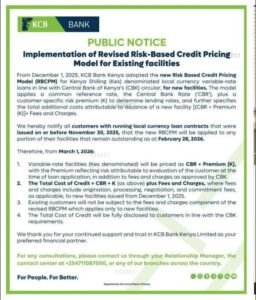

KCB Bank has officially adopted the revised Risk-Based Credit Pricing Model (RBCPM) for its existing facilities.

According to a public notice, KCB began applying this model to new Kenya Shilling-denominated variable-rate loans. For older loans issued on or before November 30, 2025, any outstanding portions will transition to the new system by March 1, 2026, provided they remain unpaid as of February 28, 2026.

Under the RBCPM, variable-rate loans will now be priced using the Central Bank Rate (CBR) plus a customer-specific risk premium, known as “K.” This premium is based on the borrower’s risk assessment at the time of the loan application.

On top of that, fees and charges such as origination, processing, negotiation, and commitment fees may apply, but only to new facilities issued from December 1, 2025.

Existing customers won’t face these extra fees for their current loans, with KCB saying the total cost of credit will be fully disclosed, aligning with Central Bank of Kenya (CBK) rules, ensuring transparency for borrowers.

The model pushes banks to use the Kenya Shilling Overnight Interbank Average (KESONIA) as the primary reference rate, which is a transaction-based benchmark reflecting average overnight lending rates between banks.

KESONIA is designed to be closer to short-term Treasury Bill rates, giving banks more flexibility.

However, banks had the option to stick with the CBR in certain cases, like when volatility makes KESONIA tricky to manage. Surprisingly, big players like KCB have chosen the CBR (currently at 9.00%) over KESONIA’s 8.98%. as of late January 2026.

According to the CBK, about 48% of Kenya’s 37 banks were using the CBR exclusively for loan pricing (as of December 2025), 34% were mixing both rates, and only 18% relied solely on KESONIA.

“The banks were resisting CBR, saying it was punitive as it was not in sync with the cost of funds/risk-free rate of return,” said Gideon Kipyakwai, the CEO of Metropol Credit Reference Bureau.

“CBK then gave them the option of KESONIA, which is closer to T-Bill rate. Banks who chose CBR are therefore favoring the original position from CBK, which they were resisting. Very interesting twist.”

Also Read: CBK’s New KESONIA Loan Pricing Model Explained in Simple Terms as it Takes Effect December

But Why the Flip?

Banks initially pushed back against the CBR because it felt too rigid and not reflective of their actual funding costs. But KESONIA’s daily fluctuations could mean constant rate tweaks, needing CBK approvals each time, which complicates things for lenders and customers alike.

The CBR, adjusted only every two months by the Monetary Policy Committee, offers predictability.

This choice has winners and losers, and as Gideon points out, “the governments, through CBK and consumers (borrowers) are winners when CBR is adopted,” because it strengthens the CBK’s hand in monetary policy.

“It’s a monetary policy transmission nightmare… CBK can adjust and issue new CBR anytime, to manage inflation and other govt policy dynamics. Which is what governments want.”

In everyday terms, when the CBK cuts the CBR, as it did to 9% in December 2025, borrowers could see lower interest rates faster.

Kenya is a socialist democracy where affordable credit helps families and businesses thrive amid economic challenges.

“Governments in social democracies like ours are hill bent to be populist and to please the masses, rather than banks.. reason CBR is a good anchor of interest rates for Kenyans.”

For banks, it might squeeze profits by capping how much they can charge above the CBR but for you as a borrower, it means fairer, more stable rates without hidden surprises.

The full rollout by March 2026 will transition all existing variable-rate loans, so if you’re with KCB or similar banks, check your statements and reach out to your relationship manager for details.