Despite facing economic challenges this year, Africa is showing signs of hope, with some of its economies demonstrating promising growth.

According to the International Monetary Fund (IMF), six of the world’s top-10 performing economies in 2024 are predicted to be from Sub-Saharan Africa.

Although these smaller economies won’t compensate for the underperformance of South Africa and Nigeria, which together make up 40% of Africa’s $2 trillion economy, they are collectively contributing to positive change in a region heavily affected by poverty and inequality.

“The growth outlook for Sub-Saharan Africa is improving. Eight of the region’s largest economies, which together represent another 40% of regional GDP, are expected to grow by an average of 5%,” said Yvonne Mhango an Economist at Bloomberg.

This includes Ivory Coast with a growth rate of 6.6% and Tanzania at 6.1%. Both countries have successfully diversified their economies and attracted foreign investment.

As a result, the IMF anticipates a moderate improvement in regional growth to 4% in 2024, up from 3.3% in 2023. While Nigeria and South Africa may not see rapid growth in the short term, both are implementing reforms that could yield long-term benefits.

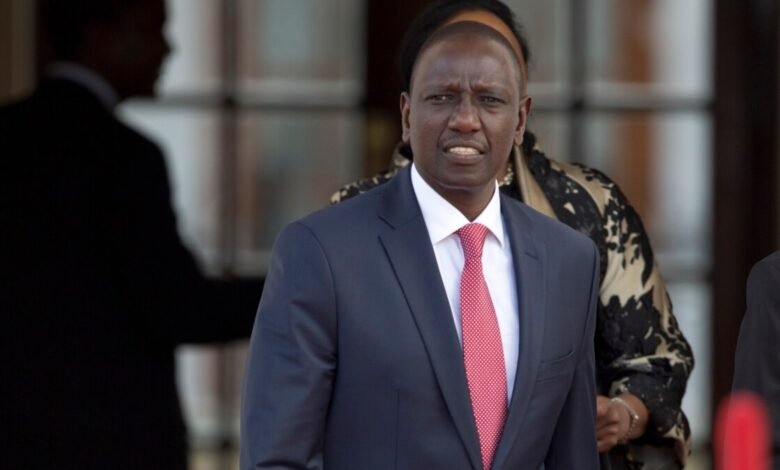

IMF projects Kenya, placed fifth on the list, to grow at 5.3% in the region.

In a report released by the World Bank on Kenya’s poverty and equity assessment 2023, the country’s robust economic growth over the past decade has outperformed its Sub-Saharan Africa peers.

Kenya bounced back from the COVID-19 pandemic with a 7.6 % growth beating the Sub-Saharan Africa average growth.

Kenya, having the highest Human Capital Index (HCI) score in mainland Sub-Saharan Africa, has made noteworthy progress in human capital development and expanding access to basic services, and investments that are fundamental for inclusive growth.

The report states that the access to health care available in the country has resulted in significantly improved health outcomes and this has contributed to human capital achievements.

“For instance, the under-5 mortality rate in Kenya decreased from 74 deaths per 1,000 live births in 2008/09 to 41 deaths per 1,000 live births in 2022, significantly lower compared with its peers,” World Bank revealed.

The IMF, however, projects growth in Nigeria to reach about 3% this year and next, while South Africa is expected to grow by 1.8% and 1.6% over the next two years, up from a sluggish 0.9% in 2023.

Analysts are still wary about Africa’s near-term outlook. The region’s growth recovery is starting from a low base following the pandemic’s impact, which strained public finances and left many countries burdened with heavy debts.

Defaults have already occurred in Ghana, Zambia, and Ethiopia, and the IMF warns that other countries are at risk, with access to foreign capital markets effectively shut.

Moody’s Investors Service has a negative outlook on the credit of African sovereigns due to high debt-refinancing risks and the expectation that China’s slower growth will reduce demand for the region’s commodity exports.

Moody’s estimates that about $5 billion of eurobonds will mature in 2024 in Sub-Saharan Africa, with more than $6 billion due in 2025. This does not include debts due to bilateral creditors like China or multilateral lenders.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.