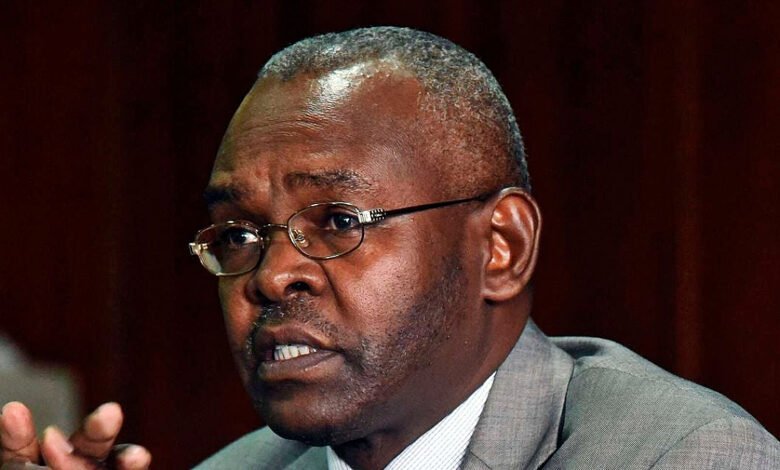

Central Bank of Kenya (CBK) Governor Kamau Thugge has expressed confidence in the current level of the Kenyan shilling, currently placed as best performing globally.

Thugge said the central bank is prepared to utilize record foreign reserves to defend the currency if necessary.

The Kenyan shilling has gained 21% against the US dollar, making it the world’s best-performing currency so far in 2024, according to data from Bloomberg. The shilling now trades at Ksh.129 per dollar.

“We are fairly comfortable with the FX rate,” Governor Thugge said during an interview on the sidelines of the World Bank and International Monetary Fund (IMF) annual meetings in Washington.

He added that the CBK expects Kenya’s gross international reserves to reach $8.9 billion by the end of 2024, up $1.9 billion from the previous year. These reserves are critical in maintaining the shilling’s stability.

“We have built strong external buffers and are in a good position to handle any short-term external shocks,” Thugge said. “We will manage the exchange rate in a smooth manner, driven by economic fundamentals.”

IMF Program and Fiscal Outlook

Kenya expects $3.9 billion extended fund facility from the IMF – scheduled for October 30, 2024. Kenya requested a waiver from the IMF after missing revenue targets in the current review period.

Also Read: Kenya Shilling Hits One-Month Low to 130 Units Amid Nationwide Protests

CBK will begin talks with the IMF about a new program once the current reviews are completed, potentially seeking additional concessional funding.

“We are aiming for as much concessional funding as possible from the IMF,” he said, though he did not specify the amount Kenya might request.

Addressing Revenue Targets and Social Discontent

The governor acknowledged the social unrest that occurred in mid-June, when thousands of young Kenyans took to the streets of Nairobi and other towns to protest against the government’s new tax proposals.

The taxes were set to be imposed on essential items such as bread, diapers, and imported wheelchair tires.

“We were overly aggressive with our revenue targets,” Thugge admitted. “Given the social disruptions, we now recognize the need for a balance between fiscal consolidation and maintaining social stability.”

According to Thugge, this would be a key consideration in discussions with the IMF for any future programs.

Eurobond Issuance and Debt Performance

Earlier this year, Kenya successfully issued a $1.5 billion Eurobond, which was used to partially repurchase notes maturing in June 2024. This helped alleviate liquidity pressures at the time. The new securities were issued at a rate of 9.75%, refinancing bonds originally sold a decade ago.

Kenyan debt has performed well in 2024, delivering an 8.5% return, compared to an average of 7% for emerging-market government bonds, according to Bloomberg data.

Despite the success of the Eurobond, Thugge ruled out the possibility of returning to international capital markets in the near future, noting that the country’s budget is fully financed for now.

That is the correct weblog for anybody who needs to find out about this topic. You realize a lot its almost exhausting to argue with you (not that I really would need…HaHa). You definitely put a brand new spin on a topic thats been written about for years. Nice stuff, just great!

It is in point of fact a great and useful piece of info. I am happy that you simply shared this helpful information with us. Please keep us up to date like this. Thanks for sharing.

http://semaglupharm.com/# Semaglu Pharm

http://semaglupharm.com/# Rybelsus for blood sugar control

how is rybelsus taken: semaglutide en espaГ±ol – Semaglu Pharm

online order prednisone 10mg PredniPharm 50mg prednisone tablet

CrestorPharm: Crestor Pharm – Order rosuvastatin online legally

https://semaglupharm.com/# rybelsus covered by medicaid

can you stop taking rybelsus: No prescription diabetes meds online – п»їBuy Rybelsus online USA

http://semaglupharm.com/# Safe delivery in the US

Crestor Pharm Crestor Pharm CrestorPharm

can crestor cause swelling in ankles: crestor 5 mg – CrestorPharm

http://semaglupharm.com/# SemagluPharm

https://semaglupharm.com/# SemagluPharm

crestor mental side effects: Crestor Pharm – Crestor Pharm

semaglutide new jersey: how many units is 0.25 mg of semaglutide – Semaglu Pharm

https://lipipharm.com/# Lipi Pharm

https://semaglupharm.com/# Semaglu Pharm

does rosuvastatin cause fatigue Crestor Pharm CrestorPharm

LipiPharm: what does lipitor look like – FDA-approved generic statins online

CrestorPharm is crestor a high risk medication? Safe online pharmacy for Crestor

how much does atorvastatin 40 mg cost without insurance: Affordable Lipitor alternatives USA – LipiPharm

PredniPharm: PredniPharm – Predni Pharm

https://semaglupharm.com/# SemagluPharm

https://lipipharm.com/# LipiPharm

Semaglu Pharm rybelsus vs victoza Rybelsus side effects and dosage

Crestor Pharm: Crestor Pharm – Crestor Pharm

Cheap Lipitor 10mg / 20mg / 40mg: FDA-approved generic statins online – Order cholesterol medication online

http://semaglupharm.com/# Online pharmacy Rybelsus

SemagluPharm Rybelsus for blood sugar control can rybelsus cause high blood pressure

Rosuvastatin tablets without doctor approval: CrestorPharm – CrestorPharm

https://semaglupharm.com/# Semaglu Pharm

PredniPharm PredniPharm Predni Pharm

ashwagandha and lipitor: Affordable Lipitor alternatives USA – п»їBuy Lipitor without prescription USA

https://prednipharm.shop/# prednisone prices

http://semaglupharm.com/# No prescription diabetes meds online

Rybelsus for blood sugar control: Semaglu Pharm – can semaglutide cause hair loss

Semaglu Pharm Semaglu Pharm SemagluPharm

how to buy prednisone online: PredniPharm – PredniPharm

https://semaglupharm.shop/# rybelsus side effect

Crestor 10mg / 20mg / 40mg online: п»їBuy Crestor without prescription – CrestorPharm

injecting semaglutide in thigh SemagluPharm semaglutide structure

Affordable Lipitor alternatives USA: Affordable Lipitor alternatives USA – Affordable Lipitor alternatives USA

https://semaglupharm.com/# best compounded semaglutide

https://lipipharm.shop/# Lipi Pharm

price of prednisone 5mg: PredniPharm – cost of prednisone 40 mg

Over-the-counter Crestor USA stopping rosuvastatin rosuvastatin manufacturer

ezetimibe with atorvastatin: LipiPharm – LipiPharm

https://semaglupharm.com/# Semaglu Pharm

CrestorPharm: п»їBuy Crestor without prescription – Crestor Pharm

Crestor Pharm CrestorPharm Crestor Pharm

https://semaglupharm.com/# SemagluPharm

prednisone 10 tablet: Predni Pharm – Predni Pharm

https://canadapharmglobal.com/# best canadian online pharmacy

best india pharmacy: pharmacy website india – п»їlegitimate online pharmacies india

https://indiapharmglobal.com/# india online pharmacy

canadian pharmacy online store best canadian online pharmacy reviews canadian pharmacies online

India Pharm Global: India Pharm Global – India Pharm Global

best india pharmacy: India Pharm Global – reputable indian pharmacies

http://indiapharmglobal.com/# India Pharm Global

Meds From Mexico: medication from mexico pharmacy – Meds From Mexico

mexican online pharmacies prescription drugs Meds From Mexico Meds From Mexico

https://indiapharmglobal.shop/# India Pharm Global

п»їbest mexican online pharmacies: reputable mexican pharmacies online – buying prescription drugs in mexico online

mexico drug stores pharmacies: Meds From Mexico – buying prescription drugs in mexico

mexican online pharmacies prescription drugs reputable mexican pharmacies online Meds From Mexico

https://canadapharmglobal.shop/# best online canadian pharmacy

canadian pharmacy antibiotics: Canada Pharm Global – buy prescription drugs from canada cheap

buy drugs from canada: canadian compounding pharmacy – pharmacies in canada that ship to the us

https://canadapharmglobal.shop/# canadian mail order pharmacy

canadian pharmacy ratings canadian pharmacy checker canadian pharmacy phone number

http://medsfrommexico.com/# mexican border pharmacies shipping to usa

canadianpharmacymeds: Canada Pharm Global – canadian pharmacy online ship to usa

India Pharm Global: India Pharm Global – India Pharm Global

medicine in mexico pharmacies Meds From Mexico buying prescription drugs in mexico

http://indiapharmglobal.com/# online pharmacy india

world pharmacy india: indianpharmacy com – India Pharm Global

https://medsfrommexico.com/# pharmacies in mexico that ship to usa

canadian pharmacy oxycodone: my canadian pharmacy – canadian pharmacy prices

India Pharm Global India Pharm Global India Pharm Global

http://canadapharmglobal.com/# cheap canadian pharmacy online

canadian mail order pharmacy: Canada Pharm Global – canadian pharmacy checker

India Pharm Global: India Pharm Global – online pharmacy india

canada rx pharmacy world canadian pharmacy 24 best rated canadian pharmacy

http://indiapharmglobal.com/# India Pharm Global

Meds From Mexico: Meds From Mexico – buying prescription drugs in mexico online

https://medsfrommexico.com/# Meds From Mexico

canadian pharmacy: Canada Pharm Global – best canadian pharmacy

http://indiapharmglobal.com/# top 10 online pharmacy in india

cheapest online pharmacy india India Pharm Global top 10 pharmacies in india

canadian mail order pharmacy: Canada Pharm Global – best canadian pharmacy to buy from

Svenska Pharma Svenska Pharma Svenska Pharma

https://efarmaciait.shop/# voltaren fiale a cosa serve

Rask Apotek: Rask Apotek – Rask Apotek

EFarmaciaIt: EFarmaciaIt – EFarmaciaIt

https://raskapotek.shop/# krem mot klГёe apotek

https://efarmaciait.com/# stilnox compresse prezzo

+46 8-750 92 20 graviditetstest billigt magnesium apotek

EFarmaciaIt: EFarmaciaIt – farmae it

Papa Farma: dos farmas – mejor gel para niГ±os ocu

https://raskapotek.com/# Rask Apotek

apotek Г¶ppet annandag jul Svenska Pharma Svenska Pharma

EFarmaciaIt: EFarmaciaIt – EFarmaciaIt

Svenska Pharma: apotek jod – Svenska Pharma

https://papafarma.shop/# Papa Farma

http://efarmaciait.com/# EFarmaciaIt

Svenska Pharma hur mycket kostar kondomer Svenska Pharma

mallorca apotheke: Papa Farma – farmacia a domicilio zaragoza

https://papafarma.shop/# Papa Farma

Papa Farma: mycostatin para que sirve – comprar brentan crema online

farmacia veterinaria granada Papa Farma comprar todacitan

EFarmaciaIt: EFarmaciaIt – EFarmaciaIt

https://svenskapharma.shop/# Svenska Pharma

https://raskapotek.shop/# kalium apotek

Svenska Pharma: duschskydd barn huvud – apotek snabb leverans

Papa Farma farmacias por internet Papa Farma

Rask Apotek: stressmin apotek – Rask Apotek

https://raskapotek.shop/# Rask Apotek

EFarmaciaIt EFarmaciaIt desamix effe a cosa serve

pillola novadien recensioni: EFarmaciaIt – EFarmaciaIt

Rask Apotek: Rask Apotek – Rask Apotek

https://svenskapharma.com/# springmask tabletter

https://papafarma.shop/# Papa Farma

Papa Farma sildenafilo 100 precio farmacias abiertas hoy vigo

cosa serve arcoxia: cingal amazon – medrol gocce

EFarmaciaIt: EFarmaciaIt – farmacia tedesca online

http://efarmaciait.com/# EFarmaciaIt

Papa Farma: cejas cerca de mi – natura veterinaria

Svenska Pharma: hostmedicin apotek – Svenska Pharma

http://raskapotek.com/# Rask Apotek

https://papafarma.shop/# pastillas roche

Papa Farma: pedir medicamentos online – martiderm cremas opiniones

cbd envio 24h Papa Farma prospecto pastilla del dia despues

https://raskapotek.shop/# apotek resept på nett

Papa Farma: diprogenta crema precio sin receta – comprar ozempic en amazon

augmentin serve ricetta farmacia europa recensioni EFarmaciaIt

https://raskapotek.shop/# Rask Apotek

Papa Farma: Papa Farma – fermacia

https://svenskapharma.shop/# bilder på nagelsvamp

comprar viagra online brentan crema precio una farmacia

EFarmaciaIt: 15% di 120 – EFarmaciaIt

https://raskapotek.com/# doptest apotek

MedicijnPunt apteka eindhoven europese apotheek

http://pharmaconfiance.com/# pharmacy online france

https://pharmaconnectusa.com/# online pharmacy meds

shop apotjeke: Pharma Jetzt – apotheke onlineshop

panacea pharmacy: venlafaxine online pharmacy – online pharmacy fioricet

panadol pharmacy cost of viagra from pharmacy handling methotrexate in pharmacy

https://pharmaconfiance.shop/# tadalafil 20 mg forum

utilisation god: Pharma Confiance – Pharma Confiance

usa online pharmacy store: plavix pharmacy price – cheapest viagra online pharmacy

http://pharmaconnectusa.com/# PharmaConnectUSA

https://pharmaconnectusa.shop/# alliance rx pharmacy

Pharma Connect USA Pharma Connect USA PharmaConnectUSA

PharmaJetzt: PharmaJetzt – medikamente.de

http://pharmaconfiance.com/# Pharma Confiance

medicijnlijst apotheek: Medicijn Punt – Medicijn Punt

Pharma Jetzt Pharma Jetzt online apotheke

https://pharmaconfiance.com/# Pharma Confiance

Pharma Connect USA: Pharma Connect USA – xeloda specialty pharmacy alliance

https://pharmaconnectusa.com/# indian pharmacy

PharmaConnectUSA: PharmaConnectUSA – prescriptions online pharmacy

Medicijn Punt internet apotheek nederland MedicijnPunt

Pharma Confiance: Pharma Confiance – Pharma Confiance

http://pharmaconnectusa.com/# mometasone online pharmacy

de apotheker: MedicijnPunt – Medicijn Punt

compounding pharmacy finasteride PharmaConnectUSA ketamine online pharmacy

https://pharmajetzt.com/# Pharma Jetzt

cialis india pharmacy: Pharma Connect USA – PharmaConnectUSA

https://pharmajetzt.shop/# Pharma Jetzt

PharmaJetzt: shop apptheke – apotheke online versandkostenfrei

apotheke online deutsche apotheke Pharma Jetzt

http://pharmaconfiance.com/# caudalie siège social bordeaux

MedicijnPunt: Medicijn Punt – Medicijn Punt

online pharmacy delivery delhi: advair hfa online pharmacy – PharmaConnectUSA

apotehke Pharma Jetzt Pharma Jetzt

https://pharmaconfiance.com/# Pharma Confiance

online medicijnen bestellen: Medicijn Punt – onl8ne drogist

https://pharmaconnectusa.com/# pharmacy selling cytotec

gГјnstiger apotheke: schopapoteke – Pharma Jetzt

pharmacy viagra cialis PharmaConnectUSA roadrunner pharmacy

https://pharmaconnectusa.com/# PharmaConnectUSA

mexican online mail order pharmacy: online pharmacy generic valtrex – buy pain pills online pharmacy

non prescription online pharmacy reviews: Pharma Connect USA – Pharma Connect USA

https://pharmaconnectusa.com/# PharmaConnectUSA

marques pharmacie Pharma Confiance caudalie. com

online pharmacy australia: paxil pharmacy – davita rx pharmacy

https://pharmaconfiance.shop/# pharmacy france

https://pharmaconnectusa.com/# Vermox

Pharma Confiance boite croquette chat 10 kg cure a vichy arthrose

Pharma Jetzt: apotheke onlin – PharmaJetzt

https://pharmaconfiance.shop/# laroche posay cure

pharmacy certificate programs online: dapoxetine us pharmacy – Pharma Connect USA

Pharma Confiance Pharma Confiance chat incontinent aprГЁs accident

Pharma Connect USA: Pharma Connect USA – differin guardian pharmacy

https://pharmaconfiance.com/# Pharma Confiance

https://medicijnpunt.com/# apotek online

Pharma Jetzt: Pharma Jetzt – versandapotheke shop apotheke

online pharmacy amitriptyline: PharmaConnectUSA – rite aid pharmacy store

http://pharmaconnectusa.com/# online pharmacy legit

amoxicilline 500 posologie adulte: parapharmacie luxembourg – Pharma Confiance

Pharma Connect USA generic paxil online pharmacy PharmaConnectUSA

soolantra pharmacie en ligne: Pharma Confiance – Pharma Confiance

https://medicijnpunt.shop/# Medicijn Punt

Pharma Jetzt: PharmaJetzt – PharmaJetzt

Pharma Jetzt: apotal online shop – Pharma Jetzt

https://medicijnpunt.com/# betrouwbare online apotheek zonder recept

https://medicijnpunt.shop/# apohteek

Pharma Connect USA: Pharma Connect USA – Pharma Connect USA

scripts rx pharmacy: PharmaConnectUSA – Pharma Connect USA

https://pharmaconnectusa.shop/# rx reliable pharmacy

viagra reputable online pharmacy: tamoxifen pharmacy – Pharma Connect USA

apteka amsterdam: Medicijn Punt – online medicijnen kopen

http://pharmaconnectusa.com/# pharmacy world rx

https://pharmajetzt.com/# Pharma Jetzt

Medicijn Punt: online apotheek recept – beste online apotheek

apotheek online: shop aphotheke – PharmaJetzt

https://pharmaconfiance.com/# Pharma Confiance

PharmaConnectUSA: online pharmacy ultram – Pharma Connect USA

https://pharmaconfiance.shop/# Pharma Confiance

ahop apotheke: PharmaJetzt – shops apotheke

http://medicijnpunt.com/# Medicijn Punt

legitimate online pharmacy list: Pharma Connect USA – express scripts pharmacy

https://medicijnpunt.shop/# MedicijnPunt

apotheke online bestellen: apotheke.com online – PharmaJetzt

https://medicijnpunt.shop/# MedicijnPunt

cold medicine in france: Pharma Confiance – Pharma Confiance

medicijnen online: MedicijnPunt – Medicijn Punt

http://pharmaconfiance.com/# appareil pour mesurer le ph piscine

http://medicijnpunt.com/# apteka internetowa holandia

Medicijn Punt: MedicijnPunt – apotheke holland

apotheken: Pharma Jetzt – internet apotheke versandkostenfrei

Pharma Jetzt: online medicine – apotheke im internet

https://pharmaconfiance.com/# Pharma Confiance

Pharma Confiance: pharmacie de l’europe rouen – Pharma Confiance

https://medicijnpunt.com/# Medicijn Punt

Pharma Jetzt: Pharma Jetzt – Pharma Jetzt

PharmaConnectUSA: Pharma Connect USA – pharmacy2u finasteride

http://pharmaconnectusa.com/# Pharma Connect USA

PharmaJetzt: medikamente online gГјnstig – PharmaJetzt

http://pharmajetzt.com/# medikamente deutschland

Pharma Jetzt: Pharma Jetzt – apozheke

http://pharmaconfiance.com/# Pharma Confiance

Pharma Jetzt: medikament online bestellen – Pharma Jetzt

Pharma Confiance pharmacie l’univers Pharma Confiance

MedicijnPunt: Medicijn Punt – MedicijnPunt

https://pharmaconnectusa.shop/# Pharma Connect USA

Medicijn Punt: apotheek apotheek – farmacia online

Medicijn Punt: belgische online apotheek – medicatie apotheek

https://medicijnpunt.shop/# medicijn bestellen

pharmacie pas cher montpellier: clinique vГ©tГ©rinaire vet 24 – Pharma Confiance

https://medicijnpunt.shop/# medicijnen online

Pharma Jetzt: bad steben apotheke – medikamente preisvergleich testsieger

PharmaJetzt: PharmaJetzt – medikamente per click

cialis mexico pharmacy: PharmaConnectUSA – Pharma Connect USA

croquettes chat en gros pas cher achat mГ©dicaments en ligne suisse distribution de en eaux trГЁs troubles

https://medicijnpunt.shop/# medicatie bestellen apotheek

Pharma Confiance: Pharma Confiance – pharmacie aprium

pharmacy nederlands: de apotheek – MedicijnPunt

https://medicijnpunt.com/# medicatie online

http://pharmajetzt.com/# PharmaJetzt

Very interesting info !Perfect just what I was searching for! “Neurotics build castles in the air, psychotics live in them. My mother cleans them.” by Rita Rudner.

online pharmacy netherlands medicatielijst apotheek Medicijn Punt

PharmaConnectUSA: PharmaConnectUSA – amazon online pharmacy

MedicijnPunt: Medicijn Punt – med apotheek

medicijn bestellen apotheek: medicijnen apotheek – Medicijn Punt

Pharma Confiance: Pharma Confiance – daflon et doliprane

https://pharmajetzt.shop/# apotheke obline

medicijnen zonder recept met ideal MedicijnPunt Medicijn Punt

https://medicijnpunt.com/# Medicijn Punt

PharmaConnectUSA: PharmaConnectUSA – Pharma Connect USA

https://medicijnpunt.shop/# online medicijnen bestellen apotheek

PharmaConnectUSA: pharmacy rx online – freds pharmacy store

PharmaJetzt: PharmaJetzt – Pharma Jetzt

versand apotheke online PharmaJetzt Pharma Jetzt

https://pharmaconnectusa.shop/# Pharma Connect USA

PharmaJetzt: ipill apotheke versandkostenfrei – Pharma Jetzt

pharmacie lourdes: Pharma Confiance – Pharma Confiance

http://pharmaconnectusa.com/# nexium pharmacy coupon

pharmacy rx symbol best online non prescription pharmacy PharmaConnectUSA

Medicijn Punt: medicijn – mediceinen

discount pharmacy: PharmaConnectUSA – PharmaConnectUSA

https://pharmaconnectusa.com/# target pharmacy refills online

PharmaConnectUSA: 24 hour online pharmacy – cheapest pharmacy to get concerta

lisinopril online pharmacy no prescription: lasix mexican pharmacy – PharmaConnectUSA

MedicijnPunt apteka holandia MedicijnPunt

canadian pharmacies CanRx Direct rate canadian pharmacies

http://tijuanameds.com/# TijuanaMeds

https://tijuanameds.shop/# TijuanaMeds

canadian neighbor pharmacy: buy drugs from canada – buy canadian drugs

mexican pharmaceuticals online: TijuanaMeds – buying prescription drugs in mexico

https://canrxdirect.com/# canada pharmacy online legit

TijuanaMeds medication from mexico pharmacy TijuanaMeds

TijuanaMeds: mexico pharmacies prescription drugs – п»їbest mexican online pharmacies

buying prescription drugs in mexico: mexico drug stores pharmacies – medication from mexico pharmacy

http://indimedsdirect.com/# IndiMeds Direct

https://tijuanameds.shop/# TijuanaMeds

IndiMeds Direct IndiMeds Direct IndiMeds Direct

best canadian pharmacy: CanRx Direct – canadian pharmacy ed medications

http://canrxdirect.com/# certified canadian pharmacy

mail order pharmacy india IndiMeds Direct IndiMeds Direct

mexican online pharmacies prescription drugs: TijuanaMeds – TijuanaMeds

http://indimedsdirect.com/# IndiMeds Direct

mexican drugstore online TijuanaMeds mexico drug stores pharmacies

https://tijuanameds.com/# TijuanaMeds

IndiMeds Direct: cheapest online pharmacy india – best india pharmacy

https://indimedsdirect.shop/# online shopping pharmacy india

mexico pharmacies prescription drugs TijuanaMeds mexican border pharmacies shipping to usa

buy prescription drugs from india: IndiMeds Direct – best india pharmacy

https://canrxdirect.shop/# canada online pharmacy

TijuanaMeds mexico drug stores pharmacies TijuanaMeds

IndiMeds Direct: IndiMeds Direct – IndiMeds Direct

https://canrxdirect.shop/# my canadian pharmacy

legal to buy prescription drugs from canada: legit canadian pharmacy – pharmacy com canada

https://canrxdirect.shop/# canada ed drugs

indianpharmacy com: india pharmacy mail order – IndiMeds Direct

pharmacies in mexico that ship to usa TijuanaMeds TijuanaMeds

http://tijuanameds.com/# TijuanaMeds

Hi , I do believe this is an excellent blog. I stumbled upon it on Yahoo , i will come back once again. Money and freedom is the best way to change, may you be rich and help other people.

TijuanaMeds: TijuanaMeds – TijuanaMeds

http://farmaciaasequible.com/# Farmacia Asequible

farmacia 24h zaragoza: compra ozempic – Farmacia Asequible

apollo pharmacy store locator where to buy viagra pharmacy adipex p online pharmacy

http://rxfreemeds.com/# mail order pharmacies

enclomiphene for men: buy enclomiphene online – enclomiphene citrate

https://rxfreemeds.shop/# publix pharmacy wellbutrin

enclomiphene: buy enclomiphene online – enclomiphene best price

viagra american pharmacy RxFree Meds RxFree Meds

Farmacia Asequible: Farmacia Asequible – le dolmen valladolid

https://enclomiphenebestprice.shop/# enclomiphene testosterone

enclomiphene for sale: enclomiphene citrate – enclomiphene citrate

https://enclomiphenebestprice.com/# enclomiphene citrate

enclomiphene price enclomiphene citrate enclomiphene price

RxFree Meds: solutions rx pharmacy – RxFree Meds

https://enclomiphenebestprice.com/# enclomiphene citrate

Farmacia Asequible: casenlax opiniones – exelvit esencial amazon

RxFree Meds pharmacy online viagra generic online pharmacy uk cialis

enclomiphene price: buy enclomiphene online – enclomiphene citrate

https://rxfreemeds.com/# amlodipine online pharmacy

dulcolax pharmacy: RxFree Meds – RxFree Meds

famacias Farmacia Asequible Farmacia Asequible

https://enclomiphenebestprice.com/# enclomiphene for sale

parafarmacia y farmacia: farmacies – Farmacia Asequible

https://rxfreemeds.shop/# RxFree Meds

davita rx pharmacy: RxFree Meds – triamcinolone cream online pharmacy

cbd shop santander wegovy spania Farmacia Asequible

http://rxfreemeds.com/# target pharmacy hours

RxFree Meds: RxFree Meds – RxFree Meds

viagra online indian pharmacy RxFree Meds RxFree Meds

https://enclomiphenebestprice.com/# enclomiphene testosterone

http://enclomiphenebestprice.com/# enclomiphene for men

enclomiphene best price enclomiphene enclomiphene testosterone

https://enclomiphenebestprice.shop/# enclomiphene for men

enclomiphene price enclomiphene best price buy enclomiphene online

http://farmaciaasequible.com/# horario farmacias cerca de mi

epiduo gel farmacia precio: Farmacia Asequible – Farmacia Asequible

http://rxfreemeds.com/# publix pharmacy online ordering

RxFree Meds RxFree Meds RxFree Meds

mejor tratamiento caГda cabello mujer ocu: trabajo farmacia barcelona – Farmacia Asequible

enclomiphene testosterone enclomiphene enclomiphene buy

https://rxfreemeds.com/# RxFree Meds

generic wellbutrin pharmacy target pharmacy flonase RxFree Meds

RxFree Meds: RxFree Meds – RxFree Meds

enclomiphene best price enclomiphene for men enclomiphene

http://rxfreemeds.com/# platinum rx pharmacy

farmasi espaГ±a farmacia te comprar wegovy espaГ±a

farmacias vigo 24 horas: Farmacia Asequible – oral b starter

enclomiphene online buy enclomiphene online enclomiphene

http://enclomiphenebestprice.com/# enclomiphene citrate

autobronceadores orales efectos secundarios: linea 334 mallorca – mycostatin comprar

RxFree Meds online pharmacy us RxFree Meds

enclomiphene best price enclomiphene citrate enclomiphene buy

Farmacia Asequible: Farmacia Asequible – casenlax que es

https://rxfreemeds.shop/# RxFree Meds

RxFree Meds australia pharmacy viagra viagra pharmacy prices

Farmacia Asequible: Farmacia Asequible – crema solar embarazo ocu

http://farmaciaasequible.com/# chocolat-box reseГ±as

online pharmacy pain relief chem rx pharmacy people’s pharmacy bupropion

reputable online pharmacy uk: RxFree Meds – RxFree Meds

ozempic spain price empleo farmacia malaga Farmacia Asequible

https://rxfreemeds.shop/# internet pharmacy

enclomiphene price: enclomiphene online – enclomiphene citrate

Farmacia Asequible Farmacia Asequible prospecto pastilla dia despues

princeton university store pharmacy wellbutrin pharmacy online people’s pharmacy

buy enclomiphene online: enclomiphene testosterone – enclomiphene price

RxFree Meds RxFree Meds review online pharmacy

https://enclomiphenebestprice.shop/# enclomiphene

Farmacia Asequible: farmacia valencia cerca de mi – farmacias abiertas ahora en zaragoza

buy enclomiphene online buy enclomiphene online enclomiphene

veterinario valladolid barato: Farmacia Asequible – viagra farmacia

skip’s pharmacy low dose naltrexone RxFree Meds RxFree Meds

RxFree Meds: RxFree Meds – pharmacy cialis prices

enclomiphene for sale: enclomiphene best price – enclomiphene best price

https://farmaciaasequible.shop/# Farmacia Asequible

https://farmaciaasequible.shop/# Farmacia Asequible

enclomiphene price: enclomiphene – enclomiphene buy

http://farmaciaasequible.com/# farmacia comprar

IndoMeds USA IndoMeds USA india pharmacy

https://medismartpharmacy.com/# viagra uk pharmacy online

https://medismartpharmacy.shop/# zyprexa pharmacy price

buying drugs from canada: MediSmart Pharmacy – trusted canadian pharmacy

IndoMeds USA: IndoMeds USA – п»їlegitimate online pharmacies india

best online pharmacy india IndoMeds USA IndoMeds USA

http://medismartpharmacy.com/# viagra online pharmacy europe

online pharmacy degree: prescription pricing – viagra-american trust pharmacy

MexiMeds Express: mexico pharmacies prescription drugs – mexican online pharmacies prescription drugs

https://medismartpharmacy.shop/# best no prescription pharmacy

pharmacies Shallaki scripts rx pharmacy

https://meximedsexpress.shop/# reputable mexican pharmacies online

propecia online pharmacy: online pharmacy cymbalta – how to start a pharmacy store

buying prescription drugs in mexico: mexico drug stores pharmacies – MexiMeds Express

IndoMeds USA п»їlegitimate online pharmacies india IndoMeds USA

http://meximedsexpress.com/# reputable mexican pharmacies online

IndoMeds USA: indian pharmacy – IndoMeds USA

https://medismartpharmacy.shop/# zoloft pharmacy prices

IndoMeds USA: indian pharmacy online – п»їlegitimate online pharmacies india

MexiMeds Express mexico drug stores pharmacies MexiMeds Express

https://meximedsexpress.shop/# best online pharmacies in mexico

MexiMeds Express: MexiMeds Express – MexiMeds Express

pharmacies in mexico that ship to usa: MexiMeds Express – MexiMeds Express

IndoMeds USA indian pharmacy online india pharmacy

https://indomedsusa.shop/# indianpharmacy com

Online medicine order: IndoMeds USA – best online pharmacy india

https://indomedsusa.com/# IndoMeds USA

MexiMeds Express: buying prescription drugs in mexico online – MexiMeds Express

https://meximedsexpress.com/# MexiMeds Express

MexiMeds Express MexiMeds Express mexican drugstore online

u s pharmacy online: MediSmart Pharmacy – finasteride target pharmacy

IndoMeds USA: buy prescription drugs from india – Online medicine order

https://meximedsexpress.shop/# buying prescription drugs in mexico online

top online pharmacy india IndoMeds USA IndoMeds USA

canadia online pharmacy: MediSmart Pharmacy – good pill pharmacy

https://indomedsusa.shop/# indian pharmacy paypal

http://medismartpharmacy.com/# xl pharmacy generic viagra

canadian pharmacy ltd: MediSmart Pharmacy – ordering drugs from canada

aldara online pharmacy reliable rx pharmacy reviews triamcinolone acetonide cream pharmacy

pharmacies in mexico that ship to usa: MexiMeds Express – п»їbest mexican online pharmacies

http://meximedsexpress.com/# MexiMeds Express

top 10 online pharmacy in india: buy medicines online in india – reputable indian pharmacies

reputable indian pharmacies IndoMeds USA indian pharmacy

abortion pill online pharmacy: MediSmart Pharmacy – walgreen pharmacy

https://medismartpharmacy.com/# zofran online pharmacy

http://medismartpharmacy.com/# in house pharmacy domperidone

canadian drug pharmacy: MediSmart Pharmacy – canadianpharmacymeds

IndoMeds USA india online pharmacy indian pharmacy

mexican drugstore online: mexican mail order pharmacies – MexiMeds Express

https://meximedsexpress.com/# MexiMeds Express

nizoral online pharmacy provigil mexican pharmacy imiquimod uk pharmacy

mexican pharmaceuticals online: medicine in mexico pharmacies – purple pharmacy mexico price list

https://indomedsusa.shop/# cheapest online pharmacy india

http://meximedsexpress.com/# medication from mexico pharmacy

MexiMeds Express MexiMeds Express best online pharmacies in mexico

medication from mexico pharmacy: MexiMeds Express – mexican pharmaceuticals online

https://indomedsusa.com/# Online medicine order

buying from online mexican pharmacy MexiMeds Express buying from online mexican pharmacy

https://indomedsusa.shop/# indian pharmacy online

no prescription online pharmacy: erectile dysfunction treatment – the drug store pharmacy

http://medismartpharmacy.com/# priceline pharmacy xenical

kaiser permanente pharmacy MediSmart Pharmacy direct rx pharmacy

rx unlimited pharmacy: why is pharmacy rx – percocet price pharmacy

https://indomedsusa.shop/# IndoMeds USA

https://meximedsexpress.com/# buying from online mexican pharmacy

indian pharmacy online IndoMeds USA IndoMeds USA

IndoMeds USA: mail order pharmacy india – IndoMeds USA

https://meximedsexpress.shop/# reputable mexican pharmacies online

MexiMeds Express mexico drug stores pharmacies mexican pharmaceuticals online

mexican drugstore online: pharmacies in mexico that ship to usa – MexiMeds Express

https://ordinasalute.com/# farmacia tedesca online

https://ordinasalute.shop/# dibase 50.000 2 flaconcini

comprar trankimazin sin receta medica: Clinica Galeno – farmacia paris online

inorial sans ordonnance sirop angine sans ordonnance pharmacie en ligne sans ordonnance viagra

https://pharmadirecte.shop/# acheter solupred sans ordonnance

Г©quivalent ketoderm sans ordonnance: jasmine generique – kamagra en pharmacie sans ordonnance

farmacia via curie OrdinaSalute isodifa 10 mg

http://clinicagaleno.com/# farmacia alcorcon online

http://pharmadirecte.com/# trГ©tinoГЇne crГЁme pharmacie sans ordonnance

tadalafil 5 mg prix: PharmaDirecte – vitamine d3 en pharmacie sans ordonnance

sro pharmacie sans ordonnance mГ©dicament infection urinaire sans ordonnance viagra sans ordonnance pharmacie belgique

https://ordinasalute.shop/# sporanox prezzo

doxazosina se puede comprar sin receta: se puede comprar rubifen sin receta – farmacia torreblanca online

blemish age defense skinceuticals PharmaDirecte ordonnance ibuprofene

https://ordinasalute.shop/# quetiapina 50 mg

https://clinicagaleno.shop/# la farmacia online en casa

pleinvue comprar online: Clinica Galeno – sildenafil se puede comprar sin receta

farmacia online valencia mascarillas farmacia online comparativa que pastillas puedo comprar para dormir sin receta medica

https://clinicagaleno.shop/# comprar cialis 5 mg sin receta

ketum gel: acheter vitamine d en pharmacie sans ordonnance – coupe faim en pharmacie sans ordonnance

kenacort prezzo clodronato 200 mg prezzo aircort aerosol adulti

https://clinicagaleno.shop/# farmacia online veterinaria código promocional

comprar mentis sin receta: es legal comprar viagra sin receta – comprar citalopram sin receta

http://clinicagaleno.com/# que antibiГіtico se puede comprar sin receta mГ©dica

https://ordinasalute.com/# debridat 150 mg

consultation en ligne ordonnance collyre pharmacie sans ordonnance rose des vignes caudalie

kakao barn Snabb Apoteket vattenflaska med doft

apotek finland leverans sverige: nytt apotek – pcr-test apotek

https://snabbapoteket.shop/# vit fästing hund

medisiner levert pГҐ dГёra kan apotek sette b12 sprГёyte jojobaolje apotek

https://tryggmed.shop/# plus apotek

apotek fullmaktskjema: aloe vera gel apotek – bestille medisin pГҐ nett

http://snabbapoteket.com/# schengenintyg apotek

badetermometer baby apotek: jobbe i apotek – roseolje apotek

gebiss lim apotek Trygg Med mГёllkuler apotek

https://tryggmed.com/# hГҐrfjerningskrem apotek

http://tryggmed.com/# apotek åpent langfredag

online apotheken: MedicijnPunt – medicijnen aanvragen apotheek

apteka holandia online medicijnen kopen zonder recept medicijn

https://tryggmed.com/# stressmin apotek

mijn medicijn.nl: Medicijn Punt – apotheek online

online apotheke apotheek winkel 24 review apteka holandia

https://snabbapoteket.com/# tablett

apotek lager jobb: apotek hem – svart nagellack betyder

apotek vitamin: apotek recept – apotekr

asda viagra pharmacy ExpressCareRx ExpressCareRx

http://expresscarerx.org/# ExpressCareRx

MediMexicoRx: buy cheap meds from a mexican pharmacy – get viagra without prescription from mexico

online pharmacy australia viagra Kamagra Polo princeton u store pharmacy

https://medimexicorx.com/# mexico drug stores pharmacies

IndiaMedsHub: top 10 pharmacies in india – reputable indian pharmacies

safe place to buy semaglutide online mexico: amoxicillin mexico online pharmacy – MediMexicoRx

http://indiamedshub.com/# IndiaMedsHub

ExpressCareRx best online mexican pharmacy ExpressCareRx

india pharmacy: п»їlegitimate online pharmacies india – IndiaMedsHub

https://expresscarerx.online/# ExpressCareRx

target pharmacy tretinoin ExpressCareRx ExpressCareRx

is reliable rx pharmacy legit: metoclopramide online pharmacy – ExpressCareRx

MediMexicoRx: online mexico pharmacy USA – buy meds from mexican pharmacy

https://expresscarerx.org/# ExpressCareRx

http://indiamedshub.com/# best india pharmacy

IndiaMedsHub IndiaMedsHub india pharmacy mail order

clindamycin uk pharmacy: voltaren gel online pharmacy – ExpressCareRx

atenolol people’s pharmacy: people’s pharmacy wellbutrin – indian pharmacy ambien

http://indiamedshub.com/# top 10 online pharmacy in india

IndiaMedsHub IndiaMedsHub online shopping pharmacy india

tesco pharmacy artane: pharmacy online 365 review – us pharmacy viagra prices

best online pharmacy india: top 10 online pharmacy in india – IndiaMedsHub

https://medimexicorx.shop/# buying from online mexican pharmacy

https://expresscarerx.org/# online pharmacy viagra utah

ExpressCareRx thrifty drug store ExpressCareRx

kroger pharmacy crestor: medco pharmacy viagra – cialis online generic pharmacy

https://expresscarerx.online/# tesco pharmacy cialis price

world pharmacy india: IndiaMedsHub – online pharmacy india

best mexican pharmacy online MediMexicoRx buy viagra from mexican pharmacy

http://medimexicorx.com/# MediMexicoRx

cheapest online pharmacy india: indian pharmacy paypal – online shopping pharmacy india

Online medicine home delivery: IndiaMedsHub – IndiaMedsHub

http://expresscarerx.org/# amoxicillin from pharmacy

ExpressCareRx ExpressCareRx pharmacy times

https://expresscarerx.org/# ambien us pharmacy

MediMexicoRx: isotretinoin from mexico – real mexican pharmacy USA shipping

ExpressCareRx viagra cialis online pharmacy tesco pharmacy viagra prices

board of pharmacy: ExpressCareRx – ExpressCareRx

http://finasteridefromcanada.com/# Finasteride From Canada

buy Cialis online cheap: cheap tadalafil 20mg – tadalafil capsules 21 mg

https://zoloft.company/# buy Zoloft online

Cialis without prescription cheap Cialis Canada tadalafil online no rx

Cialis without prescription: buy tadalafil in usa – generic Cialis from India

buy tadalafil over the counter: buy Cialis online cheap – generic Cialis from India

https://lexapro.pro/# Lexapro for depression online

http://tadalafilfromindia.com/# tadalafil online no rx

generic Finasteride without prescription generic Finasteride without prescription cheap Propecia Canada

buy cheap propecia without insurance: Propecia for hair loss online – cost of cheap propecia without rx

buy Zoloft online without prescription USA: generic sertraline – purchase generic Zoloft online discreetly

http://finasteridefromcanada.com/# cheap Propecia Canada

cheap Cialis Canada buy Cialis online cheap Tadalafil From India

Accutane for sale: generic isotretinoin – purchase generic Accutane online discreetly

medication lexapro 10 mg: Lexapro for depression online – Lexapro for depression online

https://lexapro.pro/# lexapro 5mg

https://zoloft.company/# cheap Zoloft

Isotretinoin From Canada order isotretinoin from Canada to US generic isotretinoin

cheap Cialis Canada: Cialis without prescription – tadalafil 20mg pills

Accutane for sale: buy Accutane online – cheap Accutane

https://isotretinoinfromcanada.com/# order isotretinoin from Canada to US

USA-safe Accutane sourcing Accutane for sale generic isotretinoin

Propecia for hair loss online: Propecia for hair loss online – generic Finasteride without prescription

cheap Accutane: Accutane for sale – purchase generic Accutane online discreetly

http://isotretinoinfromcanada.com/# Isotretinoin From Canada

https://lexapro.pro/# lexapro generic over the counter

buy Cialis online cheap: cheap Cialis Canada – generic Cialis from India

lexapro tablets australia Lexapro for depression online lexapro 0.5 mg

generic Finasteride without prescription: cheap Propecia Canada – Finasteride From Canada

https://tadalafilfromindia.shop/# tadalafil tablets 20 mg india

cheap Zoloft: buy Zoloft online without prescription USA – cheap Zoloft

order generic propecia without prescription Finasteride From Canada cheap Propecia Canada

Propecia for hair loss online: generic Finasteride without prescription – generic Finasteride without prescription

http://isotretinoinfromcanada.com/# Accutane for sale

https://tadalafilfromindia.com/# cheap Cialis Canada

Accutane for sale: generic isotretinoin – Isotretinoin From Canada

cheap Zoloft buy Zoloft online without prescription USA generic sertraline

https://lexapro.pro/# Lexapro for depression online

generic Finasteride without prescription: generic Finasteride without prescription – Propecia for hair loss online

generic sertraline: buy Zoloft online without prescription USA – Zoloft for sale

https://tadalafilfromindia.shop/# Cialis without prescription

Cialis without prescription buy tadalafil 20mg price tadalafil online no rx

generic Finasteride without prescription: generic Finasteride without prescription – cheap Propecia Canada

https://tadalafilfromindia.shop/# Cialis without prescription

https://isotretinoinfromcanada.com/# cheap Accutane

buy Zoloft online without prescription USA: sertraline online – cheap Zoloft

purchase generic Accutane online discreetly Isotretinoin From Canada cheap Accutane

Lexapro for depression online: Lexapro for depression online – lexapro 10

http://tadalafilfromindia.com/# Cialis without prescription

cheap Accutane: generic isotretinoin – buy Accutane online

purchase generic Accutane online discreetly isotretinoin online buy Accutane online

https://zoloft.company/# Zoloft for sale

http://isotretinoinfromcanada.com/# order isotretinoin from Canada to US

Accutane for sale: order isotretinoin from Canada to US – generic isotretinoin

sertraline online Zoloft online pharmacy USA generic sertraline

lexapro 5 mg tablet price: Lexapro for depression online – Lexapro for depression online

where can you buy lexapro Lexapro for depression online Lexapro for depression online

generic isotretinoin: purchase generic Accutane online discreetly – isotretinoin online

https://lexapro.pro/# lexapro tablets price

cheap Propecia Canada: buying generic propecia without dr prescription – Finasteride From Canada

cheap Cialis Canada Tadalafil From India generic Cialis from India

cheap Cialis Canada: cheap Cialis Canada – Cialis without prescription

https://tadalafilfromindia.shop/# Cialis without prescription

cost of cheap propecia online: Propecia for hair loss online – generic Finasteride without prescription

order isotretinoin from Canada to US: generic isotretinoin – purchase generic Accutane online discreetly

lexapro 5 mg tablet price: Lexapro for depression online – Lexapro for depression online

https://lexapro.pro/# buy lexapro online without prescription

generic Cialis from India: buy Cialis online cheap – cheap Cialis Canada

information about the drug gabapentin side effects from gabapentin drug NeuroRelief Rx

amoxacillian without a percription: amoxicillin 500 mg price – order amoxicillin without prescription

gabapentin priority monitoring: NeuroRelief Rx – gabapentin mouth blisters

order Provigil without prescription: WakeMedsRX – buy Modafinil online USA

antibiotic treatment online no Rx amoxicillin 500mg capsule buy online generic amoxicillin

Relief Meds USA: prednisone cream – cost of prednisone 10mg tablets

can you buy prednisone: prednisone buy – prednisone generic brand name

where can i get gabapentin: which is best for nerve pain amitriptyline or gabapentin – gabapentin magyarul

Clomid Hub order generic clomid cost cheap clomid

Clomid Hub Pharmacy: how to get cheap clomid without a prescription – Clomid Hub

how to buy cheap clomid no prescription: Clomid Hub – Clomid Hub Pharmacy

smart drugs online US pharmacy where to buy Modafinil legally in the US smart drugs online US pharmacy

ReliefMeds USA: Relief Meds USA – compare prednisone prices

where to buy Modafinil legally in the US: prescription-free Modafinil alternatives – Modafinil for ADHD and narcolepsy

Clear Meds Direct: amoxicillin buy online canada – ClearMeds Direct

wakefulness medication online no Rx safe Provigil online delivery service safe Provigil online delivery service

how to get generic clomid for sale: clomid without dr prescription – cost clomid

http://clearmedsdirect.com/# order amoxicillin without prescription

NeuroRelief Rx: is gabapentin safe in pregnancy – efectos secundarios del gabapentin 300 mg

can you gain weight on gabapentin canine side effects gabapentin gabapentin rx

WakeMeds RX: affordable Modafinil for cognitive enhancement – Modafinil for focus and productivity

NeuroRelief Rx NeuroRelief Rx NeuroRelief Rx

anti-inflammatory steroids online: order corticosteroids without prescription – anti-inflammatory steroids online

gabapentin and remeron: NeuroRelief Rx – NeuroRelief Rx

https://clomidhubpharmacy.shop/# can i get cheap clomid without insurance

order amoxicillin without prescription amoxicillin canada price order amoxicillin without prescription

where to buy generic clomid tablets: Clomid Hub – where can i buy generic clomid

gabapentin cost gabapentin and menopause gabapentin neurontin hot flashes

ClearMeds Direct: amoxicillin 500mg – order amoxicillin without prescription

http://reliefmedsusa.com/# ReliefMeds USA

order corticosteroids without prescription: ReliefMeds USA – order corticosteroids without prescription

Clomid Hub Pharmacy: how can i get clomid without a prescription – Clomid Hub

Clomid Hub order clomid no prescription cost of clomid online

Relief Meds USA: Relief Meds USA – 100 mg prednisone daily

antibiotic treatment online no Rx: Clear Meds Direct – ClearMeds Direct

Modafinil for focus and productivity WakeMedsRX wakefulness medication online no Rx

https://clomidhubpharmacy.com/# can i order cheap clomid prices

smart drugs online US pharmacy: buy Modafinil online USA – where to buy Modafinil legally in the US

prescription-free Modafinil alternatives: smart drugs online US pharmacy – where to buy Modafinil legally in the US

anti-inflammatory steroids online: ReliefMeds USA – order corticosteroids without prescription

This is a very good tips especially to those new to blogosphere, brief and accurate information… Thanks for sharing this one. A must read article.

pregabalin and gabapentin combination therapy: can you take gabapentin with dayquil – can you buy fluoxetine

Wake Meds RX: Modafinil for ADHD and narcolepsy – Modafinil for ADHD and narcolepsy

prednisone 50 mg canada: ReliefMeds USA – anti-inflammatory steroids online

IndiGenix Pharmacy: indian pharmacies safe – IndiGenix Pharmacy

MexiCare Rx Hub: real mexican pharmacy USA shipping – sildenafil mexico online

IndiGenix Pharmacy: pharmacy website india – india online pharmacy

online mexico pharmacy USA: best mexican pharmacy online – MexiCare Rx Hub

legal to buy prescription drugs from canada: CanadRx Nexus – CanadRx Nexus

MexiCare Rx Hub: prescription drugs mexico pharmacy – MexiCare Rx Hub

CanadRx Nexus: CanadRx Nexus – CanadRx Nexus

CanadRx Nexus: canadian pharmacies comparison – CanadRx Nexus

MexiCare Rx Hub: buy viagra from mexican pharmacy – zithromax mexican pharmacy

MexiCare Rx Hub: mexican mail order pharmacies – buying prescription drugs in mexico

canadian pharmacy ltd: CanadRx Nexus – CanadRx Nexus

MexiCare Rx Hub: get viagra without prescription from mexico – MexiCare Rx Hub

https://mexicarerxhub.com/# mexico drug stores pharmacies

MexiCare Rx Hub: mexican border pharmacies shipping to usa – MexiCare Rx Hub

buy cialis from mexico: tadalafil mexico pharmacy – MexiCare Rx Hub

CanadRx Nexus: CanadRx Nexus – CanadRx Nexus

CanadRx Nexus: best canadian online pharmacy reviews – legitimate canadian mail order pharmacy

accutane mexico buy online: MexiCare Rx Hub – gabapentin mexican pharmacy

online shopping pharmacy india: india pharmacy – best india pharmacy

https://mexicarerxhub.shop/# buying prescription drugs in mexico

IndiGenix Pharmacy: indian pharmacy paypal – top online pharmacy india

CanadRx Nexus: canadian drugs online – CanadRx Nexus

IndiGenix Pharmacy: IndiGenix Pharmacy – IndiGenix Pharmacy

IndiGenix Pharmacy: IndiGenix Pharmacy – IndiGenix Pharmacy

canadian pharmacy ltd: CanadRx Nexus – canadian pharmacy com

mail order pharmacy india: IndiGenix Pharmacy – IndiGenix Pharmacy

MexiCare Rx Hub: pharmacies in mexico that ship to usa – MexiCare Rx Hub

http://indigenixpharm.com/# IndiGenix Pharmacy

generic drugs mexican pharmacy: MexiCare Rx Hub – best prices on finasteride in mexico

IndiGenix Pharmacy: indian pharmacies safe – pharmacy website india

CanadRx Nexus: online canadian pharmacy – canada pharmacy online legit

IndiGenix Pharmacy: IndiGenix Pharmacy – top 10 pharmacies in india

MexiCare Rx Hub: mexico drug stores pharmacies – MexiCare Rx Hub

canadian pharmacy online ship to usa: cross border pharmacy canada – canadian drugs pharmacy

https://mexicarerxhub.shop/# mexican border pharmacies shipping to usa

MexiCare Rx Hub: isotretinoin from mexico – MexiCare Rx Hub

canadian pharmacies comparison: canadian pharmacy 365 – pharmacy canadian superstore

Zanaflex medication fast delivery: Tizanidine tablets shipped to USA – buy Zanaflex online USA

IverCare Pharmacy ivermectin buy canada pour-on ivermectin for goats

ivermectin for dogs with mange: ivermectin for birds – IverCare Pharmacy

lasix pills: FluidCare Pharmacy – furosemide

ventolin nz ventolin buy canada AsthmaFree Pharmacy

RelaxMedsUSA: prescription-free muscle relaxants – order Tizanidine without prescription

relief from muscle spasms online: order Tizanidine without prescription – Tizanidine 2mg 4mg tablets for sale

FluidCare Pharmacy FluidCare Pharmacy FluidCare Pharmacy

AsthmaFree Pharmacy: AsthmaFree Pharmacy – AsthmaFree Pharmacy

can i buy ivermectin over the counter: IverCare Pharmacy – IverCare Pharmacy

http://glucosmartrx.com/# rybelsus 14 mg tablets

ivermectin sheep drench for dogs cvs ivermectin covid ivermectin

safe online source for Tizanidine: Tizanidine tablets shipped to USA – muscle relaxants online no Rx

lasix furosemide 40 mg: FluidCare Pharmacy – generic lasix

buy Zanaflex online USA: RelaxMedsUSA – order Tizanidine without prescription

https://glucosmartrx.com/# AsthmaFree Pharmacy

AsthmaFree Pharmacy ventolin proventil AsthmaFree Pharmacy

lasix 40mg: FluidCare Pharmacy – FluidCare Pharmacy

relief from muscle spasms online: muscle relaxants online no Rx – affordable Zanaflex online pharmacy

lasix generic name lasix furosemide 40 mg lasix medication

lasix tablet: lasix for sale – FluidCare Pharmacy

order Tizanidine without prescription: prescription-free muscle relaxants – Tizanidine 2mg 4mg tablets for sale

https://fluidcarepharmacy.shop/# FluidCare Pharmacy

how to get ventolin over the counter: AsthmaFree Pharmacy – AsthmaFree Pharmacy

FluidCare Pharmacy FluidCare Pharmacy FluidCare Pharmacy

furosemide 100 mg: buy furosemide online – FluidCare Pharmacy

lasix online FluidCare Pharmacy lasix for sale

buy Zanaflex online USA: Tizanidine tablets shipped to USA – Zanaflex medication fast delivery

Zanaflex medication fast delivery order Tizanidine without prescription order Tizanidine without prescription

IverCare Pharmacy: order ivermectin online – why is stromectol prescribed

no prescription ventolin hfa AsthmaFree Pharmacy buy ventolin pills online

IverCare Pharmacy: IverCare Pharmacy – IverCare Pharmacy

lasix furosemide FluidCare Pharmacy FluidCare Pharmacy

https://ivercarepharmacy.com/# IverCare Pharmacy

is semaglutide safe: AsthmaFree Pharmacy – AsthmaFree Pharmacy

cheap muscle relaxer online USA: safe online source for Tizanidine – order Tizanidine without prescription

cheap muscle relaxer online USA muscle relaxants online no Rx muscle relaxants online no Rx

ventolin cost uk: cheap ventolin inhaler – AsthmaFree Pharmacy

generic ventolin inhaler: AsthmaFree Pharmacy – how much is ventolin in canada

AsthmaFree Pharmacy AsthmaFree Pharmacy ventolin no prescription

FluidCare Pharmacy: lasix pills – FluidCare Pharmacy

india ivermectin: oral ivermectin for guinea pigs – IverCare Pharmacy

generic ivermectin ivermectin for guinea pig IverCare Pharmacy

https://glucosmartrx.shop/# can you drink alcohol on semaglutide

FluidCare Pharmacy: lasix for sale – FluidCare Pharmacy

rybelsus uses: AsthmaFree Pharmacy – rybelsus 3 mg tablet

ventolin capsule price AsthmaFree Pharmacy AsthmaFree Pharmacy

FluidCare Pharmacy: furosemida 40 mg – FluidCare Pharmacy

https://swertewin.life/# Swerte99 casino walang deposit bonus para sa Pinoy

Pinco kazino: Pinco kazino – Pinco casino mobil t?tbiq

Abutogel Abutogel Link alternatif Abutogel

Withdraw cepat Beta138: Login Beta138 – Beta138

Jollibet online sabong: Online casino Jollibet Philippines – Online gambling platform Jollibet

Khuy?n mai GK88: Ca cu?c tr?c tuy?n GK88 – Casino online GK88

Jiliko slots Jiliko login Jiliko casino

https://1winphili.company/# 1winphili

Slot gacor Beta138: Live casino Indonesia – Promo slot gacor hari ini

Swerte99 casino: Swerte99 login – Swerte99 casino

Beta138 Link alternatif Beta138 Live casino Indonesia

https://swertewin.life/# Swerte99 app

Mandiribet login: Live casino Mandiribet – Situs judi resmi berlisensi

Qeydiyyat bonusu Pinco casino: Onlayn rulet v? blackjack – Uduslar? tez c?xar Pinco il?

Slot game d?i thu?ng Dang ky GK88 Ca cu?c tr?c tuy?n GK88

Jollibet online sabong: Online gambling platform Jollibet – Online betting Philippines

jilwin: jilwin – Jiliko bonus

Canl? krupyerl? oyunlar Yeni az?rbaycan kazino sayt? Onlayn kazino Az?rbaycan

Jiliko bonus: jilwin – Jiliko casino

https://swertewin.life/# Swerte99 bonus

Pinco casino mobil t?tbiq: Onlayn rulet v? blackjack – Pinco casino mobil t?tbiq

1winphili jollibet Jollibet online sabong

Promo slot gacor hari ini: Beta138 – Login Beta138

Swerte99 casino: Swerte99 – Swerte99 bonus

Swerte99 slots Swerte99 online gaming Pilipinas Swerte99

https://pinwinaz.pro/# Onlayn rulet v? blackjack

Rut ti?n nhanh GK88: Khuy?n mai GK88 – Slot game d?i thu?ng

Khuy?n mai GK88: Rut ti?n nhanh GK88 – Dang ky GK88

Live casino Mandiribet Judi online deposit pulsa Situs judi resmi berlisensi

Pinco kazino: Yuks?k RTP slotlar – Pinco r?smi sayt

maglaro ng Jiliko online sa Pilipinas: Jiliko app – Jiliko app

finasteride mexico pharmacy Mexican Pharmacy Hub mexican pharmacy for americans

mexican pharmacy for americans: Mexican Pharmacy Hub – legit mexico pharmacy shipping to USA

Mexican Pharmacy Hub: п»їmexican pharmacy – sildenafil mexico online

online pharmacy india: Indian Meds One – Indian Meds One

Indian Meds One Indian Meds One buy medicines online in india

Mexican Pharmacy Hub: buy viagra from mexican pharmacy – buy antibiotics over the counter in mexico

https://mexicanpharmacyhub.shop/# Mexican Pharmacy Hub

Mexican Pharmacy Hub: semaglutide mexico price – Mexican Pharmacy Hub

Mexican Pharmacy Hub: buy cialis from mexico – Mexican Pharmacy Hub

pharmacy rx one MediDirect USA mexico pharmacy online

Mexican Pharmacy Hub: Mexican Pharmacy Hub – viagra pills from mexico

Mexican Pharmacy Hub: low cost mexico pharmacy online – Mexican Pharmacy Hub

https://mexicanpharmacyhub.shop/# Mexican Pharmacy Hub

reputable indian pharmacies: indian pharmacies safe – india pharmacy

best rx online pharmacy MediDirect USA MediDirect USA

Indian Meds One top 10 pharmacies in india indian pharmacies safe

https://medidirectusa.com/# singulair pharmacy coupon

best online pharmacy to buy accutane vytorin online pharmacy MediDirect USA

Indian Meds One Indian Meds One Online medicine order

https://medidirectusa.shop/# lasix mexican pharmacy

MediDirect USA MediDirect USA celexa online pharmacy

http://kamameds.com/# Kamagra oral jelly USA availability

SildenaPeak: SildenaPeak – SildenaPeak

Tadalify: Tadalify – Tadalify

Those are yours alright! . We at least need to get these people stealing images to start blogging! They probably just did a image search and grabbed them. They look good though!

https://sildenapeak.shop/# sildenafil 50 mg tablet

Sildenafil oral jelly fast absorption effect: Online sources for Kamagra in the United States – KamaMeds

F*ckin’ amazing things here. I am very glad to see your post. Thanks a lot and i’m looking forward to contact you. Will you kindly drop me a e-mail?

Tadalify: cialis lower blood pressure – Tadalify

http://kamameds.com/# Affordable sildenafil citrate tablets for men

shelf life of liquid tadalafil: cialis 20 mg coupon – Tadalify

Non-prescription ED tablets discreetly shipped: Sildenafil oral jelly fast absorption effect – ED treatment without doctor visits

https://kamameds.shop/# ED treatment without doctor visits

tadalafil versus cialis: cialis daily dose – why does tadalafil say do not cut pile

https://sildenapeak.shop/# sildenafil 50mg uk

Non-prescription ED tablets discreetly shipped: Online sources for Kamagra in the United States – Online sources for Kamagra in the United States

A formidable share, I simply given this onto a colleague who was doing slightly evaluation on this. And he the truth is bought me breakfast as a result of I discovered it for him.. smile. So let me reword that: Thnx for the deal with! However yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you develop into expertise, would you mind updating your blog with more particulars? It is highly useful for me. Big thumb up for this weblog put up!

where to buy sildenafil online: SildenaPeak – viagra generics

https://tadalify.shop/# cialis online pharmacy

Online sources for Kamagra in the United States: Men’s sexual health solutions online – Sildenafil oral jelly fast absorption effect

http://kamameds.com/# Compare Kamagra with branded alternatives

https://tadalify.shop/# Tadalify

https://sildenapeak.com/# SildenaPeak

https://steroidcarepharmacy.com/# SteroidCare Pharmacy

ivermectin hookworm: IverGrove – ivermectin for humans

FertiCare Online: FertiCare Online – FertiCare Online

prednisone 20mg prescription cost: SteroidCare Pharmacy – buy 10 mg prednisone

SteroidCare Pharmacy: SteroidCare Pharmacy – SteroidCare Pharmacy

https://cardiomedsexpress.shop/# CardioMeds Express

CardioMeds Express: CardioMeds Express – CardioMeds Express

FertiCare Online FertiCare Online FertiCare Online

CardioMeds Express: CardioMeds Express – CardioMeds Express

You have observed very interesting details ! ps nice web site.

clomid without a prescription: where can i buy clomid pills – how to get generic clomid without dr prescription

IverGrove IverGrove peru ivermectin

I discovered your blog site on google and check a few of your early posts. Continue to keep up the very good operate. I just additional up your RSS feed to my MSN News Reader. Seeking forward to reading more from you later on!…

https://ivergrove.com/# IverGrove

What i don’t understood is actually how you’re not actually much more well-liked than you may be right now. You are so intelligent. You realize thus considerably relating to this subject, made me personally consider it from numerous varied angles. Its like women and men aren’t fascinated unless it’s one thing to do with Lady gaga! Your own stuffs nice. Always maintain it up!

Farmacia online piГ№ conveniente accesso rapido a cialis generico online Farmacia online miglior prezzo

https://forzaintima.shop/# kamagra originale e generico online

https://farmacidiretti.com/# Farmacie on line spedizione gratuita

http://maplemedsdirect.com/# MapleMeds Direct

https://bharatmedsdirect.com/# indian pharmacy paypal

https://bordermedsexpress.shop/# medication from mexico pharmacy

india pharmacy mail order: indian pharmacy paypal – online shopping pharmacy india

spain pharmacy online: MapleMeds Direct – online pharmacy denmark

We absolutely love your blog and find most of your

post’s to be what precisely I’m looking for. Does one offer guest writers to write content in your case?

I wouldn’t mind producing a post or elaborating on a nnumber of the

subjects you write about here. Again, awdsome website! https://glassiuk.Wordpress.com/

https://bharatmedsdirect.shop/# BharatMeds Direct

world pharmacy india: BharatMeds Direct – mail order pharmacy india

india pharmacy viagra: MapleMeds Direct – MapleMeds Direct

https://bordermedsexpress.shop/# mexican mail order pharmacies

percocet pharmacy online no prescription: MapleMeds Direct – sumatriptan uk pharmacy

garuda888 live casino Indonesia: garuda888 – garuda888

https://1wbona.com/# bonaslot login

migliori casino online con Starburst: jackpot e vincite su Starburst Italia – giocare a Starburst gratis senza registrazione

https://clearmedspharm.shop/# buy antibiotics online for uti

Login Alternatif Togel inatogel 4D Login Alternatif Togel

mawartoto login mawartoto link mawartoto alternatif

hargatoto alternatif: hargatoto – hargatoto slot

situs slot batara88: batara88 – slot online

betawi77: betawi77 link alternatif – betawi77 login

batara88: bataraslot – bataraslot login

http://evergreenrxusas.com/# cialis priligy online australia

EverGreenRx USA: EverGreenRx USA – EverGreenRx USA

https://evergreenrxusas.shop/# EverGreenRx USA

cialis generic purchase: cialis alcohol – non prescription cialis

https://evergreenrxusas.shop/# EverGreenRx USA

how long does tadalafil take to work: EverGreenRx USA – does cialis lower your blood pressure

generic and branded medications UK: MediQuick – MediQuick

BluePillUK https://bluepilluk.shop/# BluePillUK

https://mediquickuk.shop/# generic and branded medications UK

viagra discreet delivery UK http://bluepilluk.com/# sildenafil tablets online order UK

ivermectin tablets UK online pharmacy: discreet ivermectin shipping UK – generic stromectol UK delivery

confidential delivery cialis UK: confidential delivery cialis UK – branded and generic tadalafil UK pharmacy

https://truenorthpharm.shop/# TrueNorth Pharm

http://saludfrontera.com/# SaludFrontera

http://curabharatusa.com/# CuraBharat USA

https://curabharatusa.com/# CuraBharat USA

medicine purchase online: online drugstore – CuraBharat USA

http://gesunddirekt24.com/# online apotheke deutschland

http://intimgesund.com/# potenzmittel diskret bestellen

https://mannerkraft.shop/# internet apotheke

http://clearmedshub.com/# ClearMedsHub

Clear Meds Hub: Clear Meds Hub – ClearMedsHub

https://clearmedshub.com/# ClearMedsHub

http://vitaledgepharma.com/# VitalEdge Pharma

https://clearmedshub.com/# Clear Meds Hub

https://evertrustmeds.shop/# Ever Trust Meds

http://vitaledgepharma.com/# VitalEdgePharma

http://evertrustmeds.com/# EverTrustMeds

ClearMedsHub: Clear Meds Hub – ClearMedsHub

https://clearmedshub.com/# Clear Meds Hub

https://evertrustmeds.com/# EverTrustMeds

Best Mexican pharmacy online: BajaMedsDirect – BajaMedsDirect

I’ve been absent for a while, but now I remember why I used to love this blog. Thanks, I?¦ll try and check back more often. How frequently you update your website?

http://bajamedsdirect.com/# Mexican pharmacy price list

http://curamedsindia.com/# online meds

https://curamedsindia.shop/# Indian pharmacy online

buy generic sildenafil online generic sildenafil citrate 100mg Sildenafil 100mg price

mexican pharmacy for americans buy propecia mexico Legit online Mexican pharmacy

buy tadalafil cialis tadalafil Generic Cialis without a doctor prescription

Hi, I think your site might be having browser compatibility issues. When I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, fantastic blog!

Buy sildenafil online usa Sildenafil 100mg price sildenafil

Buy Tadalafil 20mg tadalafil Generic tadalafil 20mg price

AmoxDirect USA Purchase amoxicillin online AmoxDirect USA

ZithroMeds Online cheap zithromax generic zithromax

http://amoxicareonline.com/# buy amoxicillin

MedRelief UK: cheap prednisolone in UK – Prednisolone tablets UK online

http://medreliefuk.com/# Prednisolone tablets UK online

BritPharm Online: order ED pills online UK – BritPharm Online

https://amoxicareonline.shop/# buy amoxicillin

buy penicillin alternative online: buy amoxicillin – amoxicillin uk

http://britpharmonline.com/# viagra

Prednisolone tablets UK online: order steroid medication safely online – buy corticosteroids without prescription UK

https://britmedsdirect.com/# pharmacy online UK

buy amoxicillin: amoxicillin uk – amoxicillin uk

order steroid medication safely online: order steroid medication safely online – cheap prednisolone in UK

http://amoxicareonline.com/# buy penicillin alternative online

order ED pills online UK: buy viagra – buy viagra online

buy prednisolone: cheap prednisolone in UK – buy corticosteroids without prescription UK

https://britmedsdirect.com/# UK online pharmacy without prescription

https://britmedsdirect.com/# pharmacy online UK

BritPharm Online: buy sildenafil tablets UK – viagra

https://britpharmonline.shop/# British online pharmacy Viagra

affordable online pharmacy for Americans trusted online pharmacy USA buy amoxil

online pharmacy trusted online pharmacy USA ZenCare Meds

pharmacy in mexico: mexican pharmacy – MedicoSur

ZenCare Meds com ZenCareMeds trusted online pharmacy USA

mexico city pharmacy: mexico pharmacy – mexico pharmacy

cialis 20mg preis: Cialis Preisvergleich Deutschland – eu apotheke ohne rezept

farmacia online italiana Cialis: tadalafil italiano approvato AIFA – acquistare Cialis online Italia

dove comprare Cialis in Italia: tadalafil senza ricetta – tadalafil senza ricetta

Cialis genérico económico: comprar Cialis online España – comprar cialis

acheter Cialis en ligne France: achat discret de Cialis 20mg – livraison rapide et confidentielle

farmacia online italiana Cialis: tadalafil italiano approvato AIFA – cialis

pillole verdi: farmacia online italiana Cialis – cialis

Viagra utan läkarbesök: MannensApotek – diskret leverans i Sverige

MediUomo miglior sito per acquistare Sildenafil online trattamento ED online Italia

https://confiafarmacia.shop/# farmacia online para hombres

MediUomo: Viagra generico con pagamento sicuro – Medi Uomo

https://mediuomo.com/# ordinare Viagra generico in modo sicuro

https://herengezondheid.com/# officiele Sildenafil webshop

apotek online utan recept Viagra utan läkarbesök apotek online utan recept

farmacia online para hombres: Viagra sin prescripción médica – farmacia confiable en España

Sildenafil zonder recept bestellen: Heren Gezondheid – Viagra online kopen Nederland

https://confiafarmacia.com/# farmacia con entrega rapida

erektionspiller på nätet: apotek online utan recept – Sildenafil utan recept

HerenGezondheid: erectiepillen discreet bestellen – goedkope Viagra tabletten online

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.

consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Madnix propose également une offre de bienvenue impressionnante qui ne manquera pas d’attirer les nouveaux joueurs. En s’inscrivant, les joueurs peuvent profiter d’un bonus de 100% jusqu’à 300€, accompagné de 290 free spins. Ce bonus permet de doubler le premier dépôt, offrant ainsi un capital de départ conséquent. Les 290 free spins offrent une multitude d’opportunités pour essayer différents jeux de la plateforme sans frais supplémentaires. Pour les nouveaux inscrits, l’offre de bienvenue s’étend sur trois dépôts et peut atteindre jusqu’à 1 000€ et 100 free spins. D’autres promotions sont prévues pour maintenir l’intérêt des joueurs en boostant leur bankroll.

https://losprosdelcampo.com/frumzi-casino-analyse-complete-pour-les-joueurs-francais/

Les jeux de table et le vidéo poker complètent l’offre, mais l’identité du casino reste ancrée dans la chasse au jackpot. C’est un environnement parfait pour les joueurs qui aiment la montée d’adrénaline, la tension avant le “big drop”, et les mécaniques simples à relancer sans prise de tête. Pragmatic Play est reconnue comme l’un des meilleurs fournisseurs de jeux pour les machines à sous en ligne, et Gates of Olympus prouve une nouvelle fois son talent. Notre Gates of Olympus slot avis est positif et nous pouvons vous dire que notre équipe a passé un bon moment en jouant sur cette machine à sous. La machine à sous dispose d’un design élégant sur le thème attractif des dieux grecs et permet d’obtenir différents bonus dont des tours gratuits et des multiplicateurs. Elle bénéficie également d’un RTP avantageux de 96,5 % et peut vous faire gagner jusqu’à 5 000 fois votre mise.

Creators we have a problem; we can’t upload our audio to the most popular social networks, we miss out by not sharing our best work. EchoWave was founded to solve the audio share-ability problem. With EchoWave you can convert sound to video enabling you to upcycle your excellent content on social. EchoWave allows you to upload audio to Facebook, Twitter and Instagram with an easy to use self-service interface. Convert your audio to videos now and start getting 10x engagement. Creating quality, branded videos has never been easier and cheaper (or more enjoyable) Easily create amazing videos and presentations Kapwing’s online Video Editor works with all popular file types for video (MP4, AVI, MOV, WebM, and more) After you’re done editing the YouTube video, click the Export button. Your video will be rendered in 3 minutes or less thanks to our cloud powered video processing tech. You can also choose to publish your video directly to YouTube to save time!

https://buktijpdewalive.com/in-depth-review-of-sugar-rush-1000-by-pragmatic-play-for-multi-players/

Gates of Olympus takes you into Zeus’ realm where you may experience his wrath or enjoy an adventure if you’re brave enough. The game from Pragmatic Play is a 6×5 video slot machine with 20 paylines. Symbols tumble down and pay in clusters of eight. Zeus is on the side of the colorful reels and he triggers the multiplier feature at random where your win is multiplied from 2x to 500x. In conclusion, if you’re searching for a slot game that offers more than just spinning reels, Gates of Olympus delivers. With its innovative features, generous multipliers, and captivating theme, it’s no surprise that this game has become a favorite in the online casino world. Give it a try and see if the gods are on your side. Gates of Olympus Slot With a plethora of online poker platforms available, players now have access to a wide range of games, tournaments, and bonuses that cater to all skill levels and preferences With the rise of technology and the internet, players can now access a wide variety of online poker games at their fingertips In terms of game selection, casino online offers a wide range of options to cater to different preferences and skill levels Slot Axa Defender

GAMES CERTIFICATIONS Gather groups away from rewarding treasures and you may gold trinkets because you twist the newest reels of your Gates out of Hades slot in the finest united kingdom harbors sites. Make sure to gamble from the a needed internet sites which have an educated return to players you wear’t shed even if the money. It is a dangerous choice, nonetheless it has invited of several players on the Twitch, Stop, otherwise YouTube and make significant progress to your Doors out of Olympus. By paying one hundred minutes their bet amount, you can attempt our added bonus function and aspire to earn upwards to help you x5000. This will make it a necessity-play for those who take pleasure in scatter pays harbors and the best introduction for anyone just who have not yet , discover the first video game. Few videos ports earn online casino prizes, that have hundreds yearly contending for the esteemed EGR Providers slot of the season prize. Also it comes while the no wonder why Gates out of Olympus has been so popular.

https://netpos.com.ng/2025/11/03/mines-cash-game-real-experiences-from-pakistan/

Unfortunately, justcasino is not available in your country. Gates of Olympus 1000 is based around Greek mythology, with a focus on the mighty gods of Mount Olympus. This theme is not just present in the symbols but also reflected in the overall design and feel of the game. Mythology has influenced many aspects of human culture, including art, literature, and even slot games. One popular slot that exemplifies this influence is Gates of Olympus by Pragmatic Play. This game takes players on an exciting journey to Mount Olympus to meet the Greek gods. рџ’Ў Expert advice: “With over 12,000 games, including 10,000 pokies and 350+ live games, Rocket Riches is one of the largest NZ sites I’ve ever tested. The huge selection of games has something for everyone, and I’d definitely recommend joining if you enjoy playing a variety of games or trying out new ones.