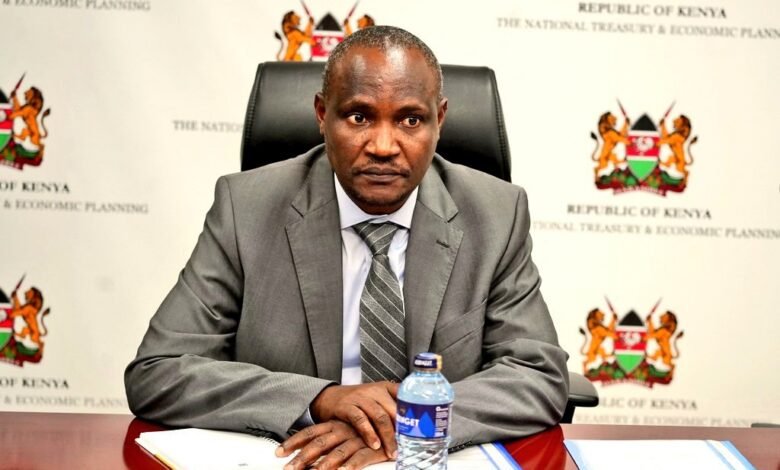

Cabinet Secretary (CS) John Mbadi has unveiled a series of measures aimed at boosting revenue and ensuring the stability of the country.

During the handover event from former CS Njuguna Ndungu, Mbadi made public his plans, which include various cost-cutting initiatives such as the removal of zero rating on certain goods.

Finance Bill, 2024 Implementation

Although the Finance Bill 2024’s proposal to eliminate zero rating was initially rejected, Mbadi believes it was essential for the country’s growth.

However, he clarified that he will not implement the proposal as it stands, out of respect for the Kenyan people. Instead, he will focus on allowing tax subsidies only for basic commodities that impact daily life.

“We have lost the Finance Bill of 2024. Reintroducing it would be wrong and disrespectful to the people of Kenya. We cannot reintroduce it despite its progressive provisions,” Mbadi stated.

According to the CS, the bill contained measures that would foster growth, particularly in reducing tax expenditure, which is often inflated by fictitious tax refund claims.

Mbadi proposed shifting some basic commodities to exceptions, rather than zero-rating them, as a way to manage tax expenditure better.

No Subsidised Goods for Companies

He said tax refunds currently account for about 65 percent of the country’s expenditure, and the government should not continue subsidizing products for companies.

“VAT returns could be contributing around 65 percent of total expenditure. If we manage this, it frees up funds for development,” Mbadi explained.

He assured that essential items would still be subsidized, offering relief on critical goods while eliminating zero rating.

The Finance Bill 2024 had included a proposal for a 16 percent VAT on both unleavened and leavened bread, which were previously tax-exempt.

The former CS argued that this move would significantly increase returns and alleviate financial pressures by broadening revenue sources, based on an understanding of market and purchasing patterns.

“Total VAT collected in Kenya makes up about 40 percent of the total tax, with 18 percent going to tax refunds for items considered consumed by the poor. However, 95 percent of these refunds go to bread and milk, which are largely purchased by the middle class, not the poor,” he argued.