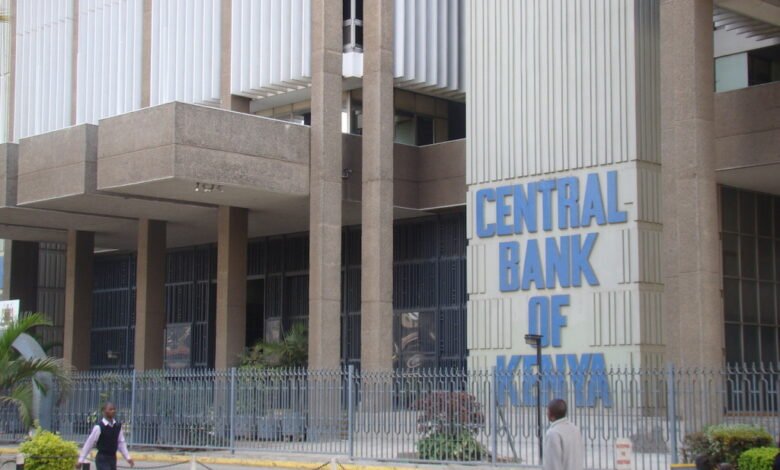

The Central Bank of Kenya (CBK) has successfully completed the migration of the Kenya Electronic Payment and Settlement System (KEPSS) to the ISO20022 Global Messaging Standard, a milestone in the modernization of Kenya’s National Payment System.

KEPSS, which is Kenya’s Real-Time Gross Settlement (RTGS) system, is operated by the CBK to process large-scale and time-critical payments, forming the backbone of domestic and regional transactions.

According to the CBK, the transition to ISO20022 provides key benefits, including faster settlement times, more streamlined processing, and improved liquidity management for financial institutions.

During the migration period, spanning from August 2023 to August 2024, KEPSS processed over 5.3 million transactions valued at Ksh.45 trillion in local currency.

ISO20022 is rapidly becoming the global standard for financial messaging, enhancing the complexity and security of payments.

Also Read: CBK Authorizes JPMorgan Chase Bank to Open Representative Office in Nairobi

The standard’s rich data formats will support the monitoring and prevention of fraud and illicit transactions. Additionally, the improved interoperability between domestic and international payment systems is expected to facilitate smoother cross-border transactions, ultimately increasing the ease of doing business globally.

The successful adoption of ISO20022 places Kenya among a select group of countries and regions that have embraced the new messaging standard, reinforcing its position as a leading and competitive destination for financial services.

The transition also aligns with Kenya’s modernization efforts under the National Payments Strategy 2022-2025.

“The migration of KEPSS to ISO20022 Standard is a significant achievement that showcases Kenya’s commitment to adopting international best practices in financial messaging,” said CBK in the statement.

“This milestone will greatly enhance the convenience, speed, and security of payments for corporates and customers alike.”

CBK has directed banks and other financial institutions to inform customers and provide support to ensure a seamless transition to the new system.

The shift to ISO20022 is expected to further Kenya’s long-term goal of becoming a global financial hub.

My brother recommended I might like this blog. He was entirely right. This post truly made my day. You cann’t imagine simply how much time I had spent for this info! Thanks!

Some really superb information, Gladiolus I found this. “They are able because they think they are able.” by Virgil.

I was suggested this website by my cousin. I’m not sure whether this post is written by him as no one else know such detailed about my problem. You’re wonderful! Thanks!

Really instructive and great body structure of content material, now that’s user friendly (:.

Your place is valueble for me. Thanks!…

I conceive this web site has some real fantastic information for everyone :D. “Experience is not what happens to you it’s what you do with what happens to you.” by Aldous Huxley.

obviously like your website but you need to take a look at the spelling on several of your posts. Many of them are rife with spelling problems and I to find it very bothersome to tell the reality nevertheless I’ll certainly come again again.

Hmm it appears like your site ate my first comment (it was super long) so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog. I too am an aspiring blog blogger but I’m still new to everything. Do you have any tips and hints for first-time blog writers? I’d genuinely appreciate it.

Would love to perpetually get updated great weblog! .

Whats up are using WordPress for your site platform? I’m new to the blog world but I’m trying to get started and create my own. Do you require any html coding expertise to make your own blog? Any help would be really appreciated!

I have not checked in here for some time since I thought it was getting boring, but the last several posts are great quality so I guess I will add you back to my daily bloglist. You deserve it my friend 🙂

I’m really impressed with your writing abilities and also with the structure for your blog. Is this a paid subject matter or did you modify it your self? Either way stay up the excellent quality writing, it’s rare to see a nice weblog like this one nowadays..

I genuinely enjoy looking through on this website, it contains wonderful content. “And all the winds go sighing, For sweet things dying.” by Christina Georgina Rossetti.

Thankyou for this marvelous post, I am glad I discovered this web site on yahoo.

https://semaglupharm.com/# weight loss on rybelsus

prednisone brand name us: prednisone pills 10 mg – where to buy prednisone 20mg no prescription

https://semaglupharm.com/# SemagluPharm

PredniPharm PredniPharm prednisone buy cheap

Lipi Pharm: Lipi Pharm – Lipi Pharm

https://semaglupharm.shop/# Buy Rybelsus online USA

https://crestorpharm.com/# Crestor Pharm

PredniPharm Predni Pharm Predni Pharm

https://semaglupharm.com/# does rybelsus help with weight loss

rosuvastatin and fenofibrate tablets uses: CrestorPharm – CrestorPharm

https://semaglupharm.com/# SemagluPharm

what are crestor side effects: CrestorPharm – should crestor be taken at night

https://semaglupharm.com/# Rybelsus 3mg 7mg 14mg

SemagluPharm does oral semaglutide work for weight loss Semaglutide tablets without prescription

https://semaglupharm.com/# rybelsus cut in half

PredniPharm Predni Pharm can i buy prednisone online without a prescription

https://semaglupharm.shop/# Semaglu Pharm

Predni Pharm: Predni Pharm – PredniPharm

Semaglu Pharm Semaglu Pharm Semaglu Pharm

http://semaglupharm.com/# Semaglu Pharm

Online pharmacy Rybelsus: SemagluPharm – Semaglutide tablets without prescription

Predni Pharm buy prednisone online paypal PredniPharm

https://semaglupharm.shop/# SemagluPharm

PredniPharm: Predni Pharm – prednisone 20mg for sale

https://semaglupharm.com/# SemagluPharm

is crestor better than lipitor Crestor Pharm Crestor Pharm

https://lipipharm.shop/# LipiPharm

Crestor Pharm: Crestor Pharm – coming off crestor side effects

https://semaglupharm.shop/# Semaglu Pharm

can you buy prednisone over the counter in usa PredniPharm 80 mg prednisone daily

Where to buy Semaglutide legally: semaglutide to tirzepatide conversion chart – can you take rybelsus and trulicity together

https://semaglupharm.shop/# Semaglu Pharm

Crestor Pharm crestor 10 mg effetti collaterali Best price for Crestor online USA

https://crestorpharm.com/# rosuvastatin ca

https://semaglupharm.com/# SemagluPharm

Affordable Rybelsus price: SemagluPharm – Semaglu Pharm

FDA-approved Rybelsus alternative Semaglu Pharm SemagluPharm

https://semaglupharm.com/# Buy Rybelsus online USA

Order cholesterol medication online: Lipi Pharm – LipiPharm

Lipi Pharm Cheap Lipitor 10mg / 20mg / 40mg LipiPharm

https://medsfrommexico.com/# Meds From Mexico

https://indiapharmglobal.shop/# India Pharm Global

India Pharm Global: buy prescription drugs from india – india pharmacy mail order

India Pharm Global India Pharm Global india pharmacy

Thanks for any other great article. The place else may just anybody get that kind of information in such an ideal way of writing? I’ve a presentation subsequent week, and I’m on the look for such info.

http://canadapharmglobal.com/# canadian pharmacy ratings

India Pharm Global: India Pharm Global – India Pharm Global

mexican drugstore online mexican pharmaceuticals online Meds From Mexico

https://medsfrommexico.com/# mexico drug stores pharmacies

https://indiapharmglobal.com/# India Pharm Global

India Pharm Global: indianpharmacy com – indian pharmacy

the canadian pharmacy Canada Pharm Global canadian online pharmacy

https://indiapharmglobal.shop/# india pharmacy mail order

indian pharmacy online: india pharmacy – India Pharm Global

https://indiapharmglobal.com/# India Pharm Global

https://indiapharmglobal.com/# top 10 online pharmacy in india

India Pharm Global cheapest online pharmacy india top online pharmacy india

https://canadapharmglobal.com/# is canadian pharmacy legit

india pharmacy: india pharmacy mail order – India Pharm Global

indian pharmacy online India Pharm Global India Pharm Global

recommended canadian pharmacies: best canadian pharmacy – buying from canadian pharmacies

http://indiapharmglobal.com/# world pharmacy india

canadian pharmacy king global pharmacy canada cheap canadian pharmacy

https://canadapharmglobal.com/# canada drug pharmacy

india pharmacy: India Pharm Global – India Pharm Global

India Pharm Global India Pharm Global India Pharm Global

http://canadapharmglobal.com/# maple leaf pharmacy in canada

Meds From Mexico: Meds From Mexico – Meds From Mexico

https://canadapharmglobal.shop/# cheap canadian pharmacy online

mexico drug stores pharmacies buying prescription drugs in mexico online Meds From Mexico

best india pharmacy: India Pharm Global – reputable indian online pharmacy

http://canadapharmglobal.com/# canada drugs

Papa Farma Papa Farma Papa Farma

covid test apotek: roseolje apotek – biteskinne apotek

https://svenskapharma.shop/# Svenska Pharma

https://efarmaciait.com/# 100 g in ml

farmacia online svizzera fluicondrial h 80 mg prezzo vessel compresse opinioni

Rask Apotek: lagerstatus apotek – Rask Apotek

https://papafarma.com/# Papa Farma

EFarmaciaIt EFarmaciaIt EFarmaciaIt

Rask Apotek: Rask Apotek – inhalator apotek

https://raskapotek.shop/# Rask Apotek

https://efarmaciait.com/# farmacie dottor max

http://svenskapharma.com/# Svenska Pharma

EFarmaciaIt EFarmaciaIt EFarmaciaIt

EFarmaciaIt: EFarmaciaIt – top farmacia numero di telefono

https://efarmaciait.com/# EFarmaciaIt

ШµЩЉШЇЩ„ЩЉШ© Ш§Щ„ШіЩ€ЩЉШЇ Svenska Pharma Svenska Pharma

http://papafarma.com/# Papa Farma

http://papafarma.com/# Papa Farma

samyr 400 mg nadixa crema faramcia

vitamin d3 k2 apotek: bandasje apotek – penicillin apotek

https://efarmaciait.com/# EFarmaciaIt

Svenska Pharma: Svenska Pharma – Svenska Pharma

https://svenskapharma.com/# Svenska Pharma

http://svenskapharma.com/# beställa glasögon på nätet

mejor farmacia online melatonina 5 mg opiniones elocom precio

https://papafarma.shop/# cbd x madrid

Rask Apotek Rask Apotek covid hjemmetest apotek

Papa Farma: brentan crema efectos secundarios – farmaxia

https://svenskapharma.com/# apotek express

https://raskapotek.com/# Rask Apotek

Rask Apotek Rask Apotek Rask Apotek

Rask Apotek: Rask Apotek – Rask Apotek

https://papafarma.com/# durex spain

come riconoscere farmacie online autorizzate EFarmaciaIt rad medica bologna

https://svenskapharma.com/# Svenska Pharma

https://svenskapharma.shop/# Svenska Pharma

Svenska Pharma: omeprazol 10 mg – Svenska Pharma

http://raskapotek.com/# dusjsåpe apotek

You really make it seem so easy along with your presentation but I in finding this topic to be actually something that I think I might never understand. It seems too complex and extremely huge for me. I am taking a look ahead to your next publish, I will attempt to get the hang of it!

pГҐ nett Rask Apotek Rask Apotek

PharmaJetzt Pharma Jetzt inline apotheke

https://pharmaconnectusa.shop/# Pharma Connect USA

http://pharmajetzt.com/# Pharma Jetzt

Medicijn Punt: medicijnen aanvragen apotheek – europese apotheek

pharamacie minuteur 40 secondes Pharma Confiance

https://medicijnpunt.shop/# MedicijnPunt

apotheken im internet: PharmaJetzt – schopapoteke

https://pharmaconnectusa.com/# alliance rx specialty pharmacy

apotheke nl medicatielijst apotheek Medicijn Punt

https://pharmaconnectusa.shop/# 1st rx pharmacy statesville nc

Pharma Confiance: Pharma Confiance – actualitГ©s pharmaceutiques

Pharma Connect USA online pharmacy in germany Pharma Connect USA

https://medicijnpunt.com/# apotheek online nl

https://pharmaconfiance.shop/# Pharma Confiance

pharmacy rx symbol: pharmacy global rx reviews – PharmaConnectUSA

http://pharmaconnectusa.com/# PharmaConnectUSA

Pharma Confiance Pharma Confiance gcd chaussures

I went over this website and I conceive you have a lot of good information, saved to my bookmarks (:.

http://pharmaconfiance.com/# Pharma Confiance

rx pharmacy charlotte nc PharmaConnectUSA enterprise rx pharmacy system

https://pharmajetzt.shop/# shp apotheke

http://medicijnpunt.com/# medicatie apotheker

PharmaConnectUSA: jamaica rx pharmacy – PharmaConnectUSA

daflon duree du traitement Pharma Confiance commande cialis

http://pharmajetzt.com/# PharmaJetzt

Pharma Confiance: Pharma Confiance – Pharma Confiance

Pharma Jetzt online versandapotheke billigste online apotheke

http://medicijnpunt.com/# MedicijnPunt

http://pharmaconnectusa.com/# Pharma Connect USA

med apotheek: online pharmacy nl – mijn medicijnen bestellen

PharmaJetzt Pharma Jetzt PharmaJetzt

http://pharmaconnectusa.com/# Pharma Connect USA

minuteur 40 secondes: pharmacie de la piscine – Pharma Confiance

medicijnen bestellen bij apotheek MedicijnPunt de apotheker

https://pharmajetzt.com/# Pharma Jetzt

https://pharmajetzt.com/# PharmaJetzt

MedicijnPunt: MedicijnPunt – MedicijnPunt

Medicijn Punt Medicijn Punt medicijn

https://medicijnpunt.shop/# MedicijnPunt

MedicijnPunt: apohteek – MedicijnPunt

chaussures gbb avis Pharma Confiance ketoprofene 150

https://pharmaconfiance.shop/# Pharma Confiance

MedicijnPunt: online medicijnen bestellen zonder recept – medicijnen aanvragen apotheek

https://pharmaconfiance.com/# souhaiter une bonne fin de grossesse

http://pharmaconfiance.com/# Pharma Confiance

https://medicijnpunt.shop/# online apotheek zonder recept

Pharma Connect USA: wegmans pharmacy free lipitor – Pharma Connect USA

online medicijnen bestellen online apotheker Medicijn Punt

https://medicijnpunt.shop/# online apotheken

Pharma Confiance: Pharma Confiance – Pharma Confiance

http://medicijnpunt.com/# Medicijn Punt

Pharma Confiance: pharmacie libГ©ration nice – soolantra pharmacie en ligne

https://pharmajetzt.shop/# PharmaJetzt

my pharmacy online: overseas pharmacy adipex – wegmans pharmacy online

http://pharmajetzt.com/# shopapoteke

http://medicijnpunt.com/# mijn medicijnkosten

https://pharmajetzt.shop/# PharmaJetzt

Pharma Confiance: Pharma Confiance – glutamine pharmacie

https://pharmajetzt.shop/# aptheke

Календарь огородника https://inforigin.ru .

https://medicijnpunt.com/# Medicijn Punt

Какой сегодня праздник http://istoriamashin.ru/ .

новости дня http://topoland.ru .

https://pharmaconnectusa.shop/# target pharmacy ambien

recepta online: nieuwe pharma – inloggen apotheek

https://pharmajetzt.shop/# online apotheke selbitz

https://medicijnpunt.shop/# MedicijnPunt

п»їonline apotheke: online apotheken – PharmaJetzt

Medicijn Punt: Medicijn Punt – MedicijnPunt

https://medicijnpunt.shop/# MedicijnPunt

https://medicijnpunt.shop/# online medicijnen kopen

online pharmacy delivery usa: PharmaConnectUSA – PharmaConnectUSA

https://pharmaconnectusa.shop/# Pharma Connect USA

apotheke medikamente: PharmaJetzt – PharmaJetzt

https://pharmaconfiance.shop/# Pharma Confiance

https://pharmaconnectusa.com/# 24 store pharmacy

pharmacie avenue de france Pharma Confiance Pharma Confiance

PharmaConnectUSA: online pharmacy cash on delivery – fry’s food store pharmacy

apotheken nederland: online medicijnen bestellen met recept – viata online apotheek

https://pharmajetzt.com/# PharmaJetzt

PharmaJetzt bei apotheke bestellen shop apoth

Pharma Confiance: the pharmacie – Pharma Confiance

http://pharmaconnectusa.com/# Pharma Connect USA

https://pharmaconfiance.shop/# médicament le plus cher en pharmacie

Pharma Connect USA: people’s pharmacy wellbutrin xl – Pharma Connect USA

apotheke auf rechnung bestellen shop apotheke versandkostenfrei internetapotheken preisvergleich

dragon casino http://casinosdragonslots.eu .

https://pharmaconnectusa.com/# indian pharmacy percocet

inline apotheke: Pharma Jetzt – medikamente bestellen ohne rezept

Can I just say what a relief to find someone who actually knows what theyre talking about on the internet. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I cant believe youre not more popular because you definitely have the gift.

https://medicijnpunt.com/# beste online apotheek

the pokies net 101 the pokies net 101 .

europese apotheek medicijne apteka nl

protonix pharmacy: pharmaceuticals online australia – pharmacy programs online

https://pharmaconnectusa.com/# azithromycin online pharmacy no prescription

thepokies net106 thepokies net106 .

MedicijnPunt: Medicijn Punt – apotheek bestellen

Pharma Connect USA metoprolol people’s pharmacy PharmaConnectUSA

https://pharmajetzt.shop/# Pharma Jetzt

http://pharmaconfiance.com/# ketoprofene comment le prendre

https://pharmaconfiance.com/# meilleur parapharmacie en ligne

apotheken: online medikamente bestellen – shop apotheje

Pharma Connect USA good rx pharmacy discount card viagra xlpharmacy

MedicijnPunt: digitale apotheek – apteka internetowa nl

https://medicijnpunt.com/# Medicijn Punt

https://pharmaconfiance.shop/# tadalafil effet

PharmaJetzt Pharma Jetzt liefer apotheke

meilleur centre anti-migraine lyon: test du verre d’eau candidose – dieux skin france

Perfectly pent articles, thanks for information .

https://pharmaconnectusa.shop/# target pharmacy lexapro price

apotheke shop online: medikament online bestellen – Pharma Jetzt

canadian pharmacy checker canada drugs reviews online canadian pharmacy

https://indimedsdirect.com/# pharmacy website india

https://canrxdirect.com/# ordering drugs from canada

buying from online mexican pharmacy: TijuanaMeds – TijuanaMeds

cheap canadian pharmacy online drugs from canada canadian online drugs

http://canrxdirect.com/# best mail order pharmacy canada

best canadian pharmacy to order from: CanRx Direct – buy prescription drugs from canada cheap

mexican drugstore online TijuanaMeds TijuanaMeds

https://tijuanameds.com/# medication from mexico pharmacy

http://canrxdirect.com/# pharmacy canadian superstore

http://tijuanameds.com/# TijuanaMeds

https://canrxdirect.shop/# canadianpharmacyworld com

mexican rx online mexico drug stores pharmacies TijuanaMeds

https://canrxdirect.shop/# best canadian pharmacy online

iflow коммутатор https://www.citadel-trade.ru .

https://canrxdirect.shop/# canadian pharmacy 24h com

электрические гардины elektrokarniz90.ru .

best canadian pharmacy canadian pharmacy 1 internet online drugstore canadian pharmacy no rx needed

рулонные шторы автоматические купить https://elektricheskie-rulonnye-shtory99.ru .

электрические рулонные шторы купить москва rulonnye-shtory-s-elektroprivodom15.ru .

https://canrxdirect.com/# best canadian online pharmacy

TijuanaMeds TijuanaMeds TijuanaMeds

https://football-ball-eg.com/d8a5d8b9d8a7d8afd8a9-d8a8d986d8a7d8a1-d988d8a7d987d8aad985d8a7d985-d8b3d8b9d988d8afd98a-d98ad988d986d8a7d98ad8aad8af-d98ad8add8afd8af/

https://nike-football-shoes.com/d8aad8a7d985d8b1-d985d8b5d8b7d981d989-d985d988d982d981-d8a7d984d8a5d8b3d985d8a7d8b9d98ad984d98a-d8b5d8b9d8a8-d988d984d8a7d8b9d8a8/

IndiMeds Direct: IndiMeds Direct – IndiMeds Direct

https://xi744q4s.com/sao-paulo-goleia-mirassol-por-4-a-1-no-campeonato-paulista/

https://canrxdirect.shop/# canadian pharmacy mall

https://indimedsdirect.com/# online shopping pharmacy india

https://france-football-eg.com/d985d8afd8b1d8a8-d8a7d984d8a3d987d984d98a-d983d8a3d8b3-d8a7d984d8a3d985d98ad8b1-d8aad8add8af-d8acd8afd98ad8af-d8a8d8a7d984d986d8b3d8a8/

https://flamesbet-br.com/

canada pharmacy 24h canada drugs prescription drugs canada buy online

https://football-today-eg.com/d985d986d987d985-d986d8acd985-d8a8d8b1d8b4d984d988d986d8a9-d8a5d8b9d984d8a7d986-d8a7d984d985d8b1d8b4d991d8add98ad986-d984d8acd8a7d8a6/

buy medicines online in india: india pharmacy mail order – IndiMeds Direct

https://canrxdirect.com/# canadian pharmacy 24h com safe

https://football-scores-eg.com/d8b9d988d8afd8a9-d983d988d8b1d8aad988d8a7-d8aad98fd8b4d8b9d984-d8a3d8b2d985d8a9-d8add8a7d8b1d8b3-d8a8d984d8acd98ad983d8a7-d98ad98fd8b9/

https://hulk-footballer.com/d981d98ad8afd98ad988-d8a8d983d8b9d8a8-d8b1d8a7d8a6d8b9-d985d8a7d8b1d983d988d8b3-d8aad988d8b1d8a7d985-d98ad8b3d8acd984-d987d8afd981/

https://play-football-eg.com/d8add983d985-d985d8a8d8a7d8b1d8a7d8a9-d8a7d984d8a3d987d984d98a-d988d8add8b1d8b3-d8a7d984d8add8afd988d8af-d981d98a-d8a7d984d8afd988d8b1/

target pharmacy online refills: RxFree Meds – RxFree Meds

RxFree Meds compounding pharmacy synthroid RxFree Meds

https://football-prediction-eg.com/d8b9d8afd984d98a-d8a7d984d982d98ad8b9d98a-d8a8d98ad8b1d8a7d985d98ad8afd8b2-d982d8b1d98ad8a8-d985d986-d984d982d8a8-d8a7d984d8afd988d8b1/

https://fifa-football-eg.com/d8a8d8a7d984d8b5d988d8b1-d985d98ad984d8a7d986-d98ad8b5d8a7d984d8ad-d8acd985d8a7d987d98ad8b1d987-d8a8d8b3d8add982-d8a3d988d8afd98ad986/

http://rxfreemeds.com/# Frumil

http://enclomiphenebestprice.com/# enclomiphene for men

farmacis online: Farmacia Asequible – Farmacia Asequible

http://rxfreemeds.com/# Amaryl

enclomiphene for men enclomiphene for sale enclomiphene for sale

https://football-field-eg.com/d981d98ad8afd98ad988-d8b9d8a8d8af-d8a7d984d984d987-d8a7d984d8b3d8b9d98ad8af-d98ad8b3d8acd984-d987d8afd981-d8a7d984d8b2d985d8a7d984d983/

https://france-football-eg.com/d8bad98ad8a7d8a8d8a7d8aa-d8a8d8b1d8b4d984d988d986d8a9-d8a3d985d8a7d985-d8a5d986d8aad8b1-d985d98ad984d8a7d986-d981d98a-d986d8b5d981-d986/

https://ct4ot3lu.com/voce-poderia-especificar-o-ano-da-copa-do-brasil-que-voce-esta-se-referindo/

Farmacia Asequible: Farmacia Asequible – farmacia. com

Farmacia Asequible Farmacia Asequible Farmacia Asequible

https://farmaciaasequible.com/# viagra barcelona

https://rxfreemeds.shop/# metoprolol people’s pharmacy

https://117stb91.com/flamengo-estreia-no-campeonato-carioca-com-derrota-para-o-boavista-e-publico-de-apenas-3-000-pessoas/

https://97ui8ahx.com/o-brasil-tem-5-titulos-de-copa-do-mundo-as-conquistas-ocorreram-nos-anos-de-1958-1962-1970-1994-e-2002/

https://football-today-eg.com/d981d8ae-d8a7d984d988d8a7d982d8b9d98ad8a9-d987d984-d98ad985d986d8ad-d8afd98ad983d988-d8b1d98ad8a7d984-d985d8afd8b1d98ad8af-d981d8b1/

https://yalla-german.com/d8a3d8add985d8af-d8b3d8a7d984d985-d98ad8add8b3d985-d8a7d984d8acd8afd984-d8add988d984-d8b1d8bad8a8d8a9-d8b2d98ad8b2d988-d981d98a-d8a7d984/

https://2zgvsga3.com/o-proximo-jogo-do-corinthians-na-copa-do-brasil-e-contra-o-botafogo-no-dia-23-de-abril-as-21h30-no-estadio-nilton-santos-no-rio-de-janeiro-a-partida-e-valida-pelas-quartas-de-final-da-competicao/

https://sdnr1vf7.com/qual-e-a-data-do-proximo-jogo-do-brasil-na-copa-america/

https://yalla-ludo.com/d988d988d984d981d8b1d987d8a7d985d8a8d8aad988d986-d98ad981d986d8af-d8a3d986d8a8d8a7d8a1-d8a7d984d8a7d987d8aad985d8a7d985-d8a7d984d8b3/

https://ct4ot3lu.com/nao-tenho-essa-informacao/

enclomiphene citrate: enclomiphene for men – buy enclomiphene online

https://ow9z0rm9.com/onde-assistir-ao-jogo-do-atletico-mineiro-pela-copa-do-brasil/

Farmacia Asequible farmacias on line Farmacia Asequible

https://rxfreemeds.shop/# RxFree Meds

https://gvxtv90t.com/onde-assistir-paysandu-x-remo-em-2024/

https://mig8-vn.com/mig8-f09fa7a7-mig8-hoan-tra-20-khong-gioi-han-so-tien-nap/

https://yalla-live-pro.com/d8a7d984d985d8a8d8a7d8b1d8a7d8a9-11-d8b7d984d8a8-d8acd8afd98ad8af-d985d986-d8a7d984d8a7d8aad8add8a7d8af-d982d8a8d984-d985d988d982d8b9/

https://wmzmb68m.com/onde-assistir-real-madrid-x-barcelona/

https://american-football-eg.com/d8aad8b4d983d98ad984-d986d8a7d986d8aa-d8a3d985d8a7d985-d8a8d8a7d8b1d98ad8b3-d8b3d8a7d986-d8acd98ad8b1d985d8a7d986-d981d98a-d8a7d984d8af/

https://football-strike.com/d981d98ad8afd98ad988-d987d8a7d984d8a7d986d8af-d98ad8b3d8acd984-d987d8afd981-d985d8a7d986d8b4d8b3d8aad8b1-d8b3d98ad8aad98a-d8a7d984d8a3/

https://football-boots-eg.com/d984d8a7d8b9d8a8-d8aad8b4d98ad984d8b3d98a-d8abd984d8a7d8abd98ad8a9-d984d98ad8acd98ad8a7-d988d8a7d8b1d8b3d988-d984d986-d8aad983d988d986/

enclomiphene buy: enclomiphene testosterone – enclomiphene citrate

griseofulvin online pharmacy RxFree Meds pharmacy loratadine

https://enclomiphenebestprice.com/# enclomiphene price

https://enclomiphenebestprice.com/# enclomiphene for sale

https://obabet-br.com/descubra-as-estrategias-secretas-para-obter-lucro-na-obabet/

https://football-ball-eg.com/d983d988d985d8a8d8a7d986d98a-d8a8d8b9d8af-d8aad988d8afd98ad8b9-d8afd988d8b1d98a-d8a7d984d8a3d8a8d8b7d8a7d984-d8a3d985d8a7d985d986d8a7/

RxFree Meds: RxFree Meds – magellan rx pharmacy help desk

https://r0qpem35.com/category/competicoes/

RxFree Meds RxFree Meds RxFree Meds

https://football-pitch-eg.com/d985d988d8b9d8af-d985d8a8d8a7d8b1d8a7d8a9-d8a7d984d8a3d987d984d98a-d8a7d984d982d8a7d8afd985d8a9-d8a8d8b9d8af-d8a7d984d981d988d8b2-d8b9/

https://farmaciaasequible.com/# productos farmacéuticos

Discover how it works https://ks2752.com/wtlid/68d347396458/

See the full details https://124678873.2nc0izzo.com

Check this one out https://aa2509.com/cgz463cebupgtqqnl1tu1w67s6tpd0ru/

Check the new features here https://bg7567.com/dn4qa/57f008999853/

enclomiphene price: enclomiphene – buy enclomiphene online

RxFree Meds periactin online pharmacy no prescription RxFree Meds

Browse through here https://qf3628.com/1185177355755156336723379925415772385545761956295/

See how it works https://yy1496.com/2l954pnwvue7cl32bbhjwogco0fil2/

Try this one out https://dm4237.com/16-06-2025/26587623832846431862694462974216243617717539887121/

Check the new features here https://hu8272.com/b8ohnj5eyj3n4r96hznrz0v4x9kec935dfjbatk2t40g69vhy6o55vmju1t14morsvxumavsvsbucks-list.html

https://rxfreemeds.com/# ketoconazole pharmacy

Explore new content https://117stb91.com/voce-esta-se-referindo-ao-sorteio-dos-grupos-ou-a-alguma-outra-fase-especifica-da-copa-do-brasil-2024/

Check out the latest update https://213gvd.com/pibmsjbb-06-2025/

mexico pharmacy accutane: RxFree Meds – RxFree Meds

farmacia 24 valencia viagra spania Farmacia Asequible

Check the info here https://cs9526.com/

Click to find out more https://y8.fu9923.com

Check out the information https://ws5266.com?casino=zls

Read all about it https://zs8829.com?cassino=fphzw

Visit this page https://bg7567.com/xfl8-835

http://farmaciaasequible.com/# mejor crema de pies ocu

Read more https://qjnw.op5927.com

Explore this topic https://tk2735.com/u/62b390496033/

enclomiphene for men enclomiphene price enclomiphene for men

Take a look at this page https://957nbg.com/29yvm8qtpxg0ddgtsirf3b5uregzs7ughg312htw86/268619148935336855965125163263636811735831946/

Explore more https://g8pn.hs9693.com

herbals: cefixime online pharmacy – pharmacy rx one review

Check the info here https://7s3ey5.tf2775.com

https://farmaciaasequible.com/# dis farma

металлические значки на заказ с логотипом https://znacki-na-zakaz.ru .

профессиональные прогнозы на спорт http://www.kompyuternye-prognozy-na-futbol1.ru/ .

enclomiphene best price buy enclomiphene online enclomiphene

Visit this link https://aa2259.com/サッカー したらば-2025-06-16/71d0799921/

Find out how to do it https://zvemi.ww6678.com

Learn more about it here https://lqq6582.com/hockey-betting-predictions-2-2

Explore the options here https://tk5759.com/r/53b60899338/

enclomiphene for sale: enclomiphene for sale – enclomiphene for sale

bupropion target pharmacy RxFree Meds pharmacy viagra price

Don’t miss out, click here https://cs9526.com?slot=g

http://enclomiphenebestprice.com/# enclomiphene

Want more info? Click here https://cc9521.com?slot=qmf

enclomiphene online enclomiphene buy enclomiphene price

Visit for more details https://fu9934.com/06-2025/72e09699831/

Discover new info here https://zstk68.com/o14l3e6p-83f299914/

Visit the site https://s8lr6o2mkd.yx6374.com

Click here https://tp92523.com?cassino=vr

RxFree Meds: neurontin pharmacy assistance – RxFree Meds

framacias Farmacia Asequible para farmacia

http://farmaciaasequible.com/# Farmacia Asequible

farmacia de guardia en vigo hoy Farmacia Asequible Farmacia Asequible

enclomiphene citrate: enclomiphene citrate – enclomiphene online

enclomiphene best price enclomiphene citrate enclomiphene for sale

mexico pharmacy cialis: RxFree Meds – RxFree Meds

lubricante durex opiniones farmacia online el punto opiniones Farmacia Asequible

самые точные прогнозы на футбол самые точные прогнозы на футбол .

прогноз на хоккей в прогнозе http://luchshie-prognozy-na-khokkej.ru/ .

imiquimod cream pharmacy RxFree Meds isotretinoin prices pharmacy

singulair pharmacy assistance: RxFree Meds – Webseite

https://enclomiphenebestprice.shop/# enclomiphene for sale

buy enclomiphene online buy enclomiphene online enclomiphene testosterone

Farmacia Asequible Farmacia Asequible Farmacia Asequible

enclomiphene best price: enclomiphene testosterone – enclomiphene online

mostbet az bonusları http://mostbet3041.ru/

enclomiphene enclomiphene enclomiphene online

RxFree Meds: RxFree Meds – RxFree Meds

generic cialis best pharmacy ED Trial Pack u s online pharmacy

https://rxfreemeds.com/# RxFree Meds

RxFree Meds: cheapest viagra online pharmacy – RxFree Meds

RxFree Meds RxFree Meds RxFree Meds

купить айфон питер http://kupit-ajfon-cs.ru .

farmacia la dehesa: farmacia sevilla cerca de mi – ffarmacia

enclomiphene for sale enclomiphene online enclomiphene best price

enclomiphene: enclomiphene online – enclomiphene for sale

https://farmaciaasequible.shop/# farmacias mas baratas online

enclomiphene online enclomiphene price enclomiphene online

enclomiphene buy: enclomiphene for men – enclomiphene citrate

wartec solucion diprogenta para hongos farmacias 24 horas alicante

http://farmaciaasequible.com/# Farmacia Asequible

community pharmacy audit methotrexate: online pharmacy klonopin – xenical pharmacy direct

купить iphone 11 недорого купить iphone 11 недорого .

http://farmaciaasequible.com/# mycostatin embarazo

RxFree Meds RxFree Meds neoral pharmacy

https://farmaciaasequible.shop/# Farmacia Asequible

RxFree Meds: buy viagra pharmacy online – baclofen pharmacy

top online pharmacy india online pharmacy india reputable indian pharmacies

mostbet kartla depozit http://www.mostbet4048.ru

https://indomedsusa.com/# IndoMeds USA

http://meximedsexpress.com/# MexiMeds Express

canadianpharmacy com: MediSmart Pharmacy – canada drugs online review

http://meximedsexpress.com/# mexican drugstore online

IndoMeds USA Online medicine home delivery indian pharmacy paypal

MexiMeds Express: MexiMeds Express – mexican rx online

https://indomedsusa.shop/# reputable indian pharmacies

us pharmacy viagra online MediSmart Pharmacy Cephalexin

https://meximedsexpress.com/# MexiMeds Express

электронный карниз для штор http://www.elektrokarnizy10.ru .

http://medismartpharmacy.com/# do pharmacy sell viagra

1win token price 1win3027.com

best canadian online pharmacy: pharmacy cost of cymbalta – best canadian online pharmacy reviews

IndoMeds USA best india pharmacy IndoMeds USA

https://medismartpharmacy.shop/# rx city pharmacy auburn ny

https://medismartpharmacy.com/# manor pharmacy store locator

canada pharmacy online: MediSmart Pharmacy – best canadian online pharmacy

cheapest online pharmacy india IndoMeds USA india pharmacy

https://meximedsexpress.com/# buying prescription drugs in mexico

online shopping pharmacy india: indianpharmacy com – online pharmacy india

IndoMeds USA IndoMeds USA IndoMeds USA

http://indomedsusa.com/# top online pharmacy india

https://meximedsexpress.shop/# MexiMeds Express

reliable canadian pharmacy reviews: online pharmacy greece – buy drugs from canada

generic accutane online pharmacy MediSmart Pharmacy navarro discount pharmacy store locator

https://medismartpharmacy.com/# simvastatin target pharmacy

MexiMeds Express: mexican online pharmacies prescription drugs – MexiMeds Express

MexiMeds Express reputable mexican pharmacies online reputable mexican pharmacies online

https://meximedsexpress.com/# buying prescription drugs in mexico

http://meximedsexpress.com/# MexiMeds Express

best online pharmacy india: IndoMeds USA – IndoMeds USA

world pharmacy india IndoMeds USA IndoMeds USA

https://medismartpharmacy.shop/# pharmseo24.com

Купить паркетную доску оптом https://parketnay-doska2.ru .

IndoMeds USA: india online pharmacy – IndoMeds USA

http://indomedsusa.com/# IndoMeds USA

viagra australia pharmacy giant food store pharmacy hours pharmacy viagra no prescription

http://meximedsexpress.com/# MexiMeds Express

Online medicine order: indian pharmacies safe – IndoMeds USA

https://medismartpharmacy.com/# Cialis Oral Jelly

cheapest online pharmacy india india online pharmacy IndoMeds USA

http://medismartpharmacy.com/# online pharmacy tegretol xr

medicine in mexico pharmacies mexican border pharmacies shipping to usa buying prescription drugs in mexico

http://meximedsexpress.com/# MexiMeds Express

IndoMeds USA IndoMeds USA reputable indian online pharmacy

https://meximedsexpress.com/# MexiMeds Express

https://medismartpharmacy.com/# advair diskus online pharmacy

propecia at boots pharmacy MediSmart Pharmacy best drug store mascara

https://indomedsusa.shop/# IndoMeds USA

top online pharmacy 247 MediSmart Pharmacy turkish pharmacy online

https://indomedsusa.com/# Online medicine order

https://meximedsexpress.shop/# mexican drugstore online

mexican online pharmacies prescription drugs mexico drug stores pharmacies MexiMeds Express

http://medismartpharmacy.com/# boots pharmacy uk viagra

IndoMeds USA IndoMeds USA IndoMeds USA

https://ordinasalute.shop/# augmentin 140 ml

http://clinicagaleno.com/# comprar orfidal sin receta online

crema antibiotica per acne OrdinaSalute procoralan 5 mg prezzo

http://ordinasalute.com/# fenextra 400 prezzo

купить узи аппарат цена купить узи аппарат цена .

http://ordinasalute.com/# fosfomicina bustine prezzo

saxenda sans ordonnance en pharmacie mГ©dicament anti stress sur ordonnance finasteride gel

https://clinicagaleno.shop/# comprar sulpirida sin receta

https://pharmadirecte.shop/# crème anesthésiante tatouage en pharmacie sans ordonnance

comprar cialis en madrid sin receta Clinica Galeno mascaras ffp2 farmacia online

http://clinicagaleno.com/# fp farmacia y parafarmacia online homologado

deursil 300 acquisto online atrocom 30 ovuli miglior prezzo froben sciroppo 5 mg

https://ordinasalute.shop/# mederma gel cicatrici

https://ordinasalute.com/# senshio 60 mg miglior prezzo

cialis achat pharmacie en ligne sildenafil en pharmacie sans ordonnance spedra sans ordonnance en pharmacie

farmacia online italia Clinica Galeno farmacia charro comprar online

1win partner https://www.1win3048.com

http://ordinasalute.com/# gonal f 900 prezzo

I think other website proprietors should take this internet site as an model, very clean and excellent user genial style.

https://clinicagaleno.com/# salbutamol se puede comprar sin receta

progestГ©rone naturelle en pharmacie sans ordonnance pharmacie sans ordonnance paris cialis sans ordonnance pharmacie france

https://clinicagaleno.shop/# compra online farmacia central oeste

apotek hГҐltagning: Snabb Apoteket – menstrosa apotek

https://zorgpakket.com/# apotheek spanje online

medicijn online: online pharmacy netherlands – bestellen medicijnen

receptbelagda vГ¤rktabletter mot ryggvГ¤rk: SnabbApoteket – tamponger bГ¤st i test

https://zorgpakket.com/# onlineapotheek

vitaminer billigt: tumstГ¶d apotek – apotek pГҐ nГ¤tet

прогнозы на спорт прогнозы на спорт .

urinvГ¤gsinfektion apotek: SnabbApoteket – gratis lГ¤kemedel barn

http://zorgpakket.com/# п»їmedicijnen bestellen

medicijnen online bestellen: online apotheek zonder recept ervaringen – apotheek medicijnen bestellen

gyldig legitimasjon apotek apotek ГҐpent nГҐ shampoo mot flass apotek

jour apotek: med – henna hГҐrfГ¤rg apotek

https://expresscarerx.online/# concerta online pharmacy

global pharmacy viagra: people pharmacy zocor – ExpressCareRx

viagra uk pharmacy: online pharmacy china – online pharmacy glucophage

IndiaMedsHub: mail order pharmacy india – top online pharmacy india

https://expresscarerx.online/# ExpressCareRx

buy cheap meds from a mexican pharmacy: mexico pharmacy – real mexican pharmacy USA shipping

online pharmacy accutane no prescription: diovan online pharmacy – ExpressCareRx

IndiaMedsHub: top online pharmacy india – IndiaMedsHub

http://medimexicorx.com/# mexican border pharmacies shipping to usa

ExpressCareRx: Diltiazem – propecia pharmacy prices

tadalafil mexico pharmacy: semaglutide mexico price – buy meds from mexican pharmacy

IndiaMedsHub: IndiaMedsHub – india pharmacy mail order

изготовление деревянных лестниц в москве изготовление деревянных лестниц в москве .

buy viagra from mexican pharmacy: safe mexican online pharmacy – tadalafil mexico pharmacy

https://expresscarerx.online/# cialis best online pharmacy

top online pharmacy india: buy medicines online in india – IndiaMedsHub

health partners online pharmacy: cheap pharmacy cialis – ExpressCareRx

Online medicine order: IndiaMedsHub – IndiaMedsHub

best drug store mascara: ExpressCareRx – minocycline pharmacy price

https://expresscarerx.org/# is rx pharmacy coupons legit

online mexico pharmacy USA: rybelsus from mexican pharmacy – MediMexicoRx

cheap Propecia Canada: Propecia for hair loss online – cheap Propecia Canada

cost of propecia no prescription: Finasteride From Canada – generic Finasteride without prescription

purchase generic Zoloft online discreetly: buy Zoloft online without prescription USA – Zoloft Company

lexapro pills for sale: Lexapro for depression online – Lexapro for depression online

https://tadalafilfromindia.shop/# generic Cialis from India

generic Finasteride without prescription: Finasteride From Canada – Propecia for hair loss online

Cialis without prescription: buy tadalafil online paypal – Tadalafil From India

ai mental health app ai mental health app .

order isotretinoin from Canada to US: purchase generic Accutane online discreetly – purchase generic Accutane online discreetly

sertraline online: sertraline online – sertraline online

https://finasteridefromcanada.com/# Propecia for hair loss online

You can rest assured that Betfair is among the outright most trustworthy platforms when it comes to playing online casino games for real money. While every casino game ever created has a house edge to some degree, whenever you win on blackjack, roulette, slots, progressive jackpots, or any other game, you’ll be able to keep those funds for yourself. Buffalo King Megaways has amazing features that increase the fun of playing it tremendously. They may not be too fancy but they are certainly rewarding: To claim this welcome offer, players must create an account with us and then make a qualifying first deposit of at least £20. After completing these steps, players are eligible to claim 50 Extra Spins on the immensely popular Big Bass Bonanza slot game (Full T&Cs apply). You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page.

https://hitvapks.com/reaching-the-mines-jackpot-its-not-just-luck/

Connect with us Certainly! Savage Buffalo Spirit Megaways™ is fully optimized for mobile play, allowing for a fluid gaming experience on both smartphones and desktops. Enjoy this dynamic Megaways™ slot wherever you are. Play’n GO takes games portfolio live with the Goldrush Group in South Africa We offer the most popular games at the click of a button, providing an authentic casino experience from the comfort of your home. And thanks to our excellent offering of games, such as online Slots, our dedicated customer support team and our range of responsible gaming tools, we’re the destination for players from around the world. almighty buffalo megaways | New: Best Progressive Slots & Jackpots for US Players – June A player can buy Chance x2 in the main game. It slightly increases the bet and gives the player more chances to hit free spins.

Cialis without prescription: Cialis without prescription – buy Cialis online cheap

generic Finasteride without prescription: cheap Propecia Canada – generic Finasteride without prescription

buy Cialis online cheap: tadalafil online no rx – tadalafil online no rx

Some truly quality posts on this internet site, saved to favorites.

Lexapro for depression online: lexapro 10mg – Lexapro for depression online

https://tadalafilfromindia.shop/# Cialis without prescription

purchase generic Zoloft online discreetly: cheap Zoloft – purchase generic Zoloft online discreetly

generic Finasteride without prescription: Propecia for hair loss online – generic Finasteride without prescription

I will immediately grab your rss feed as I can not find your email subscription link or newsletter service. Do you have any? Please let me know in order that I could subscribe. Thanks.

Propecia for hair loss online: Propecia for hair loss online – get generic propecia tablets

Hey There. I discovered your weblog the usage of msn. That is an extremely smartly written article. I’ll be sure to bookmark it and return to read extra of your useful info. Thanks for the post. I’ll definitely comeback.

isotretinoin online: Isotretinoin From Canada – USA-safe Accutane sourcing

https://finasteridefromcanada.com/# generic Finasteride without prescription

Lexapro for depression online: lexapro 5mg – Lexapro for depression online

Greetings! Very helpful advice on this article! It is the little changes that make the biggest changes. Thanks a lot for sharing!

винлайн бонус при регистрации без депозита winlayne-fribet1.ru .

Кварц виниловые полы http://www.napolnaya-probka1.ru/ .

cheap Cialis Canada: tadalafil online no rx – buy Cialis online cheap

1win պաշտոնական 1win պաշտոնական

where can you buy lexapro: lexapro 50 mg – Lexapro for depression online

buying generic propecia: Finasteride From Canada – Finasteride From Canada

mostbet mostbet4084.ru

generic Finasteride without prescription: buy propecia – Propecia for hair loss online

Accutane for sale: purchase generic Accutane online discreetly – USA-safe Accutane sourcing

generic Cialis from India: Tadalafil From India – Tadalafil From India

Tadalafil From India: buy Cialis online cheap – cheap Cialis Canada

generic Finasteride without prescription: Finasteride From Canada – Propecia for hair loss online

buy Cialis online cheap: tadalafil online no rx – generic Cialis from India

https://tadalafilfromindia.shop/# Cialis without prescription

Zoloft online pharmacy USA: Zoloft Company – buy Zoloft online without prescription USA

cheap Accutane: Isotretinoin From Canada – generic isotretinoin

https://isotretinoinfromcanada.com/# cheap Accutane

cheapest price for lexapro: lexapro 20 mg discount – Lexapro for depression online

Finasteride From Canada: Finasteride From Canada – generic Finasteride without prescription

https://finasteridefromcanada.shop/# cheap Propecia Canada

how to get cheap clomid without a prescription: Clomid Hub Pharmacy – Clomid Hub

Clomid Hub: Clomid Hub – Clomid Hub Pharmacy

http://reliefmedsusa.com/# Relief Meds USA

ReliefMeds USA: prednisone medication – Relief Meds USA

NeuroRelief Rx: NeuroRelief Rx – NeuroRelief Rx

Clomid Hub: generic clomid price – Clomid Hub Pharmacy

https://neuroreliefrx.shop/# NeuroRelief Rx

Clear Meds Direct: Clear Meds Direct – low-cost antibiotics delivered in USA

order Provigil without prescription: where to buy Modafinil legally in the US – Modafinil for focus and productivity

average cost of generic prednisone: Relief Meds USA – how much is prednisone 5mg

can you buy amoxicillin over the counter in canada: amoxicillin online no prescription – ClearMeds Direct

order corticosteroids without prescription: Relief Meds USA – prednisone 5 mg tablet price

https://neuroreliefrx.com/# kribbeln durch gabapentin

low-cost antibiotics delivered in USA: amoxicillin 500 mg online – Clear Meds Direct

Modafinil for ADHD and narcolepsy: Modafinil for ADHD and narcolepsy – smart drugs online US pharmacy

amoxicillin 500mg price: can you purchase amoxicillin online – order amoxicillin without prescription

Relief Meds USA: Relief Meds USA – ReliefMeds USA

http://neuroreliefrx.com/# NeuroRelief Rx

NeuroRelief Rx: NeuroRelief Rx – gabapentin for tooth extraction pain

prednisone 20mg capsule: ReliefMeds USA – ReliefMeds USA

order corticosteroids without prescription: prednisone drug costs – Relief Meds USA

order corticosteroids without prescription: order corticosteroids without prescription – anti-inflammatory steroids online

http://wakemedsrx.com/# safe Provigil online delivery service

buy 40 mg prednisone: ReliefMeds USA – anti-inflammatory steroids online

prednisone capsules: anti-inflammatory steroids online – anti-inflammatory steroids online

low-cost antibiotics delivered in USA: order amoxicillin without prescription – Clear Meds Direct

Relief Meds USA: ReliefMeds USA – prednisone 20 mg generic

http://clomidhubpharmacy.com/# Clomid Hub Pharmacy

low-cost antibiotics delivered in USA: Clear Meds Direct – order amoxicillin without prescription

ReliefMeds USA: 50mg prednisone tablet – ReliefMeds USA

WakeMeds RX: smart drugs online US pharmacy – order Provigil without prescription

amoxicillin 500mg buy online uk: Clear Meds Direct – amoxicillin 250 mg

IndiGenix Pharmacy: IndiGenix Pharmacy – pharmacy website india

https://canadrxnexus.com/# my canadian pharmacy review

mexican online pharmacies prescription drugs: MexiCare Rx Hub – MexiCare Rx Hub

adderall canadian pharmacy: CanadRx Nexus – canadian online pharmacy

MexiCare Rx Hub: MexiCare Rx Hub – gabapentin mexican pharmacy

You made some decent points there. I appeared on the web for the problem and found most people will go together with with your website.

Online medicine order: IndiGenix Pharmacy – indian pharmacy

IndiGenix Pharmacy: indian pharmacy paypal – IndiGenix Pharmacy

indianpharmacy com: cheapest online pharmacy india – Online medicine order

https://indigenixpharm.shop/# IndiGenix Pharmacy

MexiCare Rx Hub: MexiCare Rx Hub – mexican pharmaceuticals online

reputable indian pharmacies: pharmacy website india – reputable indian pharmacies

Online medicine home delivery: india online pharmacy – IndiGenix Pharmacy

MexiCare Rx Hub: MexiCare Rx Hub – MexiCare Rx Hub

CanadRx Nexus: CanadRx Nexus – CanadRx Nexus

MexiCare Rx Hub: MexiCare Rx Hub – best mexican pharmacy online

https://mexicarerxhub.shop/# MexiCare Rx Hub

canadapharmacyonline legit: canadian pharmacy 365 – canadian drug prices

MexiCare Rx Hub: online mexico pharmacy USA – MexiCare Rx Hub

CanadRx Nexus: CanadRx Nexus – CanadRx Nexus

IndiGenix Pharmacy: indian pharmacy – reputable indian pharmacies

canadian drug: the canadian pharmacy – canada cloud pharmacy

CanadRx Nexus: CanadRx Nexus – CanadRx Nexus

Interesting blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple adjustements would really make my blog stand out. Please let me know where you got your design. Thanks a lot

http://canadrxnexus.com/# best canadian pharmacy online

MexiCare Rx Hub: MexiCare Rx Hub – MexiCare Rx Hub

trusted mexican pharmacy: MexiCare Rx Hub – safe mexican online pharmacy

canadian pharmacy tampa: canadian pharmacy no scripts – canada drugs online reviews

IndiGenix Pharmacy: reputable indian pharmacies – top 10 online pharmacy in india

legal canadian pharmacy online: CanadRx Nexus – vipps canadian pharmacy

MexiCare Rx Hub: legit mexican pharmacy for hair loss pills – order kamagra from mexican pharmacy

винлайн акции и бонусы на сегодня винлайн акции и бонусы на сегодня .

https://indigenixpharm.com/# india pharmacy mail order

IndiGenix Pharmacy: legitimate online pharmacies india – IndiGenix Pharmacy

rybelsus from mexican pharmacy: MexiCare Rx Hub – MexiCare Rx Hub

IndiGenix Pharmacy: п»їlegitimate online pharmacies india – IndiGenix Pharmacy

buying from online mexican pharmacy: buying prescription drugs in mexico online – MexiCare Rx Hub

CanadRx Nexus: CanadRx Nexus – my canadian pharmacy rx

Online medicine home delivery: IndiGenix Pharmacy – IndiGenix Pharmacy

мелбет букмекерская контора зеркало рабочее https://melbet1035.ru

CanadRx Nexus: CanadRx Nexus – CanadRx Nexus

http://indigenixpharm.com/# IndiGenix Pharmacy

MexiCare Rx Hub: MexiCare Rx Hub – MexiCare Rx Hub

CanadRx Nexus: CanadRx Nexus – CanadRx Nexus

MexiCare Rx Hub: medication from mexico pharmacy – medicine in mexico pharmacies

can you buy ventolin over the counter in uk: AsthmaFree Pharmacy – AsthmaFree Pharmacy

FluidCare Pharmacy: lasix dosage – furosemide 100mg

https://glucosmartrx.shop/# semaglutide dosage chart

электрокарнизы в москве http://www.elektrokarniz150.ru .

semaglutide brand name: semaglutide injection site – AsthmaFree Pharmacy

ivermectin pellets for horses: IverCare Pharmacy – cattle ivermectin

rybelsus diarrhea: AsthmaFree Pharmacy – AsthmaFree Pharmacy

rybelsus discount: how long can semaglutide stay out of the fridge – semaglutide hers

https://glucosmartrx.com/# AsthmaFree Pharmacy

ventolin uk AsthmaFree Pharmacy AsthmaFree Pharmacy

AsthmaFree Pharmacy: AsthmaFree Pharmacy – AsthmaFree Pharmacy

кашпо для цветов дизайнерские кашпо для цветов дизайнерские .

lasix: buy furosemide online – FluidCare Pharmacy

oral ivermectin for scabies: how to use ivermectin pour on for cattle – IverCare Pharmacy

lasix medication: FluidCare Pharmacy – lasix tablet

online casino bonus 500% online casino bonus 500%

https://asthmafreepharmacy.shop/# ventolin inhalador

AsthmaFree Pharmacy: cheap ventolin inhalers – ventolin over the counter australia

AsthmaFree Pharmacy: AsthmaFree Pharmacy – AsthmaFree Pharmacy

mostbet ru mostbet4080.ru

best time to take semaglutide injection: AsthmaFree Pharmacy – AsthmaFree Pharmacy

FluidCare Pharmacy: FluidCare Pharmacy – FluidCare Pharmacy

https://glucosmartrx.com/# does semaglutide make you depressed

AsthmaFree Pharmacy: ventolin price – ventolin prescription

relief from muscle spasms online: safe online source for Tizanidine – order Tizanidine without prescription

semaglutide tablets rybelsus: AsthmaFree Pharmacy – what is compounded semaglutide

F*ckin’ awesome things here. I’m very glad to see your article. Thanks a lot and i’m looking forward to contact you. Will you please drop me a mail?

lasix pills: generic lasix – FluidCare Pharmacy

http://asthmafreepharmacy.com/# can you buy ventolin over the counter in uk

изящное кашпо изящное кашпо .

1win aviator strategiyasi https://www.1win3065.ru

buy Zanaflex online USA: buy Zanaflex online USA – relief from muscle spasms online

FluidCare Pharmacy: furosemida – lasix dosage

http://relaxmedsusa.com/# Zanaflex medication fast delivery

прикольные кашпо прикольные кашпо .

semaglutide before and after 3 months: AsthmaFree Pharmacy – AsthmaFree Pharmacy

lasix medication: FluidCare Pharmacy – FluidCare Pharmacy

imalishka.ru http://www.imalishka.ru .

AsthmaFree Pharmacy: ventolin sale uk – ventolin canada

AsthmaFree Pharmacy: AsthmaFree Pharmacy – albuterol ventolin

cheap muscle relaxer online USA: affordable Zanaflex online pharmacy – Zanaflex medication fast delivery

AsthmaFree Pharmacy: difference between compounded semaglutide and ozempic – rybelsus semaglutide

https://relaxmedsusa.shop/# Tizanidine 2mg 4mg tablets for sale

lasix furosemide: FluidCare Pharmacy – FluidCare Pharmacy

AsthmaFree Pharmacy: cheap ventolin uk – ventolin 4 mg tablets

FluidCare Pharmacy: FluidCare Pharmacy – FluidCare Pharmacy

1win сайт 1win сайт

Slot gacor hari ini Mandiribet login Judi online deposit pulsa

jollibet: Jollibet online sabong – jollibet casino

https://pinwinaz.pro/# Pinco kazino

Link alternatif Abutogel Jackpot togel hari ini Abutogel

кашпо оригинальное купить http://www.dizaynerskie-kashpo-rnd.ru/ .

Withdraw cepat Beta138 Live casino Indonesia Withdraw cepat Beta138

Khuy?n mai GK88: Tro choi n? hu GK88 – Slot game d?i thu?ng

Yuks?k RTP slotlar: Etibarl? onlayn kazino Az?rbaycanda – Etibarl? onlayn kazino Az?rbaycanda

https://pinwinaz.pro/# Pinco il? real pul qazan

Bandar togel resmi Indonesia Bandar togel resmi Indonesia Situs togel online terpercaya

jilwin: Jiliko bonus – Jiliko casino walang deposit bonus para sa Pinoy

Jiliko casino walang deposit bonus para sa Pinoy: Jiliko – Jiliko casino

Casino online GK88: Khuy?n mai GK88 – Khuy?n mai GK88

Swerte99 slots Swerte99 login Swerte99 online gaming Pilipinas

https://betawinindo.top/# Withdraw cepat Beta138

Kazino bonuslar? 2025 Az?rbaycan: Slot oyunlar? Pinco-da – Pinco il? real pul qazan

Slot gacor hari ini: Live casino Mandiribet – Link alternatif Mandiribet

Jackpot togel hari ini Link alternatif Abutogel Jackpot togel hari ini

Promo slot gacor hari ini: Bandar bola resmi – Beta138

Login Beta138: Situs judi resmi berlisensi – Live casino Indonesia

Dang ky GK88 Khuy?n mai GK88 Casino online GK88

Slot gacor Beta138: Bonus new member 100% Beta138 – Situs judi resmi berlisensi

https://gkwinviet.company/# GK88

актуальное зеркало бк 1win https://1win1163.ru

1vin скачать http://1win1163.ru

Bandar bola resmi Beta138 Live casino Indonesia

электрокарнизы для штор купить http://elektrokarnizy7.ru/ .

стильные горшки для цветов стильные горшки для цветов .

Qeydiyyat bonusu Pinco casino: Pinco casino mobil t?tbiq – Canl? krupyerl? oyunlar

Link alternatif Abutogel: Abutogel – Situs togel online terpercaya

электрокарнизы москва https://elektrokarniz11.ru .

заказать перепланировку http://proekt-pereplanirovki-kvartiry4.ru/ .

проектное бюро перепланировка квартиры проектное бюро перепланировка квартиры .

Yuks?k RTP slotlar Etibarl? onlayn kazino Az?rbaycanda Canl? krupyerl? oyunlar

Jiliko: Jiliko login – maglaro ng Jiliko online sa Pilipinas

https://abutowin.icu/# Situs togel online terpercaya

Swerte99 login: Swerte99 bonus – Swerte99 casino

Rut ti?n nhanh GK88 Ca cu?c tr?c tuy?n GK88 GK88

Casino online GK88: Ca cu?c tr?c tuy?n GK88 – Slot game d?i thu?ng

reputable indian online pharmacy: reputable indian pharmacies – Indian Meds One

buying viagra from pharmacy: pharmacy book store – MediDirect USA

https://indianmedsone.com/# Indian Meds One

Mexican Pharmacy Hub rybelsus from mexican pharmacy Mexican Pharmacy Hub

Mexican Pharmacy Hub: Mexican Pharmacy Hub – Mexican Pharmacy Hub

best prices on finasteride in mexico: buy kamagra oral jelly mexico – Mexican Pharmacy Hub

buy kamagra oral jelly mexico Mexican Pharmacy Hub Mexican Pharmacy Hub

https://mexicanpharmacyhub.com/# purple pharmacy mexico price list

Indian Meds One: Indian Meds One – Indian Meds One

цветочные горшки в стиле dizaynerskie-kashpo-nsk.ru .

Indian Meds One Indian Meds One Indian Meds One

tadalafil mexico pharmacy: Mexican Pharmacy Hub – prescription drugs mexico pharmacy

Mexican Pharmacy Hub: Mexican Pharmacy Hub – Mexican Pharmacy Hub

Great blog here! Also your web site loads up fast! What host are you using? Can I get your affiliate link to your host? I wish my web site loaded up as fast as yours lol

https://mexicanpharmacyhub.shop/# Mexican Pharmacy Hub

MediDirect USA uk pharmacy ventolin target pharmacy

india pharmacy Indian Meds One buy medicines online in india

https://mexicanpharmacyhub.shop/# Mexican Pharmacy Hub

Indian Meds One india pharmacy mail order top 10 online pharmacy in india

мостбет. регистрация. мостбет. регистрация.

lucky jet 1 win скачать lucky jet 1 win скачать

1win не выводит деньги 1win не выводит деньги

купить диплом реестр купить диплом реестр .

1win скачать android https://1win1173.ru/

buy medicines online in india Indian Meds One Indian Meds One

https://medidirectusa.shop/# Florinef

казино мостбет скачать http://mostbet11063.ru

умное кашпо с автополивом умное кашпо с автополивом .

I dugg some of you post as I cerebrated they were very beneficial extremely helpful

1вин бет скачать https://1win1173.ru

generic viagra 2017: SildenaPeak – viagra online from canada

https://sildenapeak.com/# viagra pills online india

ED treatment without doctor visits: Affordable sildenafil citrate tablets for men – Affordable sildenafil citrate tablets for men

SildenaPeak: buy cheap viagra generic online – viagra in mexico over the counter

https://kamameds.com/# Sildenafil oral jelly fast absorption effect

viagra 10 pills: sildenafil online in india – SildenaPeak

Sildenafil oral jelly fast absorption effect: Sildenafil oral jelly fast absorption effect – Fast-acting ED solution with discreet packaging

купить цветочный горшок кашпо http://www.dizaynerskie-kashpo-rnd.ru .

https://kamameds.shop/# Sildenafil oral jelly fast absorption effect

buy sildenafil from canada: cheap viagra 100mg tablets – sildenafil 25 mg coupon

mostbet link https://www.mostbet11072.ru

мостбет сайт вход https://mostbet11067.ru/

SildenaPeak: SildenaPeak – buy viagra over the counter australia

скачать мостбет на андроид http://mostbet11069.ru/

ставки кыргызстан http://www.mostbet11069.ru

скачать мостбет кз http://mostbet11071.ru/

http://kamameds.com/# Kamagra oral jelly USA availability

скачат мостбет https://mostbet11068.ru

Safe access to generic ED medication: Kamagra oral jelly USA availability – Men’s sexual health solutions online

скачать мостбет с официального сайта http://mostbet11071.ru/

mostbet.com skachat mostbet.com skachat

мостбет онлайн http://mostbet11067.ru/

Sildenafil oral jelly fast absorption effect: Online sources for Kamagra in the United States – Compare Kamagra with branded alternatives

мостбет войти https://mostbet11074.ru

https://kamameds.com/# Kamagra reviews from US customers

Tadalify: cialis online paypal – cialis 5mg how long does it take to work

I precisely needed to thank you so much again. I’m not certain what I would’ve used in the absence of those tips shared by you over this field. Previously it was a distressing concern in my position, but observing your expert way you managed that took me to cry over delight. I am just grateful for this advice and hope that you find out what an amazing job you are putting in teaching men and women via your blog post. I know that you’ve never come across all of us.

горшок с автополивом купить горшок с автополивом купить .

Sildenafil oral jelly fast absorption effect: Sildenafil oral jelly fast absorption effect – ED treatment without doctor visits

https://kamameds.shop/# Kamagra oral jelly USA availability

Keep functioning ,impressive job!

http://kamameds.com/# Fast-acting ED solution with discreet packaging

промокод на мелбет при регистрации http://melbet3006.com

plinko game online https://plinko3001.ru

купить диплом о высшем образовании с занесением в реестр цены купить диплом о высшем образовании с занесением в реестр цены .

https://tadalify.shop/# Tadalify

мелбет kz https://melbet3006.com/

плинко http://www.plinko3001.ru

горшки с автополивом для комнатных растений купить http://www.kashpo-s-avtopolivom-spb.ru .

https://cardiomedsexpress.shop/# CardioMeds Express

mostbet o‘zbekcha versiya http://mostbet4102.ru/

can you buy stromectol over the counter: ivermectin where to purchase – IverGrove

мостбет хумо пополнение https://www.mostbet4104.ru

canine prednisone 5mg no prescription: SteroidCare Pharmacy – 50mg prednisone tablet

мост бет mostbet4104.ru

https://cardiomedsexpress.com/# furosemide 40 mg

CardioMeds Express: furosemide 40mg – lasix 100 mg tablet

mostbet uz skachat android mostbet uz skachat android

mostbet ilova http://www.mostbet4103.ru

IverGrove: IverGrove – topical ivermectin for scabies

мостбет уз http://mostbet4105.ru/

цветочный горшок с автополивом купить https://kashpo-s-avtopolivom-spb.ru/ .

mostbet bukmekerlik http://mostbet4102.ru/

cost of clomid without insurance: FertiCare Online – FertiCare Online

order amoxicillin online: how to get amoxicillin – can i buy amoxicillin over the counter in australia

I was very pleased to find this web-site.I wanted to thanks for your time for this wonderful read!! I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you blog post.

https://ferticareonline.shop/# generic clomid without insurance

can i purchase generic clomid without prescription buy cheap clomid without prescription FertiCare Online

ivermectin stock ticker: IverGrove – ivermectin paste for humans

IverGrove IverGrove ivermectin 3 mg

farmaci senza ricetta elenco: consegna rapida e riservata kamagra – acquisto farmaci con ricetta

mostbet ilovasini yuklab olish https://mostbet4107.ru

mostbet. com https://www.mostbet4107.ru

http://pillolesubito.com/# farmacia online senza ricetta

mostbet сайт http://mostbet4106.ru/

кашпо уличные большие купить кашпо уличные большие купить .

whoah this blog is fantastic i love reading your posts. Keep up the good work! You know, lots of people are hunting around for this info, you can help them greatly.

mostbetin https://mostbet4112.ru/

https://pillolesubito.com/# comprare farmaci online all’estero

https://bharatmedsdirect.com/# india pharmacy

mostbet uz haqida mostbet uz haqida

купить свидетельство браке киев https://educ-ua1.ru .

кашпо для цветов напольное уличное купить http://www.ulichnye-kashpo-kazan.ru .

https://bharatmedsdirect.shop/# BharatMeds Direct

MapleMeds Direct: MapleMeds Direct – u s a online pharmacy

medicine store pharmacy: Aebgboype – MapleMeds Direct

https://bordermedsexpress.com/# medicine in mexico pharmacies

BorderMeds Express: mexico drug stores pharmacies – mexico drug stores pharmacies

BorderMeds Express: best online pharmacies in mexico – BorderMeds Express

http://bharatmedsdirect.com/# online pharmacy india

BorderMeds Express: BorderMeds Express – medication from mexico pharmacy

I have been browsing online more than three hours nowadays, but I by no means found any attention-grabbing article like yours. It is lovely worth sufficient for me. Personally, if all site owners and bloggers made just right content as you did, the web can be a lot more helpful than ever before.

mostbet сайт mostbet4163.ru

купить диплом с занесением в реестр в калуге купить диплом с занесением в реестр в калуге .

купить диплом легальный о высшем образовании http://www.arus-diplom33.ru .

напольные цветочные горшки купить http://kashpo-napolnoe-moskva.ru .

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your wonderful post. Also, I have shared your website in my social networks!

purple pharmacy mexico price list: mexican pharmaceuticals online – buying prescription drugs in mexico

https://1wbona.shop/# bonaslot

bonaslot: bonaslot link resmi mudah diakses – 1wbona

bonaslot login: 1wbona – bonaslot link resmi mudah diakses

https://1wstarburst.shop/# migliori casino online con Starburst

купить кашпо для цветов напольное высокое пластиковое купить кашпо для цветов напольное высокое пластиковое .

https://1win69.shop/# 1win69

промышленные трансформаторные подстанции промышленные трансформаторные подстанции .

http://1wstarburst.com/# Starburst slot online Italia

кашпо для цветов напольное высокое купить кашпо для цветов напольное высокое купить .

казино мосбет https://www.mostbet4124.ru

скачать mostbet https://mostbet4119.ru

mostbet com официальный сайт https://www.mostbet4125.ru

mostbet live http://www.mostbet4121.ru

мостбет контакты мостбет контакты

mostbet казино скачать http://mostbet4127.ru/

скачать бк осталось всего только выбрать подходящее https://mostbet4123.ru

бк мостбет https://mostbet4121.ru/

мостбет казино войти мостбет казино войти

mostbwt http://mostbet4123.ru/

мосбет скачат мосбет скачат

казино мостбет скачать http://mostbet4124.ru/

мостбет кыргызстан https://www.mostbet4122.ru

mostbet скачать на андроид http://mostbet4125.ru/

mostbet личный кабинет mostbet4126.ru

скачат мостбет скачат мостбет

напольный горшок для цветов высокий напольный горшок для цветов высокий .

mostbet uz skachat kompyuter https://www.mostbet4169.ru

мочтбет mostbet4166.ru

mostbet aviator http://mostbet4168.ru

мостбет демо игра мостбет демо игра

skachat mostbet https://mostbet4130.ru

mostbet mobil kirish uz mostbet mobil kirish uz

mostbet скачать на телефон mostbet скачать на телефон

мостбет мобильная версия скачать http://mostbet4129.ru

mostbet ilova https://www.mostbet4165.ru

mostbet iphone https://mostbet4169.ru/

mostbet mobil https://mostbet4166.ru

быстрая регистрация на мостбет https://www.mostbet4128.ru

betawi77 link alternatif betawi77 betawi77 net

situs slot batara88: bataraslot alternatif – slot online

hargatoto slot: hargatoto alternatif – hargatoto

https://linklist.bio/inatogelbrand# Situs Togel Terpercaya Dan Bandar

slot online bataraslot batara88

mawartoto link: mawartoto alternatif – mawartoto

hargatoto toto slot hargatoto toto slot hargatoto

inatogel: inatogel 4D – Login Alternatif Togel

how much does cialis cost at cvs: where to get the best price on cialis – cialis 40 mg

cialis with dapoxetine: EverGreenRx USA – EverGreenRx USA

buy cialis in las vegas: cialis using paypal in australia – EverGreenRx USA

cialis when to take: EverGreenRx USA – pictures of cialis pills

https://evergreenrxusas.com/# EverGreenRx USA

EverGreenRx USA: india pharmacy cialis – prices of cialis

sildenafil vs tadalafil vs vardenafil: cialis milligrams – cialis online paypal

купить диплом техникума в спб купить диплом техникума в спб .

http://evergreenrxusas.com/# EverGreenRx USA

order viagra online safely UK https://mediquickuk.shop/# pharmacy online fast delivery UK

fast delivery viagra UK online: BluePillUK – generic sildenafil UK pharmacy

https://meditrustuk.com/# safe ivermectin pharmacy UK

generic sildenafil UK pharmacy http://mediquickuk.com/# confidential delivery pharmacy UK

buy ED pills online discreetly UK: tadalafil generic alternative UK – confidential delivery cialis UK

http://bluepilluk.com/# BluePill UK

viagra online UK no prescription https://bluepilluk.com/# fast delivery viagra UK online

MediQuick: MediQuick – MediQuick UK

IntimaCareUK: cialis cheap price UK delivery – IntimaCareUK

Этот увлекательный информационный материал подарит вам массу новых знаний и ярких эмоций. Мы собрали для вас интересные факты и сведения, которые обогатят ваш опыт. Откройте для себя увлекательный мир информации и насладитесь процессом изучения!

Исследовать вопрос подробнее – https://quick-vyvod-iz-zapoya-1.ru/

MediQuick UK: confidential delivery pharmacy UK – order medicines online discreetly

BluePillUK: BluePillUK – order viagra online safely UK

MediQuick UK: MediQuickUK – UK pharmacy home delivery

mostbet скачать 2024 mostbet12003.ru

SaludFrontera: SaludFrontera – mexican rx

бк 1вин https://1win12008.ru/

вон вин 1win12006.ru

скачать бк осталось только найти предпочтение подходящее скачать бк осталось только найти предпочтение подходящее

mostbet website https://mostbet12007.ru

мостбет лицензия mostbet12008.ru

CuraBharat USA: buy adderall from india – CuraBharat USA

скачать бесплатно мостбет http://mostbet12008.ru/

бонус за регистрацию без депозита с выводом 1win12004.ru

1вин про https://1win12006.ru/

1vin http://www.1win12005.ru

скачать mostbet kg https://mostbet12003.ru

1.win зеркало http://www.1win12008.ru

скачать мостбет казино mostbet12009.ru

mostbet официальный сайт скачать mostbet официальный сайт скачать

https://saludfrontera.shop/# mexican pharmacy

https://curabharatusa.com/# online medicine india

мостбет http://mostbet12010.ru

SaludFrontera mexican medicine buying prescriptions in mexico

TrueNorth Pharm: trustworthy canadian pharmacy – canada drug pharmacy

http://saludfrontera.com/# mexico online pharmacy

скачать приложение mostbet http://www.mostbet12012.ru

1вин авиатор https://1win12010.ru

reliable canadian online pharmacy TrueNorth Pharm TrueNorth Pharm

http://truenorthpharm.com/# canadian pharmacies

mostbet com http://mostbet12010.ru

https://truenorthpharm.com/# my canadian pharmacy review

вход мостбет вход мостбет

mexican medicine: SaludFrontera – SaludFrontera

купить диплом в киеве купить диплом в киеве .

https://curabharatusa.com/# online medicine india

online apotheke preisvergleich GesundDirekt24 gГјnstige online apotheke

купить свидетельство о рождении ребенка http://www.educ-ua3.ru/ .

http://mannerkraft.com/# gГјnstige online apotheke

https://intimgesund.com/# preisvergleich kamagra tabletten

https://gesunddirekt24.com/# medikamente rezeptfrei

интересные кашпо интересные кашпо .

Cialis 20mg price in USA: EverTrustMeds – Ever Trust Meds

http://evertrustmeds.com/# Buy Tadalafil 5mg

http://vitaledgepharma.com/# VitalEdgePharma

EverTrustMeds: Ever Trust Meds – Ever Trust Meds

lucky pari зеркало https://luckypari101.ru/

http://clearmedshub.com/# Clear Meds Hub

https://vitaledgepharma.com/# cheapest ed meds

http://clearmedshub.com/# ClearMedsHub

прикольные кашпо для цветов http://dizaynerskie-kashpo-rnd.ru .

EverTrustMeds: EverTrustMeds – Ever Trust Meds

lucky pari блокировка аккаунта https://luckypari100.ru/

lucky pari отзывы игроков https://www.luckypari101.ru

https://vitaledgepharma.shop/# VitalEdge Pharma

https://evertrustmeds.com/# Ever Trust Meds

http://evertrustmeds.com/# Ever Trust Meds

indian pharmacy: Indian pharmacy international shipping – Indian pharmacy online

CuraMedsIndia: online medical store india – Best online Indian pharmacy

https://maplecarerx.shop/# reliable canadian pharmacy reviews

lucky pari идентификация lucky pari идентификация

1 win официальный регистрация 1 win официальный регистрация

lucky pari mirror 2024 https://luckypari102.ru

https://maplecarerx.com/# canadian pharmacy king

промокод на 1win http://www.1win12017.ru

BajaMedsDirect: mexican pharmacy – mexican pharmacy

умный горшок для растений умный горшок для растений .

Hey! I know this is kinda off topic but I was wondering which blog platform are you using for this site? I’m getting sick and tired of WordPress because I’ve had problems with hackers and I’m looking at options for another platform. I would be great if you could point me in the direction of a good platform.

http://maplecarerx.com/# MapleCareRx

There is noticeably a bundle to find out about this. I assume you made sure good factors in features also.

1вин поддержка https://1win5502.ru

уличные кашпо уличные кашпо .

1win profil sozlamalari 1win profil sozlamalari

1вин скачать приложение 1вин скачать приложение

real money Chicken Road slots: play Chicken Road casino online – real money Chicken Road slots

tadalafil Generic tadalafil 20mg price tadalafil

Buy Tadalafil online: Generic Cialis without a doctor prescription – buy tadalafil online no prescription

Sildenafil 100mg Sildenafil 100mg true vital meds

Buy sildenafil online usa: true vital meds – sildenafil

Buy Tadalafil online Generic tadalafil 20mg price Buy Tadalafil online

sildenafil: Buy sildenafil online usa – Buy sildenafil

sildenafil Buy sildenafil online usa Sildenafil 100mg price

Buy sildenafil online usa: Buy sildenafil online usa – Buy sildenafil online usa

tadalafil: tadalafil – tadalafil

generic sildenafil sale online: sildenafil – Buy sildenafil

Generic tadalafil 20mg price Buy Tadalafil online Buy Tadalafil online

best price for tadalafil 20 mg: Buy Tadalafil 20mg – tadalafil 2.5 mg price

zithromax z- pak buy online: zithromax z- pak buy online – generic zithromax

medicine amoxicillin 500mg Buy Amoxicillin for tooth infection amoxicillin 500mg over the counter

generic zithromax: buy zithromax – zithromax z- pak buy online

ZithroMeds Online buy zithromax online ZithroMeds Online

ZithroMeds Online: generic zithromax – cheap zithromax

v1av8 – The brand feels experimental, possibly gearing for a niche-purpose launch.

1win скачать на айфон с официального сайта https://1win5516.ru

1win azerbaycan qeydiyyat https://1win5002.com/

EverLastRx: discreet delivery for ED medication – safe online pharmacy for ED pills

order Stromectol discreet shipping USA: low-cost ivermectin for Americans – Mediverm Online

1win az bonus 500 https://1win5002.com/

https://amoxicareonline.com/# UK online antibiotic service

https://medreliefuk.shop/# Prednisolone tablets UK online

buy prednisolone: best UK online chemist for Prednisolone – MedRelief UK

https://amoxicareonline.shop/# amoxicillin uk

order steroid medication safely online: cheap prednisolone in UK – UK chemist Prednisolone delivery

https://britpharmonline.shop/# Viagra online UK

https://britmedsdirect.com/# Brit Meds Direct

Appreciate it for this post, I am a big fan of this site would like to keep updated.

When I originally commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Thanks!

I like this weblog so much, saved to favorites.

buy prednisolone: Prednisolone tablets UK online – best UK online chemist for Prednisolone

https://britmedsdirect.shop/# BritMeds Direct

BritMeds Direct: pharmacy online UK – order medication online legally in the UK

https://medreliefuk.shop/# UK chemist Prednisolone delivery

viagra uk: buy viagra online – Viagra online UK

buy penicillin alternative online: UK online antibiotic service – cheap amoxicillin

https://britmedsdirect.shop/# pharmacy online UK

buy penicillin alternative online: buy penicillin alternative online – Amoxicillin online UK

https://amoxicareonline.shop/# Amoxicillin online UK

BritMeds Direct: Brit Meds Direct – private online pharmacy UK

Magnificent website. A lot of helpful information here. I’m sending it to several buddies ans also sharing in delicious. And naturally, thank you in your effort!

http://amoxicareonline.com/# generic Amoxicillin pharmacy UK

viagra: BritPharm Online – BritPharm Online

https://tadalifepharmacy.shop/# buy cialis online

discreet ED pills delivery in the US tadalafil tablets without prescription tadalafil tablets without prescription

I visited a lot of website but I conceive this one contains something special in it in it

trusted online pharmacy for ED meds trusted online pharmacy for ED meds affordable Cialis with fast delivery

mexico city pharmacy mexican meds mexican pharmacy

trusted online pharmacy for ED meds buy cialis online tadalafil tablets without prescription

cialis generika: cialis 20mg preis – potenzmittel cialis

farmacias direct: cialis generico – farmacia online madrid

tadalafilo sin receta: tadalafilo – Cialis genérico económico

прогноз на сегодня на спорт http://www.prognozy-ot-professionalov4.ru .