Kenya and its peers in Sub Saharan Africa (SSA) are facing increasingly adverse climate conditions, said the International Monetary Fund (IMF), and will need a series of funding to tackle the situation.

In its report released on November 1, the multilateral lender said that advanced economies must meet or exceed the pledge of Ksh.12.1 trillion in climate finance for developing countries—not least for equity reasons.

Among countries in the Sub-Saharan Region where IMF has already set Ksh.4.8 billion under Resilience and Sustainability Trust, is Rwanda. Besides Rwanda, the multilateral lender has also designated the funding for Barbados, Costa Rica.

“And our first ever long-term financing tool, the Resilience and Sustainability Trust, now has more than Ksh.4.8 billion ($40 billion) in funding pledges, along with three staff-level agreements with Barbados, Costa Rica, and Rwanda,” said IMF in its report.

Scientists are looking at limiting further temperature rises to less than 1.5 degrees to 2 degrees.

According to IMF, delivering on that by 2050 requires cutting emissions by 25 – 50 percent by 2030 compared to pre-2019 levels.

So far, about 140 countries, accounting for 91 percent of greenhouse gas emissions have already proposed or set net-zero targets for around mid-century.

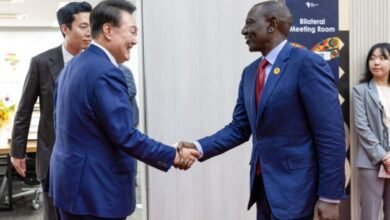

In his debut speech at the United Nations General Assembly, New York, on September 21, President William Ruto said climate change and the devastating drought has swept across the Horn of Africa, endangering 20 million lives.

“We cannot afford to waste another moment debating the merits of doing something vis a vis doing nothing. It will soon be too late to reverse the course of events,” said the President.

And so far, a number of Kenyan banks including Family Bank and Kenya Commercial Bank (KCB) have lined up loan facilities to finance public transport sectors in a bid to fight gas emission.

Family Bank already signed a 90 percent electric vehicle financing deal with a repayment plan of up to 48 months.

“Through this partnership, we will be offering financing for a 25-seater dubbed ‘BYD K6 BUS’ that requires far less maintenance than diesel-powered buses with zero transmission of gases,” said Family Bank Chief Executive Officer Rebecca Mbithi.

KCB on the other hand, inked a deal with BasiGo, an e-mobility firm for Public Service Vehicle (PSV) operators to access financing of up to 90 percent, with a 36-month repayment plan.

IMF said leveraging additional resources would enlarge SSA countries’ policy space, allowing them to simultaneously address challenges from climate change and the coronavirus pandemic.

Other challenges that would be addressed are socioeconomic disruptions caused by Russia’s invasion of Ukraine, and longstanding structural impediments ultimately, paving the way for accelerated economic development while containing emissions in the region.