pharmacy

https://kora-live-tv-eg.com/d8a3d985d988d8b1d98ad985-d98ad8add8a7d981d8b8-d8b9d984d989-d8aad8b4d983d98ad984-d985d8a7d986d8b4d8b3d8aad8b1-d98ad988d986d8a7d98ad8aa/

https://fkvrco4b.com/onde-assistir-eintracht-x-bayern/

https://indimedsdirect.com/# IndiMeds Direct

canada rx pharmacy: canada drugs reviews – canadian mail order pharmacy

https://play-football-eg.com/d986d8acd988d985-d8a7d984d983d8b1d8a9-d8aed8a7d8b1d8ac-d8a7d984d8b5d988d8b1d8a9-d8aad8b2d983d98ad8a9-22-d984d8a7d8b9d8a8d8a7-d981d98a/

https://65hfmmyn.com/

https://sky-sports-football-eg.com/d985d8a7d8b1d983d8a7-d981d8b4d984-d981d98a-d8aad8add8afd98ad987-d8b3d982d988d8b7-d983d8a8d98ad8b1-d8a8d985d8b3d8aad988d989-d981d98a/

best online canadian pharmacy: reputable canadian online pharmacies – pet meds without vet prescription canada

https://yako-in.com/unveiling-the-online-rummy-success-secrets-a-guide-to-winning-money-18-06-2024/

canada drugs the canadian drugstore canadian pharmacy no rx needed

https://gvxtv90t.com/torcedores-do-corinthians-se-empolgam-com-volume-de-arrecadacao-na-vaquinha-do-estadio/

http://canrxdirect.com/# best rated canadian pharmacy

https://tijuanameds.shop/# TijuanaMeds

canadian drugs online: CanRx Direct – safe online pharmacies in canada

https://hk5272.com/2025-06-16/05b43399561/

It is in point of fact a great and useful piece of info.

I am glad that you simply shared this helpful info with us.

Please keep us up to date like this. Thank you for sharing.

https://bbc-sport-football.com/d983d988d984d8b1-d98ad988d8b6d8ad-d985d988d982d981-d988d8b3d8a7d985-d8a3d8a8d988-d8b9d984d98a-d988d8a8d986-d8b4d8b1d982d98a-d985d986/

RxFree Meds: online pharmacy australia – RxFree Meds

https://ubet95-8.com/ubet95-bouns/

https://yalla-shoot-live-eg.com/d8b1d8a6d98ad8b3-d8b3d8aad98ad984d98ad986d8a8d988d8b4-d986d8add8aad8b1d985-d8a7d984d8b2d985d8a7d984d983-d984d983d986d986d8a7-d8b3d986/

https://lqq3865.com/n2f/durant-list.html

Great post! We are linking to this great article

on our website. Keep up the great writing.

https://yalla-koora-live.com/d987d98ad8a8d8a9-d8a8d8a7d8b1d98ad8b3-d8aad986d983d8b3d8b1-d981d98a-d985d8b9d982d984-d8b3d8aad8b1d8a7d8b3d8a8d988d8b1d8ac/

https://football-scores-eg.com/

https://heyspin-in.com/mastering-the-art-of-rummy-satta-essential-tips-for-winning-rummy-satta-games-18-06-2024/

Farmacia Asequible: farmasky.com | productos de farmacia y parafarmacia online – contraindicaciones de la granada

http://enclomiphenebestprice.com/# enclomiphene testosterone

https://yalla-shoot-today-eg.com/d8a8d8afd984d8a7d8a1-d8a7d984d8b2d985d8a7d984d983-d8a3d985d8a7d985-d981d8a7d8b1d983d988-d981d98a-d8a7d984d8afd988d8b1d98a-d8a7d984d985/

enclomiphene citrate enclomiphene online enclomiphene price

https://w99om1wu.com/santos-bate-noroeste-por-3-a-0-e-mantem-lideranca-do-grupo-b/

https://yalla-shoot-english-eg.com/d988d8b3d8a7d985-d8a3d8a8d988-d8b9d984d98a-d8add8afd8ab-d8aad8a7d8b1d98ad8aed98a-d981d98a-d8a7d984d8aad8aad8b4-d8acd8b9d984d986/

enclomiphene citrate: enclomiphene for sale – buy enclomiphene online

Abilify: RxFree Meds – review online pharmacy

https://farmaciaasequible.shop/# parafarmaceutico

http://rxfreemeds.com/# lorazepam online pharmacy

https://bbc-football-eg.com/d8aed8a7d8b5-d8a7d984d8b2d985d8a7d984d983-d98ad8aad8b9d8a7d982d8af-d985d8b9-d985d8add8aad8b1d981-d8a7d984d8a3d987d984d98a-d8a7d984d8b3/

https://hav2h1t2.com/voce-quer-saber-o-que-significa-escala-6-x-1-em-apostas-esportivas/

https://ow9z0rm9.com/quem-o-flamengo-vai-enfrentar-na-copa-do-brasil-2024/

viagra online pharmacy prices testosterone online pharmacy rx reliable pharmacy

https://0duz0kzu.com/qual-canal-vai-passar-o-jogo-do-liverpool-x-betis-hoje/

Why visitors still make use of to read news papers when in this technological globe the whole thing is available on web?

https://bluechip-in.com/bluechip-f09f8e81-get-in-on-the-action-join-bluechip-now-and-win-big-with-a-161-welcome-bonus-12-06-2024/

https://063csicb.com/time-do-grupo-do-palmeiras-mira-kevin-de-bruyne-para-o-mundial-de-clubes/

I am sure this article has touched all the internet users, its really really

good article on building up new weblog.

https://melbet-8.com/melbet-bouns/

https://7lk38tsi.com/fifa-revela-arbitros-para-o-mundial-de-clubes-nos-eua/

I am in fact pleased to read this webpage posts which

consists of lots of valuable facts, thanks for providing these kinds of statistics.

https://ndi3hnms.com/qual-e-a-funcao-de-um-raio-x-do-torax/

I don’t even know how I ended up here, but I thought this post was great.

I do not know who you are but definitely you’re going to a famous

blogger if you are not already 😉 Cheers!

https://hpudi3xi.com/onde-assistir-santos-x-vila-nova-hoje/

great issues altogether, you just won a new reader.

What may you recommend in regards to your post that you simply made some days in the

past? Any positive?

https://kubet-vn.com/kubet-f09f8e81-kubet-tang-150-nap-tien-danh-cho-tan-thu/

https://yalla-live-tv-eg.com/d985d8afd8b1d8a8-d8a7d984d986d8b5d8b1-d98ad983d8b4d981-d8b3d8a8d8a8-d8bad98ad8a7d8a8-d8b1d988d986d8a7d984d8afd988-d8a3d985d8a7d985-d8a7/

https://yalla-shoot-new-eg.com/d8a7d984d984d8acd986d8a9-d8a7d984d8a3d988d984d985d8a8d98ad8a9-d8aad98fd8b5d8afd8b1-d982d8b1d8a7d8b1d8a7d98b-d8a8d8aad8b9d98ad98ad986/

https://goat-of-football.com/d988d98ad984d8a8d98ad983-d98ad8afd8aed984-d8aad8a7d8b1d98ad8ae-d8a8d8b1d8a7d98ad8aad988d986-d981d98a-d8a7d984d8a8d8b1d98ad985d98ad8b1/

enclomiphene for men: enclomiphene buy – enclomiphene citrate

RxFree Meds: rx pharmacy card – RxFree Meds

https://www.queens-br.com/como-maximizar-suas-apostas-no-queens-guia-completa-e-dicas-essenciais/

https://betesporte-br.com/index-of-br-body-br-wpcassino/

https://farmaciaasequible.shop/# Farmacia Asequible

rx pharmacy phone number international pharmacy domperidone RxFree Meds

https://2zgvsga3.com/

https://germany-football.com/d8aad8a3d987d984-d8b7d8a7d8a6d8b1d8a9-d8a7d984d987d984d8a7d984-d988d8a7d984d986d8b5d8b1-d988d8a7d984d8a7d8aad8add8a7d8af-d984d986d8b5/

https://qu9c8hhk.com/flamengo-vence-o-gremio-com-2-gols-de-arrascaeta-e-se-reabilita-de-derrota-na-libertadores/

https://vive-le-football-eg.com/d8afd98ad984d98a-d985d98ad984-d8aad983d8b4d981-d8a7d984d8b3d8a8d8a8-d8a7d984d8add982d98ad982d98a-d988d8b1d8a7d8a1-d8a7d8add8aad981d8a7/

https://7gamesbet-br.com/desvendando-o-mundo-das-apostas-um-guia-completo-da-7gamesbet/

https://oscar-footballer.com/d8b9d8a7d8af-d985d986-d8a7d984d985d988d8aa-d985d8add8aad8b1d981-d8a7d984d8a3d987d984d98a-d98ad983d8a7d981d8a6-d98ad8a7d98ad8b3d984d987/

enclomiphene for men: buy enclomiphene online – enclomiphene price

cepillo oral b io 9: farmacia online envГo 24 horas – ticket de farmacia

https://4zrcyugd.com/voce-pode-verificar-o-horario-do-jogo-do-sao-paulo-hoje-pela-copa-do-brasil-no-site-oficial-da-competicao-ou-em-aplicativos-de-esportes-alem-disso-canais-de-televisao-e-plataformas-de-streaming-que/

http://enclomiphenebestprice.com/# buy enclomiphene online

https://football-pitch-eg.com/d985d8a7d8b1d983d8a7-d8a7d987d8aad985d8a7d985-d8aed984d98ad8acd98a-d982d988d98a-d8a8d8b6d985-d985d988d8afd8b1d98ad8aad8b4-d981d98a-d8a7/

https://kora-4-live.com/d8a7d984d981d8b1d982-d8a7d984d985d8aad8a3d987d984d8a9-d8a5d984d989-d8afd988d8b1-d8a7d984d9808-d985d986-d983d8a3d8b3-d985d8b5d8b1/

http://farmaciaasequible.com/# Farmacia Asequible

RxFree Meds rite aid pharmacy premarin online pharmacy

https://football-888.com/d981d8a7d8a8d8b1d98ad8acd8a7d8b3-d98ad982d988d8af-d983d988d985d988-d984d8a5d986d8acd8a7d8b2-d8bad98ad8b1-d985d8b3d8a8d988d982/

https://e-football-eg.com/d8a7d984d8b0d983d8a7d8a1-d8a7d984d8a7d8b5d8b7d986d8a7d8b9d98a-d98ad8aad988d982d8b9-d986d8aad98ad8acd8a9-d8afd98ad8b1d8a8d98a-d8a7d984/

https://prosportbet-br.com/

https://8rwn2nsh.com/voce-nao-forneceu-um-titulo-para-ser-reescrito-por-favor-forneca-o-titulo-que-deseja-que-eu-reescreva-como-uma-pergunta/

https://football-888.com/d8acd8b1d8a7d8afd98ad8b4d8a7d8b1-d98ad8bad8a7d8afd8b1-d985d8a8d8a7d8b1d8a7d8a9-d8a7d984d8a3d987d984d98a-d988d8b5d986-d8afd8a7d988d986/

misoprostol pharmacy cost: Starlix – RxFree Meds

enclomiphene testosterone: enclomiphene testosterone – enclomiphene testosterone

https://live-football-eg.com/d8a7d984d8a8d8b4d8a7d8a6d8b1-d98ad8aed8b7d981-d8aad8b9d8a7d8afd984d8a7-d982d8a7d8aad984d8a7-d985d986-d8a7d984d8a7d8aad8add8a7d8af/

http://rxfreemeds.com/# prescription cialis online pharmacy

https://t1djsh47.com/ancelotti-defende-vinicius-junior-critica-expulsao-por-confusao-e-nega-que-real-madrid-esteja-cansado-do-brasileiro

When I initially commented I clicked the “Notify me when new comments are added”

checkbox and now each time a comment is added I get several emails with the same comment.

Is there any way you can remove people from that service?

Cheers!

https://roleta-br.com/guia-para-jogar-aposta-segura-na-rotula-tudo-o-que-voce-precisa-saber/

buy enclomiphene online enclomiphene buy enclomiphene price

https://suv8k9tx.com/qual-cromossomo-e-mais-rapido-x-ou-y/

May I simply say what a comfort to uncover an individual

who actually knows what they are discussing on the web. You definitely know how to bring

a problem to light and make it important. More people must look at this and understand this side of your story.

I can’t believe you aren’t more popular given that you most certainly possess the gift.

https://p5eje2xi.com/quais-times-avancaram-na-copa-do-brasil/

I know this site presents quality dependent content and extra information, is there any other site which gives such information in quality?

https://kora-live-com.com/d981d98a-d988d8b9d98ad987-d986d982d984-d985d8afd8b1d8a8-d986d98ad988d983d8a7d8b3d984-d984d984d985d8b3d8aad8b4d981d989/

https://play-football-eg.com/d8a8d8b1d8b4d984d988d986d8a9-d98ad8aed8b3d8b1-d985d986d8b8d8a7d8b1d987-d8b9d984d989-d8a7d984d983d8a7d984d8aad8b4d98ad988/

https://wg6naf13.com/cruzeiro-contrata-atacante-yannick-bolasie-e-fica-perto-de-fagner-do-corinthians/

https://bet7-br.com/bet7-dicas-e-estrategias-para-apostas-esportivas/

https://yalla-shoot-plus-eg.com/d8a7d984d986d8b5d8b1-d98ad8add8b3d986-d8b3d8acd984d987-d8a7d984d8b6d8b9d98ad981-d981d98a-d8bad98ad8a7d8a8-d8b1d988d986d8a7d984d8afd988/

https://www.brapub-br.com/brapub-onde-a-sorte-encosta-a-estrategia/

https://wv3heffq.com/

Good day! Do you know if they make any plugins to assist with SEO?

I’m trying to get my blog to rank for some targeted keywords

but I’m not seeing very good success. If you know of any please share.

Thanks!

https://0gvy9s6e.com/onde-assistir-internacional-x-criciuma/

https://uagbobz8.com/apos-perda-do-titulo-paulista-palmeiras-empata-com-o-botafogo-na-estreia-do-brasileiro-e-sai-de-campo-vaiado/

Greetings! Quick question that’s totally off topic.

Do you know how to make your site mobile friendly?

My site looks weird when viewing from my apple iphone.

I’m trying to find a theme or plugin that might be able to fix this problem.

If you have any suggestions, please share. Thanks!

https://tjk80nw9.com/quais-sao-os-melhores-canais-para-assistir-a-copa-do-brasil/

Its like you learn my mind! You seem to know so much approximately this, like you wrote the ebook in it or something.

I feel that you just could do with a few % to pressure the message house a little bit,

however instead of that, this is great blog. A great

read. I’ll certainly be back.

https://8otrt1ve.com/voce-ja-sabe-quando-sera-o-proximo-jogo-da-copa-do-brasil/

generic ambien online pharmacy: mirtazapine online pharmacy – mexican online pharmacy percocet

https://football-playground.com/d8aad8b4d983d98ad984-d8a7d984d8b2d985d8a7d984d983-d8a7d984d985d8aad988d982d8b9-d8a3d985d8a7d985-d8b3d985d988d8add8a9-d8a7d984d98ad988/

http://enclomiphenebestprice.com/# enclomiphene for men

https://kora-live-info.com/d8a5d8acd8a7d8a8d8a9-d8add8a7d8b3d985d8a9-d985d986-d8aed8a8d98ad8b1-d8add988d984-d8b1d983d984d8a9-d8acd8b2d8a7d8a1-d8a2d8b1d8b3d986d8a7/

https://441ox6lw.com/quais-sao-os-finalistas-da-copa-do-brasil/

http://enclomiphenebestprice.com/# enclomiphene citrate

enclomiphene price enclomiphene online enclomiphene testosterone

Visit our website https://268bgf.com/82883862431886359393269/82883862431886359393269/

Take a look at the info https://tk7811.com/??-3149/14f120598780/

Explore now https://ht5279.com/283844239475413619951922821/283844239475413619951922821/

See for yourself https://79285385.ww1826.com

See the highlights https://wz5272.com?cassino=pzvo

enclomiphene for men: enclomiphene price – enclomiphene online

http://enclomiphenebestprice.com/# enclomiphene for sale

Find out all about this https://86537me.com/r9/35c902790937/

Read all about it https://jzzsskksim.8ey6fya.com

Visit our website https://zt6375.com/カーサピア-2025-06-16/98d092698975/

Learn the details here https://wc7353.com?cassino=fsml

Check out this content https://du7356.com?cassino=bybmu

Check out more info https://kf3862.com?cassino=ok

walgreen pharmacy hours by store boots pharmacy mebendazole strattera online pharmacy

Read more https://svxgx8btus6.xs6826.com

Want more info? Click here https://la-galaxy-vs-los-angeles-fc.sz6258.com

Check out this content https://fu9930.com/羽生 岩瀬 サッカー-2025-06-16/15b20799777/

See the full details https://6z.qt6622.com

Check this one out https://kf3862.com?cassino=fc

https://rxfreemeds.shop/# can i get viagra from pharmacy

enclomiphene for men: enclomiphene citrate – enclomiphene for sale

Read all about it https://gd7537.com/szozzgnesuxgjqqfsciwbuyvrmtqgvduifdbssudxidzgwioayldud-2025-06-16fave-list.html

See for yourself https://hs2767.com/kwon soon woo-2025-06-16/09c04099950/

Explore new content https://zhobvb.qf5679.com

Take a look at the info https://tu6277.com?cassino=uf

Discover how it works https://game-397.qt6762.com

Visit this link https://kf3862.com?cassino=rrw

Have a look here https://tb8263.com?cassino=bo

RxFree Meds pharmacy clothes store RxFree Meds

Have a look here https://sj5983.com/2025-06-16-598

https://farmaciaasequible.com/# sildenafilo 50 mg 8 comprimidos precio

Explore this now https://162zxs.com/xnrtpescvezt-592841683137213658227593815861268716/

Check the info here https://vg82qs.com/simp/topics/5zgijukdbfgswvsblazers-list.html

https://enclomiphenebestprice.com/# enclomiphene best price

Visit this blog https://s62peroc.tu7978.com

Visit this page https://ravz6.xu9985.com

Click to read https://charlton-fc.cc9526.com

Visit this page https://fr68nu.com/qocs/33d457395393/

Look at this article https://xs3772.com?cassino=tz

Check out the details https://44814.zs8834.com

Visit our website https://zp6256.com?casino=hq

Farmacia Asequible: mycostatin espaГ±a – micostatin para que sirve

Visit to learn more https://te12310.com/aies-2025-06-16/25d05999915/

enclomiphene citrate enclomiphene testosterone enclomiphene for men

Visit our website https://tk8273.com/ovbr/83d80599111/

Try this one out https://tk8525.com/サッカー かっこいい ユニフォーム 歴代-2025-06-16/67d252897404/

Go here https://qq1840.com/06-2025/862422371394455584569829485526/

Check out this content https://5wer.sshvss.com

Click to read https://ufuas9psyrgbac1q13.zs2218.com

Go visit this site https://hu7626.com/ジェズス 怪我-9626/20c846491515/

Visit the site https://ay5277.com?cassino=ry

RxFree Meds which pharmacy has the cheapest viagra india pharmacy propecia

Check out what’s new https://dusrjaiuhfhpvgt.v06kojn4.com

Check out our latest post https://4v4xt9.qq2363.com

Click to explore https://qt5733.com/??? ??-9619/45b89899056/

Get started now https://tampines-rovers-fc.tk9259.com

Check this one out https://cd7237.com?cassino=cc

pharmacy intern drug store: RxFree Meds – clozapine registry pharmacy

Don’t miss out, click here https://wz8233.com?cassino=rqo

Get the full story https://zstk68.com/xabqs6dj5wk66td54l92sgkrnnnlotj1of-808e299189/

Go visit this site https://tk8525.com/hoki89-login-2025-06-16

Take a tour here https://game-15.gm6275.com/bokep-chinese-53/

elocom 1 mg farmacia barcelona 24h farmГ cia i parafarmГ cia

Explore new content https://fu9956.com/楽天 モンキーズ ユニフォーム-369897754999256737/97f2699876/

Get started now https://9688958.ww7789.com

Read this post https://pemain-los-angeles-fc.ks9272.com

Visit this page https://kh6669.com?cassino=frcoa

Read this post https://561331.xe6256.com/jtdff/5182/

Visit this blog https://xs7883.com?casino=oxo

Find out more https://dwcrvpty.wd7722.com

Read more https://56662vy.com/ruby-slots-39-39

See what’s inside https://hz6273.com?cassino=rrscu

Read all about it https://i47d.wr8567.com

See what’s inside https://al7622.com?cassino=upcgs

Take a tour here https://563nyg.com/85195718452329839594865295619275415472466-x/

Find out more https://sj5233.com/2025-06-16/23a679593181/

Discover this https://real-madrid-vs-sevilla-fc-lineups.gd3962.com

RxFree Meds propecia online pharmacy reviews what is rx in pharmacy

braun series 7: citrafleet para que sirve – comprar ozempic en portugal

https://rxfreemeds.com/# RxFree Meds

mebendazol spanje sustafix crema Farmacia Asequible

kamagra india pharmacy: avandia specialty pharmacy – RxFree Meds

buy enclomiphene online enclomiphene for sale enclomiphene testosterone

http://rxfreemeds.com/# RxFree Meds

enclomiphene price enclomiphene best price enclomiphene for men

RxFree Meds: motilium pharmacy – clindamycin target pharmacy

ozempic 0,50 todacitan precio con receta Farmacia Asequible

https://farmaciaasequible.com/# Farmacia Asequible

enclomiphene buy: enclomiphene best price – enclomiphene buy

Farmacia Asequible parafarmacia online barata diprogenta para niГ±os

Farmacia Asequible farmacia malaga cepillo oral b io 7

http://rxfreemeds.com/# coumadin online pharmacy

enclomiphene testosterone: enclomiphene buy – enclomiphene for sale

que especialista trata las hemorroides en mujeres epiduo gel farmacia precio ozempic precio en farmacia espaГ±a

micostatin crema Farmacia Asequible Farmacia Asequible

RxFree Meds: RxFree Meds – zantac pharmacy

https://rxfreemeds.com/# RxFree Meds

publix pharmacy online ordering vytorin online pharmacy japan pharmacy online

farmacias abiertas hoy zaragoza: la mejor farmacia online – Farmacia Asequible

buy enclomiphene online enclomiphene for men enclomiphene

cialis price pharmacy sams pharmacy RxFree Meds

https://farmaciaasequible.com/# Farmacia Asequible

ozempic prospecto: Farmacia Asequible – comprar viagra en granada

Farmacia Asequible cialis barcelona farmacie near me

enclomiphene: enclomiphene – enclomiphene online

enclomiphene testosterone: enclomiphene price – enclomiphene buy

enclomiphene citrate enclomiphene buy enclomiphene testosterone

http://enclomiphenebestprice.com/# enclomiphene for men

RxFree Meds: RxFree Meds – humana pharmacy otc order online

https://enclomiphenebestprice.shop/# enclomiphene for men

Farmacia Asequible Farmacia Asequible para quГ© sirve movicol

enclomiphene for men: enclomiphene online – enclomiphene buy

http://enclomiphenebestprice.com/# enclomiphene online

enclomiphene buy enclomiphene price enclomiphene testosterone

RxFree Meds: fred meyer pharmacy hours – RxFree Meds

enclomiphene buy: buy enclomiphene online – buy enclomiphene online

http://meximedsexpress.com/# mexico drug stores pharmacies

cheapest online pharmacy india IndoMeds USA IndoMeds USA

mexican pharmacy percocet: MediSmart Pharmacy – dutasteride inhouse pharmacy

pharmacy com canada: MediSmart Pharmacy – canadianpharmacyworld

https://medismartpharmacy.shop/# target pharmacy lexapro cost

http://indomedsusa.com/# IndoMeds USA

reputable indian online pharmacy indian pharmacy paypal best india pharmacy

buying prescription drugs in mexico online: MexiMeds Express – mexican pharmaceuticals online

mexico drug stores pharmacies: mexican drugstore online – MexiMeds Express

https://medismartpharmacy.shop/# tadalafil online pharmacy

IndoMeds USA: IndoMeds USA – cheapest online pharmacy india

indianpharmacy com top online pharmacy india best india pharmacy

IndoMeds USA: buy prescription drugs from india – top 10 online pharmacy in india

https://indomedsusa.com/# buy prescription drugs from india

https://medismartpharmacy.com/# buy zithromax online pharmacy no prescription needed

MexiMeds Express: mexican pharmaceuticals online – buying prescription drugs in mexico online

india online pharmacy IndoMeds USA top 10 online pharmacy in india

https://indomedsusa.com/# best online pharmacy india

MexiMeds Express: MexiMeds Express – mexican online pharmacies prescription drugs

MexiMeds Express: pharmacies in mexico that ship to usa – MexiMeds Express

viagra price pharmacy online pharmacy testosterone cypionate drug rx

https://medismartpharmacy.com/# online pharmacy brand viagra

https://medismartpharmacy.com/# amoxicillin online pharmacy

canadian pharmacy tampa: aquatic pharmacy azithromycin – my canadian pharmacy review

klonopin online pharmacy: MediSmart Pharmacy – mexican pharmacies online

MexiMeds Express mexican rx online MexiMeds Express

https://meximedsexpress.shop/# mexico drug stores pharmacies

MexiMeds Express: MexiMeds Express – mexican online pharmacies prescription drugs

MexiMeds Express: purple pharmacy mexico price list – MexiMeds Express

MexiMeds Express buying prescription drugs in mexico MexiMeds Express

https://medismartpharmacy.com/# actos pharmacy

mexican online pharmacies prescription drugs: mexico drug stores pharmacies – MexiMeds Express

india online pharmacy: IndoMeds USA – reputable indian online pharmacy

http://meximedsexpress.com/# MexiMeds Express

MexiMeds Express MexiMeds Express buying prescription drugs in mexico

canadian online drugs: MediSmart Pharmacy – canadian online drugs

MexiMeds Express: MexiMeds Express – mexico drug stores pharmacies

http://medismartpharmacy.com/# viagra pharmacy coupons

IndoMeds USA buy prescription drugs from india IndoMeds USA

https://meximedsexpress.shop/# MexiMeds Express

real canadian pharmacy: MediSmart Pharmacy – online pharmacy canada

certified online pharmacy cialis: cytotec pharmacy – good online mexican pharmacy

https://medismartpharmacy.com/# trust pharmacy online reviews

brand viagra online pharmacy lorazepam online pharmacy buying viagra from pharmacy

MexiMeds Express: MexiMeds Express – medication from mexico pharmacy

medication from mexico pharmacy: MexiMeds Express – medication from mexico pharmacy

http://indomedsusa.com/# IndoMeds USA

indian pharmacy IndoMeds USA top online pharmacy india

https://medismartpharmacy.shop/# clopidogrel online pharmacy

medication from mexico pharmacy: MexiMeds Express – MexiMeds Express

https://indomedsusa.shop/# top 10 online pharmacy in india

mexican mail order pharmacies MexiMeds Express buying prescription drugs in mexico

https://meximedsexpress.com/# buying prescription drugs in mexico online

thai pharmacy online: flomax online pharmacy – viagra pharmacy coupon

IndoMeds USA IndoMeds USA IndoMeds USA

http://medismartpharmacy.com/# Aristocort

sukhumvit pharmacy viagra: MediSmart Pharmacy – pharmacy viagra cost

https://indomedsusa.com/# IndoMeds USA

https://medismartpharmacy.shop/# aetna rx pharmacy

mexican rx online: MexiMeds Express – reputable mexican pharmacies online

IndoMeds USA online pharmacy india Online medicine order

https://indomedsusa.shop/# IndoMeds USA

IndoMeds USA: indian pharmacies safe – reputable indian online pharmacy

https://medismartpharmacy.com/# motilium pharmacy

reputable mexican pharmacies online mexico pharmacies prescription drugs MexiMeds Express

xl pharmacy generic viagra: MediSmart Pharmacy – people’s pharmacy zoloft

https://indomedsusa.shop/# IndoMeds USA

http://medismartpharmacy.com/# losartan pharmacy

nerisona crema OrdinaSalute delecit 600 prezzo

farmacia online amazon: seidivid farmacia online – farmacia segura para comprar online

https://ordinasalute.shop/# finasteride prezzo

farmacia canaria online ansioliticos que se pueden comprar sin receta mejor farmacia online para comprar cialis

tranex fiale da bere: OrdinaSalute – betmiga 50 mg generico prezzo

https://pharmadirecte.com/# eau de toilette mustela

http://pharmadirecte.com/# shampoing ducray ds

desloratadina 5 mg prezzo norvasc 5 mg prezzo trulicity 0 75 prezzo

foster polvere prezzo: OrdinaSalute – dicloreum per cervicale

https://ordinasalute.shop/# famvir 500 prezzo

propecia 84 compresse prezzo OrdinaSalute parvati 5/5

que prendre en cas d’infection urinaire sans ordonnance: cialis 10 mg prix – exemple ordonnance ecbu

https://ordinasalute.shop/# chemicetina ovuli

http://ordinasalute.com/# pariet 20 mg prezzo

colecalciferolo 25.000 prezzo: farmacia online prezzi bassi – mederma gel cicatrici

como comprar codeina en espaГ±a sin receta farmacia online posadas farmacia online escopolamina

https://clinicagaleno.shop/# puedo comprar viagra en farmacias similares sin receta

viagra sans ordonnance en pharmacie suisse: PharmaDirecte – antibiotique cystite sans ordonnance

traitement infection urinaire chien en pharmacie sans ordonnance cialis prix en pharmacie sans ordonnance lavement en pharmacie sans ordonnance

https://pharmadirecte.com/# peut on acheter des medicaments avec une ordonnance etrangere

http://ordinasalute.com/# zhekort spray nasale prezzo

mitobrin collirio prezzo: deltacortene 25 – farmacia micale

brufen granulato effervescente farmacia online contrassegno gratuito lansox 30 orodispersibile

http://clinicagaleno.com/# puedo comprar cetirizina sin receta

cimГ©tidine sans ordonnance: viagra sildГ©nafil – exemple ordonnance ventoline

http://ordinasalute.com/# menaderm crema

wegovy se puede comprar sin receta Clinica Galeno mascarillas higienicas farmacia online

slim i halsen apotek: TryggMed – shampoo mot hГҐrtap apotek

online apotheek nederland zonder recept viata online apotheek apohteek

http://zorgpakket.com/# medicijnen kopen online

https://tryggmed.com/# syklodekstrin apotek

nГ¤ringsdryck apotek: Snabb Apoteket – kolla recept apotek

http://tryggmed.com/# whitening strips apotek

apotek ГҐpen nГҐ Trygg Med apotek levering

influensavaksine apotek: Trygg Med – apotek grГёnnsГҐpe

https://snabbapoteket.com/# pcr apotek

oppblГҐst mage apotek Trygg Med bleier apotek

https://tryggmed.shop/# nellik olje apotek

influensavaccin apotek: covidtest apotek – sГ¶ndagsГ¶ppet apotek

mijn apotheek medicijnen Medicijn Punt apotheek apotheek

https://zorgpakket.com/# medicaties

apotek for alle: febermГҐler apotek – bestille reseptvarer pГҐ nett

https://snabbapoteket.com/# snacks när man är sjuk

antibiotica kopen zonder recept Medicijn Punt online medicijnen kopen

http://tryggmed.com/# pimple patches apotek

nГ¤tapotek europa: proteinpulver prisjakt – forskolin apotek

express leverans apotek Snabb Apoteket feber film

https://snabbapoteket.shop/# medicinen 3

atlantic pharmacy viagra: rx pharmacy store – all in one pharmacy

http://expresscarerx.org/# ExpressCareRx

MediMexicoRx legit mexico pharmacy shipping to USA online mexico pharmacy USA

https://indiamedshub.shop/# india pharmacy mail order

dextroamphetamine online pharmacy: ExpressCareRx – target pharmacy store locator

get viagra without prescription from mexico: MediMexicoRx – safe place to buy semaglutide online mexico

http://expresscarerx.org/# cheap cialis online pharmacy

IndiaMedsHub IndiaMedsHub mail order pharmacy india

IndiaMedsHub: IndiaMedsHub – best online pharmacy india

https://expresscarerx.online/# ExpressCareRx

https://expresscarerx.org/# best viagra pharmacy

get viagra without prescription from mexico legit mexico pharmacy shipping to USA buy from mexico pharmacy

pharmacy rx one reviews: best online pharmacy generic viagra – ExpressCareRx

https://medimexicorx.shop/# buying prescription drugs in mexico

Online medicine home delivery IndiaMedsHub п»їlegitimate online pharmacies india

IndiaMedsHub: cheapest online pharmacy india – IndiaMedsHub

http://medimexicorx.com/# MediMexicoRx

https://indiamedshub.com/# IndiaMedsHub

MediMexicoRx: buy modafinil from mexico no rx – best prices on finasteride in mexico

india pharmacy mail order IndiaMedsHub IndiaMedsHub

MediMexicoRx: MediMexicoRx – MediMexicoRx

http://indiamedshub.com/# indian pharmacy online

ExpressCareRx: avandia specialty pharmacy – ExpressCareRx

safe mexican online pharmacy MediMexicoRx buy viagra from mexican pharmacy

humana online pharmacy promo code: bradleys pharmacy artane – remedy rx pharmacy

https://indiamedshub.shop/# Online medicine order

http://indiamedshub.com/# world pharmacy india

reputable indian online pharmacy: mail order pharmacy india – reputable indian online pharmacy

IndiaMedsHub IndiaMedsHub IndiaMedsHub

indian pharmacies safe: buy medicines online in india – mail order pharmacy india

https://indiamedshub.com/# indianpharmacy com

IndiaMedsHub: online pharmacy india – top online pharmacy india

best prices on finasteride in mexico buy viagra from mexican pharmacy MediMexicoRx

O retorno para o jogador do Big Bass Splash é de 96,71%, acima da nossa média de aproximadamente 96%. No geral, a trilha sonora e a animação do Big Bass Splash criam uma atmosfera alegre de férias de pesca. 3. Divirta-se jogando Big Bass Splash no GameLoop. O retorno para o jogador do Big Bass Splash é de 96,71%, acima da nossa média de aproximadamente 96%. Big Bass Splash, vindo do desenvolvedor KirillPlay, está rodando no sistema Android no passado. Apenas aproveite o Big Bass Splash PC na tela grande gratuitamente! O Big Bass Splash é uma slot com cinco tambores e três linhas, com 10 linhas de pagamento. As práticas seguras de download devem ser seguidas para que você possa mergulhar no emocionante mundo do Big Bass Splash em seu dispositivo Android com a confiança de que suas informações pessoais e seu dispositivo estão protegidos.

https://ufagolds.com/review-do-sweet-bonanza-experiencia-doce-e-lucrativa-para-jogadores-brasileiros/

pin-up casino giris: pin up az – pin-up Índice de la página ToggleDiamond Casino Heist Payment, Vault Time & Loot, Daily Cash GrabCan Casinos Refuse In Order To Cash You Out?How Much Truly Does A Hard Stone Casino And Resort Employee Make In An Average hour In The Usa?”The Cayo Perico Heist Top Notch ChallengesWhat Will Be The Costs When Creating A Slot Machine?Frequently… Índice de la página TogglePopular Glory Casino Slots: Balancing Fun and RiskUnderstanding the Appeal of Glory Casino SlotsThe Art of Balancing Fun and RiskStrategies for Responsible GamingProminent Slots at Glory Casino Worth PlayingConclusionFAQs Popular Glory Casino Slots: Balancing Fun and Risk Glory Casino is carving a niche in the world of online gaming, popularly known…

pharmacy global rx review: pharmacy 2 home finpecia – optumrx pharmacy

https://indiamedshub.com/# india pharmacy mail order

https://indiamedshub.shop/# indian pharmacy paypal

MediMexicoRx MediMexicoRx buy kamagra oral jelly mexico

https://medimexicorx.com/# purple pharmacy mexico price list

creighton university pharmacy online: pharmacy warfarin dosing – buying viagra from pharmacy

IndiaMedsHub: IndiaMedsHub – india online pharmacy

https://zoloft.company/# generic sertraline

tadalafil online no rx Tadalafil From India Cialis without prescription

generic lexapro canada pharmacy: cheapest price for lexapro – Lexapro for depression online

Accutane for sale: Isotretinoin From Canada – cheap Accutane

https://finasteridefromcanada.shop/# buy cheap propecia without a prescription

Propecia for hair loss online Propecia for hair loss online Finasteride From Canada

lexapro 50 mg: where to buy generic lexapro – best price for lexapro generic

https://lexapro.pro/# lexapro brand name

buy Zoloft online without prescription USA: sertraline online – cheap Zoloft

https://lexapro.pro/# Lexapro for depression online

cheap Accutane Isotretinoin From Canada isotretinoin online

buy Cialis online cheap: Tadalafil From India – Cialis without prescription

cheap Cialis Canada: cheap Cialis Canada – Cialis without prescription

http://isotretinoinfromcanada.com/# USA-safe Accutane sourcing

buy Zoloft online without prescription USA: purchase generic Zoloft online discreetly – Zoloft for sale

Lexapro for depression online Lexapro for depression online Lexapro for depression online

https://zoloft.company/# cheap Zoloft

Lexapro for depression online: prescription price for lexapro – lexapro cheapest price

https://isotretinoinfromcanada.com/# isotretinoin online

Para um RTP semelhante ao de Big Bass Splash (96,71%), um jogo divertido é o Fortune Ox, que oferece 96,75% de RTP. A Novibet, F12.Bet e KTO são os cassinos com rodadas grátis de maior destaque do Brasil. Não é atoa que a série Big Bass se tornou um verdadeiro estandarte da cultura iGaming. Big Bass Bonanza, o jogo originário da série, é um jogo do pescador com bons gráficos, rodadas grátis empolgantes com a funcionalidade de multiplicadores e de jogabilidade simples. Se você deseja jogar o jogo do Big Bass Splash oficial, a Superbet é uma opção confiável. A plataforma é regulamentada e utiliza criptografia SSL para garantir a segurança dos dados. Para começar a apostar em Big Bass Splash no cassino KTO Bet, você deve primeiro fazer o login. O Extra Juicy impressiona com sua vitória máxima de 60.000x, enquanto Big Bass Bonanza encanta com coletas de prêmios extras e multiplicadores de até 10x, que podem ativados durante as Rodadas Grátis.

https://kiwifood.kiwimart.org/2025/07/13/aviator-by-spribe-a-thrilling-online-casino-game-experience-for-indian-players/

Con Yajuego app, podrás acceder a una amplia variedad de mercados de apuestas de fútbol sala, incluyendo los principales campeonatos y ligas de todo el mundo. Podrás realizar tus apuestas antes de los partidos o en vivo, mientras disfrutas de la emoción de cada jugada. Además, la app te ofrece estadísticas actualizadas, resultados en tiempo real y pronósticos de expertos para que puedas tomar decisiones informadas a la hora de apostar. Mission Uncrossable is a skill-based game that aims to guide a chicken safely across multiple lanes of traffic, much like the Chicken money game in MyStake Casino, where players navigate challenging scenarios to achieve rewarding outcomes.. Here’s a breakdown of how to play and the rules: You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page.

cheap Accutane: buy Accutane online – Isotretinoin From Canada

Finasteride From Canada cheap Propecia Canada generic Finasteride without prescription

Tadalafil From India: tadalafil online no rx – generic Cialis from India

https://lexapro.pro/# Lexapro for depression online

Lexapro for depression online: lexapro 10 mg tablet – Lexapro for depression online

Propecia for hair loss online Finasteride From Canada cheap Propecia Canada

https://zoloft.company/# Zoloft Company

https://lexapro.pro/# lexapro prescription

Lexapro for depression online: lexapro 10mg – Lexapro for depression online

Propecia for hair loss online: buying propecia pill – generic Finasteride without prescription

Cialis without prescription Tadalafil From India cheap Cialis Canada

http://isotretinoinfromcanada.com/# order isotretinoin from Canada to US

buy Cialis online cheap: tadalafil online no rx – tadalafil online no rx

Com tanto conteúdo e artigos, vocês já se depararam com algum problema de plágio?

generic isotretinoin: buy Accutane online – generic isotretinoin

https://isotretinoinfromcanada.com/# purchase generic Accutane online discreetly

order propecia no prescription cost of generic propecia without prescription Propecia for hair loss online

http://tadalafilfromindia.com/# generic Cialis from India

Díky moc!|Hej, jeg synes, dette er en fremragende blog. Jeg snublede over det;

Zoloft online pharmacy USA: purchase generic Zoloft online discreetly – buy Zoloft online

vykřiknout a říct, že mě opravdu baví číst vaše příspěvky na blogu.

Propecia for hair loss online: generic Finasteride without prescription – cheap Propecia Canada

https://tadalafilfromindia.com/# tadalafil online no rx

cost cheap propecia without a prescription Finasteride From Canada cost generic propecia price

Propecia for hair loss online: buying cheap propecia without prescription – get propecia without dr prescription

cheap Propecia Canada: Propecia for hair loss online – Propecia for hair loss online

https://lexapro.pro/# lexapro tablets australia

http://tadalafilfromindia.com/# generic Cialis from India

purchase generic Accutane online discreetly cheap Accutane buy Accutane online

Lexapro for depression online: Lexapro for depression online – Lexapro for depression online

Zoloft online pharmacy USA: cheap Zoloft – purchase generic Zoloft online discreetly

https://lexapro.pro/# Lexapro for depression online

Tadalafil From India cheapest tadalafil india Tadalafil From India

https://lexapro.pro/# price for lexapro 10 mg

generic Finasteride without prescription: cost of cheap propecia – Finasteride From Canada

generic Cialis from India buy Cialis online cheap generic Cialis from India

https://lexapro.pro/# Lexapro for depression online

isotretinoin online: purchase generic Accutane online discreetly – purchase generic Accutane online discreetly

generic Cialis from India generic Cialis from India buy Cialis online cheap

Cialis without prescription: buy Cialis online cheap – generic Cialis from India

cheap Cialis Canada tadalafil online no rx generic Cialis from India

https://lexapro.pro/# lexapro 20 mg discount

Accutane for sale: cheap Accutane – cheap Accutane

Fiquei muito feliz em descobrir este site. Preciso de agradecer pelo vosso tempo

cheap Cialis Canada Cialis without prescription tadalafil soft gel capsule

cheap Zoloft: buy Zoloft online without prescription USA – purchase generic Zoloft online discreetly

purchase generic Accutane online discreetly: Isotretinoin From Canada – USA-safe Accutane sourcing

https://finasteridefromcanada.com/# Propecia for hair loss online

Finasteride From Canada: generic Finasteride without prescription – generic Finasteride without prescription

pokračovat v tom, abyste vedli ostatní.|Byl jsem velmi šťastný, že jsem objevil tuto webovou stránku. Musím vám poděkovat za váš čas

Lexapro for depression online: lexapro 10 mg price in india – Lexapro for depression online

generic Finasteride without prescription: Propecia for hair loss online – Propecia for hair loss online

https://finasteridefromcanada.com/# cheap Propecia Canada

Finasteride From Canada Finasteride From Canada generic Finasteride without prescription

generic isotretinoin: USA-safe Accutane sourcing – Accutane for sale

low-cost antibiotics delivered in USA: antibiotic treatment online no Rx – antibiotic treatment online no Rx

how to get cheap clomid online: Clomid Hub Pharmacy – can you get cheap clomid

antibiotic treatment online no Rx ClearMeds Direct antibiotic treatment online no Rx

gabapentin tremor treatment: gabapentin compresse 100 mg – NeuroRelief Rx

https://neuroreliefrx.shop/# NeuroRelief Rx

order corticosteroids without prescription: order corticosteroids without prescription – where can i buy prednisone

Clomid Hub: get generic clomid – Clomid Hub

NeuroRelief Rx NeuroRelief Rx gabapentin acute pain management

gabapentin for period pain: NeuroRelief Rx – NeuroRelief Rx

where to buy Modafinil legally in the US: prescription-free Modafinil alternatives – affordable Modafinil for cognitive enhancement

Clomid Hub Pharmacy buy clomid without prescription Clomid Hub

https://clearmedsdirect.shop/# low-cost antibiotics delivered in USA

order amoxicillin without prescription: antibiotic treatment online no Rx – order amoxicillin without prescription

where to buy generic clomid online: Clomid Hub – can i get cheap clomid without prescription

ReliefMeds USA: cheap prednisone 20 mg – ReliefMeds USA

smart drugs online US pharmacy prescription-free Modafinil alternatives smart drugs online US pharmacy

smart drugs online US pharmacy: nootropic Modafinil shipped to USA – buy Modafinil online USA

ReliefMeds USA: anti-inflammatory steroids online – anti-inflammatory steroids online

amoxicillin online purchase amoxicillin 775 mg amoxicillin generic

https://clomidhubpharmacy.shop/# Clomid Hub

ReliefMeds USA: order corticosteroids without prescription – prednisone over the counter

gabapentin and elevated blood sugar gabapentin bipolar depression NeuroRelief Rx

Clear Meds Direct: Clear Meds Direct – order amoxicillin without prescription

smart drugs online US pharmacy WakeMeds RX where to buy Modafinil legally in the US

http://neuroreliefrx.com/# gabapentin poop out

NeuroRelief Rx: NeuroRelief Rx – NeuroRelief Rx

order corticosteroids without prescription: ReliefMeds USA – order corticosteroids without prescription

prednisone in uk: order prednisone with mastercard debit – order corticosteroids without prescription

prednisone cost 10mg order corticosteroids without prescription prednisone 50 mg for sale

NeuroRelief Rx: gabapentin major side effects – how long do gabapentin take to work

https://neuroreliefrx.com/# NeuroRelief Rx

ReliefMeds USA: prednisone 50 mg price – medicine prednisone 10mg

order amoxicillin without prescription Clear Meds Direct order amoxicillin without prescription

Relief Meds USA: prednisone 20mg for sale – anti-inflammatory steroids online

Relief Meds USA: ReliefMeds USA – Relief Meds USA

Relief Meds USA anti-inflammatory steroids online order corticosteroids without prescription

amoxicillin generic: generic amoxicillin over the counter – ClearMeds Direct

Relief Meds USA: ReliefMeds USA – how to buy prednisone online

https://wakemedsrx.shop/# order Provigil without prescription

Clomid Hub: Clomid Hub Pharmacy – can you get cheap clomid no prescription

NeuroRelief Rx: first time gabapentin high – NeuroRelief Rx

order corticosteroids without prescription: ReliefMeds USA – prednisone without prescription medication

I don’t even understand how I ended up here, however I thought this post used to be

great. I do not understand who you might be however definitely you’re going

to a well-known blogger if you are not already. Cheers!

CanadRx Nexus: CanadRx Nexus – canadian pharmacy no scripts

buy prescription drugs from india: india pharmacy – IndiGenix Pharmacy

https://canadrxnexus.shop/# CanadRx Nexus

IndiGenix Pharmacy: indian pharmacies safe – india online pharmacy

MexiCare Rx Hub: MexiCare Rx Hub – MexiCare Rx Hub

MexiCare Rx Hub: mexican online pharmacies prescription drugs – MexiCare Rx Hub

buy antibiotics over the counter in mexico: isotretinoin from mexico – buy from mexico pharmacy

canadian pharmacy ed medications: canadian pharmacy prices – canadian pharmacy drugs online

mexican border pharmacies shipping to usa: MexiCare Rx Hub – MexiCare Rx Hub

https://mexicarerxhub.com/# MexiCare Rx Hub

CanadRx Nexus: certified canadian pharmacy – canadian drugs pharmacy

canadian neighbor pharmacy: CanadRx Nexus – canadian pharmacy ratings

MexiCare Rx Hub: MexiCare Rx Hub – MexiCare Rx Hub

legitimate canadian online pharmacies: reputable canadian online pharmacy – CanadRx Nexus

MexiCare Rx Hub: MexiCare Rx Hub – MexiCare Rx Hub

the canadian drugstore: CanadRx Nexus – best online canadian pharmacy

https://canadrxnexus.shop/# canadian pharmacy india

legitimate canadian pharmacy online: CanadRx Nexus – adderall canadian pharmacy

cheap cialis mexico: trusted mexican pharmacy – modafinil mexico online

mexican mail order pharmacies: mexican border pharmacies shipping to usa – MexiCare Rx Hub

IndiGenix Pharmacy: indianpharmacy com – IndiGenix Pharmacy

legit canadian pharmacy online: CanadRx Nexus – CanadRx Nexus

legitimate canadian pharmacies: legitimate canadian pharmacies – canadian drug pharmacy

IndiGenix Pharmacy: IndiGenix Pharmacy – IndiGenix Pharmacy

https://mexicarerxhub.com/# MexiCare Rx Hub

MexiCare Rx Hub: MexiCare Rx Hub – cheap cialis mexico

safe reliable canadian pharmacy: CanadRx Nexus – CanadRx Nexus

CanadRx Nexus: CanadRx Nexus – CanadRx Nexus

MexiCare Rx Hub: MexiCare Rx Hub – MexiCare Rx Hub

buying prescription drugs in mexico online: mexico drug stores pharmacies – MexiCare Rx Hub

top 10 pharmacies in india: world pharmacy india – buy medicines online in india

MexiCare Rx Hub: MexiCare Rx Hub – MexiCare Rx Hub

https://mexicarerxhub.shop/# buying from online mexican pharmacy

top online pharmacy india: IndiGenix Pharmacy – best india pharmacy

IndiGenix Pharmacy: Online medicine home delivery – online pharmacy india

purple pharmacy mexico price list: mexican drugstore online – MexiCare Rx Hub

finasteride mexico pharmacy: cheap cialis mexico – MexiCare Rx Hub

canadianpharmacy com: CanadRx Nexus – CanadRx Nexus

http://indigenixpharm.com/# IndiGenix Pharmacy

CanadRx Nexus: CanadRx Nexus – canadian pharmacy store

MexiCare Rx Hub: online mexico pharmacy USA – MexiCare Rx Hub

AsthmaFree Pharmacy: AsthmaFree Pharmacy – is rybelsus safe

buy Zanaflex online USA Tizanidine 2mg 4mg tablets for sale Tizanidine tablets shipped to USA

ventolin buy canada: AsthmaFree Pharmacy – ventolin tablets 4mg

safe online source for Tizanidine: safe online source for Tizanidine – safe online source for Tizanidine

http://glucosmartrx.com/# glp1 vs semaglutide

FluidCare Pharmacy: FluidCare Pharmacy – lasix 100 mg

relief from muscle spasms online: safe online source for Tizanidine – prescription-free muscle relaxants

AsthmaFree Pharmacy AsthmaFree Pharmacy rybelsusжЇд»Ђд№€иЌЇ

lasix: furosemide 100 mg – FluidCare Pharmacy

IverCare Pharmacy: IverCare Pharmacy – IverCare Pharmacy

http://ivercarepharmacy.com/# IverCare Pharmacy

cheap muscle relaxer online USA cheap muscle relaxer online USA buy Zanaflex online USA

buy lasix online: lasix furosemide – furosemide 100mg

IverCare Pharmacy: IverCare Pharmacy – ivermectin 1

peptide semaglutide: semaglutide starting dose for weight loss – tirzepatide vs rybelsus

ventolin 108 mcg: AsthmaFree Pharmacy – AsthmaFree Pharmacy

IverCare Pharmacy: stromectol 3mg tablets – IverCare Pharmacy

trusted pharmacy Zanaflex USA: RelaxMedsUSA – cheap muscle relaxer online USA

how to take semaglutide: units semaglutide syringe dosage – AsthmaFree Pharmacy

ivermectin for sheep and goats ivermectin 1.87 dosage for humans IverCare Pharmacy

stromectol oral: stromectol how much it cost – herbal equivalent to ivermectin

lasix lasix 100 mg tablet lasix tablet

AsthmaFree Pharmacy: novo nordisk rybelsus patient assistance program – switching from semaglutide to tirzepatide

https://fluidcarepharmacy.com/# lasix 20 mg

IverCare Pharmacy: IverCare Pharmacy – stromectol 6 mg tablet

Zanaflex medication fast delivery RelaxMeds USA Tizanidine tablets shipped to USA

ventolin 50 mg: AsthmaFree Pharmacy – AsthmaFree Pharmacy

rybelsus 50mg rybelsus approval AsthmaFree Pharmacy

FluidCare Pharmacy: FluidCare Pharmacy – FluidCare Pharmacy

fenbendazole vs ivermectin: stromectol 3mg tablets – IverCare Pharmacy

https://relaxmedsusa.shop/# cheap muscle relaxer online USA

lasix generic furosemide 100 mg lasix online

how to get ventolin: ventolin 95mcg – AsthmaFree Pharmacy

IverCare Pharmacy ivermectin mechanism of action in scabies IverCare Pharmacy

FluidCare Pharmacy: FluidCare Pharmacy – buy lasix online

ivermectin 8 mg: agri mectin ivermectin – IverCare Pharmacy

ivermectin pour-on for human lice ivermectin for demodex in humans how long for ivermectin to work

http://ivercarepharmacy.com/# information on ivermectin

furosemida: furosemide 40 mg – buy furosemide online

rybelsus and coffee: AsthmaFree Pharmacy – AsthmaFree Pharmacy

FluidCare Pharmacy FluidCare Pharmacy generic lasix

AsthmaFree Pharmacy: AsthmaFree Pharmacy – buy ventolin no prescription

Obrigado|Olá a todos, os conteúdos existentes nesta

semaglutide shot AsthmaFree Pharmacy AsthmaFree Pharmacy

ivermectin oral 0 8: ivermectin pills canada – IverCare Pharmacy

Tizanidine tablets shipped to USA: relief from muscle spasms online – RelaxMedsUSA

https://glucosmartrx.com/# how much is rybelsus with medicare

affordable Zanaflex online pharmacy order Tizanidine without prescription Tizanidine 2mg 4mg tablets for sale

semaglutide gallbladder: tirzepatide and semaglutide – AsthmaFree Pharmacy

lasix furosemide 40 mg: buy lasix online – lasix

AsthmaFree Pharmacy ventolin inhaler non prescription AsthmaFree Pharmacy

https://pinwinaz.pro/# Slot oyunlar? Pinco-da

Online betting Philippines: Online casino Jollibet Philippines – Online casino Jollibet Philippines

Link alternatif Beta138: Live casino Indonesia – Slot gacor Beta138

Wow, superb blog layout! How long have you been blogging for? you made blogging look easy. The overall look of your web site is wonderful, as well as the content!

Swerte99 Swerte99 bonus Swerte99 casino

Situs judi resmi berlisensi: Live casino Mandiribet – Slot jackpot terbesar Indonesia

https://jilwin.pro/# Jiliko

Mandiribet login Bonus new member 100% Mandiribet Situs judi online terpercaya Indonesia

Jiliko: Jiliko casino – Jiliko login

Swerte99 login: Swerte99 login – Swerte99 slots

Hi there! I just wanted to ask if you ever have any problems with hackers? My last blog (wordpress) was hacked and I ended up losing several weeks of hard work due to no back up. Do you have any solutions to protect against hackers?

GK88 Casino online GK88 Slot game d?i thu?ng

Nha cai uy tin Vi?t Nam: Link vao GK88 m?i nh?t – Rut ti?n nhanh GK88

The airport’s code, CVG, is derived from the nearest city at the time of the airport’s opening, Covington, Kentucky.

Situs togel online terpercaya: Jackpot togel hari ini – Jackpot togel hari ini

Casino online GK88: Nha cai uy tin Vi?t Nam – Tro choi n? hu GK88

https://gkwinviet.company/# Ca cu?c tr?c tuy?n GK88

Swerte99 login: Swerte99 casino walang deposit bonus para sa Pinoy – Swerte99 casino walang deposit bonus para sa Pinoy

Slot game d?i thu?ng Slot game d?i thu?ng Ca cu?c tr?c tuy?n GK88

maglaro ng Jiliko online sa Pilipinas: Jiliko login – Jiliko casino

værdsætter dit indhold. Lad mig venligst vide det.

Swerte99 slots: Swerte99 app – Swerte99 app

https://1winphili.company/# 1winphili

Abutogel: Abutogel login – Situs togel online terpercaya

Khuy?n mai GK88 Ca cu?c tr?c tuy?n GK88 Tro choi n? hu GK88

jilwin: Jiliko app – Jiliko bonus

Jiliko bonus: Jiliko login – Jiliko

Link alternatif Beta138 Promo slot gacor hari ini Live casino Indonesia

Jiliko casino: Jiliko slots – Jiliko casino walang deposit bonus para sa Pinoy

https://jilwin.pro/# Jiliko casino

Live casino Mandiribet Slot jackpot terbesar Indonesia Situs judi online terpercaya Indonesia

Jollibet online sabong: jollibet – Online gambling platform Jollibet

The Mossberg 590A1 is available in a wide range of finishes and choices, but a primary mannequin with good sights and 9 round capability will be had for $600.

Kazino bonuslar? 2025 Az?rbaycan: Yeni az?rbaycan kazino sayt? – Qeydiyyat bonusu Pinco casino

Nha cai uy tin Vi?t Nam Slot game d?i thu?ng Rut ti?n nhanh GK88

Login Beta138: Withdraw cepat Beta138 – Live casino Indonesia

https://indianmedsone.com/# Indian Meds One

compound pharmacy domperidone: ohio pharmacy law adipex – dysfunction

MediDirect USA: best cialis online pharmacy – dapoxetine online pharmacy

lamisil boots pharmacy MediDirect USA MediDirect USA

MediDirect USA: MediDirect USA – MediDirect USA

buy cialis from mexico: real mexican pharmacy USA shipping – Mexican Pharmacy Hub

It contains fastidious material.|I think the admin of this website is actually working hard in favor of his site,

naltrexone pharmacy online kamagra oral jelly online pharmacy buy viagra pharmacy uk

http://mexicanpharmacyhub.com/# Mexican Pharmacy Hub

buy propecia mexico: Mexican Pharmacy Hub – Mexican Pharmacy Hub

MediDirect USA: MediDirect USA – MediDirect USA

Indian Meds One: Indian Meds One – top 10 pharmacies in india

prime rx pharmacy apollo pharmacy online benicar online pharmacy

pharmacy website india: top online pharmacy india – online pharmacy india

https://indianmedsone.shop/# Indian Meds One

rite aid pharmacy viagra cost: MediDirect USA – herbals

Mexican Pharmacy Hub: Mexican Pharmacy Hub – Mexican Pharmacy Hub

MediDirect USA MediDirect USA magellan rx specialty pharmacy

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

india online pharmacy world pharmacy india Indian Meds One

https://mexicanpharmacyhub.shop/# mexican online pharmacies prescription drugs

legit mexico pharmacy shipping to USA Mexican Pharmacy Hub Mexican Pharmacy Hub

https://mexicanpharmacyhub.shop/# Mexican Pharmacy Hub

Indian Meds One best online pharmacy india Indian Meds One

live pharmacy continuing education online MediDirect USA pharmacy programs online

http://tadalify.com/# why does tadalafil say do not cut pile

Affordable sildenafil citrate tablets for men: Kamagra reviews from US customers – Affordable sildenafil citrate tablets for men

Hey! This is my first visit to your blog! We are a collection of volunteers and starting a new initiative in a community in the same niche. Your blog provided us useful information to work on. You have done a marvellous job!

Tadalify: Tadalify – prescription for cialis